sankai

I’m confident that market participants are simply paying attention to freight rates after looking through some great analysis on ZIM Integrated Shipping Services Ltd. (NYSE:ZIM). It is not the only relationship, but it is a key driver for future income. Due in large part to leased vessels and the possibility of increased flexibility in comparison to its competitors, ZIM is an incredibly flexible organization.

Reading the annual report led me to some excellent discoveries, including the fact that the company is increasing its market share and that volumes matter far more than investors think. Global trade has greatly improved over the last five years, primarily in absolute terms, but it is a cyclical bet with major downside risks as the economy could continue to deteriorate. This critical story might support the current EPS revision trend going ahead, and in my opinion, the market is now undervaluing ZIM.

I still believe that the management is doing a great job by reducing the debt and emphasizing internal growth through equity growth. ZIM will continue to be profitable at even stretched freight rates despite additional downside risk and more dividend decrease, which is entirely logical. Although I would think about holding ZIM, covered call option strategy gives me the confidence to remain bullish 1-3 months ahead (despite macroeconomic challenges) while limiting the downside moves. And after a 1-3 month plan, to flip the narrative for ZIM to be solely bullish, possibly at much better prices and gained premium from options.

Why freight rates are not the only important factor

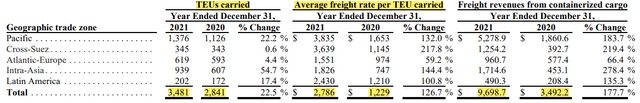

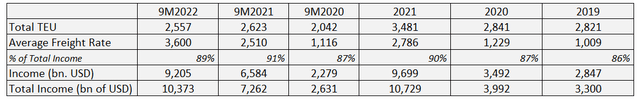

I wholeheartedly concur that the profitability of the whole business as well as the segment – Income from trips and related services – is largely determined by freight rates. But the issue is that investors just focus on the freight rate and neglect to consider the overall volume or the number of TEUs transported as a second crucial aspect. The following income results can be obtained by simply multiplying the TEUs carried across segments (Pacific, Cross-Suez, etc.) by the average freight rate for segments. It was USD $9,699 million in 2021 and USD $3,492 million in 2020, which represents 90% and 87% of the entire revenue from voyages and related services, respectively. the remaining sales.

Sales in 2022 are anticipated to increase significantly by 17% YoY, reaching USD $12.44 billion (compared to USD $10.72 bn as of 2021). There is a very high probability that average freight rates would increase much more rather than volumes.

Total TEUs and average Freight Rates (ZIM’s annual report.)

It is also confirmed by CFO Xavier Destriau in the earnings call transcripts (emphasis added):

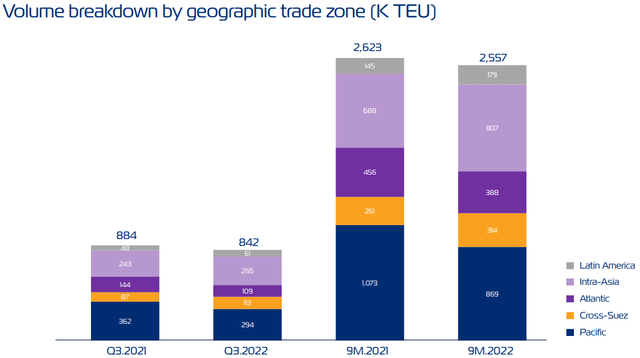

Our average freight rate per TEU of $3,253 in the third quarter was 4% higher compared to the third quarter of 2021. During the first nine months of the year, our freight rate was 43% higher than in the 2021 nine months period. Our carried volume in the third quarter declined 5%, compared to the same period last year. Lower volumes during the third quarter resulted primarily from continued congestion as well as a more normalized level of consumer demand.

ZIM’s volume breakdown (ZIM Presentation. Seeking Alpha.)

Worldwide demand will drop, but we will not reach 2020 drop

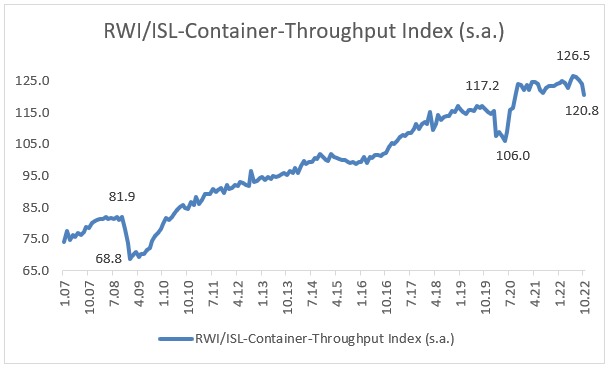

I think that the demand and volume factors are also very important for the growth of the business. It will be more important to avoid starting a financial meltdown as we observe macroeconomic headwinds, followed by soaring inflation and the necessity for central banks to combat it with monetary tightening, as I had mentioned in my previous SA article. Prior to the Fed’s most recent meeting, I put the likelihood of a recession at 40%; but, in light of the Fed’s recent statements about its determination to do everything it takes to stop one, I now place it at 55–60%. I frequently check the Global PMI for a broad overview of the manufacturing sector, and the RWI/ISL Container Throughput Index is excellent for tracking global trade and container throughput.

According to the ISL:

Container throughput aims to provide reliable conclusions on short term trends in worldwide economic activity. The RWI/ISL Container Throughput Index uses the fact that international trade is primarily handled by ships and containers, which means the container throughput in ports is an important indicator of global trade. Currently, the database consists of 82 international ports covering more than 60% of world container handling.

RWI/ISL – Contaner Throughput Index (Author’s. Based on RWI/ISL dataset.)

The following chart makes it simple to examine how long-term trends in global trade or overall economic activity have evolved. While businesses must move forward, energy shipping (LNG) will become a more and more popular option in Europe, and consumer behavior is not expected to change, there will almost certainly be a longer-term increase in positive development, which should result in an increase in the total TEUs or volumes absorbed by the shipping companies. At that time, it’s critical to determine whether any companies have gained market share. Despite halting 1.6% of the world’s cargo shipping activity as of 02/2021, ZIM is predicted by Alphaliner to earn approximately 1.7% market share by 02/2022.

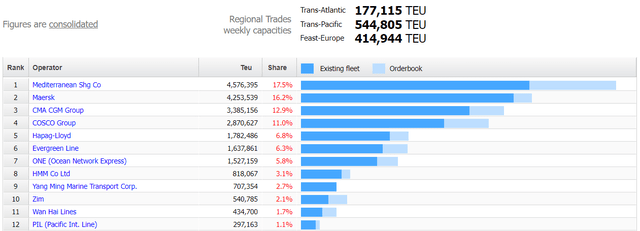

According to the most recent Alphaliner data, ZIM’s market share as of December 19, 2022, was 2.1% based on TEU volumes in the weekly monitor. The good trend is noticeable, and it is also influenced by the excellent and long-term contracts for 2022 that are highlighted in quarterly reports. Based on the statistics and the subsequent trend, we can infer that ZIM’s market share is increasing, which may also be the reason why, even in the event of a recession, we won’t have 2020 volume lows.

Although freight prices have a significant impact on profitability and margin expansion, volume is also important. Both should contract as the world economy is likely to experience further slowdown or even a recession. When we look at the RWL/ISL Container throughput, we can see how the world trade changed in 2008 and in 2020, when market volumes fell.

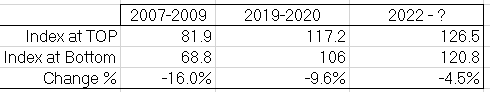

The volume-based index fell by -16% from top to bottom between 2007 and 2009, -9.6% between 2019 and 2020, and -4.5% as of 2022. Assuming a -16% takeout is a really huge one, and it would consider a very great crisis followed by the Fed’s pivot and other exceptional actions. Although there may be a slowdown or recession, I believe that the global financial crisis of 2007–2009 and a corresponding decline in international trade are not going to occur. It might provide us with a forecast for a scenario of recession, with a worst-case scenario of -16%.

RWI/ISL Container Throughput index calculation (Author’s calculation. Dataset by RWI/ISL)

Since freight rates are determined by supply and demand imbalances and the condition of the economy, they are likely to remain unstable. Despite a predicted sharp decline in market volumes, ZIM is expanding its market share, mostly as a result of good flexibility and excellent manager decisions, such as leasing vessels or signing new LNG contracts.

9M development of carried volume, rates and income (Author’s calculation. Based on ZIM’s dataset.)

Despite the my view that ZIM is clearly undervalued, I try to keep an open mind and consider all possible outcomes, including the possibility that, in the worst event, the stock might still decline by more than 50% and become even more undervalued. Due to this, I think it is absolutely sensible to use the simple option strategy described as “covered call” at the end of the article to play it.

Total carried volume (in k TEU) and freight rates (Author’s calculation based on ZIM’s data.)

Q4 could beat the estimates

We can readily determine that the total TEU has a solid upward trend based on the initial 9M comparison of the last three years. If a substantial economic recession developed, this tendency may come to an end or begin to slightly fall in 2023. The freight rate has been a major contributor to the growth in total income. According to Freightos, the price of FBX as of 16/12/2022 is 2 127 USD. This, however, does not represent the rates of prearranged contracts. The revenue projections for year-end will likely be greatly underestimated, in my opinion. I explain why below.

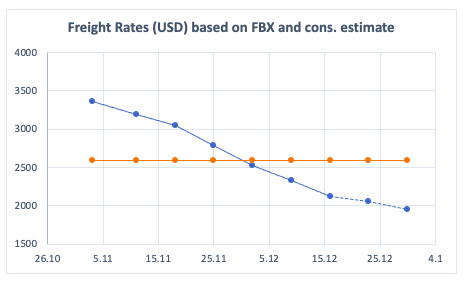

Freight Rate Index (Freightos)

In 3Q2022 Earnings call, there was a great question from public and answer from management (emphasis added):

Q:If I understand, right, you got your contract rate exposure is mainly from transpacific, which normally resets in April, right? So, why does we are actually seeing lower contract rate versus, say, Q3 or versus your previous expectation?

A: The question on the contract rate, just to fact that into perspective yes, you’re absolutely right that it’s very much relevant for the transpacific region where we operate. And we normally contract 50% of our volume with a long-term contract and remain close to the spot market for the other 50%.

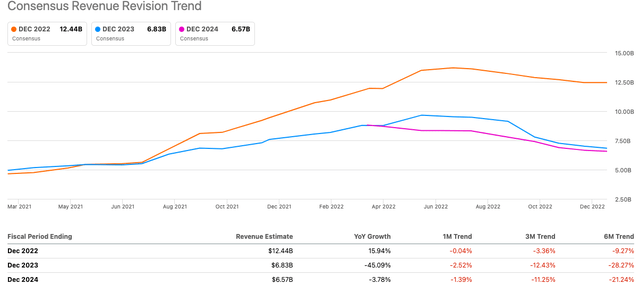

Furthermore, let’s perform a sensitivity analysis and make some important assumptions. For example, total carried volume in 4Q2021 was 858k TEU, while in 4Q2020 it was 799k. We might state that it makes no sense to count with the same carried volume as in 4Q2021, once we witness a strong macroeconomic headwind and decreased output quantities corroborated by Container Throughput. Perhaps, however the carried volume in the third quarter was 842k TEU, as seen in the chart. However, we shouldn’t completely abandon our ideas just yet, given the most recent data from Alphaliner and the previous annual report both indicate that ZIM is gaining market share. As a result, a significant decline in Q4 in carried volume should be out of table.

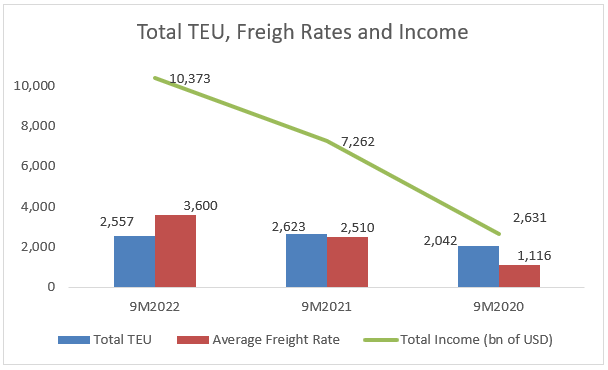

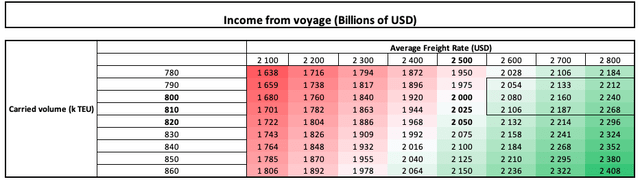

Let’s now examine the earnings revision and projections: Dec 2022 at $12.44 billion, or in Q4 2022, the revenue projection is set at $1.95 to $2.20 billion.

Consensus Revenue Revision Trend (Seeking Alpha)

Let’s examine our assumptions based on the potential volumes and the current price. I predict that the revenue and hence the EPS results will surpass or be at the top. Revenue is a little bit easier to forecast than EPS, which is significantly tougher to do because of numerous variables. But the more the revenue, the higher the EPS (likely). Here are the results for prospective revenues for the fourth quarter based on my sensitivity analysis:

Sensitivity Analysis for 4Q2022 (Author’s calculation)

- Based on the encouraging growth of container throughput, it is highly unlikely that the carried volume will be lower than the 4Q2020 (799k TEU) or greater than the 4Q2021 (858k TEU), but rather remain in the middle of this range. In the latest data, some decline had been spotted in October and will probably continue in November and December (Container Throughput).

- 50% of the deal, as it had been stated in Earnings Call (see the upper citation), signifies a long-term contract with likely much higher rates. ZIM’s clients may negotiate a price reduction, but it is quite unlikely that they will base their decisions solely on where they are right now. Spot accounts for 50%.

- Based on my calculations, data from the Freightos Baltic Index, and a conservative projection with a negative trend, the average freight data for the chosen period will be close to USD $2600. (see the chart below).Our sensitive analysis indicates that Wall Street is likely projecting revenues based on carried volumes in the range of 800-820k TEU with average freight prices at $2500 USD.

- Considering the above variables, in my opinion, the volume shouldn’t be as low as it was in the fourth quarter of 2020, with average freight prices still being much higher. According to my base-case scenario, carried volume will range between 790k and 820k TEU, with average freight charges of $2600–2800 USD. Therefore, ZIM may surpass the USD $2.06 billion revenue projection for the fourth quarter of 2022, and there is a good chance that it will surpass the USD $2.20 billion top revenue estimate.

- Remember that this income almost certainly represents the 86–90% we stated in the previous table (based non historical data).

- Additionally, keep in mind that EPS estimates could be exceeded as fuel costs as a key margin driver significantly decreased.

Freight Rate in Nov – Dec with conservative estimate (Author’s calculation. Data from FBX.)

Balance sheet, earnings and valuation

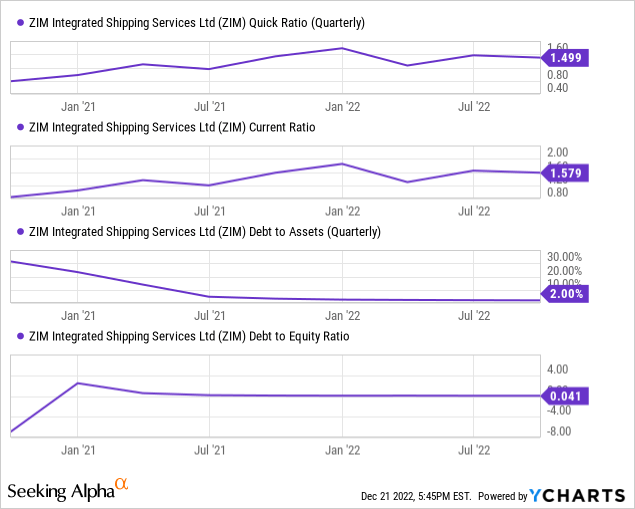

We should now examine the balance sheet of the business. As a result of effective performance of management, the financial leverage was dramatically reduced. The business produced robust CF to pay off a significant amount of debt, prepared for the normalization of freight rates, and reward its shareholders with a generous payout ratio (30–40% of EPS).

ZIM is extremely well-prepared for any market turbulence in terms of liquidity position, both in terms of its flexibility (leased vessels) and balance sheet. The liquidity situation is excellent and is likely to get better in the upcoming one to three quarters, depending on the dividend payment. Very conservative quick ratio is at 1.5 and current ratio slightly over.

Debt to asset or debt to equity ratios, which are both at record-low and extremely safe levels, are excellent indicators of leverage. It implies that the company would still have plenty of room for bank financing even if freight rates dropped to under $1,000 USD and carried volume dropped dramatically, let’s say owing to a recession.

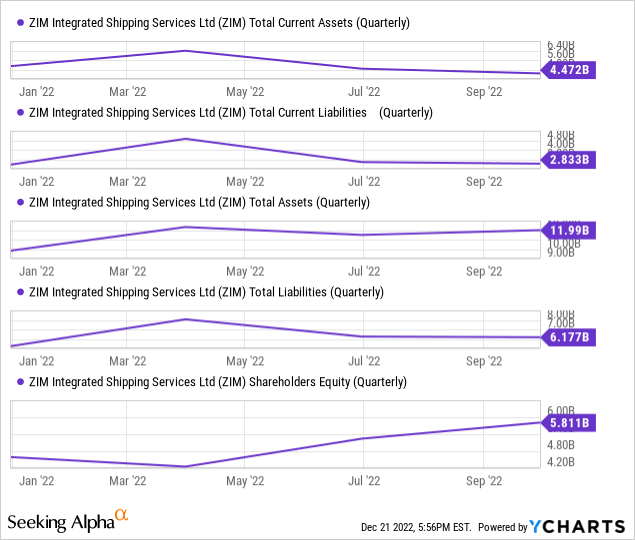

Let’s now examine the important absolute numbers. Current assets, current liabilities, total liabilities, and total liabilities are all falling while total assets are rising. When you consider the stockholders Equity, which is rapidly and dramatically expanding, this is a great move. It indicates that despite all dividend payments, the business has kept a sizable amount of cash on hand for future asset investments and debt reduction.

The ability of the corporation to reward its shareholders is crucial, even while dividend payouts reduce shareholders’ equity value and current assets (due to the reduction of cash). According to the 3Q2022 presentation, the corporation distributed $2.95 USD per share, or about 30% of 3Q2022 net income, as dividends. It halted $354 million USD in cash flow, reducing the cash position and equity by that sum. This year, the business paid out around $3,302 mill., or $27.55 per share. This is also the reason why whenever a firm pays out dividends on the ex-date, the stock price tends to fall as both cash and equity are being depleted as a consequence. This is also the reason why the balance sheet, shareholders’ equity, and cash position are crucial for valuation. The future course of the dividend policy is not yet obvious, but one thing is almost guaranteed. We won’t see similar dividends anytime soon because earnings will drastically slow down until freight rates don’t reach the higher level as we witnessed in 2021.

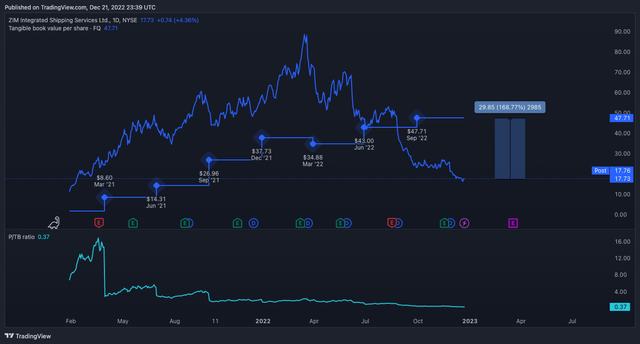

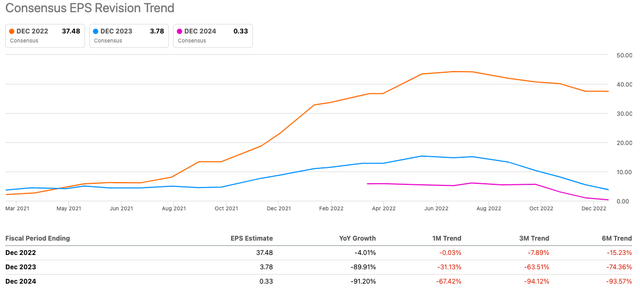

To value such a company, in my opinion, looking at Tangible Book Value is a great approach. The P/E outlook is not ideal in this situation since it is unable to look at the current P/E, which is extremely low due to large and erratic earnings. Due to decreasing profitability brought on by low freight rates, these earnings will decrease very noticeably in 2023. This would lead to incorrect conclusions. EPS and P/E projections only partially make sense. Estimates place 2023 P/E at 4.49, which is incredibly low, while 2024 EPS are “estimated” at 0.33, assuming a 2024 P/E of 51. This is absurd. Look at the revision trend right now and see how it changed over time. It fluctuated up and down and has continued to do so as the economy has strengthened or weakened. In my opinion, using the 2024 P/E in this industry to determine if a company is under or overvalued in light of the current situation is an awful way to make an investment choice.

For such a significant period of time, it is unpredictable. It’s encouraging to see that ZIM is gradually increasing its market share. Because freight prices are so unstable, it is inappropriate to anticipate EPS for 2024. Looking at the P/E ratio for 2023, which I estimate to be low, is much safer. Even if EPS were lower than in 2022, shareholders might still benefit from the company’s expanding value due to shareholders’ equity and a strong balance sheet as well as from the dividend policy, even if it would be much lower.

With asset-heavy businesses in this sector, I prefer to assess companies using Tangible Book Value since it makes it obvious to me if the business is adding value or not. Given the numerous unknown variables, it is challenging to evaluate it using FCF. The best time to invest in cyclical, though, is when there is no desire for it and the economy is struggling. B When freight rates significantly changed from September, the spread per share started to get much wider when compared to ZIM’s stock share. Based on this methodology, the price of the shares would need to increase by more than 150% to be fairly valued.

ZIM price and Tangible Book Value Per Share (Author via Tradingview)

Summary, strategy and risks

I am aware that this is a dangerous and cyclical move. The recession scenario is more likely right now if nothing changes, as I noted in my macro analysis published a few weeks ago on Seeking Alpha. If the demand were to worsen more, followed by leading indicators like the Manufacturing PMI or worse world trade, it may put considerably more pressure on the price of ZIM, which could fall another 40–50%. From this point of view, I would recommend a HOLD rating for the upcoming 1-3 months, or until we have a more certain macroeconomic forecast. I am positive on ZIM for the upcoming year because I believe it is significantly undervalued. Even if freight rates normalized, the business model’s strong trend development with share growth may provide positive development over the long run. However, I am still very positive about holding long positions in ZIM using the covered call option method.

A key option strategy that aims to produce modest but consistent income while holding a stock is the covered call option. This frequently shows that you have a favorable to neutral view on the stock. For example, let’s say you purchase 100 shares of ZIM and sell one call with a strike price of $18.0 USD at today’s price of 1.18. If the stock price were $18 or lower, you would gain the full premium amount of $118 USD (excluding costs), or it would reduce your loss if the stock price declined more than $1.18 USD. 100 shares of ZIM would cost you $1773 USD at the current price of 17.73 USD, where $118 USD is around 6.7%. In conclusion, even if the stock declines 10% down until option expiration, you will actually lose “just” 3.3%. You will receive the full premium if the price falls below the strike price. On the other hand, if the stock price increased significantly, say to $20 USD, you would profit on 100x stock of ZIM. However, because your call is acting as a short position or contrarian hedge, you would only profit by $118 USD, meaning that even if the stock increased, your profit would be limited to the premium. However, you can use this method for the first three months after that until the macro picture is more clear, and you can also collect a lot of premium, greatly reducing your risk and gaining some profit from premium. The option strategy should be rolled over every month with a view of three following months.

If you love this stock, another excellent and straightforward method is to establish a position by selling a put and collecting the premium if the stock rises, or to exercise the option if the stock price falls below the strike.

The risk for the basic case is that freight rates would be at an all-time low in 2024, which would severely worsen the balance sheet position and equity value due to lack of profitability and the need for additional funding. However, the excellent balance sheet position helps to mitigated this factor. If the economic scenario came true, the ZIM Integrated Shipping Services Ltd. stock price might also drop dramatically as a result of the extremely low demand (volumes) and freight rates. Because the considerable decrease in stock price would not be entirely covered by the option premium, it might also jeopardize the strategy’s return. However, compared to buying the straightforward shares, the loss can be far smaller. In my opinion, ZIM Integrated Shipping Services Ltd. stock may slightly decrease or move sideways over the next one to three months, thus some risks are reduced with this simple option strategy.

- Editor’s Note: This article was submitted as part of Seeking Alpha’s 2023 Market Prediction contest. Do you have a conviction view for the S&P 500 next year? If so, click here to find out more and submit your article today!

Be the first to comment