Ong-ad Nuseewor

Introduction

It is better to buy a good business at a fair price than a fair business at a good price. This is true with ePlus inc. (NASDAQ:PLUS). It’s not that the valuation is far below intrinsic value, but rather that the company is excellent at reinvesting capital back into the business, that is, making it an interesting investment opportunity.

The company offers a comprehensive portfolio of technology solutions, that helps their customers store, secure and analyze data. The company offers consulting on design and implementation of data, with expertise in cloud, cyber security and infrastructure.

Fundamentals

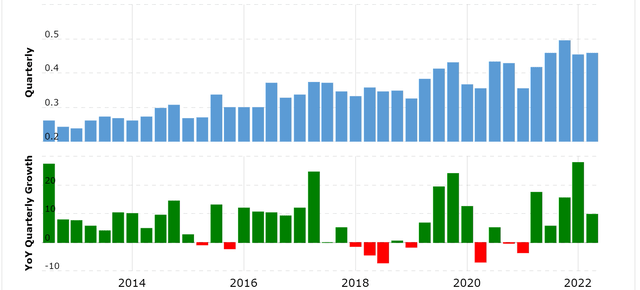

The company has grown revenue in high single-digits with little volatility. The growth is a mixture of organic growth combined with various acquisitions along the way. It does not seem cyclical nor unstable. Given the essential services the company provides, I think it’s fair to assume, that the stability will continue. Since the balance sheet is well managed, acquisitions should also continue to be pursued.

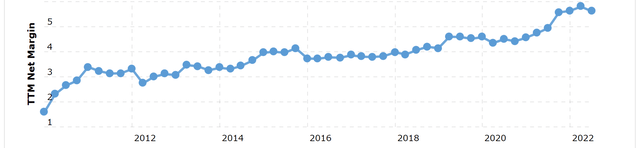

What is more impressive than the stability of the top line are the improvements in the net profit margin. This has been continuously improved over the last 12 years. Whether it will continue to rise in the future remains to be seen, so to be conservative, I will assume it will remain flat at current levels. However, it shows that the business is very competitive and has a large moat.

Net profit margin (Macrotrends.com)

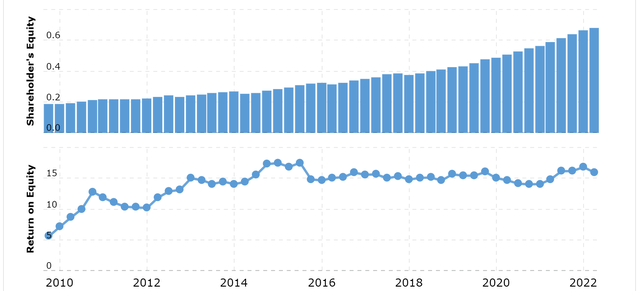

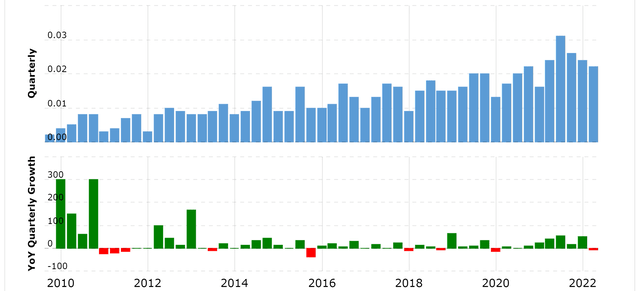

An increasing top line and profit margin have generated net income at an impressive rate. This net income has primarily been reinvested back into cash-generating assets and thus equity, but has also previously been used to finance buybacks. However, the company stopped buying back shares in 2018, which is good, since equity has contributed more than any share buyback would have.

Dividends have never been paid out, which, like the share buybacks, has been a good thing for the shareholders.

Capital allocation

The management of ePlus does a good job with capital allocation. They have maintained a high rate of ~15% on their reinvestments for more than a decade. It’s not so much the 15% return on equity that’s impressive, but the fact that it’s reinvested back into new equity at the same rate is what’s making it impressive.

The good thing about them reinvesting everything back into new equity is that, the growth in the intrinsic value is not dependent on the market valuation of the company. If the company instead used earnings to buy back shares, the intrinsic growth would depend on what the market valued the company at.

The return on equity is shown in the image below. Notice the stability of the reinvestment rate and the rapid growth in equity.

Return on equity (Macrotrends.com)

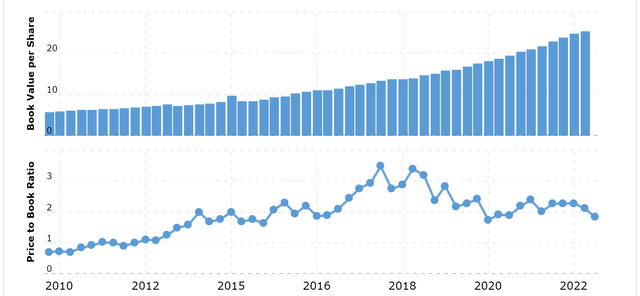

With the majority of earnings reinvested in new cash-generating assets, it is not surprising to see, that book value per share is up 13.5% per year since 2012. For that kind of growth, I’d be hesitant to buy at a P/B multiple higher than ~1.5, as that would increase the risk of overpaying.

At its current 1.83 p/b, it seems fairly valued and certainly quite attractive.

Valuation

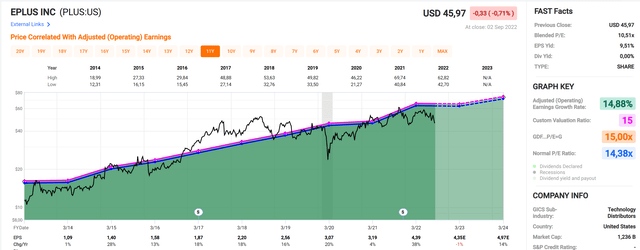

The company as of their latest quarter only has $215m in debt with $83m in cash, cash equivalents and short term investments. That gives the company a net debt of $132m. Considering their market cap at a reasonable 15 p/e would be $1.76b, the net debt does not seem to justify its current multiple.

The stock has averaged an earnings multiple of 14.38 over the past decade, making its current multiple of 10.5 seem low. A return to a reasonable earnings multiple of ~14.5, would indicate upside potential of ~37%

Earnings per share (Fastgraphs.com)

Stock chart

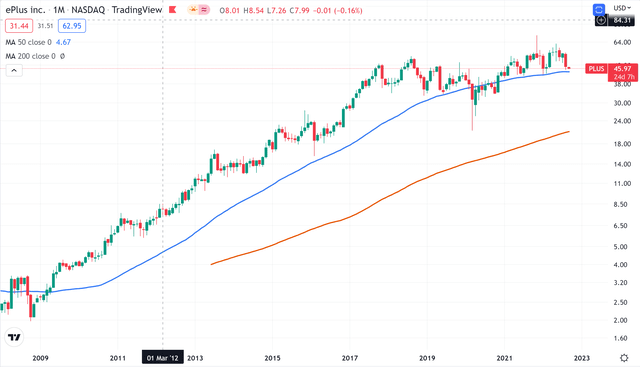

Quick disclaimer. A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

While we don’t have much data on this particular stock and how it behaves around the moving averages, it has previously found support at its 50-month moving average, which is very common for consistently growing companies to do. Given that the business continues to grow with double digits, I find it unlikely that this time will be any different.

I wouldn’t expect it to touch the 200-month moving average. That would be too far below any reasonable valuation, even if a broad crisis were to occur. Based on the performance of the stock chart, I think a price below the 50-month moving average would be a good place to accumulate.

Stock chart of PLUS (Tradingview.com)

Final thoughts

The fundamentals of the company are strong. The company has a consistent top line, which as a result of organic growth combined with occasional acquisitions, has grown by single digits each year. The net profit margin continues to improve, showing the strength of the business.

Management has shown great ability in the previous decade, as being able to reinvest at a consistent pace. Earnings have grown by double digits, which is expected to continue.

With the company currently valued at a P/B of 1.83, it seems reasonably valued. To increase the margin of safety, I believe it would be prudent to only accumulate shares when below the 50-month moving average. The company would then be cheap based on its stock chart and earnings, and should continue to deliver double-digit growth going forward.

Be the first to comment