Justin Sullivan

Chevron Earnings Overview

Chevron Corporation (NYSE:CVX) is set to report its second quarter earnings results before the market opens on Friday, July 29. Chevron’s shares have fallen sharply from their 52-week high in June.

Chevron Current Chart (Finviz)

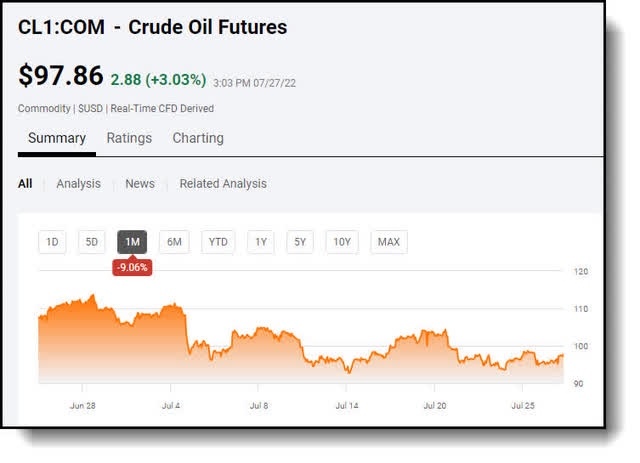

Since that point, the stock has dropped 20% in sympathy with crude oil, which is down nearly 10% for the month at the time of this writing.

Crude Oil Current Chart (Seeking Alpha)

Chevron reports Q2 2022 earnings on July 29, 2022

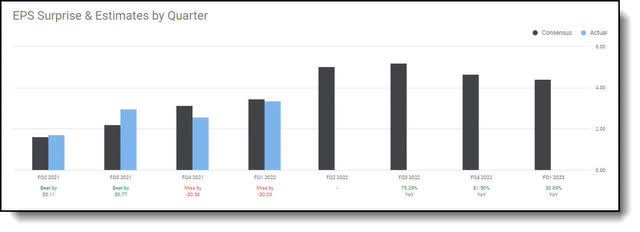

Chevron has missed EPS expectations twice in the past year (last two quarters).

Chevron earnings Expectations (Seeking Alpha)

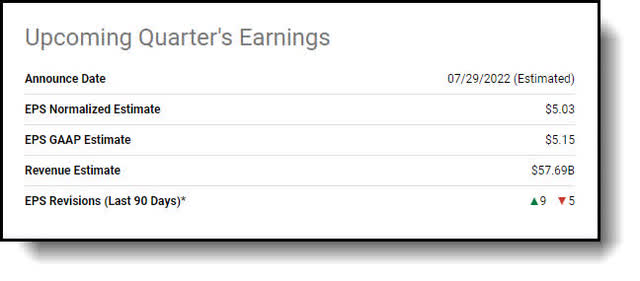

The following earnings expectations chart is for the fiscal period ending on June 30, 2022. This is Chevron’s fiscal second quarter of 2022, to be reported on July 29, 2022 before the open.

Upcoming Earnings Expectations (Seeking Alpha)

The consensus EPS estimate is $5.03, implying 70% year-over-year growth over the $3.36 EPS reported last year. The low estimate is $4.43 EPS and the high is $5.52 EPS on $57.69 billion in revenue.

Out of the 14 analysts covering the stock, there were 9 upward and 5 downward revisions for both revenue and EPS. This candidly confirms the perplexing puzzle the current earnings environment presents for Chevron. There’s an excess of inputs to consider regarding the company’s strategy and the increasingly dynamic environment for the energy sector.

Consensus EPS Revision Trend

Consensus EPS Revisions (Seeking Alpha)

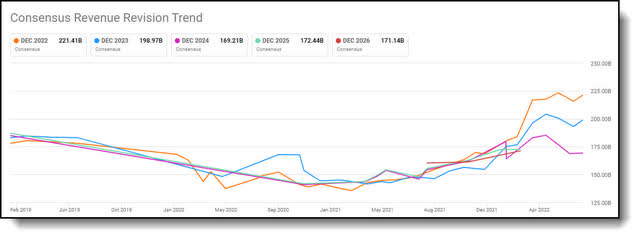

Consensus Revenue Revision Trend

Consensus Revenue Revisions Trend (Seeking Alpha)

Even so, there is a panoply of positives heading into earnings at present. First, let’s take a closer look at last quarter’s report and guidance to set the table.

Previous quarter – Q1 2022 earnings results

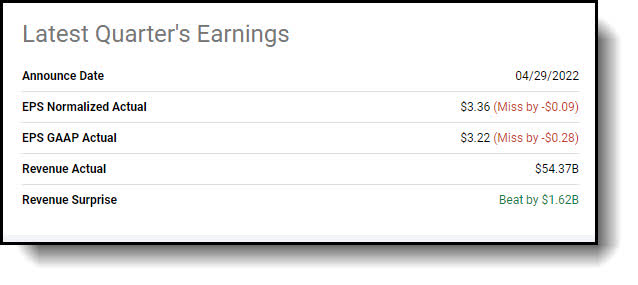

Chevron missed on EPS by $0.09 cents, coming in at $3.36.

Chevron’s Last Quarter Results (Seeking Alpha)

Yet, California’s Chevron beat on revenues by $1.62 billion, coming in at $90.50 billion. Most importantly, cash flow was solid. Chevron reported a third consecutive quarter with free cash flow of over $6 billion, enabled the San Ramon energy giant to return $4 billion to shareholders and further pay down debt.

Chevron Guidance

In the second quarter, Chevron expects lower production due to planned turnarounds at Wheatstone and Angola LNG, impacts from CPC pipeline and the expiration of the Area 1 concession in Thailand. At CPC, 2 of the 3 single port moorings are now back in service and TCO has returned to full operations. Downtime associated with the April repairs is estimated to be less than 15% of the company’s second quarter turnaround and downtime guidance.

Regarding overall second quarter guidance, CEO Michael Wirth recently stated:

“We anticipate a return of capital between $250 million and $350 million from Angola LNG in the second quarter. This cash is reported through cash from investing and not cash from operations. In the first quarter, Angola LNG returned over $500 million of capital. The differences between affiliate earnings and dividends are not ratable and TCO has not yet declared a dividend in 2022. With higher commodity prices, affiliate dividends are expected to be $1 billion higher than our previous guidance.

We’ve utilized our NOLs and other U.S. tax attributes and expect to make estimated U.S. federal and state income tax payments in the second quarter. These payments will flow through working capital accounts, just like our first quarter IRS refunded. In the second quarter, we expect to invest $600 million as we close the Bunge joint venture and to repurchase shares at the top of our guidance range.”

Based on several current positives, HSBC recently upgraded Chevron to a BUY.

Chevron raised to Buy at HSBC as sector correction offers entry point

HSBC recently upgraded Chevron shares to Buy from Hold with a $167 price target, stating the recent correction in global integrated oil stocks was overdone, leaving the sector looking attractive again. HSBC analyst Gordon Gray said Chevron has been one of the worst-performing stocks in the integrated oil group in the past month, which has brought the stock’s valuation back to levels that justify an upgrade, given that the price target implies a ~20% upside. Gray noted:

“Chevron has the lowest gearing in sector and a clear line of sight on buybacks, [with] plenty of room for buyback guidance to be raised again.”

Current market environment backdrop

A tight supply/demand environment has developed primarily due to low investment levels during the pandemic. The low supply, coupled with a substantial increase in demand as the pandemic faded, contributed greatly to the rapid increases in prices for crude, natural gas, and refined products.

What’s more, the events in Ukraine added uncertainty to what was already a tight supply outlook. Brent crude rose by about $22 per barrel, or 27% versus the fourth quarter of 2021. Today, natural gas prices remain well above the 10-year historical ranges, driven by tight global market conditions and ongoing European supply concerns.

Moreover, tight supplies to manufacturers have pushed refining margins to the top of the range. Nevertheless, chemical margins in Asia have fallen sharply, with product prices lagging the steep increases in fees and energy cost. The following section details Chevron’s current operational approach to this dynamic environment going forward.

Chevron Operations Overview

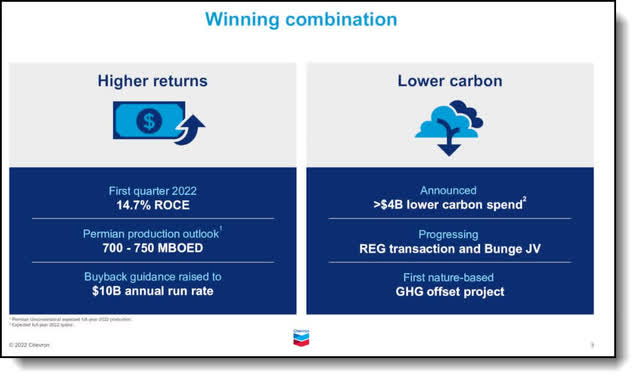

Higher returns combined with lower carbon

Chevron’s general strategy is fairly straightforward. The colossal Californian energy entity’s primary goal is to deliver higher returns to shareholders while simultaneously lowering its carbon footprint. Below is a slide detailing the company’s effort to achieve this lofty goal.

Higher Returns with Lower Carbon (Seeking Alpha)

In regards to this effort, CEO Michael Wirth recently stated:

“And the overarching goal is to sustain strong financial performance into a lower carbon future. We’re investing in advantaged assets, while maintaining a very strong balance sheet and rewarding our shareholders through a growing dividend and steady buybacks of shares, underpinning this as a commitment to both capital and cost efficiency, which is fundamental in a commodity business. And we can grow our business with less capital today than any time during my career with a focus portfolio and continued self-help, we expect to drive our unit costs even lower leading to higher returns in cash flow.

On lower carbon, we intend to remain amongst the most carbon efficient producers and also to grow new energy products in lower carbon forms that target the hardest to abate sectors of the economy, light-duty vehicle transport, which gets a lot of attention is the easiest part of the energy system to decarbonize we’re working on the things that are much more difficult than that.”

Chevron has also had a very clear and consistent financial framework across many decades as well.

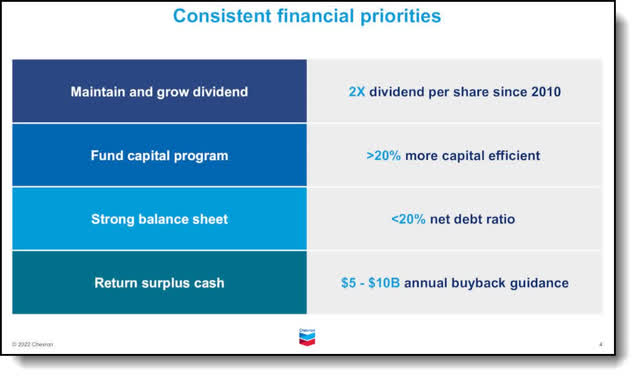

Consistent financial priorities

Chevron’s financial priorities have not changed. The top priority is maintaining and growing the dividend. See slide below detailing Chevron’s financial priorities in order of importance.

Consistent financial priorities

Consistent Financial Priorities (Seeking Alpha)

CEO Michael Wirth stated regarding this slide:

“They’re up there in the order in which we have defined them and continue to guide our business consistent with those. We’ve grown our dividends for 35 consecutive years. This year our capital budget is $15 billion and we’re growing today, we were not growing a decade ago.

Our balance sheet, I mentioned this says less than 20%. We were at 11% at the end of the first quarter and in this price environment that continues to strengthen. And then returning surplus cash, we’ve repurchased shares 15 over the last 19 years, $50 billion overall in shares we’ve repurchased at a cost that has just about matched the average price had we been in the market every single day through that period of time. So, we’ve not only repurchased shares when times are good and the equity price reflects that.”

Chevron has also been very consistent in demonstrating that in a cyclical business the company is prepared to handle the downside.

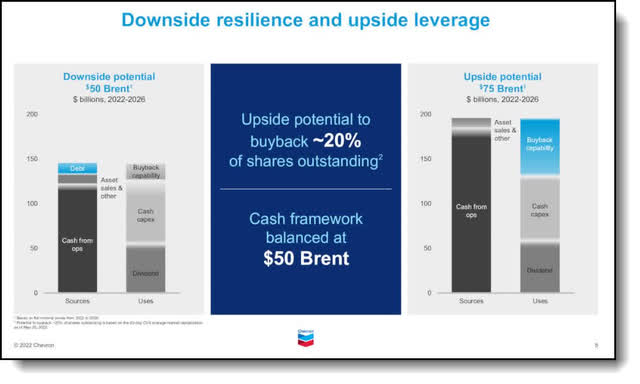

Downside resilience combined with upside leverage

Chevron’s management never lose their nerve when oil prices plunged 2020. There was never a question as to whether our dividend would be cut. In fact, Chevron actually grew the dividend. See slide below detailing the company’s downside resilience and upside leverage

Downside resilience and upside leverage

Downside Resilience and Upside leverage (Seeking Alpha)

CEO Michael Wirth stated regarding this slide:

“During the pandemic, we’ve run our dividend 20% between 2020 and today that stands out unique amongst our peers. In a downside price scenario, a $50 oil price, which seems hard to imagine today when it’s more than twice that. We continue to have the capacity to increase the dividend and buyback shares for five-year to $50 price. And this is a chart that we shared at our Investor Day in March at an upside case of $75, which doesn’t feel like upside versus today. We’ve got the capacity to buyback more than 20% of our outstanding shares over just five years. So we’ve got a very strong balance sheet, very strong cash flow, and the ability to continue to return cash to shareholders in any environment.”

Now let’s wrap up the operation section with Michael Wirth’s final point.

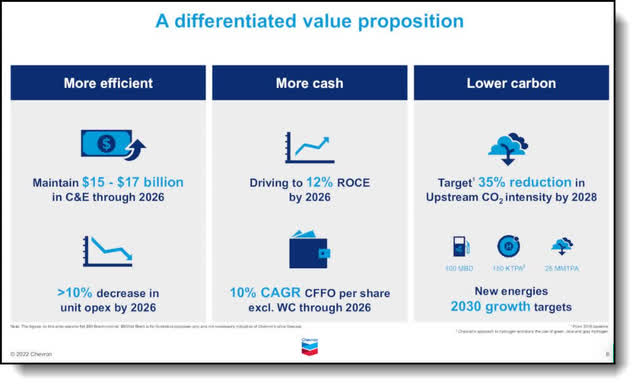

Chevron offers a differentiated value proposition

One of the final points Wirth made in the latest presentation was that Chevron offers a “very differentiated value proposition” versus the rest of the energy sector players.

Differentiated Value Proposition (Seeking Alpha)

CEO Michael Wirth stated regarding this slide:

“We’re more efficient. We generate more cash and we are driving toward a lower carbon system. The actions we’ve taken over the past few years make us a stronger company than we’ve ever been. And they position us to continue to generate strong returns in cash in a lower carbon future. I remain confident in our ability to deliver, and in fact, to deliver more than is reflected there on that chart.”

Now let’s turn our attention to the current fundamental metrics.

Chevron’s fundamental metrics

Chevron’s stock appears undervalued at present based on the current fundamental statistics.

PEG ratio less than 1

The PEG ratio is a broadly used indicator of a stock’s prospective worth. It is preferred by numerous analysts over the price/earnings ratio because it also accounts for growth. Similar to the P/E ratio, a lower PEG means that the stock may be significantly undervalued. Many financiers use 1 as the cut-off point for PEG ratios. Chevron’s PEG ratio of 0.57 is outstanding and one of the lowest in the industry.

Fortress balance sheet

Chevron’s strong balance sheet coupled with the oil giant’s oath regarding the return of capital to shareholders makes it one of the best buying opportunities in the oil patch today. Chevron’s prior investments in large long-cycle oil and gas projects coupled with the oil giant’s short cycle U.S. shale assets helps me to sleep very well at night. The company is well-positioned to increase the dividend and buyback shares based on present circumstances. In fact, the company has achieved dividend aristocrat status.

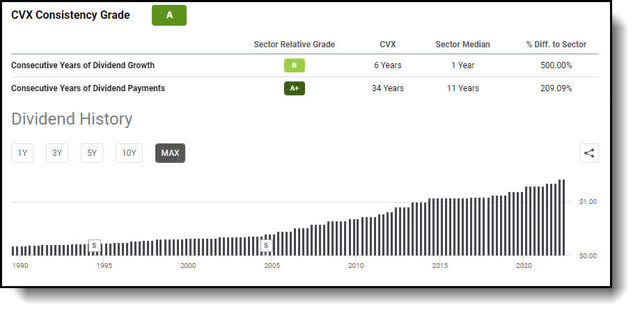

Chevron’s dividend aristocrat status

The company’s commitment to return capital to shareholders via dividend growth and share buybacks is well documented. Increasing the dividend has always been the top priority for Chevron.

Chevron Dividend History (Seeking Alpha)

Chevron is a bona fide dividend aristocrat. Chevron has not missed paying a dividend for the past 34 years consecutively and grown the payout for the last six. Now let’s bottom line this thesis.

The Bottom Line

The bottom line is Chevron has the financial wherewithal to ensure the dividend will remain intact and most likely be increased year-over-year. Come hell or high water, Chevron will come through with the dividend and share buybacks. Nevertheless, with the dividend yield presently at 3.86%, I would definitely layer into a new position over time to reduce risk.

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. You will want to have plenty of dry powder if the stock you’re interested in continues lower. As a Veteran Winter Warrior of the U.S. Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.” So, always layer in or “dollar-cost average” when building a new position and use articles such as these as starting points for your own due diligence. Those are my thoughts on the matter I look forward to reading yours. The true value of my articles is provided by the prescient comments from the well-informed Seeking Alpha members in the comment section. Do you believe Chevron is a Buy or Sell at present? Why or why not?

Be the first to comment