ryasick

Co-produced by Austin Rogers for High Yield Landlord

The Most Important Chart For REIT Returns Right Now

REITs have sold off mightily this year as investors panic over rising interest rates and persistently high inflation.

Interest rates appear to be a threat because, at least ostensibly, they will raise REITs’ cost of debt and make it more expensive to incrementally refinance their maturing debt. Also, higher cost debt will make many growth investments untenable and slow their external growth rate.

Meanwhile, high inflation makes investors fear that REITs’ rental revenue, funds from operations (“FFO”), and dividends will not be able to keep up.

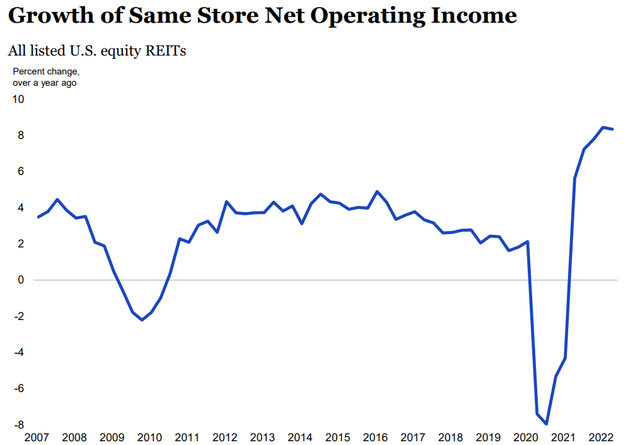

The remedy for both of these ills is growth in same-store net operating income. This is the growth in the operating income over and against the operating expenses for the portion of a REIT’s portfolio that it has owned for at least a year.

Though same-store NOI dipped in 2020, growth in same-store NOI this year has been the fastest in over a decade:

Same-store NOI growth offsets the negative impact of rising interest expenses as debt matures and needs to be rolled over at higher rates.

And fortunately, most REITs took advantage of the low interest rate environment of 2020 and 2021 to refinance a large portion of their debt, locking in very low rates for long spans of time. As such, most of the recent spike in same-store NOI has flowed directly to the bottom line, resulting in strong FFO per share and dividend growth.

Usually, when the market is panicking, there are good deals to be had. This time is not an exception. Below we highlight two of our favorite picks that are both inflation-protected and recession-resistant.

1. Crown Castle (CCI)

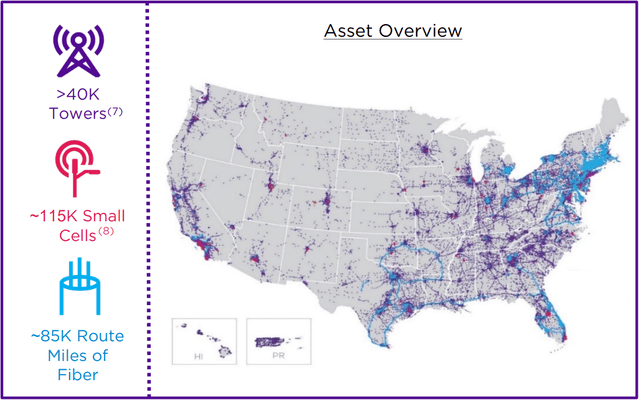

CCI is a telecommunications infrastructure REIT that owns and operates 40,000 cell towers, 115,000 small cell nodes, and 85,000 route miles of fiber across the United States:

Since US mobile carriers are still in the early stages of rolling out 5G technology across the country, there is likely still a long runway of attractive growth ahead for the likes of CCI.

That said, the REIT is selling off right now because of some temporary and relatively minor headwinds, which are leading to a reduced growth rate for the next few years.

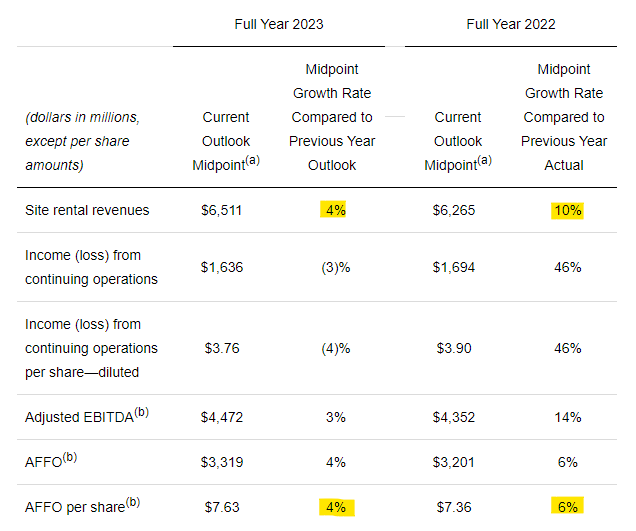

This year, revenue growth should come in at 10% while AFFO per share grows at 6%, but next year those metrics are expected to slide to 4% and 4%, respectively.

CCI Q3 2022 Earnings Release

One major reason for CCI’s slower growth rate next year is the expected rightsizing of Sprint’s tower network after its acquisition by T-Mobile (TMUS). This is obviously a one-time event and probably won’t be repeated, because the wireless telecommunications industry is effectively an oligopoly between Verizon (VZ), AT&T (T), and T-Mobile. Further consolidation would likely be blocked by antitrust regulators.

The market did not seem to like CCI’s recent dividend bump of only 6.5%, as it is below the long-term target range of 7-8% annually. Worse yet, on the Q3 conference call, CEO Jay Brown mentioned that, because Sprint’s tower rationalization isn’t expected to conclude until 2025, the REIT expects its dividend growth to be below its target range in 2024 and 2025 as well.

However, since instituting their dividend growth target in 2017, CCI has grown the dividend at a CAGR of 9%. The REIT can endure a few slower years of growth and still hit its long-term average growth target.

Here’s the CEO:

In the context of our 6.5% dividend per share growth this year, it is remarkable to consider that the underlying strength of our business can absorb the significant headwinds of interest expense increases and Sprint cancellations in the near term without disrupting the long-term growth of the business.

The CEO also mentioned that, in spite of a short-term headwind from the cutbacks of a major customer, the long-term demand outlook for its infrastructure assets remains strong:

Looking back over the last several decades in the wireless industry, we have experienced periods of network rationalization by our customers, following consolidation events. In each of those instances, we saw increased demand for our assets over times, as our customers reinvested the synergies gained from those combinations back into their networks to further improve their competitive positions, and keep pace with wireless data growth. I expect we’ll see a similar dynamic play out this time around.

… I believe we are still in the early stages of 5G development, providing a long runway of growth and demand for our comprehensive communications infrastructure, offering [access to] towers, small cells, and fiber.

But, of course, the proof is in the pudding – or, in this case, the return on investment. CCI has achieved an average return on invested capital of 12% for its towers segment, which it has been operating for decades. And already, after only 5 years of weighted average lifespan thus far, CCI’s small cells have an average return on invested capital of 7%. Management expects the yield on those to reach into the low double-digits once the small cells add a second tenant in the coming years.

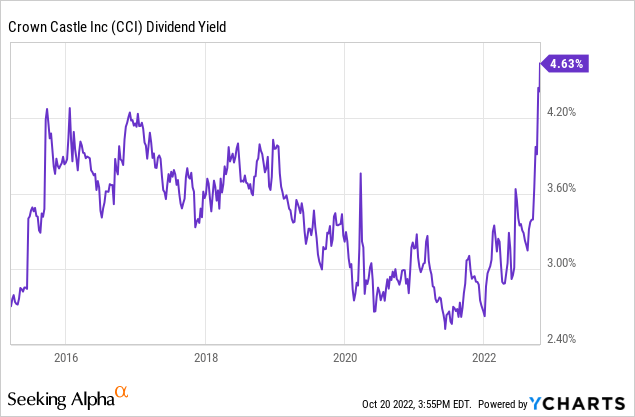

Despite only a small setback and temporary reduction in dividend growth (not a dividend cut), CCI is selling off as if its growth prospects are dead. In fact, CCI now offers the highest dividend yield ever in its history as a REIT:

The above chart shows the dividend yield based on CCI’s trailing twelve-month dividends, but its forward dividend yield based on its most recently declared dividend actually equates to a dividend yield of nearly 5%.

Contrary to what the market selloff would imply, CCI remains fundamentally strong and recession resistant. Its investment-grade balance sheet is solid, with a net debt-to-EBITDA ratio of 4.9x, 85% fixed-rate debt, and a weighted average debt maturity of 9 years.

We are happy to take advantage of the market’s overreaction and buy more of this blue-chip REIT with a long growth runway. As its growth rate picks up in the coming years, we expect its FFO multiple to expand its dividend yield to compress closer to that of growth REITs, unlocking 50%+ upside from here.

2. STAG Industrial (STAG)

Industrial landlord STAG is another REIT with strong growth prospects that has endured a baffling selloff this year. STAG has worked tirelessly (and successfully) over the past five or so years to raise the quality of its balance sheet and portfolio of single-tenant industrial properties, but the market still seems to view the REIT as “low-quality.”

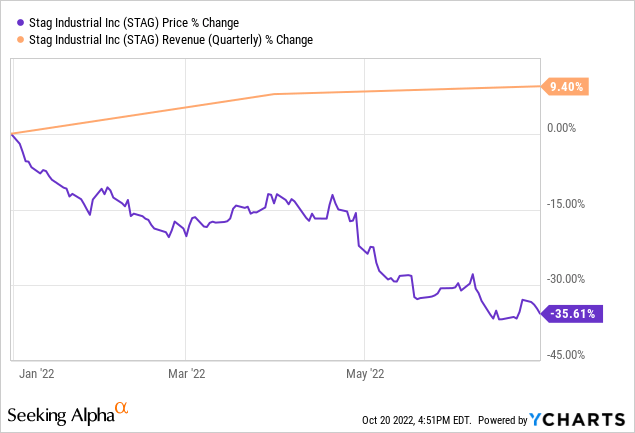

Since the beginning of 2022, the REIT has dropped over 30% in price even while revenue had climbed ~10%.

This despite enjoying the strongest internal growth in the company’s history amid unprecedented strength in industrial real estate. For instance, cash NOI spiked 18.6% in the third quarter while same-store cash NOI rose 5.6%, providing the basis for an increase in core FFO per share of 7.5%.

Occupancy sits at an ultra-high rate of 98.2%, even higher than the average across the entire industrial real estate sector of 97%. This contributes to the REIT’s ability to raise rent rates at a rapid pace, illustrated by its 25% straight-line rent growth on signed leases in Q3.

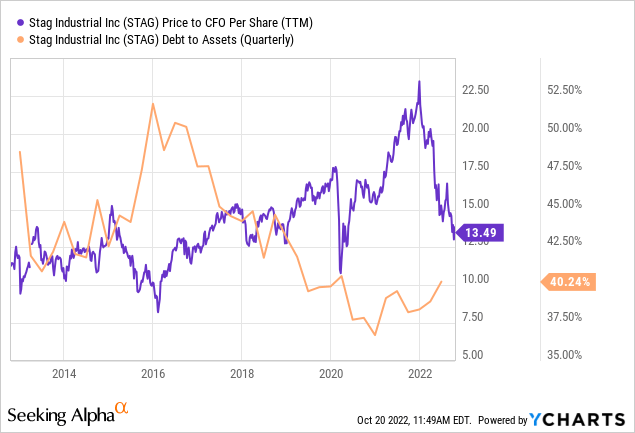

That’s what makes STAG’s ~14x FFO multiple baffling. Amid the strongest macro environment for the REIT in its history, STAG is now trading near its cheapest level ever relative to its debt level.

Though STAG was technically cheaper in 2016, it was also a more highly leveraged REIT back then and owned lower-quality assets.

Today, the company’s balance sheet has never been stronger, and neither has its monthly dividend been safer, with a payout ratio of around 70%. This payout ratio should allow the dividend to grow at the same pace as FFO per share going forward, which indicates that dividend growth should accelerate from its historically slow rate.

Bottom Line

Between CCI’s near 5% dividend yield, long-term growth of 7-8%, and upside to fair value of 40-50%, buyers at today’s price should expect very strong total returns going forward.

Likewise, between STAG’s near 5% dividend yield, growth in the mid-single-digits, and upside to fair value of 35-40%, returns should be nearly as high for this industrial stalwart.

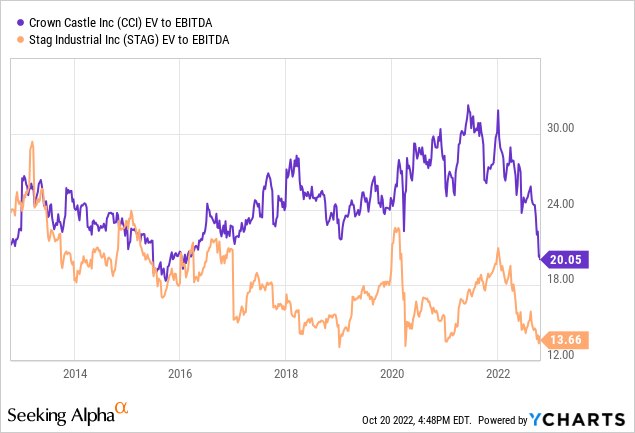

And yet, despite strong balance sheets, inflation protection, recession resistance, and attractive growth prospects, these two REITs are trading near their lowest valuations in a decade.

Take, for instance, enterprise value (market cap plus debt minus cash) to EBITDA:

Though CCI’s ~20x EV to EBITDA may not strike one as cheap on an absolute basis, (1) it is cheap relative to the REIT’s historical valuation, and (2) it is cheap compared to the REIT’s growth prospects.

Both REITs make great places to allocate capital in today’s market. At High Yield Landlord, we are taking advantage of the current bear market by accumulating more opportunistically priced REITs just like these.

Be the first to comment