Hammad Khan/iStock via Getty Images

Despite the strong equity gains seen across the world following Thursday’s lower-than-expected CPI reading out of the U.S., Brazilian stocks actually sold off due to rising fears over newly elected President Lula’s economic and social policy platform. Thursday marked one of the worst days for Brazilian assets relative to the rest of the world on record. While Lula’s socialist policies will almost certainly be negative for the economy, the stock market remains extremely cheap and the country’s economic fundamentals are far stronger than they were the last time Lula came to power in 2002, and the risk of a self-reinforcing economic crisis is low. The iShares MSCI Brazil ETF (NYSEARCA:EWZ) is priced to deliver double-digit returns over the long term, primarily through dividend income.

The EWZ ETF

The EWZ tracks the performance of the MSCI Brazil index and charges an expense fee of 0.57%. The ETF holds 50 companies at present and is heavily weighted towards commodities. The Materials sector accounts for 21% of the index, thanks to iron ore giant Vale, which has an 18% share. The Oil & Gas sector accounts for an additional 16% due to oil major Petrobras. Due to the high degree of volatility of the Brazilian currency, the EWZ’s performance has tended to be driven as much by the BRL as it has by the stock market itself. However, the key underlying driver of both markets is the price of commodities, as higher export prices benefit both local earnings and the appetite for local currency in dollar terms. The EWZ’s dividend yield is currently an impressive 5.4% and this should rise over the coming month as ETF payments track the underlying MSCI Brazil index, whose dividend yield now sits at a huge 9.4%.

Bloomberg

Lula Selloff Appears Overblown

Brazilian stocks had previously reacted positively to the election results, with former President Bolsonaro promising a smooth transition of power, allaying investors’ fears of rising social unrest. However, in his first visit to Brasilia following the run-off election, Lula prioritized social spending, noting that he may look to permanently withdraw aid programs from the current federal spending cap rules. He also criticized the 2017 labor reforms, which he argued would need to be reconsidered as they give too much power to businesses relative to labor. However, the selloff seems like an overreaction considering that Lula’s socialist policy proposals were widely anticipated in the run-up to the election, and the narrow margin of victory may suggest that he is unlikely to pursue his most radical socialist policies. Allies of Bolsonaro have captured a large presence in both chambers on top of controlling the country’s three most populous states, Sao Paulo, Minas Gerais, and Rio de Janeiro, which will provide some resistance against radical change.

Furthermore, the country’s economic fundamentals have significantly improved over the past 20 years since Lula first came to power and there is now little threat of a self-reinforcing debt crisis as was the case in 2002. This is largely thanks to the improvements made in the country’s external balance sheet. Back in 2002 central bank reserves amounted to less than half of general government external debt but the surge in reserve and efforts to reduce their reliance on dollar borrowing have seen reserves rise to roughly 5 times government external debt currently. Even if we look at the private and public sectors combined, the country’s external balance sheet is in reasonable shape. As of 2021, the country’s net international investment position amounted to 30% of GDP, while roughly half of these net external liabilities are in the form of foreign direct investment which tends to be long-term in nature. Meanwhile, of the country’s portfolio liabilities, which make up roughly another third of total liabilities, the majority are in the form of equities, while over half of the external debt is in the form of local currency.

While the form and currency denomination of portfolio liabilities does not reduce the risk of portfolio outflows, it does reduce the risk of a vicious cycle of currency weakness leading to rising external debt leading to further currency weakness. Countries which have high levels of dollar debt tend to experience rising interest costs and increases in debt in local currency terms in the event of foreign investor liquidations, which can result in self-fulfilling crises. On the other hand, countries with the bulk of their liabilities in local equities tend to experience temporary currency weakness with much fewer negative feedback loops. The implication is that the recent surge in long-term borrowing costs is likely to anchor the BRL, supporting EWZ returns.

Valuations Remain Highly Attractive Relative To EM Benchmarks

The improved economic picture contrasts greatly with the extremely low valuations on offer on Brazilian stocks. The forward PE ratio sits at 5.6x, less than half of the MSCI EM index, while the free cash flow yield is exceptionally high at 21.5% versus just 7.1% for the MSCI EM. These discounted valuations are reflected in the outsized dividend yield on offer on Brazilian stocks. The forward dividend yield is currently a world-beating 12.1% versus just 3.4% for the MSCI EM.

MSCI Brazil Vs MSCI EM: Forward Dividend Yield (Bloomberg)

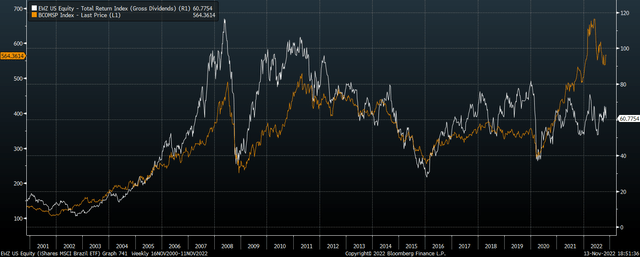

Part of the Brazil discount reflects elevated profit margins, which should be expected to mean revert lower over the coming years. Profit margins have already likely peaked in line with the drop in commodity prices. However, even after the recent decline, current commodity prices should help keep profitability strong. As the chart below shows, the EWZ has been closely correlated with the Bloomberg Commodity Complex, and the long-term correlation suggests Brazilian stocks should be trading significantly higher.

EWZ Vs Bloomberg Commodity Index (Bloomberg)

Summary

Last week’s decline in Brazilian stocks has created yet another strong buying opportunity in the EWZ. While the economic outlook has deteriorated due to the election of socialist President Luiz Inacio Lula da Silva, the country’s economic fundamentals are strong enough to support any rise in welfare spending. Exceptionally high earnings and free cash flows should continue to allow Brazilian companies to provide high dividend yields to investors.

Be the first to comment