JasonDoiy

The PayPal (NASDAQ:PYPL) stock has largely held onto its gains since reporting marked progress in the strategic transformation of its business model during the second quarter earnings call in early August. This has drawn attention from investors on whether the worst is behind as the company retracts from spreading itself too thin and adopts a narrowed focus on growing market share across its core payment solutions instead.

With the stock now trading at about 20x forward P/E, PayPal’s valuation remains well below the mean of 23.8x and 24.9x observed across the payment services and payment networks peer groups, respectively. The following analysis will explore the various investment positives and risks pertaining to the PayPal stock to gauge whether it is indeed a compelling investment opportunity at current levels.

Our bottom-line view is that while PayPal has condensed its focus towards only core payment solutions – namely, Checkout, PayPal and Venmo digital wallets, and Braintree payments processing – they are capable in broadening the company’s reach across a wide array of digital payment opportunities across both merchant and consumer end-markets stemming from continued growth in online transactions. The company’s clear business plan on restoring margin expansion and growth acceleration after a tough year is also welcomed news, bolstering investors’ sentiment on the stock – bearish calls on PayPal have lowered significantly over the past two months, with the stock maintaining support in the $90-range despite fragile market sentiment on the global economic outlook.

Looking ahead, PayPal’s continued ability in delivering positive progress on its internal restructuring efforts will remain a key focus area for investors, as it determines whether it can remain a market leader in capitalizing on secular growth trends in e-commerce through the provision of digital payment processing solutions. Sustained margin expansion and revenue reacceleration will be expected in 2H22 as key near-term catalysts for driving renewed upsides in the stock.

Key Investment Positives in PayPal

With “trillions of offline retail dollars moving online over the much longer-term”, the demand environment for digital payment procession solutions remains elevated, making strong tailwinds for PayPal’s ongoing efforts in reinvigorating market share growth and margin expansion. In the U.S. alone, e-commerce is currently the fastest growing segment within retail – total online purchases are expected to top $1 trillion by the end of the year, which poses a favorable backdrop in 2H22 for PayPal as it prepares for revenue reacceleration, a key near-term catalyst for jumpstarting its valuation uptrend. Over the longer-term, demand for digital payment processing solutions is expected to further given e-commerce is projected to represent more than a quarter of global retail transactions by mid-decade.

And PayPal is uniquely positioned to capitalize on said secular trends in e-commerce, thanks to its combination of 1) a small but comprehensive portfolio of core payment solutions, 2) significant headroom for user engagement growth, and 3) positive progress on its strategic transformation.

1. Unique Combination of Core Payment Solutions

While PayPal can boast of one of the biggest portfolios of digital payment solutions spanning peer-to-peer (“P2P”) payments, online checkout platforms, payment processing solutions, pay-out solutions, in-person payment solutions, business and risk management services, and digital marketing tools, management has narrowed focus on only its core products – Checkout, PayPal and Venmo digital wallets, and Braintree payment processing – as part of its internal transformation efforts ahead. What this suggests is that PayPal is acknowledging how the secular trends in e-commerce will bode favorably for its long-term growth prospects. And the strategic shift in focus on a narrowed portfolio of core offerings is expected to allow PayPal to better monetize on opportunities stemming from both merchant and consumer end-markets.

Although the company has shifted its strategy from “doing 100 things [to] doing 3 or 4 things extremely well”, these “3 or 4 things” have been strategically chosen to enable the company with maximized exposure to the total addressable market for digital payment processing solutions, covering everything from online payment transfers at the consumer level to back-end payment processing for merchants:

- Digital wallets: PayPal and Venmo are currently the two primary digital wallets offered by the company, and they play a critical role in broadening PayPal’s monetization opportunities in online transactions. More than half of PayPal’s active user base are signed up on either the PayPal or Venmo digital wallets, underscoring its appeal to consumer end-markets. Specifically, these accounts boast “2x higher the ARPA [average revenue per account]…, do 25% more checkout, [and] do 2x the transactions” compared to those that are not in the wallet. Digital wallets have also helped PayPal reduce its churn by 33%, underscoring the product’s effectiveness in driving revenue growth and market share gains for the company through both ARPA expansion on its existing user base and new customer acquisition.

- Checkout: We view Checkout as a critical product in reinforcing both consumer demand for PayPal’s digital wallet offerings and merchant demand for its back-end payment processing solutions. The more users on digital wallets, the more inclined merchants will be in adopting Checkout with PayPal. Alternatively, the more volume of e-retailers offering easy Checkout with PayPal, the more inclined consumers will be open to opening an active account on PayPal’s digital wallets. As such, we view management’s choice of Checkout as one of its core product focus in its transformational strategy a prudent move. Specifically, PayPal’s recent deal wins for Checkout paves a strong foundation for continued market share gains in the broader payment processing solutions market over the longer-term. For instance, PayPal’s recent partnership with Amazon (AMZN) to allow payments with Venmo on the e-retailer’s site will be crucial to furthering the company’s market share in online payment processing solution opportunities against competing peers. Amazon is expected to become America’s largest retailer by 2024, granting PayPal exposure to further total payment volume (“TPV”) expansion, and inadvertently, transaction revenue growth through the longer-term. The partnership also reinforces Venmo’s increasing value to merchant partners, with Amazon’s endorsement being a validation to the strength of the digital wallet’s 90 million active accounts, where half have indicated an interest in paying with Venmo for online purchases. Circling back to earlier discussions on the trillions of offline retail dollars that have yet to come online, increasing demand from consumers for Checkout with Venmo / PayPal makes it an enticing payment processing product for the growing number of merchants looking to digitize their businesses over coming year.

- Braintree: The full stack payment processing solution, acquired by PayPal almost a decade ago, continues to be a core driver of the company’s consolidated transaction revenue and overall market share gains. Despite Braintree being a lower margin business due to its card-funded nature, which warrants higher transaction expenses, the business continues to boast “a long track record of profitable growth”. Specifically, management has alluded to the shift in Braintree’s expansion focus from large enterprises to the small and medium-sized business segment across Europe, which exhibits better profitability characteristics, as a core compensatory factor for restoring the business’ margin profile over the longer-term. Considering the product’s strong market take-rates, as well as continued profitability improvements with scale, Braintree will remain a critical enabler of both market share gains and “at least 50 basis points of operating margin expansion” across the consolidated company this year, supporting promising valuation prospects ahead.

2. Significant Headroom for Engagement Growth

With a user base of more than 426 million active user accounts (392 million consumer active accounts; 34 million active merchant accounts) and growing, PayPal is also well-positioned for greater monetization opportunities as demand for online payment processing solutions expand in tandem with continued e-commerce adoption based on secular trends discussed in the earlier section.

PayPal’s transaction per active account (“TPA”) has consistently demonstrated expansion, reaching 48.7x per year during the second quarter to represent y/y growth of 12%. With recent Fed data indicating that a typical consumer makes approximately 800 transactions per year, and about a quarter of that volume online, PayPal’s 48.7x TPA suggests that there is still significantly headroom for account engagement growth:

If you look at the Fed came out with how many financial transactions does a typical consumer do in a year? And it’s a little over 800. About 25% of those are online, so about 200 of those are online transactions. We only capture about 25% of those. And so there’s a huge opportunity as more and more moves online, as we expand the digital wallet, as people see all they can do with that.

Meanwhile, the volume of core daily active accounts have also expanded at a three-year compounded annual growth rate (“CAGR”) of 13%. The anticipated combination of continued user base and TPA growth based on both historical success as well as solid forward prospects, buoyed by secular trends and a narrowed focus on market-leading payment processing products discussed in the earlier section, are expected to further PayPal’s overall TPV expansion, and inadvertently, increase transaction revenues over the longer-term to drive greater valuation prospects ahead.

3. Positive Progress on Strategic Transformation

More importantly, positive progress on its corporate turnaround strategy, and the strong fundamental foundation set in 2Q22 also bolsters overall confidence in management’s execution ability in 2H22. Considering guided cost savings of $900 million by the end of the year and annualized savings of $1.3 billion achieved by 2023 through increased productivity and economies of scale, PayPal is well-positioned for sustained margin expansion alongside anticipated reacceleration in top-line growth by recapturing market share via its unique portfolio of online payment processing product offerings as discussed in the earlier section.

This will accordingly contribute to management’s free cash flow target of $5 billion by the end of the year, supporting PayPal’s market valuation recovery as investors shift priorities from “growth at all costs” to profitability under the increasingly uncertain macroeconomic outlook. The newly authorized $15 billion share repurchase plan, paired with the $2.8 billion remaining from the preceding 2018 repurchase authorization plan also provides investors with further validation for management’s confidence in PayPal’s long-term value generation prospects.

Acknowledging the Investment Risks

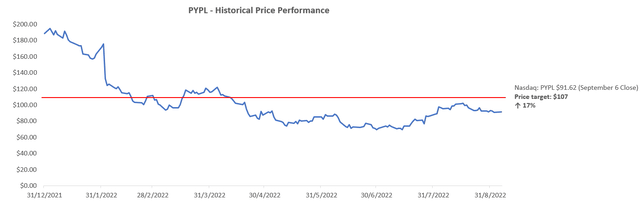

The PayPal stock is still teetering after a tough year from both a fundamental and valuation perspective due to internal operational inefficiencies, as well as broad-based macro headwinds. PayPal’s sustained gains in recent weeks has yet to make a dent in recouping the massive valuation losses incurred since the stock peaked last summer. This implies that markets continue to view the company in “transition phase” with high execution risks still.

Despite positive market sentiment on the stock coming out of PayPal’s 2Q22 earnings call, which laid out a clear improvement plan, investors remain focused on its execution abilities in the periods ahead. The risk of a violent selloff at the first hint of weakness – a frequent market trend observed in the first half of the year – remains elevated for the PayPal stock. Despite a favourable demand environment buoyed by secular digitization trends, and a sound strategic business plan from PayPal to capitalize on said opportunities, the underlying business has yet to demonstrate any structural evidence to support its ability in stemming continued market share erosion from increasing competition, and prevent stagnation of per user monetization growth. Buckling consumer sentiment under the soaring inflationary environment is also another cause for caution given PayPal’s exposure to the segment.

1. Stagnation of Per User Monetization Growth

As mentioned in the earlier section, PayPal boasts one of the largest active user bases in digital payment processing solutions, which gives it exposure to significant growth headroom ahead of increasing online transaction activity. While the company aspires to reaccelerate revenue growth after coming off of tough prior year comparables due to lapping with the eBay fallout and pandemic-era momentum last year by bolstering TPA and TPV expansion, aggressive cost-cutting efforts aimed at margin expansion could potentially backfire. PayPal is on track to spending more than $85 million this year in restructuring charges pertaining to “trimming its global workforce” alone. While management has alluded to “more productivity” rather than overall business downsizing for PayPal’s recent job cuts, a miscalculation in the balance could adversely impact the execution of its longer-term growth initiatives, and drag its share performance.

2. Increasing Competition

With 426 million active accounts across more than 200 markets worldwide, PayPal is on track towards facilitating more than $1.4 trillion worth of global transactions this year, making it a market leader in digital payment processing solutions across both merchant and consumer end-markets. But the company’s market share has dwindled from more than 50% over the past two years to now merely above 40%.

The first-mover advantage that allowed PayPal to scale its business and expand margins during the early days of digital payment adoption has worn off in recent years with increasing competition from not only payment pure-plays like Block, Inc.’s Square app (SQ), but also big tech companies like Google (GOOG / GOOGL) and Apple (AAPL) that have entered the conversation with their respective payment solutions – Google Pay / Google Wallet and Apple Pay / Apple Wallet. Digital payment processing solutions offered by big tech companies pose a significant threat to PayPal as they also boast a massive user base, with an added competitive advantage of being already integrated into consumers’ day-to-day life settings. For instance, iPhone / Apple Pay users can easily pay for mobile transactions through simple authentication with Touch ID or Face ID, which removes the need to sign up for a PayPal wallet. This might also incentivize merchants to adopt big tech’s checkout solutions over PayPal’s – primarily for mobile app-based payments – which risks further market share erosion.

3. Broad-Based Macroeconomic Headwinds

With consumer sentiment falling to record low levels this summer due to tightening economic conditions and soaring inflation, PayPal is taking a conservative stance to current year revenue growth. The company has lowered its current year guidance for TPV growth from the previous 13% to 15% guidance to now approximately 12% (i.e. ~$1.4 trillion). Management’s revenue growth expectations have also been dialed down from the previously implied guidance of $28.2 billion to $28.7 billion to now about $27.9 billion, representing a 10% y/y increase.

Yet, with strong momentum observed from 7% y/y revenue growth in April to more than 14% y/y growth observed in July, management’s expectations for continued revenue acceleration in 2H22 remains in the books. In addition to a benefit from a less competitive PY compare, PayPal’s prospects for continued revenue acceleration in 2H22 is further corroborated by improved consumer sentiment in August following signs of easing inflation. Recent data also indicates that millennials and Gen Zs – the two largest cohorts driving e-commerce demand – are less worried about near-term inflation woes compared to baby boomers and Gen X, providing partial insulation to adverse demand impact for PayPal’s online payment processing solutions. Overall American spending, adjusted for inflation, has also increased by 5% y/y, which spells room for continued revenue growth at PayPal should it continue to adequately execute its strategic transformation plans.

Fundamental Forecast

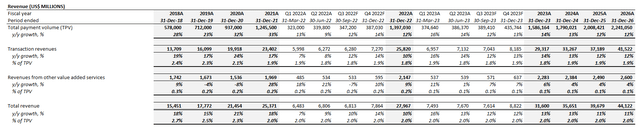

Drawing on PayPal’s solid fundamentals observed in the second quarter, as well as management’s guidance for continued acceleration through 2H22 through continued execution of its strategic transformation initiatives and a seasonality advantage, the company is expected to achieve TPV of $1.4 trillion by the end of the year. This is expected to drive transaction revenues of $25.8 billion for 2022, represent y/y growth of 10% which is consistent with management’s guidance. Paired with nominal revenues from other value added services, PayPal is expected to achieve net sales of $28.0 billion by the end of the year.

And over the longer-term, PayPal’s annual total revenues are expected to surpass $44.1 billion by 2026 based on anticipated TPV of $2.2 trillion, which represents a five-year CAGR of about 10%. The assumptions applied considers continued execution of PayPal’s long-term efforts in recapturing market share by both expanding its user base, as well as ARPA and TPA, and is also consistent with broad-based market trends on e-commerce and digital payment solutions demand.

PayPal Revenue Forecast (Author)

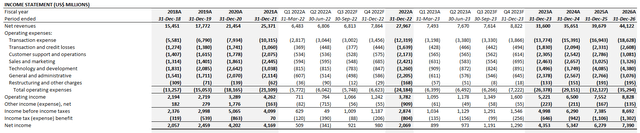

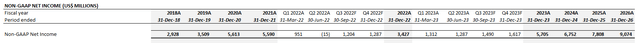

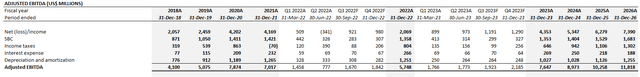

Considering management’s focus on restoring margin expansion, with $900 million in cost-savings to be realized by the end of the year, and annualized cost-savings to be realized by 2023, PayPal’s transaction margins are expected to gradually recover near 50% by 2026. Operating margins are also expected to further expand with continued scale and realization of non-transaction-related cost efficiencies from the low-teens range today towards 20% by 2026. As a result, GAAP-based net income is expected to expand from $2.1 billion in the current year towards $7.4 billion by 2026.

PayPal Financial Forecast (Author) PayPal Non-GAAP Net Income Forecast (Author) PayPal Adjusted EBITDA Forecast (Author)

PayPal_-_Forecasted_Financial_Information.pdf

Valuation Analysis

Drawing on the foregoing qualitative and fundamental analysis on PayPal’s underlying business, we have set a $107 near-term price target for the stock. This would imply upside potential of 17% based on the shares’ last traded price of $91.62 on September 6.

The price target is derived by applying a P/E multiple of 24.3x on projected NTM non-GAAP net income. The valuation multiple applied aims to better reflect PayPal’s forward growth and margin expansion profile relative to current share performance observed across the payment services and networks peer group, despite broad-based contraction this year due to tightening economic conditions. The anticipated delivery of continued growth acceleration in 2H22 through a combination of higher per user monetization and increase in user accounts as discussed in the earlier section will remain keys to unlocking near-term upsides.

Final Thoughts

Investors’ sentiment on the PayPal stock has done a 360 over the past two months compared to the first half of the year thanks to fundamental improvements in 2Q22 and greater visibility into its long-term growth outlook under strategic business transformation initiatives that prioritize a “narrowed product focus”. With the stock finding support at the $90-range despite recent market headwinds, investors are likely preparing for a transition towards renewed upsides should PayPal continue to deliver positive fundamental progress in 2H22. And this is not without reason. Despite broad-based risks that include growing macroeconomic uncertainties, competition, and potential deceleration due to inadequate execution of cost-cutting measures, the company exhibits competitive advantages – such as its continued market leadership and robust free cash flows – that support a sustained long-term growth and margin expansion trajectory ahead.

Be the first to comment