Kevin Dietsch

The departure of Sheryl Sandberg leaves Meta Platforms (NASDAQ:META) without an adult in charge of the business. At least this is the view of the market while CEO Mark Zuckerberg has successfully navigated the tech giant to one of the most valuable companies in the world. My investment thesis remains ultra-Bullish on the stock now trading at 52-week lows below $150 with a lot of irrational fears about the business.

Sheryl Sandberg’s Departure

The long-standing COO of Meta officially stepped down from her executive role at the company back on August 1. Meta had announced the plans for Sheryl Sandberg to depart back on June 1 with the BoD appointing Javier Olivan as the new COO. Sheryl will officially depart the company on September 30 and remain a member of the BoD.

In addition, the company announced in late June that CFO David Wehner was transitioning to a new role as the CSO (Chief Strategy Officer) with Susan Li becoming the new CFO on November 1. While both Sheryl and Mr. Wehner are still part of the company, the market hasn’t heard much from the new COO and CFO, leaving Mark Zuckerberg as the only major executive from the $400 billion company with any market visibility and confidence.

Altimeter Capital’s Brad Gerstner reinforced the market sentiment with this comment on a CNBC interview:

I think they’ve done an absolutely lousy job of explaining this transition to the Street. It’s time for the new CFO, for Susan and for Mark to get out in front and explain to investors exactly what’s going on.

The last earnings report took place on July 27 and neither of these new executives took part in the call. Of course, neither executive was in their new roles yet, but both executives have been announced as the new leaders since the start of August and the market hasn’t heard anything from them or the departing executives leaving a leadership void.

Meta doesn’t list any upcoming investor events and surprisingly missed the recent Goldman Sachs 2022 Communacopia + Technology Conference attended by most of the technology heavyweights. As Business Insider highlighted, the Goldman Sachs conference in San Francisco was the largest ever technology conference, with executives from Alphabet (GOOG) to Microsoft (MSFT) to Qualcomm (QCOM) in attendance.

Zuck Still In Charge

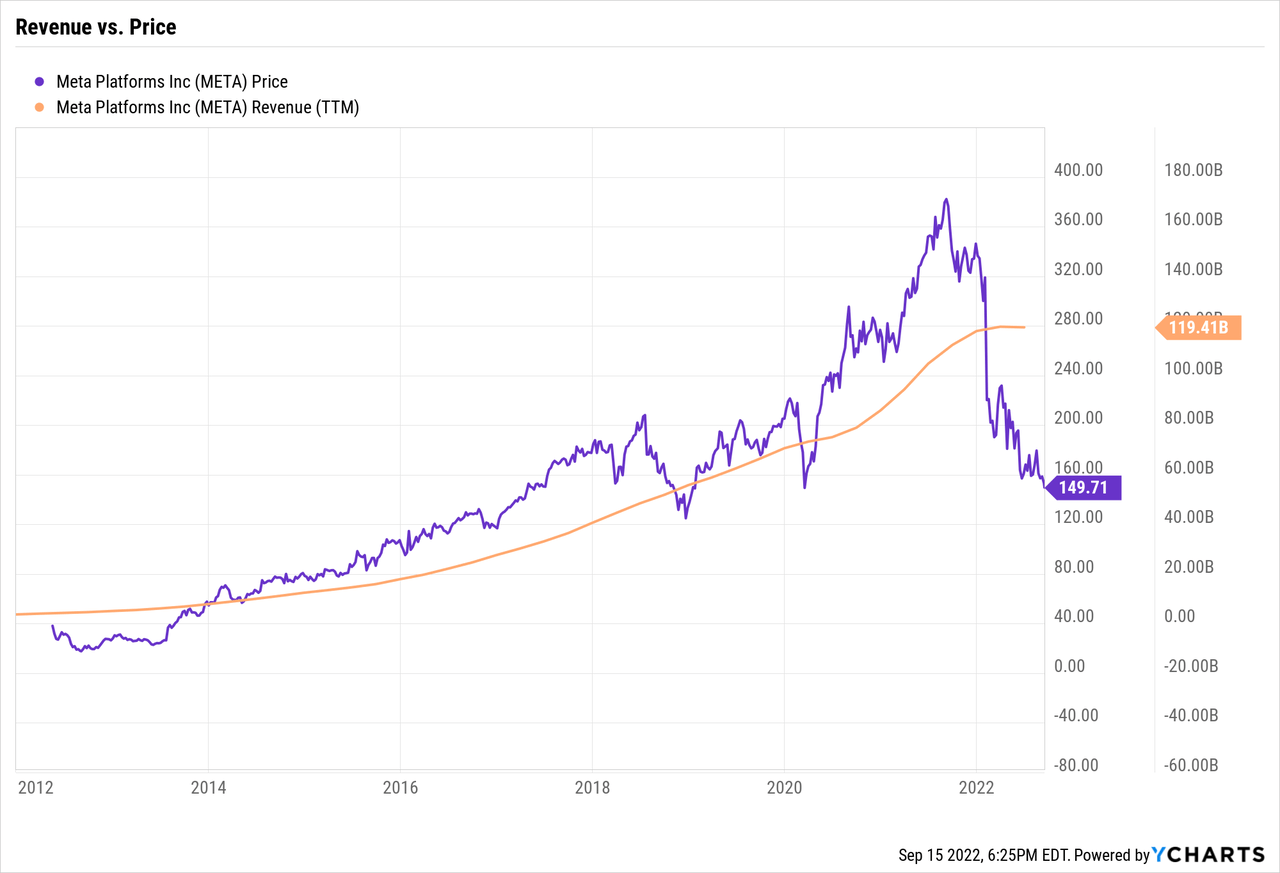

While Meta needs to do a better job of getting new and departing executives in front of the media to instill confidence in the business considering the concerning economic climate, the tech giant still has Mark Zuckerberg in charge. The founder has led the company to a $120 billion revenue base, with goals of reaching $150 billion in the next few years.

Zuckerberg has already outlined the Metaverse plans and the goals of cutting the losses for the Reality Labs division. The company is set to launch the Meta Pro headset here in the next month that should provide investors with some more confidence on the business outside of the social media space.

The biggest issue for the company is competing against TikTok and Reels continues to struggle in this competition. The timing of the executive departures is interesting considering this ongoing struggle.

According to the WSJ, an internal document titled “Creators x Reels State of the Union of 2022” highlights the major problems facing Meta until the Metaverse takes off. The internal report apparently suggests only 20.7% of the 11 million creators on the platform actually post a Reel once a month. Even worse, a large portion of the ones posted is copied from other platforms such as TikTok.

The company is now so far behind TikTok on short form videos that Instagram users only spend 17.6 million hours a day watching Reels while TikTok users spend 197.8 million hours a day watching videos. Meta definitely has a lot of opportunity to close the gap, but such a move might be impossible outside of an outright ban of TikTok by the U.S. government.

Remember, though, Reels only counts for $1 billion in annual revenues now out of the $120 billion forecast by the tech giant. Short form video is a solution to revenue problems of Meta, but not necessarily a problem to the current revenue base.

Another solution discussed in previous research is the massive reduction of the losses for the Reality Labs division. Meta was running at $10+ billion annual losses for the Metaverse division, leading to the weak income and cash flows of the last year or so.

While the market leadership outside of the CEO has a major void right now, the new COO might provide a much higher product focus versus the previous focus of Sheryl Sandberg as much more of a brand ambassador.

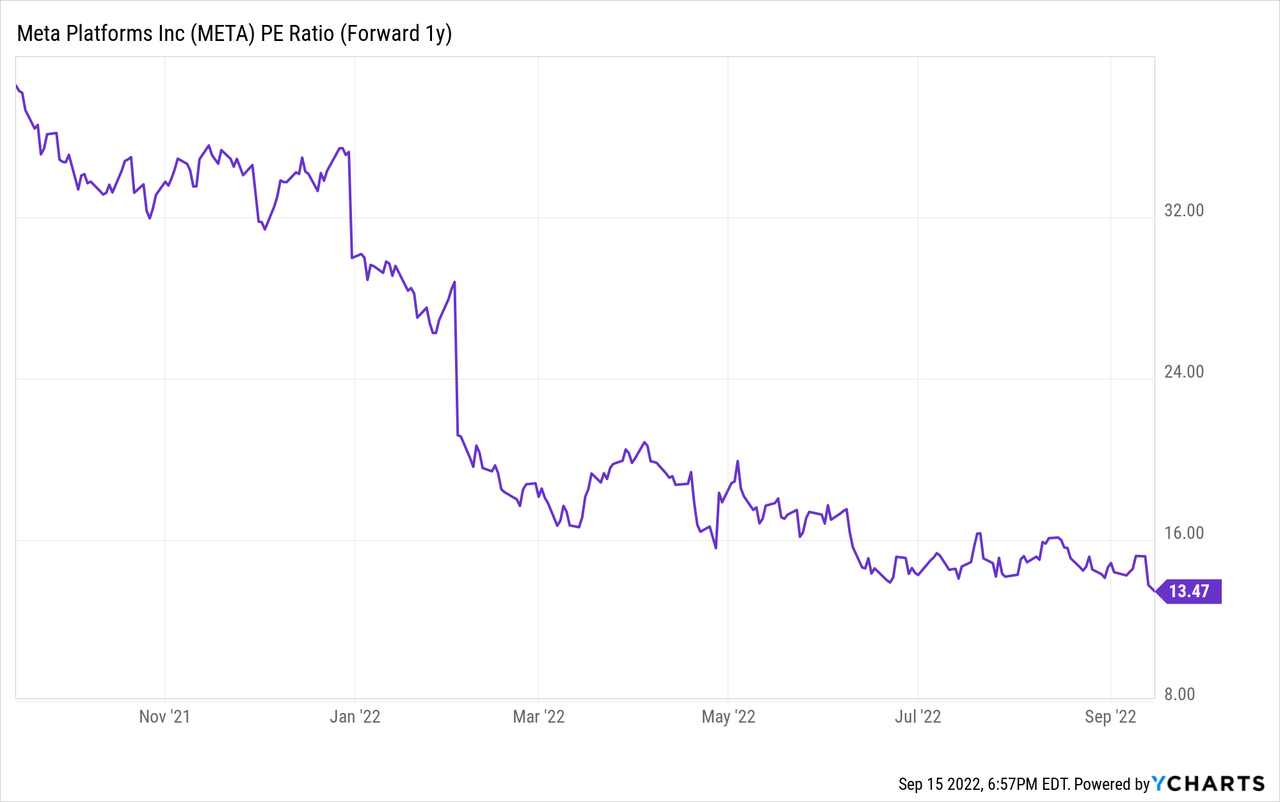

The stock only trades at 13x forward EPS targets. These estimates don’t even appear to factor in the ability of Meta to boost EPS dramatically by cutting losses in the Reality Labs division with the company just cutting those losses by 25% boosting EPS by $1.

Takeaway

The key investor takeaway is that the market has already written off the future ability of the company to return to growth, despite the opportunities in both Reels and the Metaverse. The new executives might actually provide a shift at the company to building new products versus the brand ambassador role of the prior long-standing COO and even CFO.

Meta remains too cheap here, with several catalysts to return to strong growth. The market doesn’t like the current leadership vacuum, but this issue will pass.

Be the first to comment