Yuri_Arcurs/E+ via Getty Images

The ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL) is an equity index ETF investing in Dividend Aristocrats, S&P 500 constituents with at least twenty-five consecutive years of dividend growth. NOBL’s high-quality blue-chip holdings, outstanding dividend growth track-record, and cheap valuation, make the fund a buy. NOBL only yields 2.2%, and so is mostly appropriate for dividend growth or total return investors, less so for those looking for income.

NOBL – Basics

- Investment Manager: ProShares

- Underlying Index: S&P 500 Dividend Aristocrats Index

- Expense Ratio: 0.35%

- Dividend Yield: 2.23%

- Total Returns CAGR 5Y: 12.2%

NOBL – Overview

NOBL is an equity index ETF investing in Dividend Aristocrats, S&P 500 constituents with at least twenty-five consecutive years of dividend growth. It is an equal-weight index, but there are security and industry weight caps to ensure a modicum of diversification. The resultant fund is somewhat diversified, although significantly less so than most broad-based equity indexes like the S&P 500.

NOBL invests in 64 different companies, significantly fewer than the 500 companies in the S&P 500, and specifically excludes several well-known mega-cap stocks, including Apple (AAPL), Microsoft (MSFT), and Google (GOOG) (GOOGL). These companies are mainstays in most equity indexes and most investor portfolios, but don’t have the lengthy dividend growth track-record necessary for inclusion in NOBL. Although excluding these companies is not necessarily a negative, it is an important fact for investors to consider. Mega-cap tech bulls might wish to avoid NOBL, and some investors might wish to complement their position in NOBL with positions in some of these individual names.

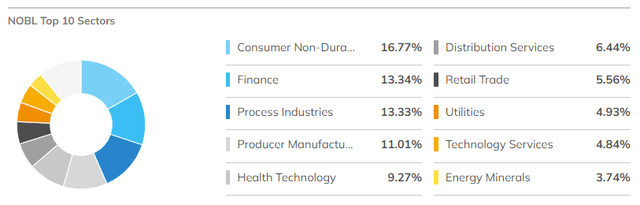

NOBL also provides investors with exposure to most relevant industry groups.

ETF.com

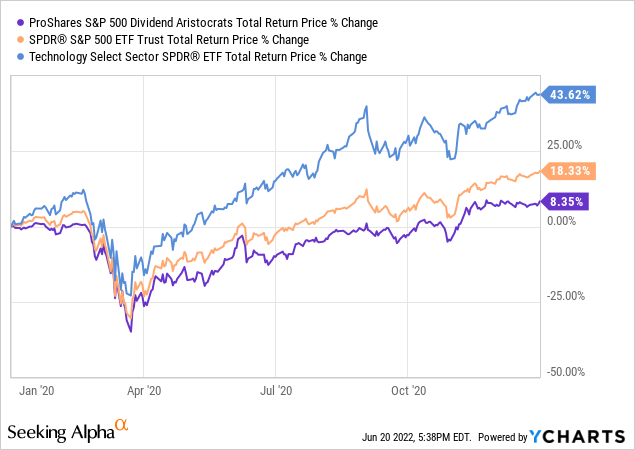

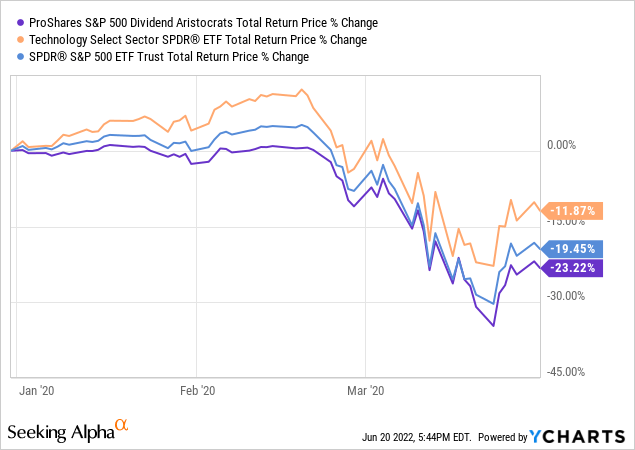

As can be seen above, NOBL provides investors with exposure to most relevant industry groups. Industry group weights, however, tend to materially differ from those of broader equity indexes. NOBL is significantly underweight tech, a sector with low dividends and short dividend growth track-records, while being overweight several old-economy industries, like finance and consumer goods. NOBL’s relative performance is somewhat dependent on the relative performance of these industries, especially tech. Expect the fund to underperform when tech outperforms, as was the case during 2020, during which the coronavirus pandemic was in full swing.

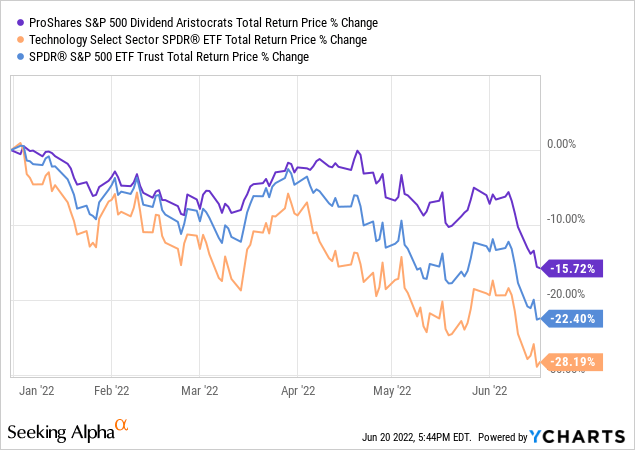

At the same time, expect the fund to outperform when tech underperforms, as has been the case YTD, during which frothy tech valuations have started to normalize.

In my opinion, NOBL’s underweight tech position is neither a negative nor a positive, but an important fact for investors to consider. NOBL might not make sense for investors who are tech bulls but might make more sense for those who are somewhat concerned about frothy tech valuations.

Besides the above, nothing much else stands out about the fund’s index or holdings. With this in mind, let’s have a look at the fund’s investment thesis.

NOBL – Investment Thesis

Outstanding Dividend Growth Track-Record

NOBL invests in companies with at least twenty-five consecutive years of dividend growth. These are, almost by definition, outstanding dividend growth track-records, and likely to persist into the future. Companies don’t grow their dividends for decades by coincidence, but by specific, explicit management and company decision or policy. These are, understandably, likely to continue into the future. As such, Dividend Aristocrats offer investors incredibly safe dividends and dividend growth, significant benefits for the fund and its shareholders.

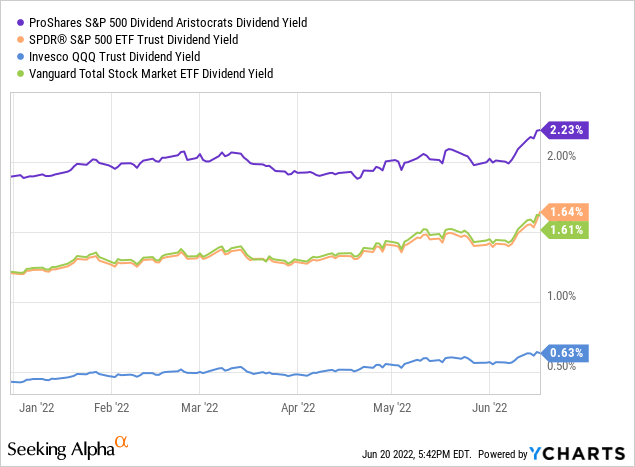

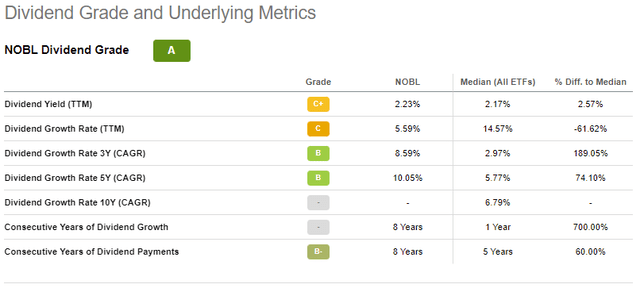

NOBL itself yields 2.2%. Although it is not a particularly strong yield, it is slightly higher than that of most broad-based equity indexes. NOBL’s slightly higher than average yield is a small benefit for shareholders, but a benefit, nonetheless.

Finally, NOBL’s dividend growth tends to be reasonably good, with the fund’s dividends growing at a 10.1% CAGR for the past five years. As a comparison, S&P 500 dividends grew at a 5.4% CAGR for the same time period. NOBL’s higher dividend growth track-record also benefits shareholders.

Seeking Alpha

NOBL’s dividend yield and dividend growth track-record are higher and longer than average, a solid combination. In my opinion, these characteristics form the core of the fund’s investment thesis. NOBL is a dividend, especially dividend growth, fund, which you buy if you are looking for strong dividend growth.

High-Quality Blue-Chip Holdings

NOBL’s holdings have all grown their dividends for at least twenty-five consecutive years. In my opinion, said dividend growth track-record is evidence of strong business models, consistent revenues and earnings, and shareholder-friendly management teams. Only the safest blue-chip stocks can grow their dividends for so long, and said safety is a significant benefit for shareholders. No investment is completely safe, but NOBL is safer than most.

Said safety should lead to reduced risk, volatility, and losses during downturns, although the situation is complicated. From what I’ve seen, the fund’s performance has been mostly driven by its underweight tech positioning, as tech has been the key equity industry for quite a few years now. As an example, the fund slightly underperformed during 1Q2020, the onset of the coronavirus pandemic, as tech outperformed during said time period. NOBL’s holdings are safer than average, but being underweight tech ended up mattering more.

On the other hand, the fund has outperformed YTD, but it seems to be driven by tech’s underperformance more than anything.

Notwithstanding the above, I do think that the fund’s high-quality blue-chip holdings make the fund a comparatively safe investment, even though that has not necessarily been reflected in the fund’s performance during prior downturns. Fundamentals and quality do matter, even though markets do not always necessarily reflect that, and even though industry positioning seems to have been more important in prior time periods.

Cheap Valuation

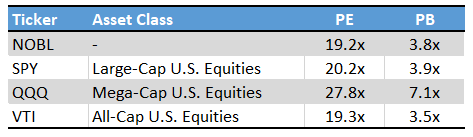

NOBL is overweight old-economy industries like financials and consumer non-discretionary, while being underweight tech. NOBL’s overweight industries tend to have lower-than-average valuations, while the opposite is true for tech. As such, the fund sports a competitive valuation, with a PE ratio of 20.7x, and a PB ratio of 4.2x, both slightly lower than average.

Fund Filings – Chart by author

NOBL’s cheap valuation is a benefit for the fund and its shareholders, and could lead to significant, market-beating returns if valuations normalize. That has been the case YTD, as previously mentioned. Importantly, NOBL’s valuation remains cheaper than average, so further gains and outperformance is likely, in my opinion at least.

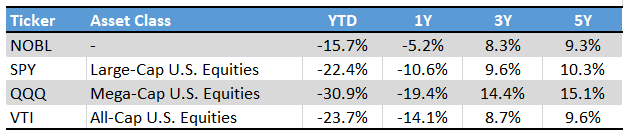

NOBL – Performance Analysis

Finally, a quick look at the fund’s performance. NOBL mostly performs in-line with its peers. It has slightly underperformed since inception, and during the past five years, as tech has significantly outperformed during the same. Performance has significantly improved in the recent past, with the fund significantly outperforming YTD, as tech has underperformed, and as valuations have started to normalize. In general terms, the fund’s performance is about average, but some potential outperformance is possible / likely if valuations continue to normalize.

Seeking Alpha – Chart by author

Conclusion – Buy

NOBL’s high-quality blue-chip holdings, outstanding dividend growth track-record, and cheap valuation, make the fund a buy.

Be the first to comment