supergenijalac

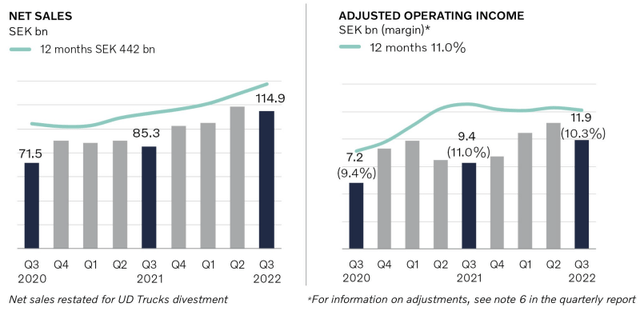

AB Volvo (OTCPK:VLVLY) just delivered what we consider to be a solid quarter showing overall good growth, even if some business segments were a little bit softer. Net sales increased to SEK 114.9 billion, an increase of 21% after adjusting for currency effects. Adjusted operating income reached SEK 11.9 billion, which corresponds to a margin of 10.3%. Earnings per share increased by 22% to SEK 4.24 from 3.47 the previous year. Supply chain constraints remain, and the company said it has low visibility as to when things will improve. On the positive side, the series production of heavy-duty 44-tonnes electric trucks has started.

Overall, demand for its products remains healthy, and order backlogs in many markets remain extended with long lead times. To control cost inflation the company continues to be restrictive in slotting orders for production too far into the future. Costs related to energy, materials, and supply chain disruptions continue to increase and the company is putting efforts to compensate for this effects. Something we are particularly happy to see is that the company is making great progress on its electrification efforts. The company is being very smart in that its electric trucks are produced on the same lines as conventional trucks, giving high production flexibility and efficiency gains.

Volvo’s Financials

The last couple of years sales have been growing at a very decent pace as can be seen in the graphs below. The operating margin has varied from ~9% to ~11%, but thanks to the increasing sales trend operating income has also been moving higher.

Volvo Group AB Investor Presentation

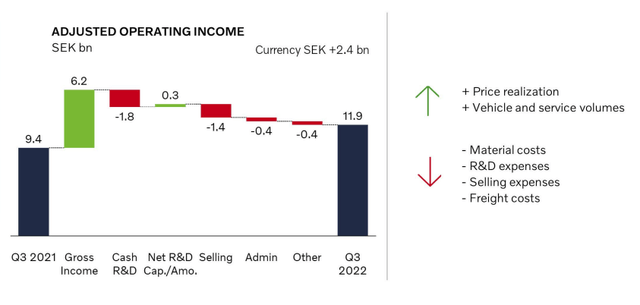

Comparing the most recent quarter to that of the previous year, it is clear that increased volumes and prices have contributed positively to increase operating income, while inflation in the form of higher material costs, R&D expenses, selling expenses, and freight expenses. Fortunately the positive factors have weighted more than the negative ones, resulting in a healthy increase in profits.

Volvo Group AB Investor Presentation

Deliveries

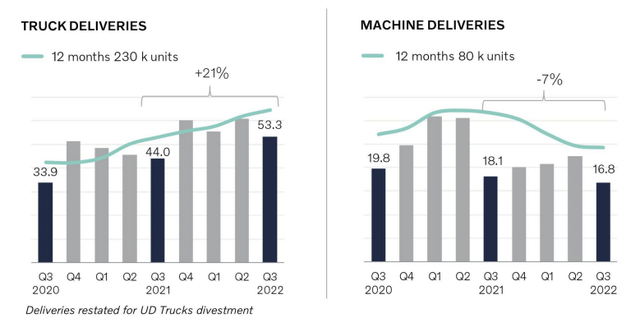

The company has been doing particularly well in the truck segment, but construction machine deliveries has seen a slight decrease.

Volvo Group AB Investor Presentation

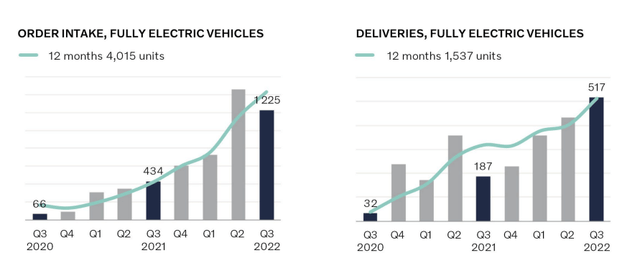

Electrification Progress

Given the company’s stated objective to transform to an electric vehicle manufacturer, it is comforting to see that it is making significant progress. In the trucks segment it started production of electric heavy-duty trucks, with 20 of these trucks going to Amazon. Renault Trucks electric heavy-duty trucks are now available for pre-order, and the company has started the process to establish a plant for battery cell production in Sweden. On the construction equipment side, the company continued the roll-out of electric machines in China and South Korea. Order intake for construction electric machines increased 98%, and deliveries increased 147%.

Volvo Group AB Investor Presentation

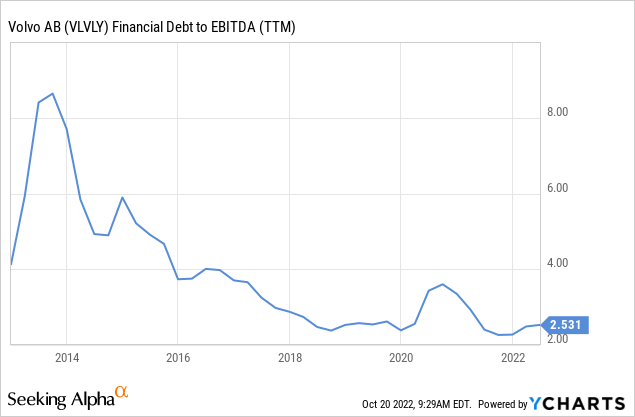

Balance Sheet

The balance sheet remains quite solid, with SEK 71 billion in cash and equivalents at the end of the quarter, compared to SEK 98 billion in outstanding bond debt and SEK 36 billion in other loans. In general we view the Volvo Group of today as having a much healthier balance sheet compared to what the group looked like ten years ago. Leverage has come down very significantly.

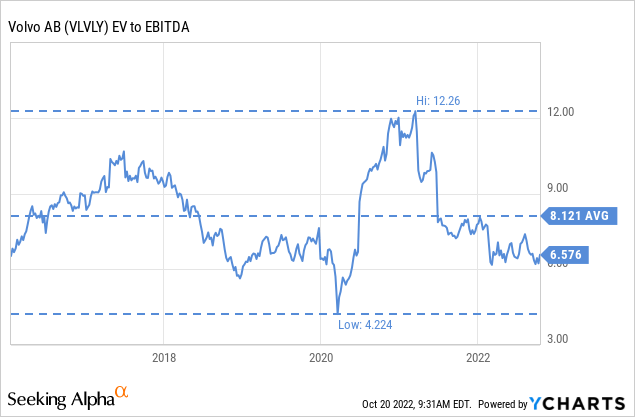

Valuation

Shares remain extremely cheap, with an EV/EBITDA multiple of only ~6.5x. We find this multiple particularly low given that the company has demonstrated it can deliver meaningful growth, and that it is transforming the business to become an electric vehicle leader. In other words, we do not see the company becoming obsolete, but instead successfully transitioning into the electric era.

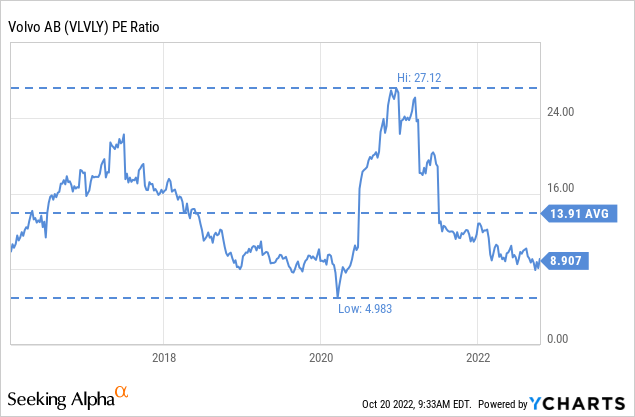

At less than 9x, we find the price/earnings ratio very attractive, and this is a significant discount to what it has averaged in recent years.

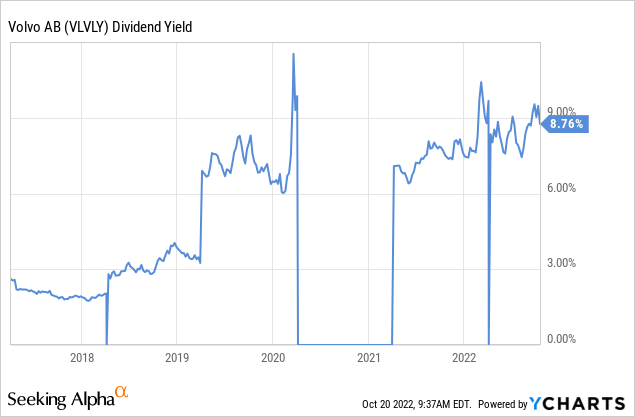

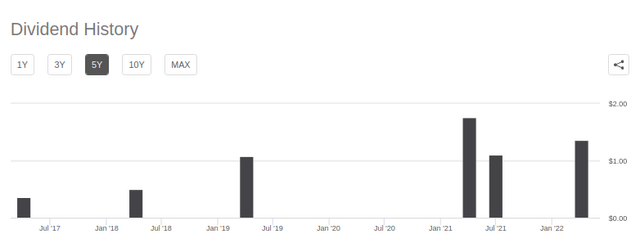

Recently the company has been distributing a large part of earnings as dividends, but investors should be cautious as the dividend history is not great. For example, the company did not pay a dividend in 2020 due to the Covid crisis uncertainty, and before that the dividends were a lot smaller.

Still, the dividend yield is quite high, and if the company manages to continue paying dividends this high, investors will be handsomely rewarded. For investors wanting to find out more about the company’s dividend we recommend visiting directly the company’s investor website, there is a special section dedicated to the dividend that also shows the split between the dividend and the extra dividend.

Risks

The main risks we currently see for investors is that the company remains cyclical, and the world economy increasingly looks about to go into recession. We are not too worried, given that the company has a healthy balance sheet and we believe it should weather the storm, but that can result in significant volatility in the share price.

Conclusion

We mostly liked the Q3 results for the Volvo Group AB, there are still some weak segments like construction equipment, but overall sales showed significant growth. The company is also delivering good results in terms of profitability, with a very healthy operating margin, which reflects the cost control and efficiency efforts the company has been implementing to counter inflation and supply chain disruptions. The company is also making significant progress on its electrification efforts. Shares look very attractively priced today, with low EV/EBITDA and price/earnings multiples, and a high dividend yield. For investors willing to look past the risk of investing before a recession, shares could be an interesting option.

Be the first to comment