tupungato

Published on the Value Lab 26/7/22

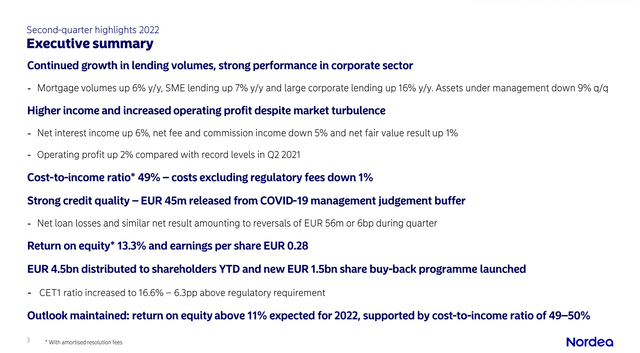

Nordea (OTCPK:NRDBY) was a pick we liked when we looked at banks last quarter as it was relatively unexposed to fee income, being a more traditional lender. This quarter brings some positive surprises on the economic activity side, while also highlighting that investors should be concerned with fee-based income at banks. With positive rate exposure likely to more than offset declines as a consequence of ailing economic activity, Nordea remains attractive.

Quarterly Update

The positive surprises were that mortgage and overall lending volumes, including to SMEs, continued to grow. Corporate lending in particular saw a surge that we suspect might be shorter lived of 16% YoY. Our feeling is that this must be people locking in rates that are still relatively low, and below what they are expected to be soon. With corporates having the most power to negotiate better terms on fixed rate loans, it makes sense that they were the ones to grow their borrowing most dramatically.

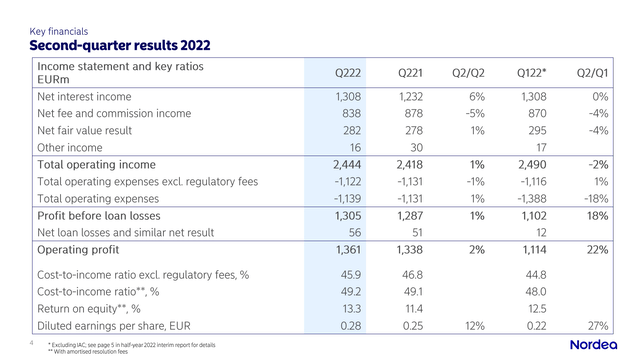

Financial Highlights (Q2 2022 Pres)

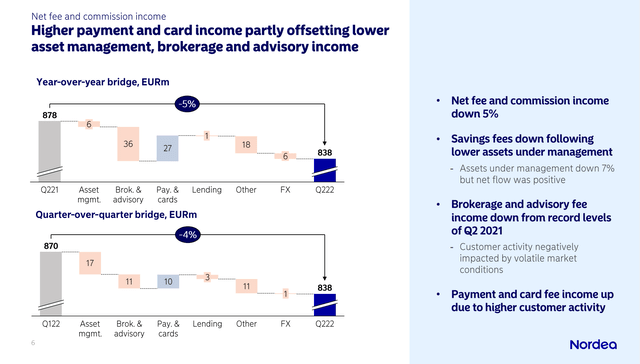

With the increased uncertainty and the beginning of some definite economic declines, fee-based income and commission-based income, the latter being from asset management, has fallen. But because of loan growth as well as rate growth, the growth in net interest income has offset these declines, and the rate hikes in previous cycles are likely to start fully contributing to the quarters in the next ones. Fee and commission income fell about 40 million EUR while net interest income grew about 70 million EUR. Assets under management fell 9% QoQ and 7% YoY.

The declines in fee income are coming from brokerage, advisory and asset management income declining, consistent with the capital environment and as a direct consequence of falling AUM. Card income is still growing and offsetting those declines to a partial extent.

Fee Income Evolutions (Q2 2022 Pres)

What Happens Next?

We will use the following rule of thumb for Nordea. For every 50 bps increase in rates in its markets, which are primarily European, their net interest income will rise by 100 million EUR. The ECB is on a bit of a different regime from the Fed, namely a less aggressive one. We feel this is because the USD benefits disproportionately due to its exorbitant privilege from rate hikes, so the Fed is more open to aggressively raising rates. The benefits are less for Europe, as it is less for Japan and other countries which have decided to proceed with low or lower rates. Nonetheless, energy prices are a key element in whether or not the ECB will consider more normalised inflation targets. Energy prices won’t fall. Moreover, it will be some years before capacity increases, which means inflation can continue to spiral. There is a reasonable chance of further rate increases. In any case, the income can be expected to grow on a larger base by about 100 million EUR, which deals with current AUM declines and advisory declines. We feel that with funds moving back into private banking, the declines shouldn’t more than double from asset management and other activities. Even during the COVID-19 crash, a 7% decline in AUM would be close to peak declines. Card income could fall if commerce takes a turn for the worse, which it could if there’s an unemployment spiral, which could be triggered by falling US consumption and might not depend on local monetary authorities’ rates. Wallet share of the US is always rather high, so this is a risk. But still, the raising base and rising rates do combine for a strong offset to declines elsewhere. Currently growth is still being achieved, and we feel declines should remain limited which is good considering the well covered dividend at 7.25%, with a payout margin of about 30%. Overall, a solid stock and a nice head-start income from the dividend.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment