Justin Sullivan

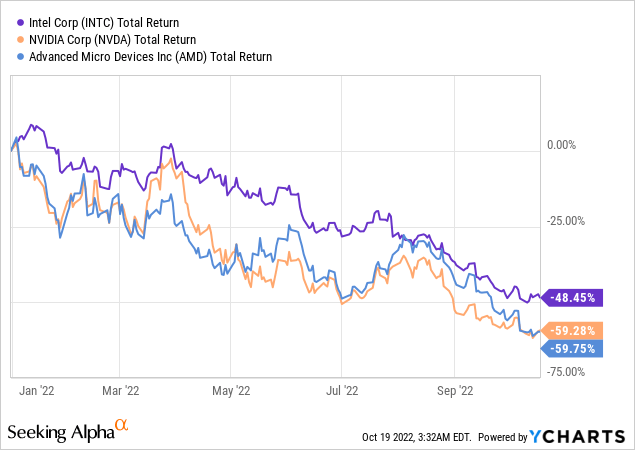

So far 2022 has been one of the worst years for semiconductor stocks on record.

Intel’s (NASDAQ:INTC) poor performance is not that surprising as the company has been on the back foot for some time now due to fierce competition from AMD (AMD). However, Intel, AMD and Nvidia (NVDA) have all experienced massive declines during the year, while their business fundamentals remained robust.

This drastic decline was not only due to lower expected growth in the semiconductors space, but also as a result of major rotation occurring out of momentum stocks. I warned about these risks back in November of last year and have also provided a detailed analysis of the semiconductors sector here.

(…) the external risk of rising interest rates and fading momentum trade is at one of its highest levels.

Source: Seeking Alpha

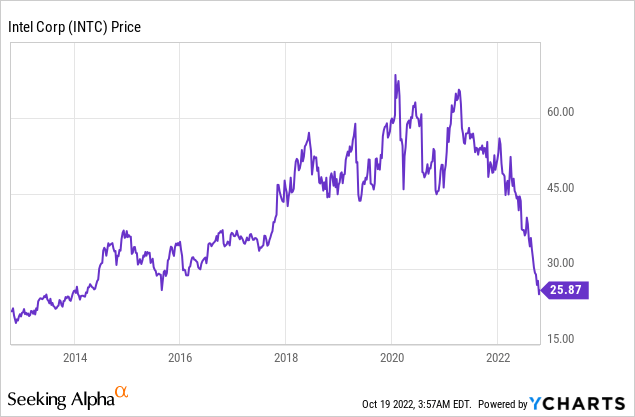

While AMD and NVDA shareholders might still be complacent with their high returns from the past few years, Intel’s long-term holders are now back to levels last seen nearly 10 years ago as this market downturn comes at the worst time possible for the company.

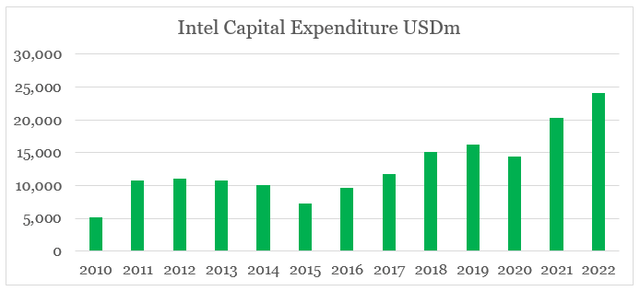

Under its new CEO, Intel has also embarked on a very ambitious business reinvestment program, which involves a significant ramp up of capital expenditure (more on that here).

prepared by the author, using data from Seeking Alpha

Moreover, under Mr. Gelsinger, Intel has also undertaken a massive restructuring which aims to make the company a leaner organization and allow it to focus on its core businesses. As a result of that the NAND and SSD business was sold and the self-driving-car unit – Mobileye – was scheduled for an Initial public offering (IPO).

Some Important Details

As mentioned earlier, the IPO of Mobileye could not have come at a worse time for Intel. Not only did growth and momentum stocks plummeted this year, but the overall IPO market has also collapsed since the beginning of 2022.

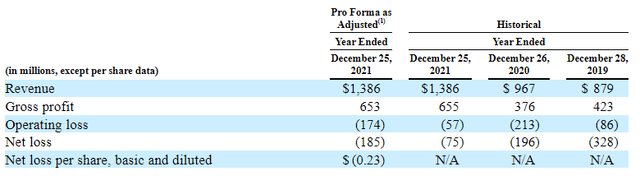

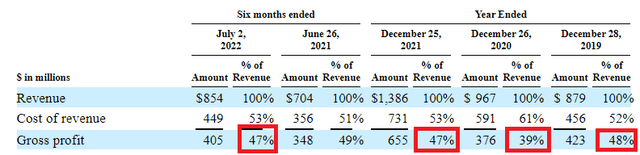

As a high-growth company in one of the hottest areas of the market – autonomous vehicles, Mobileye’s IPO is now right in the eye of the storm. The company has nearly doubled its revenue since 2019, with sales for the past 6-months totaling $854m.

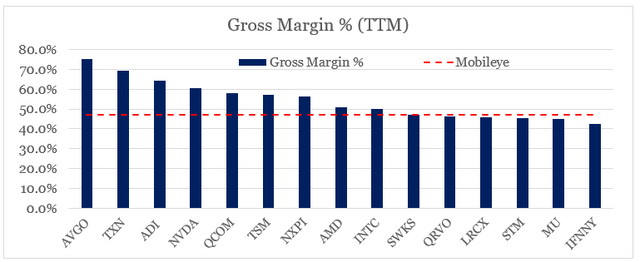

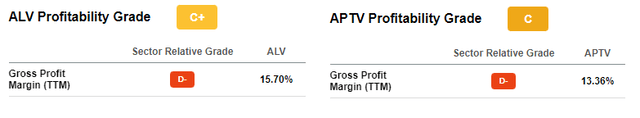

At the same time, for a business that is experiencing such a high topline growth, Mobileye’s gross margins are quite high.

Although it does not compete directly with most of the companies in the semiconductors space, Mobileye’s gross margins are already within the broader peer average.

prepared by the author, using data from Seeking Alpha

As one of the leaders in the ADAS (Advanced Driver Assistance Systems) market that is also leading the revolution to autonomous driving, Mobileye competes with a very large number of companies that all operate within different segments of the sector.

Companies, such as Autoliv (ALV) and Aptiv (ATPV), both have far lower gross profit margins when compared to Mobileye.

Larger mobility providers, such as Uber (UBER) and Lyft (LYFT) are also far from achieving such levels of profitability.

On the other hand, both comparable peers in the ADAS sector and autonomous vehicles peers more broadly do not operate independently, which has major advantages during periods of market turmoil.

The more diversified ADAS competitor Bosch Group, for example, operates with razor-thin margins. Zoox, Waymo, Continental, GM Cruise and Argo AI all operate as part of much larger enterprises that provide all the necessary funding for their capital intensive business models.

All that leads us to the main reason why in my view Intel’s new management is making a step in the right direction by proceeding with the current IPO of Mobileye.

It’s Not What It Looks Like

On the surface, it might seem that Intel has made a major mistake with Mobileye since it bought the company back in 2017 for roughly $15.3bn. At the same time, based on the current offering the division is valued in between $14.4bn and $16bn.

Seeking Alpha

Taking all the investments made by Intel throughout this period, inflation and last but not least missed opportunities, it’s not hard to conclude that buying Mobileye in the first place was a major mistake.

Although the decision to acquire Mobileye was not made under Intel’s current CEO, the decision to proceed with an IPO during the current environment might not be as a desperate move as most people believe.

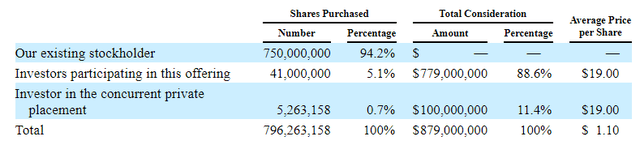

First and foremost, Intel is not actually selling the entire company. As a matter of fact, Intel is selling only a tiny proportion of its stake in Mobileye and would still hold more than 94% of the business.

Therefore, the whole deal does not mean that Intel is suddenly losing billions on its 2017 deal. At the same time, the IPO will open the door for more outside capital to flow into Mobileye, including new large investors.

By deciding to focus on its core businesses, while also developing the Foundries business, Intel need to make significant capital investments. Therefore, the self-driving business will benefit from more outside capital and new partnerships. Going alone in all these endeavors will most likely be a major mistake for Intel at this point in time and would interfere with the new strategy under Pat Gelsinger.

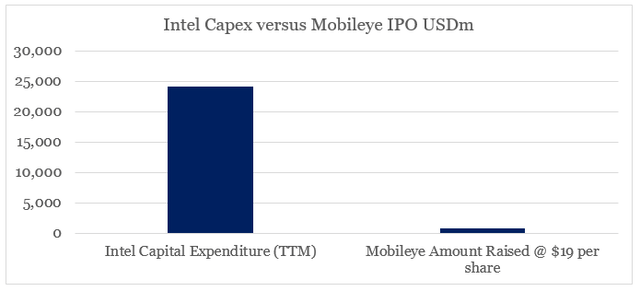

Having said all that, many people wrongly assume that Intel is going ahead with the IPO in a desperate need to fill its own capital needs. As a matter of fact, however, the 5.8% stake will raise between $800 and $900 million, which based on Intel’s annual Capital Expenditure is an insignificant amount.

prepared by the author, using data from SEC Filings

With Intel spending $24.1bn on Capex for the past 12-month period, the amount raised by the IPO will provide roughly 2-weeks’ worth of capital.

What that clearly illustrates to me is that the IPO is not done for purposes to seek emergency capital for Intel, but rather to open the door for new investors and partnerships into the self-driving business.

Conclusion

As bad as things look for Intel at the moment, the Mobileye IPO does not appear to be a sign of desperation as most people believe. Although the initial deal to acquire Mobileye could be seen as a mistake, we should not forget that it was done as part of Intel’s previous strategy and under its old CEO.

At this point in time, an IPO for a small share of Mobileye sets the stage for finding new partners and capital for the autonomous driving division. At the same time, it would ultimately give Intel more freedom to focus on its core business, where its key competitive advantages lie.

Lastly, the chip giant is still struggling with intensifying competition, ongoing restructuring problems and negative market sentiment around semiconductors stocks as a whole. That is why, even though the new long-term strategy under Pat Gelsinger is a step in the right direction, Intel’s turnaround will likely not be a short-term process.

Be the first to comment