Solskin

The iShares U.S. Healthcare Providers ETF (NYSEARCA:IHF) is relatively well positioned in the current environment. There’s a lot of capital allocated to health plans here, which will do well in the current environment and on a secular horizon with new regulation. The PE is pretty high, however, so many of the benefits of this area of the market seem rather priced in. Nonetheless, it doesn’t create any immediate worry in the current market.

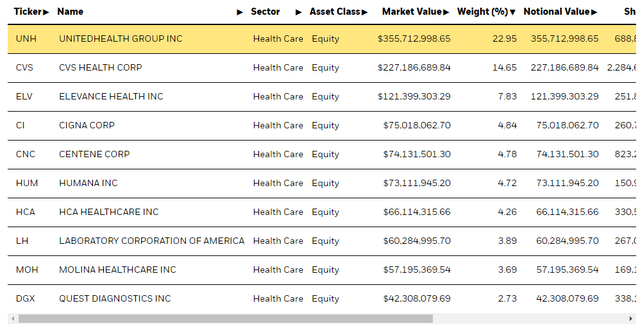

IHF Breakdown

Let’s have a quick look at what is contained in the ETF.

The top allocation is health plan provider UnitedHealth (UNH) for 23% of the ETF allocation. Companies like UNH should benefit, as other insurance companies will in the current environment. They hold substantial instruments that are ready for sale. If they choose to, and since many of the instruments are short term, they will roll over into a higher yielding short term instrument in short order. Investments will perform better in these companies’ insurance portfolios.

There is also a 14% allocation to CVS Health (CVS). Here we have pretty resilient consumer products exposure in retail pharmacy. But we also have the pretty major health insurance business in Aetna. That, much like health plans, will perform attractively on the asset side with the rate hiking environment. What’s more is that limits for both these companies have a chance to rise on a secular horizon. On one hand, prices rise for healthcare products. But there is an additional force within private health insurance, where there might be a shift of pricing into pharmacy customers covered by private health insurance since the passing of bills that mean price caps for some key drugs for Medicare-covered people. In order to deal with this in their elderly markets, drug companies may increase pricing in their private covered markets, thus an additional impulse on pricing that will mean larger underwriting. All the same goes for Cigna (CI).

Other exposures are in lab businesses and other companies that support healthcare facilities and the health insurance businesses. They should all be pretty resilient.

Conclusions

Concerns around this ETF primarily lie in the multiple. It appears rather high at 18x, meaning an earnings yield of a little above 5%, which barely outpaces risk-free reference rates. While the businesses are resilient and do carry quite low risks, there isn’t enough upside. While the ETF could provide resilience on a directional basis, how the market will view this multiple longer term is uncertain, even while there is earnings growth in the health insurance industry to stay somewhat ahead of reference rates thanks to secular forces as well.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment