Jarmo Piironen/iStock Editorial via Getty Images

Following our analysis of “Uniper Towards Nationalization” (OTCPK:UNPRF), today we are looking back at Fortum Oyj’s implications (OTCPK:FOJCF). Before the energy crisis, Fortum was Uniper’s main shareholder with an equity stake of 77.96%, but later on, the German Government decided to support Uniper with a bailout package and enter a 30% control of the gas company (Fortum’s equity stake in Uniper was reduce to 56%). However, since mid-July, the crisis further escalated and yesterday’s rumours just confirmed a potential full nationalization.

In a joint press release, Uniper and Fortum communicated that they are looking for “alternative solutions”, meaning that the German Government will likely take over the company.

Fortum latest news

Source: Fortum corporate website

So, what’s next for Fortum?

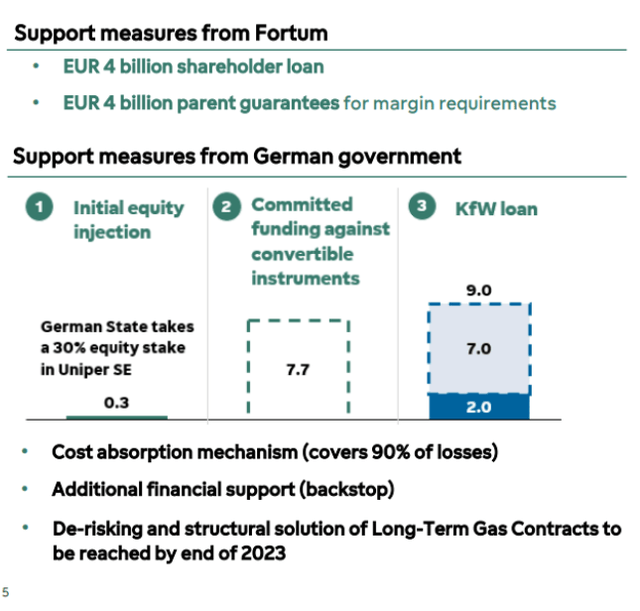

In our initiation of coverage, we said that Fortum will not back any more bridge financing to Uniper as well as it won’t provide any more equity injection. And, we continue to believe so. In detail, Fortum already committed a total of €8 billion support package, but it is important to emphasize that German intervention was dilutive for Uniper’s minor shareholders but less for the Finnish company (this was due to the optionality of converting the €4 billion support package in equity at more favourable conditions). More importantly, the KfW bank (the German national bank) guaranteed a €4 billion repayment to Fortum. In the worst-case scenario, we forecast that Fortum will have back only half of Uniper’s supportive measures for a total consideration of €4 billion.

Uniper latest news

Source: Fortum half-year results

Thanks to Fortum’s hedging strategy, the Finnish company might benefit from gas and energy price volatility given the fact that 75% and 50% are already fixed contracts for 2022 and 2023 respectively. As explained in Uniper’s note: “to continue to operate in the derivatives market, it is mandatory to pay a margin of about 20% of the value. These margins are updated daily and they have grown a lot, and some governments have granted credit lines to guarantee liquidity to companies in difficulty”. For the above reason, Fortum has agreed with its own country the financing needs to cover the extra costs. Although Fortum’s main shareholder is the Finnish government (with an equity stake of more than 50%), the authorities are looking to tax the extra energy profits which would limit Fortum’s potential upside.

As we already mentioned, Russian assets still represent more than 20% of Fortum’s total EBITDA. We believe that Russia’s asset sale will be delayed, but this has already been priced in by the market. Thus, we continue to provide a zero value with a full impairment.

Conclusion

No financial outlook is provided by the company. Regarding the valuation, we remain neutral on Fortum forecasting a minus €3.7 billion in 2022 EBITDA. We already cut EPS estimates by 10% in our internal 2023-2024 accounts. The risks paragraph is included in our initiation of coverage.

Mare Evidence Lab’s sector coverage:

Be the first to comment