vzphotos

Micron Technology, Inc. (NASDAQ:MU) has been in the semi-sphere spotlight amid weakening consumer spending. We believe it is finally time to buy the stock. We were previously hold-rated on MU based on our belief that weakening consumer spending would create more downside for the stock. Our current buy thesis is based on our belief that the DRAM industry is in recovery as we head into the first half of the new year.

MU gets most of its revenue from DRAM sales, amounting to 72% of total revenue in 4Q22. Concerns over weakening consumer spending were our main reason for moving to neutral on the stock in July. After MU’s significant pullback over the past few months, we believe the downside has been priced into the stock for the most part. At TechStockPros, we don’t only monitor the stock; we also keep a close eye on industry dynamics. We expect DRAM demand-supply dynamics to improve towards early 2023 with inventory corrections and DRAM CapEx cuts. MU stock price is currently around $53, and we believe the price dip creates a real bottom. As we expect DRAM dynamics to recover down the road, we believe MU stock provides an attractive entry point at current levels.

The worst is in the past; time to buy

DRAM sales declined 23% Q/Q in MU’s latest quarter, and we don’t believe the impact of weakening consumer spending will absolve itself overnight. Memory and storage industry dynamics have deteriorated sharply due to the current macroeconomic environment impacting customers’ buying behavior on multiple fronts. As the weakening demand has been recognized, we believe channel correction and DRAM CAPEX cuts are underway toward 2023. Hence, we believe DRAM industry demand-supply dynamics will balance during 1H23.

We believe the memory industry did not expect the weakening consumer demand to come as fast as it did or hit as hard as it did. We are optimistic now because we believe MU is taking more proactive action to react to the weak DRAM demand. In the 4Q22 earnings call, CEO Sanjay Mehrotra announced that the company intends to respond to the weak environment by “decreasing supply growth through significant cuts to fiscal 2023 CapEx and reducing utilization in our fabs.” We expect the DRAM CapEx cuts to return the memory supply-demand into balance.

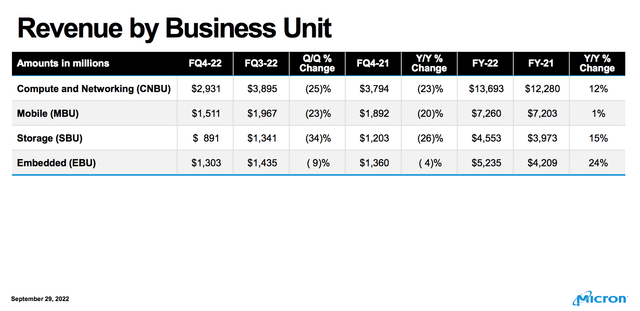

We still expect demand weakness in the near term as market demand has yet to recover. Guidance for the November quarter forecasts sales to drop 36% Q/Q. While many investors focus on lower guidance and fear buying, we focus on the industry dynamics. We believe MU is a buy at current levels, as demand weakness is priced in for the most part. The following table from 4Q22 outlines the weak market demand for MU’s products:

Ramping up DDR5 volumes

Mehrotra also announced that the company would ramp up DDR5 volumes towards 1H23. DDR5 is the updated version of DDR4 and provides double the bandwidth, which translates to faster processing for memory-intensive applications (games, videos, browsers, etc.). We’re excited about the increased volume in DDR5. We expect DDR5 to serve as a growth catalyst going forward.

CHIPS Acts, China, and MU

After the US Congress approved the CHIPS Act, MU announced plans to invest $100 billion over the next 20 years to build a giant computer factory in upstate New York. We believe this investment will pay off significantly despite headwinds on the China-memory sales front. We believe MU is well-positioned to ride the U.S.’s new and sustainable semiconductor manufacturing trend. We believe MU is easing the blow from the U.S. ban limiting memory chip shipments to China and are excited to see the role the U.S. memory chip producer plays in the future of semiconductors.

What about NAND demand?

In F2022, NAND products were around 25% of MU’s total revenue. Micron’s NAND business is heavily exposed to the consumer segment, and the NAND products are primarily used in PCs and smartphones. Consumer spending on PCs and smartphones has weakened under the current macroeconomic environment from the pandemic highs of 2020-2021. Gartner expects global PC shipments to drop by 9.5% in 2022. According to the IDC, smartphone shipments are also expected to decline 6.5% this year. As Micron’s NAND business is more heavily exposed to consumer devices, we expect NAND demand to remain weak in the near term. However, we believe channel inventory corrections will help the segment recover towards 1H23 as the weakened demand has been globally recognized. We move to a buy rating based on our constructive outlook on DRAM dynamics rather than NAND.

Valuation

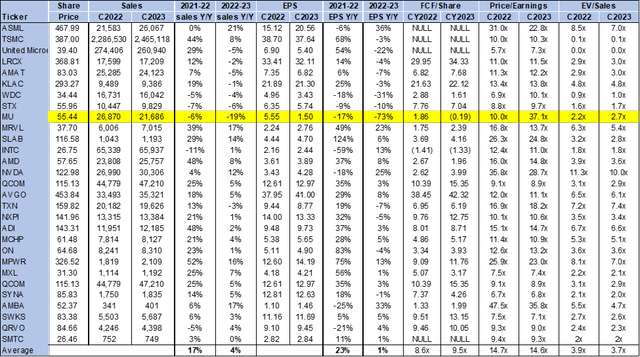

MU is relatively cheap. On the EV/Sales metric, MU is trading at 2.7x C2023 compared to the group average of 3.7x. The stock is trading at 37x EPS $1.50 on the P/E basis compared to the peer group average of 14.6x. We expect DRAM industry dynamics to improve towards 1H23 and hence move the stock to a buy.

The following chart illustrates the semiconductor peer group valuation table.

Word on Wall Street

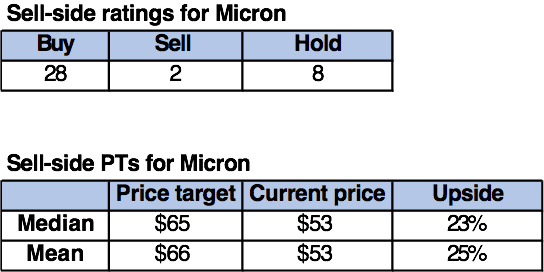

Wall Street is heavily buy-rated on the stock, as are we. Of the 38 analysts covering the stock, 28 are buy-rated, eight are hold-rated, and the remaining are sell-rated. MU is trading around $55, up from its 52-week-low of $48.45. The median and mean sell-side price targets are set at $65 and $66, respectively, with an upside of 23-25%. The following chart indicates MU stock’s sell-side ratings and price targets:

Techstockpros & Refinitiv

What to do with the stock

We expect Micron’s DRAM dynamics to recover from the lows of FY2022, especially with inventory corrections. MU is visibly cheap at the moment, and we believe the best days are ahead. We recommend investors buy Micron Technology stock at current levels.

Be the first to comment