Scott Olson/Getty Images News

Many retail stocks have been hit hard over the past few months, as concerns around consumer spending and inflation have given the market an upset stomach. This is where a contrarian mindset comes in handy, however, as I don’t expect headwinds to last forever.

This mindset also paid off handsomely for those who bought into the panic during March of 2020, when nearly everything was on sale. In the words of Napoleon, the definition of a genius is one who can do the average thing when everyone around is going crazy.

This brings me to Foot Locker (NYSE:FL), a name that I’ve kept my eye on, and have bought into at what I see as being bargain prices. In this article, I highlight what makes FL a good income stock to own for potentially strong returns, so let’s get started.

Why FL?

Foot Locker has been in business since 1974 and is a ubiquitous retailer of athletic footwear and apparel in shopping malls around the country. The company operates over 2,800 stores in 27 countries, with the vast majority (~85%) located in the United States. Foot Locker generates the vast majority of its revenue and profits from footwear sales. Apparel sales account for a much smaller portion of total revenue but have been a growing part of the business in recent years.

Foot Locker has two main customer segments: direct-to-customers (online sales) and retail. The company’s online sales have been growing at a double-digit clip in recent years, but still only account for a small percentage of total revenue. Foot Locker’s brick-and-mortar locations are primarily located in high traffic areas, such as malls, and generate the vast majority of total sales.

The company’s business model is relatively simple: it buys products from suppliers at wholesale prices and then sells them to customers at a higher retail price. Foot Locker benefits from having strong relationships with many of the major athletic footwear brands, such as NIKE (NKE), adidas (OTCQX:ADDYY), and Under Armour (UA). These brands often grant FL exclusive rights to sell their latest products in its stores.

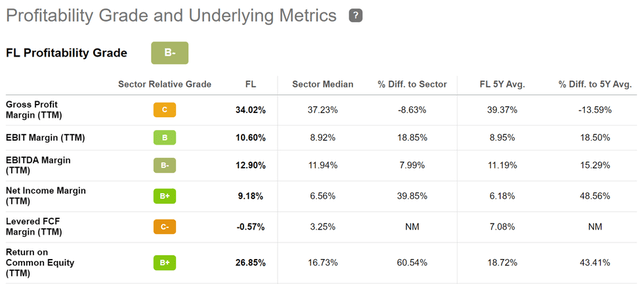

Foot Locker is a very efficient operator, with low store operating expenses as a percentage of sales. This efficiency allows the company to generate healthy profits, even during periods when same-store sales are flat or declining. As shown below, FL scores a B- for profitability, with a 9.2% net income margin, sitting well ahead of the 6.6% retail sector median.

FL Profitability (Seeking Alpha)

Moreover, FL is no longer aggressively opening stores and therefore has much more financial flexibility to return capital to shareholders. FL has aggressively reduced its outstanding share count by 23.4% over the past 5 years, and this includes $89 million worth of repurchases in the fiscal first-quarter alone. This has helped FL to realize a 27% return on equity, as shown in the Profitability metrics above.

FL Shares Outstanding (Seeking Alpha)

FL is seeing some challenges from a tough consumer retail environment, as total sales increased by just 1.0% YoY , while comparable store sales decreased by 1.9% during the first quarter. Moreover, gross margin declined by 80 basis points compared to the prior-year period, driven by higher supply chain costs and slightly higher discounting. Moreover, the potential for Nike to ramp up its direct-to-consumer efforts is likely also weighing on investor sentiment.

However, I see this threat as being overblown. While Nike does have its own stores, mostly in outlets, it remains a brand and not a retailer in most consumers’ minds, and most consumers would prefer to have comparison between brands, which is what FL excels at by offering the latest models. This is best described by management’s comments on the recent conference call:

I now want to spend some time walking through the opportunity we have with our brand diversification efforts, which have been successful to date and holds significant potential going forward. Our strategic direction to diversify our offering is supported by 3 key pillars.

Number one, consumers want choice and value a multi-brand experience; two, we are underpenetrated in virtually all of our brands outside of our top vendor; and three, we have superior brand equity in the marketplace that we can leverage to capture incremental share across our portfolio.

Also, of footwear sales from our identified customers come from those who buy from us more than 4x over a 2-year period. 80% of those frequent shoppers are multi-brand consumers.

And overall, they purchased approximately 3 different footwear brands on average. So we know that our customers want multiple options and as a house of brands, we are in a strong position to serve those needs in the marketplace.

Meanwhile, FL maintains a strong balance sheet with $95 million in cash net of long-term debt. This lends support to the 5.9% dividend yield, which is well-covered by a 25% payout ratio, based on Q1 adjusted EPS of $1.60.

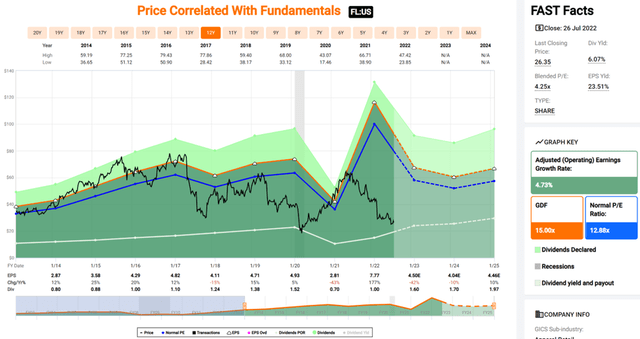

Lastly, FL appears to be cheap at the current price of $27.20, with a forward PE of just 6.1, sitting well below its normal PE of 12.3 over the past decade. As shown below, analysts expect for EPS to decline over the next year before returning to growth in 2024, and I see most of these concerns as already being baked into the share price. Sell side analysts have a consensus Buy rating on FL with an average price target of $31, translating to a potential one-year 19% total return including dividends.

FL Valuation (FAST Graphs)

Investor Takeaway

Foot Locker is a retailer that I have liked for some time, and it continues to be a solid pick in the current environment. While the company faces some challenges from a tough retail environment, its competitive advantages should help it to continue generating healthy profits. The company has a strong brand, loyal customer base, and efficient business model. I find the share price to be rather cheap at present, offering investors a strong dividend yield and potentially robust long-term returns.

Be the first to comment