DNY59

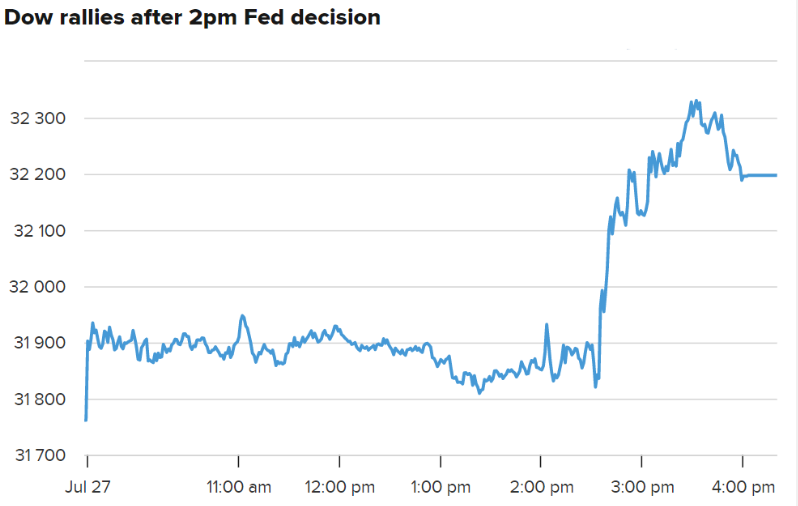

Yesterday, I asserted that Chairman Powell would acknowledge progress in slowing the rate of economic growth to the extent that it should alleviate inflationary pressures this fall, which would lower expectations for rate hikes and produce a bullish response from markets. That is basically what he said, and the stock market soared. The Nasdaq Composite had its best day since 2020. He also stated that he does not think we are in a recession, to which I concur, because there are too many segments of the economy that are performing well. The Fed raised short-term rates by 75 basis points, bringing the Fed funds rate up to 2.25%.

Finviz

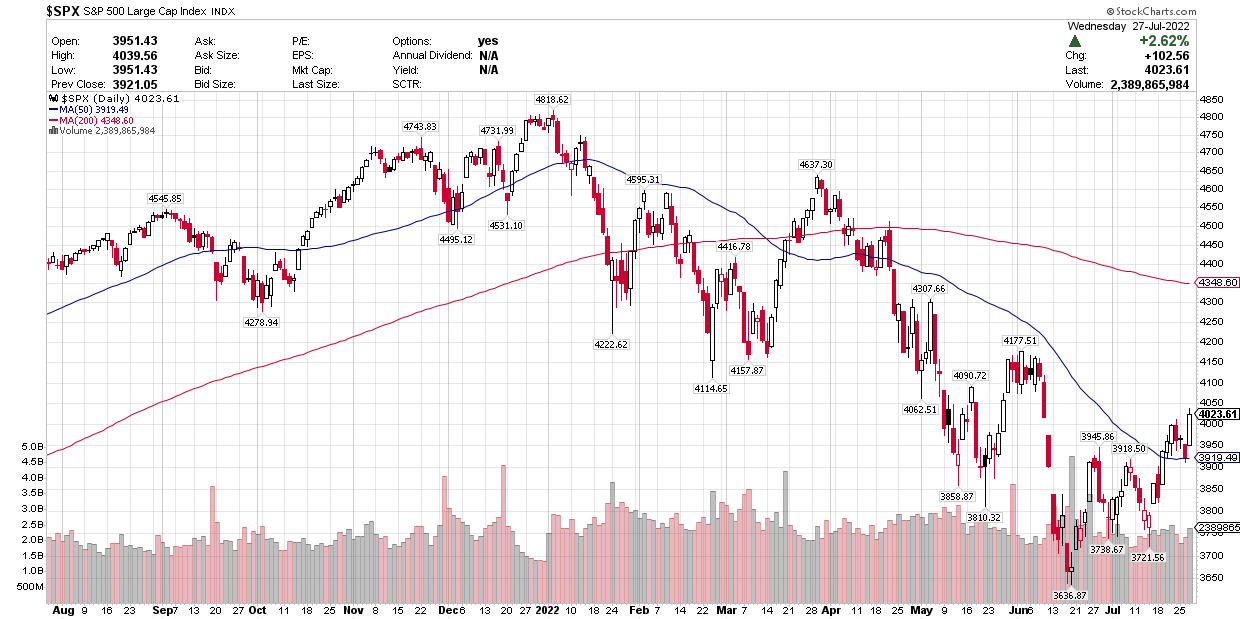

So far, this week’s earnings reports have not been as bad as feared, and now we are past a Fed meeting that was also not as bad as feared. In fact, it was a positive in that Chairman Powell was able to bring down expectations for rate increases, while at the same time forcefully expressing the Fed’s determination to bring the rate of inflation down. I think Powell has paved the way for this bullish rebound in markets to run further, but we still need today’s second-quarter GDP report and tomorrow’s inflation data to be not as bad as feared. If so, then I think the stock market has a lot more upside from here.

CNBC

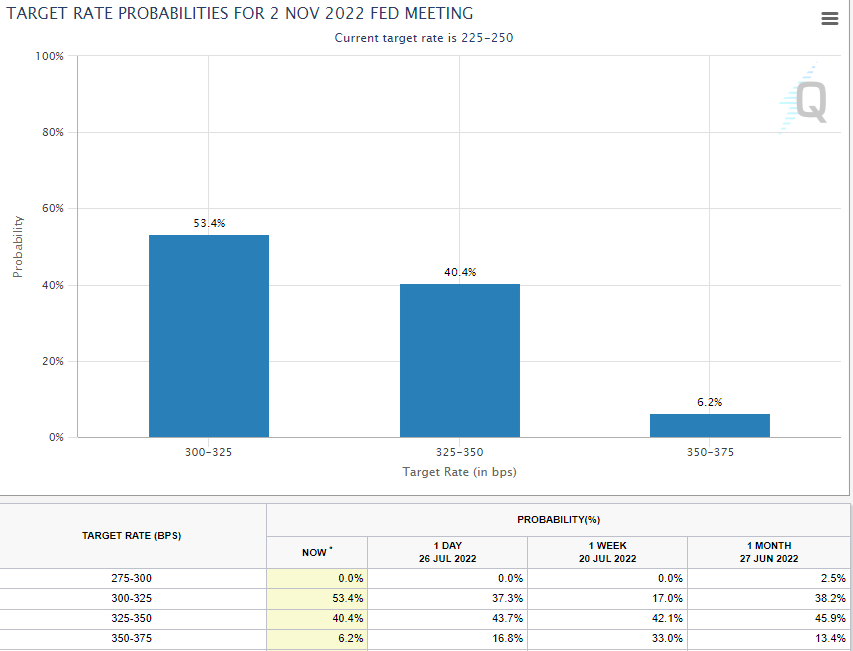

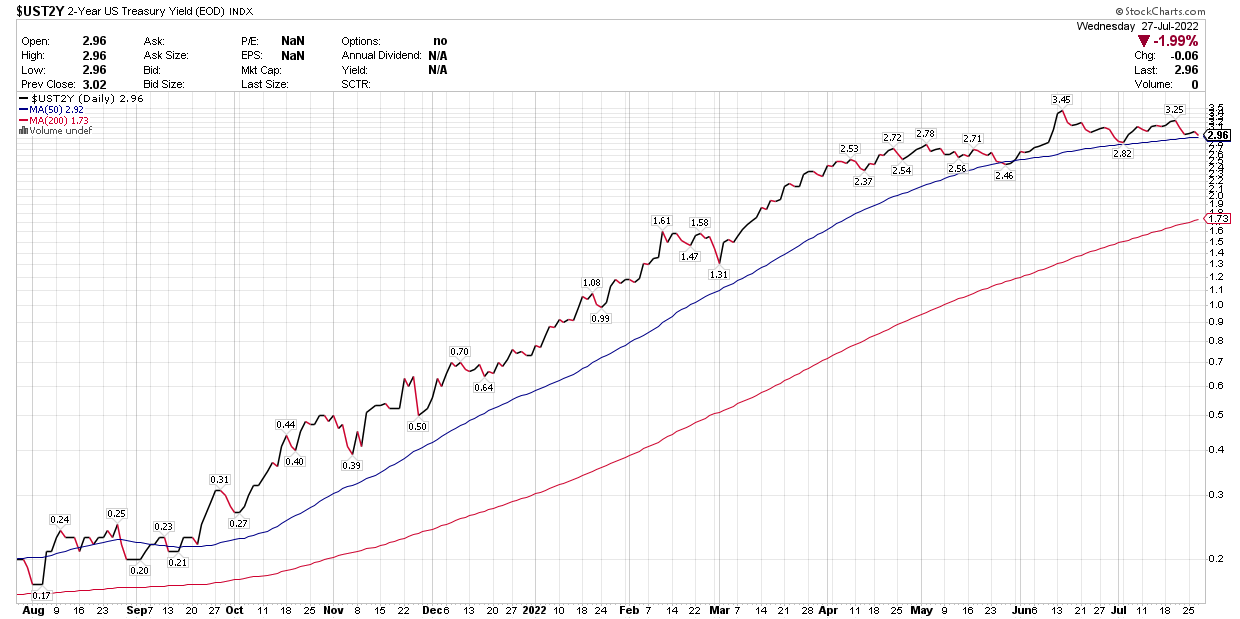

Market expectations for rate hikes eased by approximately 25 basis points, as Chairman Powell conducted his press conference. The probability that we will see a 50-basis-point rate increase in September rose to an even more likely outcome, while the likelihood we would also see a 50-basis-point increase in November fell in lieu of what is now most likely to be just 25 basis points. One more 25-basis-point increase in December puts the Fed funds rate at 3.25%, which investors expect to be the peak in short-term rates. I think the Fed will stop at 3%, which is in line with today’s 2-year Treasury yield.

CME Group

Long-term interest rates also declined, as measured by the 10-year Treasury yield, which helped mega-cap technology names lead the charge in yesterday’s rally. I would prefer to see long-term rates edge back up though, so that the yield curve is no longer inverted, suggesting that we will see a modest rebound in the rate of growth during the second half of the year.

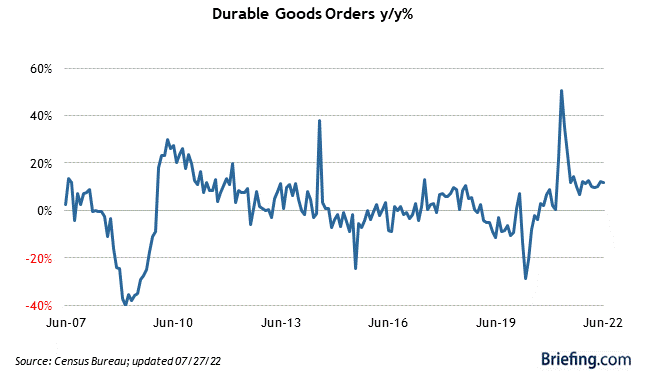

Our next hurdle is this morning’s GDP report. One final tidbit of economic data for the second quarter was released yesterday, strengthening my resolve that we will see growth in the economy for the second quarter. New orders for durable goods rose 1.9% in June, beating expectations that we would see a decline of 0.4%. While most of the gain was due to the volatile transportation sector, we also saw increases in orders for autos, as well as computer and electronic products.

Briefing.com

For the purposes of calculating the contribution business spending (capital expenditures) makes to GDP, the government uses the shipment of non-defense capital goods excluding aircraft. That figure rose 0.7% in June after a 0.8% increase in May and 1% increase in April, which means business spending will be a meaningful contributor to growth in the second quarter. The fact that unfilled orders also rose by 0.7% in June means that we are carrying that strength into the third quarter.

Let us hope that today’s report is not as bad as feared, providing more fuel for this rally off the June low. Next up will be tomorrow’s inflation report, which I think will convince more investors that the peak rate of inflation is behind us.

The Technical Picture

As I had hoped, we held the 50-day moving average on the S&P 500 yesterday, which sets the stage for a test of the 4150-4200 level.

Stockcharts

The 2-year Treasury yield gives us a good idea of where the market sees the Fed funds rate at the end of this rate-hike cycle, so it was encouraging to see it fall yesterday back below 3% to 2.96%. That also narrowed the inversion of 2- and 10-year yields to just 18 basis points, which has some investors concerned about recession.

Stockcharts

Be the first to comment