Alena Kravchenko

There has been a strong correction in the broader market over the last few months. Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) has shown that it is a good bet in this scenario with strong fundamental growth metrics. In the recent quarter, the company reported revenue of $69.7 billion against an expected $69.9 billion. However, YoY revenue growth was 13%, which is a good number when we look at the tough comps and the difficult macroeconomic situation. This growth rate is also higher than all other Big Tech peers. It should be noted that the strengthening dollar further chopped off 3.7% from the revenue growth, according to CFO Ruth Porat.

Google is showing improvement in its hardware, subscription, and cloud business. All these businesses can help the company deliver good growth in the next few years, even if we see a market correction or a short recession in the broader economy. Google also undertook a massive $13.3 billion in stock buybacks in the recent quarter. The trailing twelve-month stock buyback stood at $52 billion. This is enough to expunge close to 4% of the outstanding stock annually. A modest P/E multiple, strong growth metrics, and buybacks should increase the long-term returns potential of Alphabet stock and makes it a good bet in the current environment.

Continuation of the correction phase

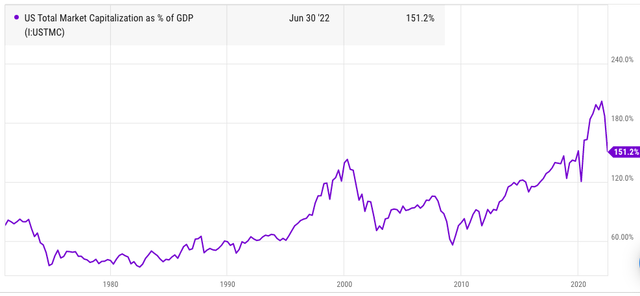

It is difficult to predict how long the current phase of correction will continue. However, if the geopolitical tensions continue, we might see higher commodity prices which can have a ripple effect on inflation and lead to bearish sentiment on Wall Street. Even after the current correction, the U.S. total market cap as % of GDP is quite high. We can look at the peak of the dot-com bubble when this metric was less than 140%. Currently, the U.S. total market cap as % of GDP stands at 151%. If the headwinds in the broader economy continue, we could see a continuation of the correction phase.

Figure 1: U.S. market cap as a percent of GDP.

In this correction phase, it is important to have a portfolio that can withstand bearish sentiment and companies which can deliver growth on a sustainable basis.

Google is a strong growth story

Google has built a number of levers that should deliver long-term growth. One of the main businesses is hardware. The company is in second position in the smart speaker and smart home devices, behind Amazon (AMZN). It has also increased the estimates of Pixel unit sales to 10 million in this fiscal year. This is significantly below Apple’s (AAPL) unit sales of over 200 million from iPhones. But Google has one of the best brand image among the Android OEMs. The 5G era has also led to rapid growth in average selling price by other Android OEMs due to higher costs. At the same time, Google is launching budget Pixel phones with high specs which have narrowed the price gap with other manufacturers.

Pixel’s growth will also be supported by an increase in the subscription business. Google has already launched Pixel Pass where customers can use all the subscription services of the company along with a new Pixel device every two years. This distributes the cost of Pixel devices over a longer period and reduces the sticker shock for customers. Google has reported over 50 million subscribers on YouTube Premium and YouTube Music platform. This number could increase rapidly as the company increases the benefits for subscribers while reducing the options for non-subscribers.

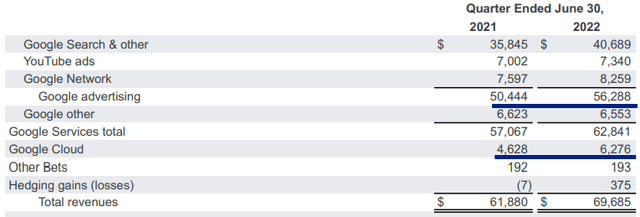

Figure 2: Strong growth in core advertising and Google Cloud.

Google Cloud is another major long-term bullish story for the company. Despite a slight slowdown, the company reported annualized revenue rate for cloud service at more than $25 billion with 35% YoY growth rate. This service still shows massive losses, but as the revenue grows we should see better economies of scale.

If Google is able to close the margin gap with Amazon’s AWS, the cloud service will become one of the main drivers for margin expansion. At the current growth rate, the cloud service should hit $100 billion revenue rate by 2025. AWS has shown an operating margin of 30% for the last few quarters. If Google cloud reports a modest margin of 20%, it will add $20 billion to the operating income of the company by 2025.

Modestly priced stock

The main reason why Google is a better bet to protect returns in a recession is due to its cheap valuation multiple. Google has a higher YoY growth rate compared to other Big Tech peers and has a number of strong growth drivers. Despite these factors, it is trading at a modest P/E multiple. The cheap valuation should allow the stock to bounce back faster in the case of a major recession.

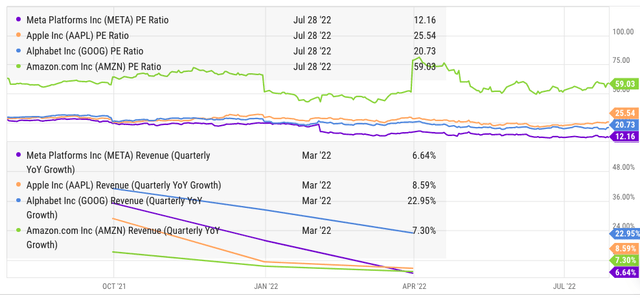

Figure 3: Comparison of YoY revenue growth and P/E ratio of Big Tech companies.

Alphabet has been reporting better YoY revenue growth rates compared to other Big Tech companies for the past few quarters. In the recent quarter, Alphabet reported 13% YoY revenue growth compared to 7% by Amazon, 2% by Apple and negative 1% by Meta Platforms (META). At the same time, Alphabet’s P/E multiple is a modest 20.5 compared to 25 in Apple and 60 in Amazon.

Alphabet’s management is also spending heavily on buybacks. In the recent quarter, the company bought back stock worth $13.3 billion and over the last twelve months it has bought back $52 billion worth of stock. Alphabet can continue and even increase the pace of buybacks due to its massive cash reserves and gargantuan free cash flows. As the cloud service achieves economies of scale, we should see better margins in this segment. A bulk of these extra resources could be spent on buybacks as the company does not have many businesses which require huge cash injections.

Investor takeaway

The U.S. stock market is undergoing a correction phase. This phase can continue for some time due to macroeconomic headwinds. Alphabet stock is a good bet due to its modest valuation multiple compared to other tech companies and the future growth outlook.

Google has already shown good progress in the hardware business where it is leading in several categories. This will be a major driver for future revenue growth as new product lines are launched. The Pixel sales are also improving which should help the subscription business of the company and reduce the long-term traffic acquisition cost.

The margin expansion in the cloud business will be the main reason for better operating income and earnings over the next few years. Due to these factors, the Alphabet stock seems as a better alternative compared to many other tech players.

Be the first to comment