grinvalds/iStock via Getty Images

Adobe (NASDAQ:ADBE) plunged after reporting third quarter earnings, even though its results were more or less in line with guidance. While the company narrowly reduced its full-year outlook, I suspect the decline had more to do with its richly valued acquisition of Figma. The deal will cost $20 billion, split evenly between cash and debt. ADBE will need to take on some debt to finance the deal, which would put a pause to its share repurchase program until it is paid down. While the stock remains richly valued even after this earnings reaction, the stock is still buyable here on account of the strong free cash flow generation and resilient growth profile.

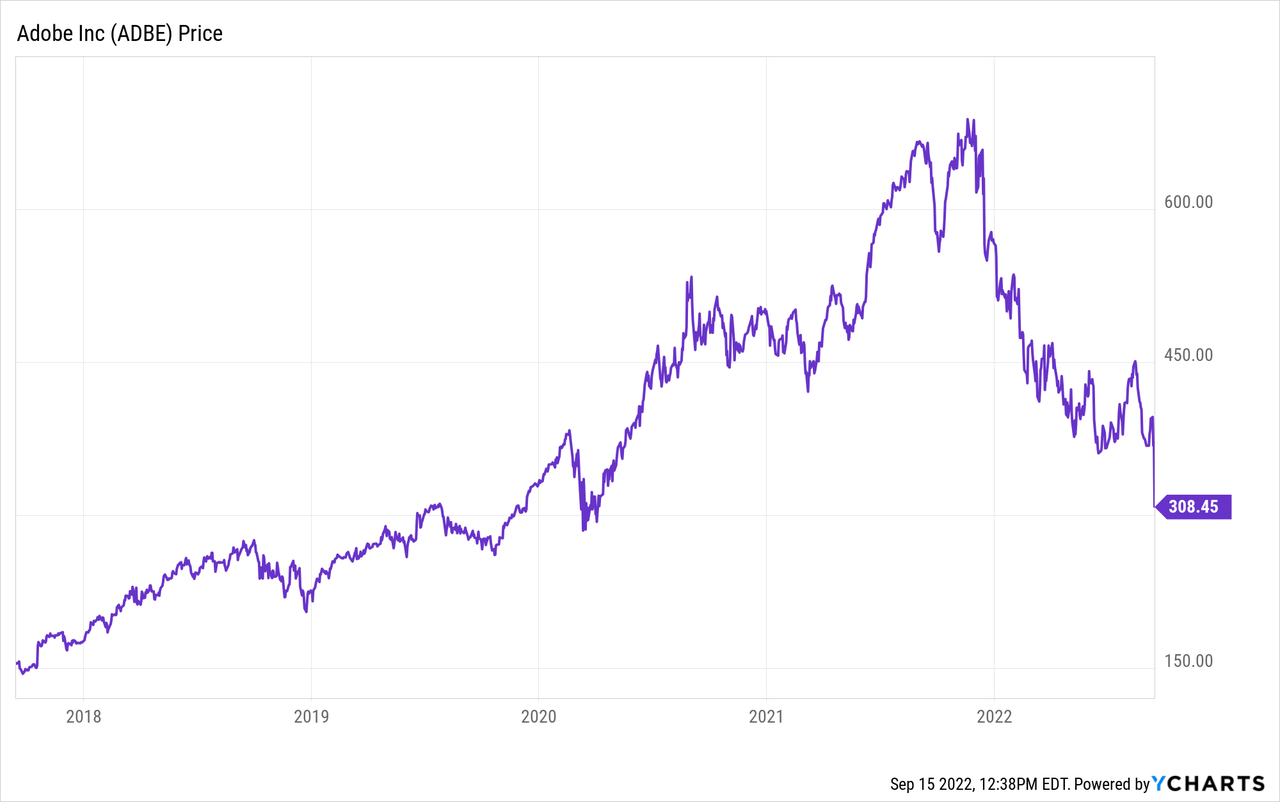

ADBE Stock Price

Late last year, ADBE peaked at $699 per share. The stock has since fallen 56% amidst a broader valuation reset in the tech sector. It appears that even highly profitable tech companies have not been immune from the tech weakness.

I last covered the stock in June, where I rated it a buy on account of the ongoing share repurchase program. The stock is down 19% since then, and the share repurchase program appears set to wind down rapidly. Is the thesis broken?

Adobe Stock Key Metrics

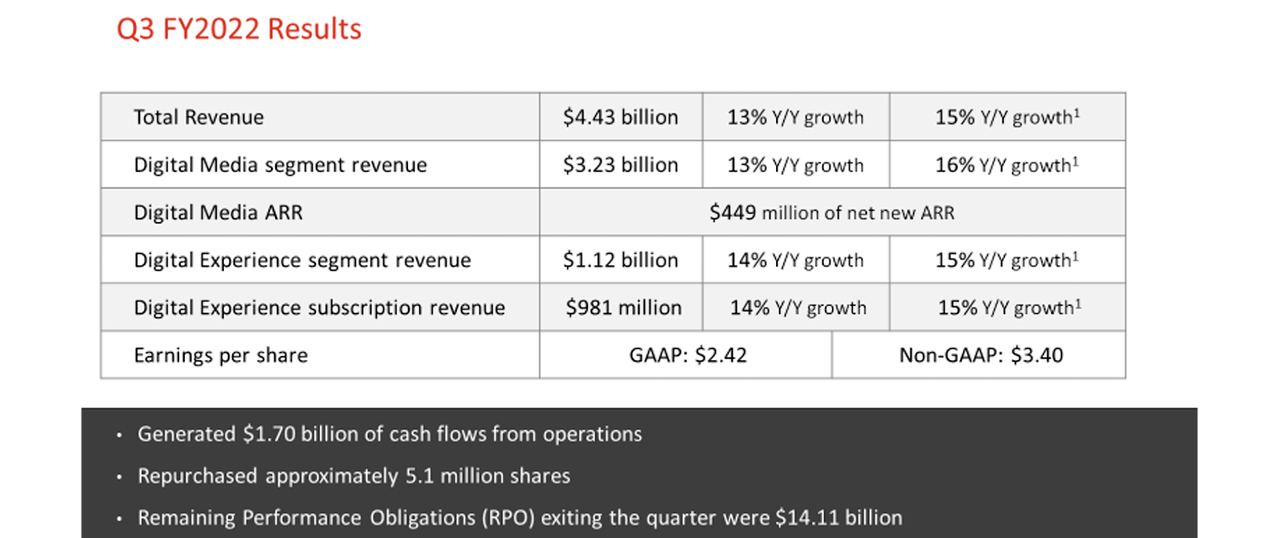

ADBE’s latest quarter saw 13% year-over-year growth (15% constant currency).

Q3 FY2022 Slides

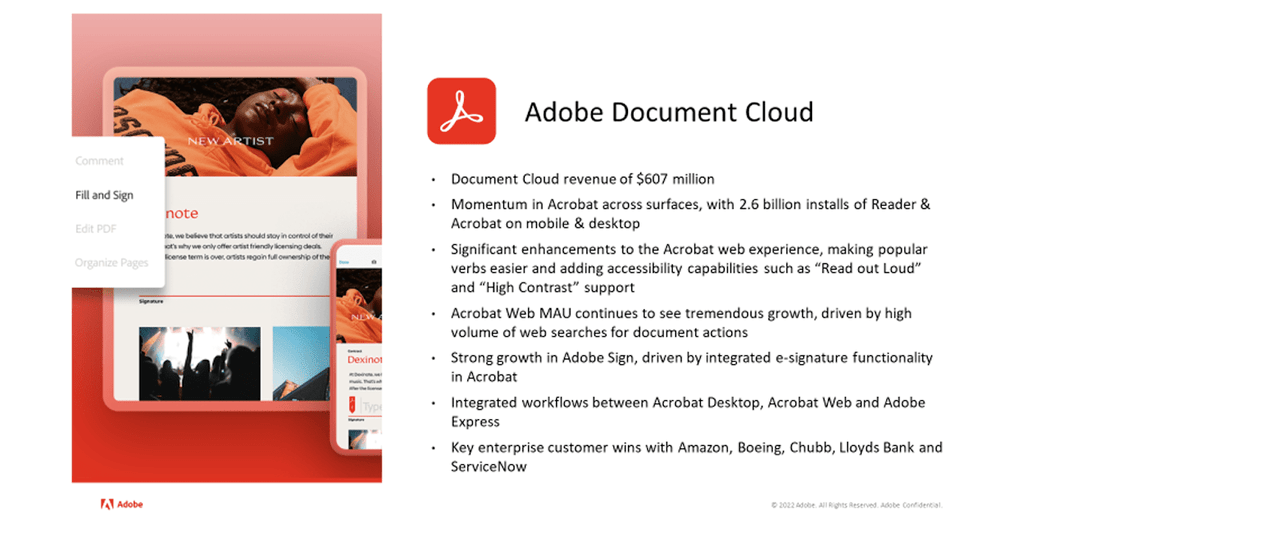

Non-GAAP EPS of $3.40 beat guidance of $3.33. While ADBE saw digital media and digital experience revenues fall slightly short on guidance, it was able to make up for that weakness with strength in its document cloud division, which grew by 25%.

Q3 FY2022 Slides

The strength in ADBE’s document cloud product makes one wonder if it is taking market share from DocuSign (DOCU), which has not seen growth rates nearly as strong.

ADBE ended the quarter with $5.8 billion of cash versus $4.1 billion of debt, but that net cash position should not be relied upon due to the announced acquisition of Figma.

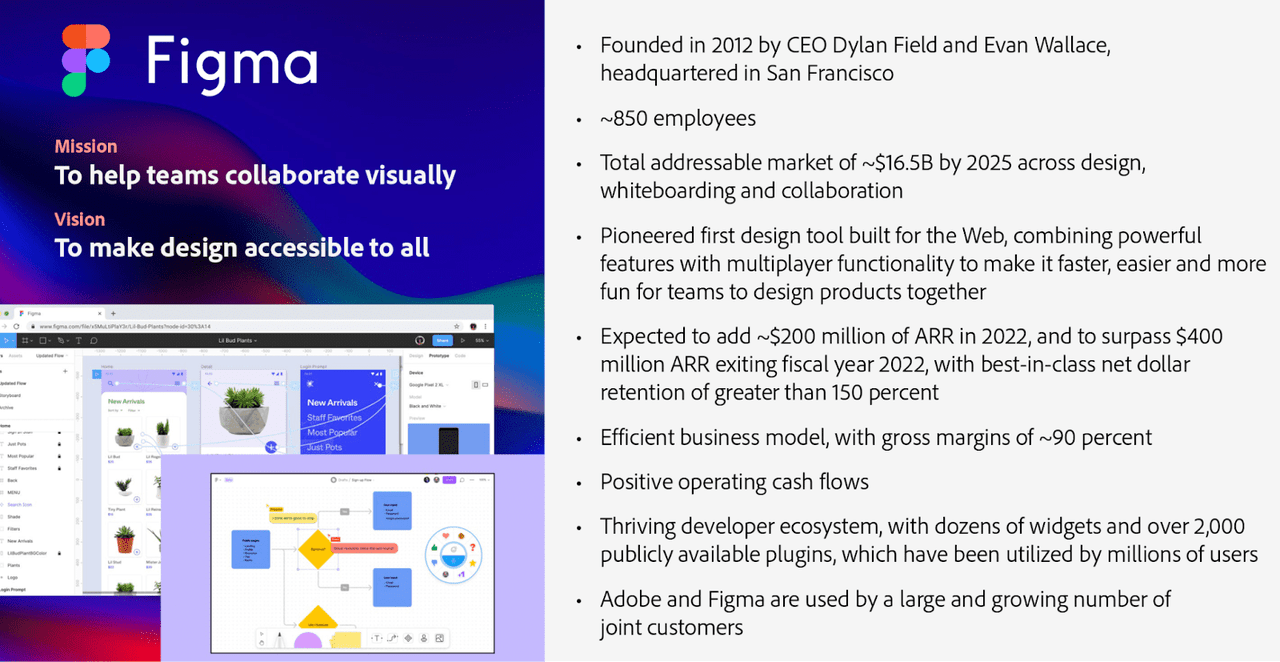

Figma provides web design tools – not too dissimilar with ADBE’s own products. It actually looks like a direct competitor to the company.

Q3 FY2022 Slides

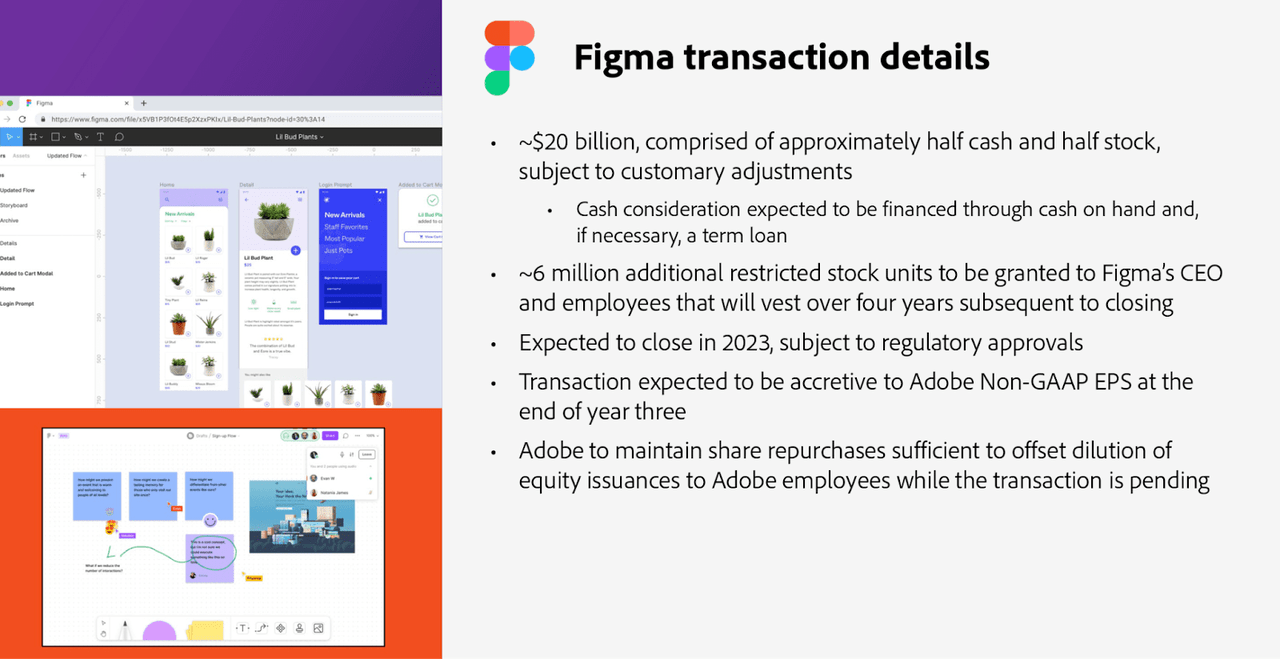

The transaction will cost around $20 billion compromising half cash and half stock. That implies around $10 billion of debt to be added to the balance sheet, bringing the company to an $8.3 billion net debt position. It appears also that there is another $1.8 billion in restricted stock units that would be granted to Figma employees.

Q3 FY2022 Slides

On the conference call, management stated expectations for accelerated top-line growth based on:

(1) we extend Figma’s reach to our customers and through our global go-to-market footprint, (2) Figma accelerates the delivery of new Adobe offerings on the web to the next generation of users, and (3) we jointly introduce new offerings to market as we unlock the possibilities of collaborative creativity.

Management also stated that their priority following the transaction would be to pay down associated debt and only resume stock repurchases afterward. From now until the closing of the transaction, the company would also limit stock repurchases to only those necessary to offset dilution.

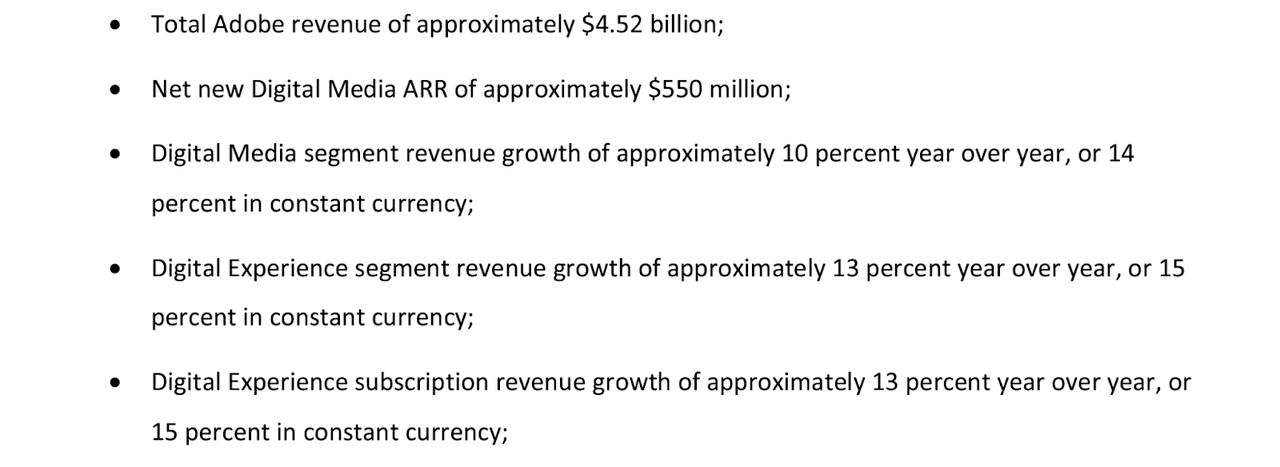

Looking ahead, ADBE guided to $4.52 billion in total revenues, representing 10% growth.

Q3 FY2022 Slides

That guidance implies some reduction to full year revenue estimates, at $17.60 billion, down from $17.65 billion.

ADBE also guided to non-GAAP earnings per share of approximately $3.50, representing 9.4% growth.

Is ADBE Stock A Buy, Sell, Or Hold?

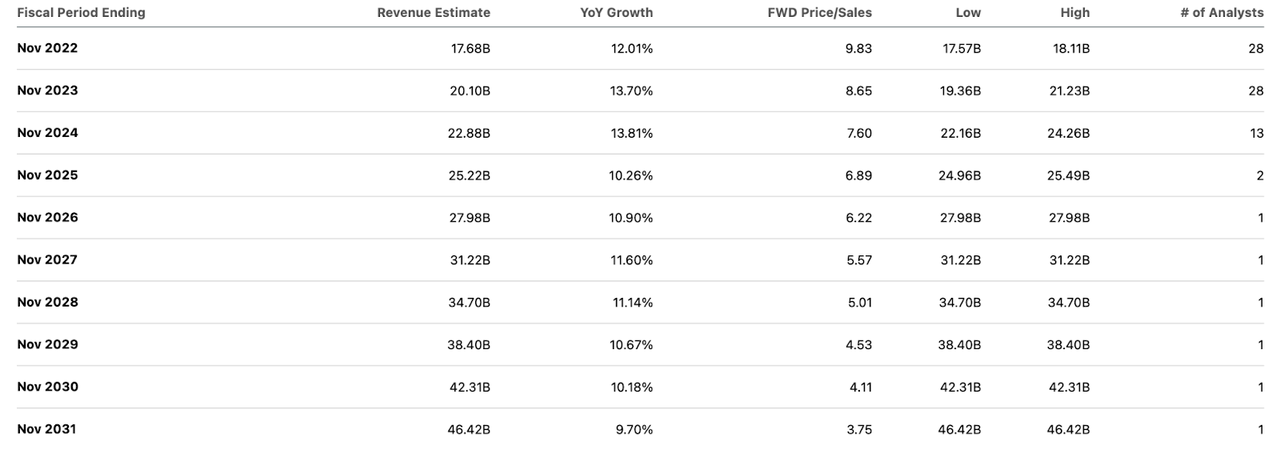

Consensus estimates call for $13.54 in earnings per share, below guidance of $13.62 in non-GAAP earnings per share. ADBE is trading at just 23x forward earnings. The company is expected to sustain mid-double-digit earnings growth over the next decade.

Seeking Alpha

Yet that projection may prove conservative considering that the company is expected to sustain double-digit revenue growth as well – consensus estimates are implying minimal operating leverage.

Seeking Alpha

Based on a 2x price-to-earnings growth ratio (‘PEG ratio’), I could see ADBE trading at 34x earnings by next year, implying a stock price of $539 per share or 75% upside over the next 12 months.

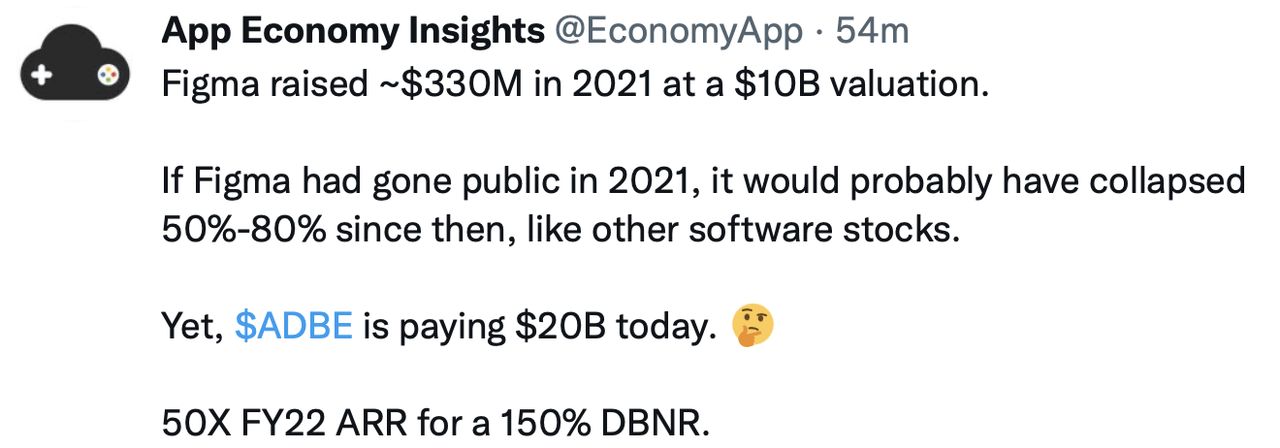

That said, the Figma acquisition raises some questions. While the optimist might point out that putting cash to work in such a bearish tech environment should be construed as a bullish development, my colleague App Economy Insights astutely points out that the $20 billion implied valuation is 2x the valuation which Figma raised capital at in 2021 – not to mention that tech stocks have seen steep multiple contraction since then.

Twitter

Perhaps that observation is missing the context that Figma likely grew very rapidly over the past year, but even then, this deal still appears quite rich at an implied 50x 4th quarter annualized revenues. That kind of valuation is what one would have expected 12 months ago prior to the tech crash. Is this deal a sign of desperation? Does the deal foreshadow competition risks? It is arguable that ADBE deserves the benefit of the doubt considering their strong track record, but it is only human nature to pose such doubts considering the bearish environment for tech stocks. Another risk is that of valuation. Even after a sizable decline from all-time highs, ADBE stock remains at a premium valuation relative to its modest earnings growth profile. This acquisition will slow down the repurchase program, which might have the side effect of reducing buying pressure on the stock as well as reducing sentiment. Stocks like PayPal (PYPL) have shown that even formerly loved stocks can suddenly go unloved by the market – with steep consequences for the stock price. ADBE’s free cash flow generation, due to slowing repurchases, is unlikely to offer the same protection from volatility as it has in the past, at least in the near term. I rate ADBE a buy for long-term investors.

Be the first to comment