Joe Raedle

Investment Thesis

Shares of Stanley Black & Decker (NYSE:SWK) have contracted heavily after the latest quarterly results. Consumer demand and forward guidance fell so hard that the company announced a massive overhaul of their operations.

I think that the company’s plans for a turnaround are promising. However, I still believe there is some execution risk for the company. At the current valuation, shares still seem somewhat expensive considering this risk. I’m avoiding the stock right now, but I will be closely watching for updates on the company’s execution.

A Disaster Quarter

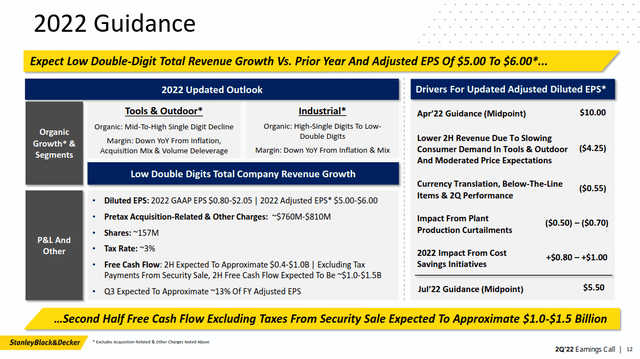

Stanley Black & Decker is coming out of a disaster earnings report. The company reported a 16% decline in volume during the quarter. The company revised guidance for its core tools and outdoor segment. The company previously expected mid to high single digit growth. Now, they expect a mid to high single digit decline. Since their initial guidance, GAAP earnings projections cratered from a midpoint of $12.25 per share to $5.50 per share.

Stanley Black & Decker Q2 2022 Earnings Deck

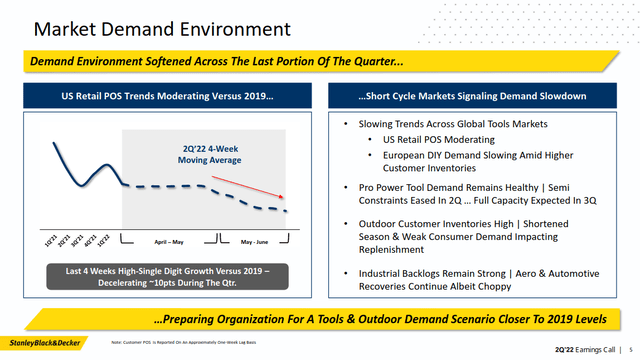

Management primarily blamed this cut on a rapid deterioration in demand trends. And some of these trends are due to macro factors. For example, the company had mediocre results in their outdoors segment due to poor weather. Other trends include predicted declines in consumer spending and a softening housing market. A potential recession would disproportionately impact companies in the tools space.

Stanley Black & Decker Q2 2022 Earnings Deck

But some of this is also likely due to the company’s execution. Industry bellwethers such as Home Depot (HD) and Lowe’s (LOW) are still reporting strong demand going forward. These companies are more exposed to the professional market than Stanley Black & Decker. But a 16% decline in volume is still very worrying in this environment.

A Transformation Towards Tools

Stanley Black & Decker is at the end of a long term transformation of its business. Ten years ago, the company was a diversified industrial manufacturer. Its segments ranged from security businesses to automotive repair manufacturing. But over the past ten years, the company has worked to reorient its business around its tools and storage segment.

The business has been divesting its industrial and security segments. In 2012, the company’s consumer business made up about half of its revenue. Now, the equivalent segment contributes over 80% of revenue. This segment is heavily tied to the consumer discretionary and housing markets. I believe this makes the company much more cyclical and riskier.

I think Stanley Black & Decker has a questionable moat in this area. Yes, the company has a high quality brand portfolio in the tools and outdoor spaces. Craftsman, DeWalt, and Black & Decker are all well known brands. But the company operates in a highly competitive industry. I don’t think the company’s brand translates into pricing power. On their last earnings call, management implied that they couldn’t increase prices further. They also said that they don’t see many retail price gaps compared to their competition. This would indicate that their products don’t have as strong of a moat as some investors might believe.

Since 2017, the company has spent $7.2 billion on acquisitions. But the business hasn’t generated much sustainable operating income growth from it. Simply put, I don’t think the company has invested capital well in their transformation.

An Ambitious Cost Cutting Plan

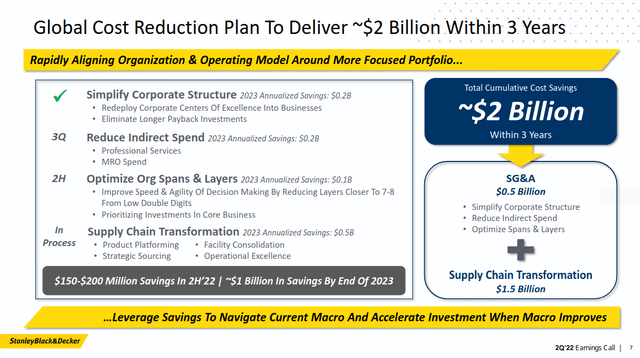

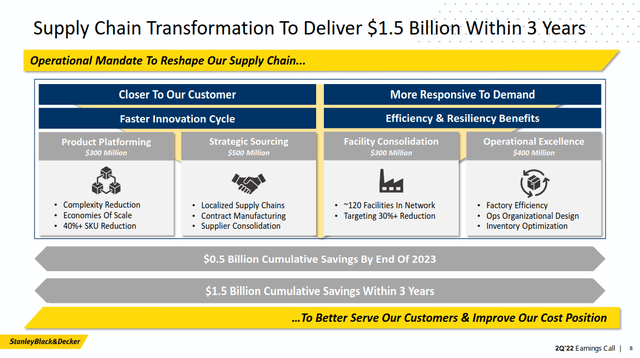

To soften the blow of the terrible quarter, management announced a series of cost cutting measures to improve the company’s margins. The company is targeting a whopping $1 billion in savings by the end of 2023.

Stanley Black & Decker Q2 2022 Earnings Deck

A lot of these cost cutting measures focus on reducing a bloated corporate structure. I don’t see how this is bad. I do find it odd that these issues weren’t fixed during previous restructurings. But the most significant source of projected cost savings is the company’s supply chain.

Stanley Black & Decker Q2 2022 Earnings Deck

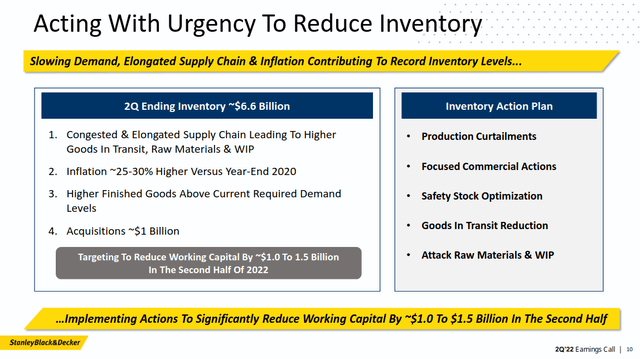

These supply chain difficulties are tied to the company’s elevated inventory levels. During the last quarter, the company had 188 days of inventory on its balance sheet. This is more than double pre-pandemic levels and much higher than the company’s ten year average of 97 days. On their last earnings call, management discussed this dynamic.

One of many lessons from the pandemic is that complex and long supply chains are prone to disruption. And in our specific case are not matched well with the short cycle nature of our businesses. So you have a choice maintain very high levels of inventory due to the long supply chain or have your supply chain closer to your customer, elevate your agility, and resiliency to better serve those customers. We believe being closer to the customer is the right answer.

This ties into the business’s “Make Where We Sell” strategy. The plan aims to localize supply chains and reduce SKUs. This strategy has been in the works since before the pandemic. Management is accelerating it because of the recent downturn. In total, the company wants to reduce its operating footprint by 30%.

Stanley Black & Decker Q2 2022 Earnings Deck

I really like this move. It should massively reduce the company’s required inventory levels and their lead times. It also helps management’s plan to cut inventory levels and reduce working capital. It could help the company reset to a reasonable baseline.

But there may be some execution risk here. The announced cost cutting measures were a hard pivot due to poor performance. Investors should take these plans within the context of the broader report. They’re specifically designed to increase investor confidence after a terrible result.

I don’t think the company has been well managed in the past. For example, it seems as if the company has been constantly restructuring for at least a decade. Restructuring has been a regular topic in management’s earnings calls for almost thirteen years. It sounds like management hasn’t been very effective at getting these cost savings to stick.

So yes, management’s plan sounds promising at first glance. But I don’t have total confidence in their ability to execute. I’m still waiting for more clarity on the results of this.

Is The Valuation Cheap Enough?

Stanley Black & Decker’s stock has fallen almost 50% year to date. Shares have slid over 25% since their disastrous Q2 earnings report. However, I believe that shares could still have room to fall further.

The company’s shares are currently trading at a forward P/E of 16 times. This price looks cheap if management can stabilize earnings. But this doesn’t include the company’s increasing levels of debt. Since 2017, the company’s debt burden has increased from $3.9 billion to $11.6 billion. This is similar to the company’s $13 billion market cap.

Some of this debt will be offset by the $3.5 billion in net proceeds from the sale of the company’s security business. But factoring in the company’s net debt, shares suddenly start to seem more expensive.

The company’s free cash flow for the year will likely be negative. For the purposes of this analysis, I’m going to use the company’s long term target of free cash flow generation equal to net income. At the current debt adjusted valuation, the company would have a forward free cash flow yield of just 3% to 5%. I think this is low for a business with this uncertain of an outlook. There’s a significant risk of underperformance if management doesn’t deliver on their promises.

I think that return on invested capital is a useful metric for some companies like this. Stanley Black & Decker’s ROIC leaves something to be desired as well. The business has a forward ROIC of just 5.4%. I don’t think this justifies the risk, since the company is not effective at allocating its capital in my opinion.

The company’s dividend king status is a major selling point for investors. I believe this dividend is safe, even if the current payout ratio is on the high side. But I think it is at risk of stagnating if the company doesn’t execute well. The company has spent years increasing its dividend by only one cent. Even recently, the company’s dividend increases have been uninspiring. Most of the dividend’s growth rate is due to a 13% hike in 2021. I doubt management would have hiked it as aggressively if they knew demand would fall off so much.

Final Verdict

I think there is some value in Stanley Black & Decker. The company has many strong brands and its stock is trading at a cheap valuation. An ambitious turnaround plan promises to boost earnings back to previous levels.

But the company has a long way to go to convince me of its ability to execute. I’m willing to take a worse entry price if it reduces the chance of my investment being dead money for an extended period of time.

If you’re confident in the company’s ability to execute, I think starting a small income position is a fine choice. However, I don’t believe I have enough insight into the company’s operations right now. For these reasons, I’m not buying or holding the stock.

Be the first to comment