kentoh/iStock via Getty Images

Investment Summary

After another solid quarter, we are more constructive on NovoCure Limited (NASDAQ:NVCR) shares. The company extended its trajectory of sales growth, free cash conversion and return on capital – all factors conducive to the current investment landscape. Moreover, NVCR continues to advance its footprint into the Tumour Treating Fields (“TTFields”) segment, and this is a clear inflection point for investors to focus on with this name.

Despite the various pivot points, valuations are priced rich compared to peers and a potential mispricing to the downside has us trigger shy in this name. With the culmination of these factors, we rate the stock neutral with a price target of $59.

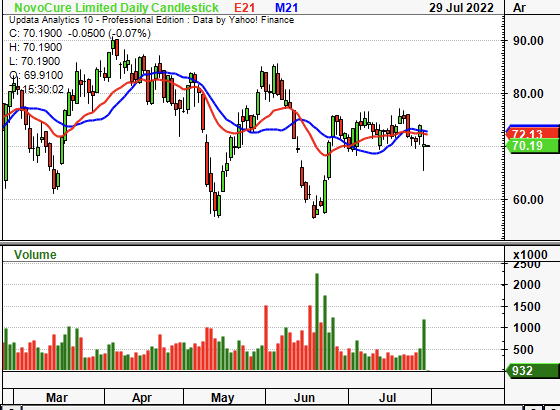

Exhibit 1. NVCR 6-month price action

Data: Updata

Q2 Earnings Momentum On Full Display

Second quarter revenue came in strong at ~$141 million, a 550bps YoY growth at the top. Gross profit on these revenues was $112 million, up 770bps YoY. Meanwhile, the company recorded 3,453 global active patients on therapy at the end of the quarter, representing YoY growth of ~3%. Due to lack of visibility in Germany, it couldn’t reiterate a guided 2-3% patient growth there.

As an update on the Optune pricing dilemma, NVCR looks to have achieved some price stability in Germany after reaching an agreement with one of the largest public payers in Germany. It now formalized the contract so that it represents ~70% of the covered lives in Germany. This will serve as an important benchmarking tool as NVCR strives to achieve reimbursement within numerous European markets. However, the negotiations did have a net-impact to revenue, unspecified by management. It notes that some payers withheld new patient approvals and denied approval for others under existing DME listing criteria.

Geographically, NVCR recognized upsides in its US markets and achieved an 80% gross margin for the second quarter. The ~150bps of YoY margin lift was attributed to a ~500bps YoY decrease in COGS per active patient. Importantly, the company stated it did not recognize any impact to COGS from cost inflation during the quarter.

However, the company did realize a 1,400bps YoY headwind at the SG&A line, totalling $76 million. The spend was underlined by marketing initiatives as the company approaches a number of pivotal trial readouts. NVCR continued its aggressive R&D schedule, as R&D expense came in at $57 million for the quarter, a 1,300bps increase from the previous year. Moving down the P&L, it recognized a loss of $0.23 EPS for the quarter, down from -$0.14 the year prior.

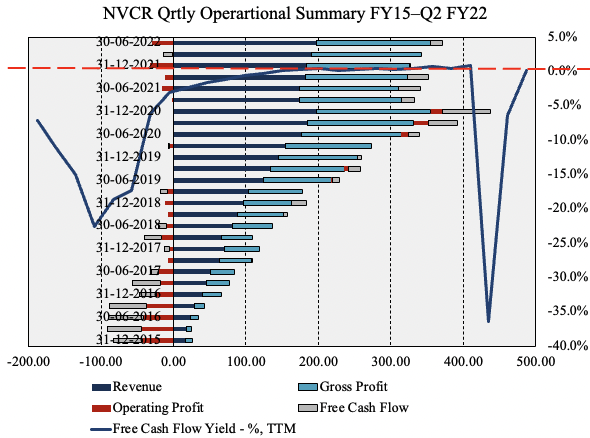

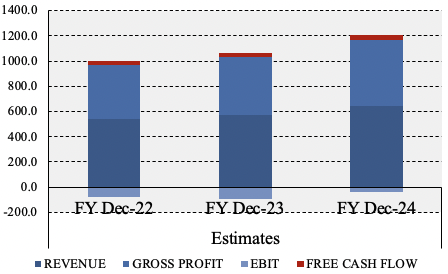

NVCR’s Q2 earnings continue a longer-term quarterly growth trend across the company’s operations since FY15–date. As seen in Exhibit 2, both sales and gross profit have continued to widen over the past few years to date. Meanwhile, FCF has been lumpy, but averaged ~$13 million on a quarterly basis since FY18. It printed ~$11.7 million of FCF in Q2. As seen below, investors realize a ~300bps TTM yield on this.

Exhibit 2.

Data: HB Insights, NVCR SEC Filings

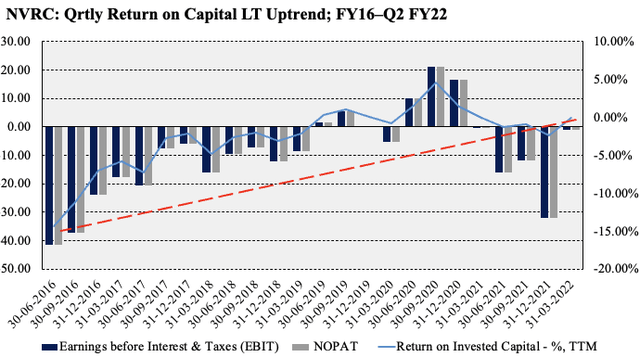

With these trends in mind, it’s unsurprising to see long-term return on investment trends continue for the stock. Here we examined how much NOPAT NVCR generates from its invested capital as a measure of management’s decision-making. As seen in Exhibit 3, ROI has increased on a sequential basis since FY16, offering investors substantial upside capture now that ROI is printing positive on average for the past three years. These are desirable characteristics in the forward-looking regime.

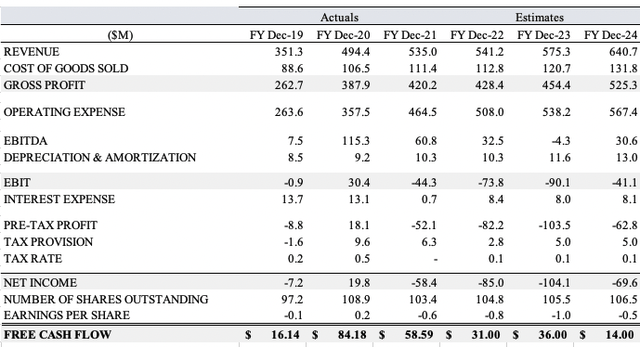

Looking ahead, and we’ve modelled NVCR to print $542 million at the top this year, with $575 million and $640 million in FY23 and FY24 respectively. Despite this, we expect the company to recognize a net loss of $85 million this year. We project NVCR to deliver $32 million in FCF this year, ahead of consensus estimates, and forecast this to stretch up to $36 million by FY23.

Exhibit 3. Long-term ROI trends continued this quarter and this illustrates a solid bedrock for the coming periods

Data: HB Insights, NVCR SEC Filings

Exhibit 5. NVCR Forward Estimates

Data: HB Insights Estimates

Exhibit 6. Forward P&L contribution

Data: HB Insights Estimates

Perhaps most importantly for the NVCR story, by estimate, the company continued making inroads on its penetration into the Tumour Treating Fields (“TTFields”) market. Findings from Carrieri et al. (2020) illustrate that TTFields show promise “as an innovative, non-invasive anti-cancer treatment modality.” Specifically, TTFields are a low intensity, intermediate frequency (100–300 kHz) alternating electric field delivered to cancer cells, the authors say. They are non-invasive and exhibit minimal systemic toxicity. TTFields have more than 1,500 citations this YTD alone.

On the call, management said that it is pushing various avenues to increase the adoption of TTFields therapy. In June, NVCR announced the EF-31 Phase 2 study met its primary endpoint at a 50% objective response rate, and displayed supportive signals across secondary endpoints. The median progression-free survival was 7.8 months. Aside from this, additional data was presented throughout the quarter. Research examining genomic factors related to the response rate of the Optune treatment. Optune uses TTFields and is indicated as an alternative therapy for the treatment of glioblastoma multiforme in adults. Data showed Optune’s efficacy in overall survival in the study’s cohort. This data was published in the June edition of the Journal of Neuro-Oncology.

Valuation

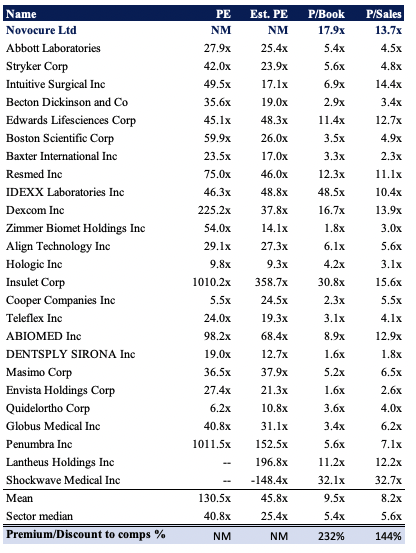

Prescribing a concrete valuation looks to be tricky at present given a number of variables impacting the company’s profitability. Shares are richly valued, and here’s where the forward-looking risk/reward calculus starts to balance itself out. Shares are trading at ~18x book value and 14x sales. At 18x book, this either represents fantastic value creation for shareholders, or a substantial mispricing to the downside by estimation.

Exhibit 5. Multiples and comps

Data: HB Insights

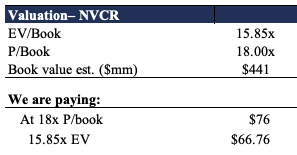

Consequently, when examining this in more detail, we note that NVCR is also valued at 15.85x enterprise value (“EV”)/book value of equity. Hence, if paying the approximate 18x or 15.85x book value, then we’d theoretically be paying anywhere between $66.76–$76 for the stock, suggesting it’s at least overvalued by around 13% on the culmination of its latest earnings. Therefore, we see NVCR fairly priced at $59.

Exhibit 5.

Data: HB Insights Estimates

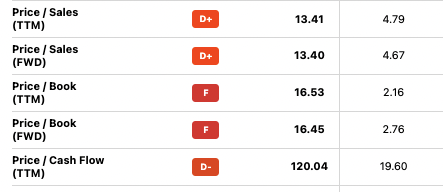

The stock is also showing as overvalued relative to the sector across a wider array of multiples, as seen in the chart below. In particular, it trades at exorbitant multiples to cash flow, as observed.

Exhibit 6. Seeking Alpha Quantitative Factor ratings provide an objective measure of value. As seen below, the scoring system has NVCR rated poorly relative to the sector median (right-hand side).

Data: Seeking Alpha Quantitative Factor Ratings, NVCR

In Short

NVCR came in with another robust quarter that saw upside at revenue, but missed consensus EPS estimates. Nevertheless, long-term return on capital trends continued this quarter and the company realized some clinical trial momentum throughout the period. We look to upcoming data readouts as potential catalysts for the share price, and ultimately, we were impressed by the quarter.

The question now turns to one of value, and our findings demonstrate the stock might be ~13% overvalued right now. Hence, we price NVCR at $59 per share and look for it to re-rate to that level before making a more concrete call on entry. For now, it’s simple, we are bullish on the long-term value potential of NCVR, but valuations have us on the sidelines for now. Rate neutral.

Be the first to comment