Eoneren/E+ via Getty Images

The strength of the market since touching the correction and bear-market lows in the major averages has caught an overly cautious consensus off guard. This is because most assumed the market had yet to fully discount the war in Ukraine, rising commodity prices, and tightening monetary policy. Now the economic fundamentals are gaining strength again, as the headwinds from the pandemic fall in the rear view mirror, and two years of unprecedented fiscal stimulus continue to fuel growth. Any easing in concerns investors already have should provide additional upside in risk assets.

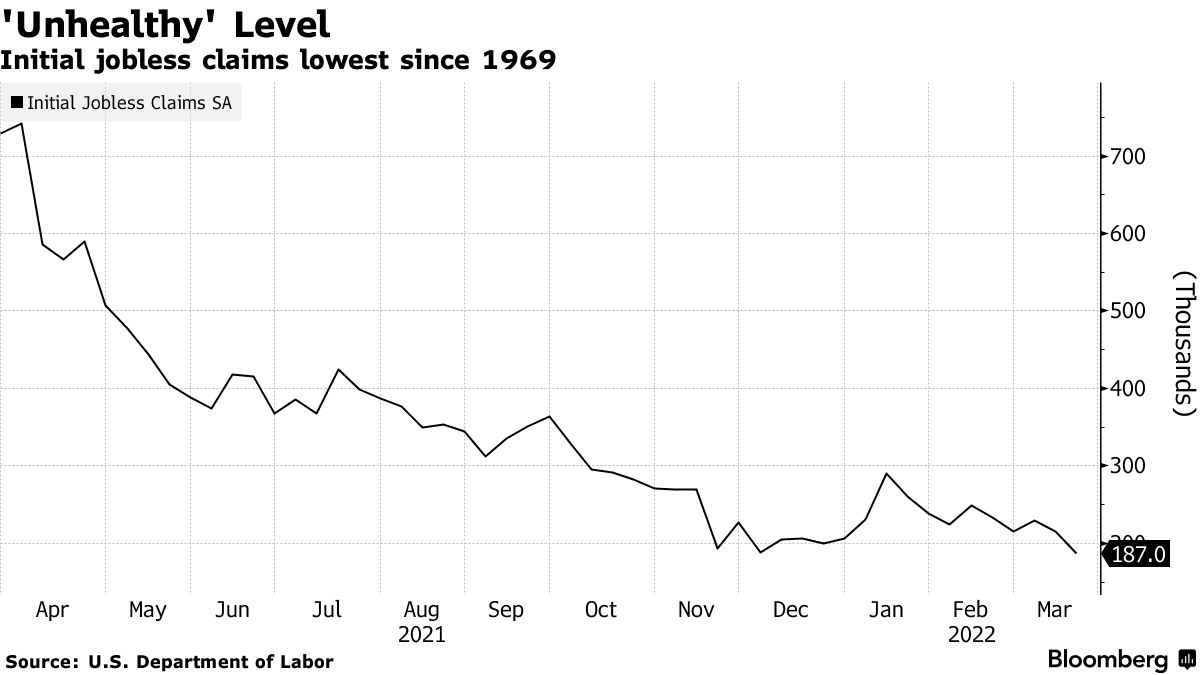

Initial unemployment claims fell 28,000 last week to just 187,000, which is the lowest number since 1969, while continuing claims for state benefits fell to just 1.35 million, which is the lowest number since 1970. Meanwhile, there are still a record number of job openings, which means that wage growth should remain strong through the remainder of this year. Additionally, the elevated rate of inflation should draw more workers into the labor force, as savings are sourced to fuel spending, which will bring the participation rate back to pre-pandemic levels. That will further strengthen the labor market, which suggests to me that there is very little chance of recession in 2022. This is supporting the recent rebound in stock prices.

bloomberg.com

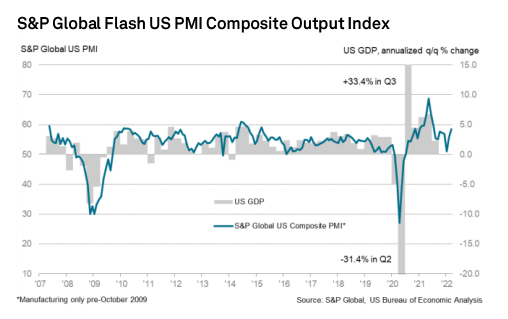

S&P Global’s mid-month survey of manufacturing and services firms for March, otherwise known as the Flash PMI, showed an uptick in output to a level that was at an 8-month high.

markiteconomics.com

The ending of pandemic-related restrictions, easing of supply chain bottlenecks, and hiring of additional workers is leading to better production numbers with the index increasing to a very strong 58.5 from 55.9 in February. New orders rose to a 9-month high, and export order rose as well. Despite faster rates of production, order backlogs continued to climb, which is what is driving the sharpest increase in hiring in a year. Again, there are no signs of recession.

markiteconomics.com

The only negative is that input costs are still rising at record levels, but output charges are rising commensurate, which is protecting margins. This report is indicative of an economy that is gaining strength as we close out the first quarter, despite the ongoing Russia-Ukraine war, and it bodes well for first quarter earnings reports, which begin in two weeks.

If there is a region we should be concerned about, it is Europe, as the conflict in Ukraine could undermine its recovery, but that has not materialized yet. To the contrary, Markit’s Composite Purchasing Managers Index (PMI) for the Eurozone rose to 54.5 in March, beating expectations of 53.9, with readings above 50 indicating growth. Business activity is picking up there as well.

As I surmised last month, we are seeing a rebound in economic activity, as expected from the easing of economic restrictions due to the waning Omicron variant. This is allowing consumers to tap record savings levels and rising wages and meet pent-up demand for goods and services. The record amounts of fiscal stimulus over the past two years, while partially responsible for the increase in prices we see today, are also helping consumers overcome them.

Technical Picture

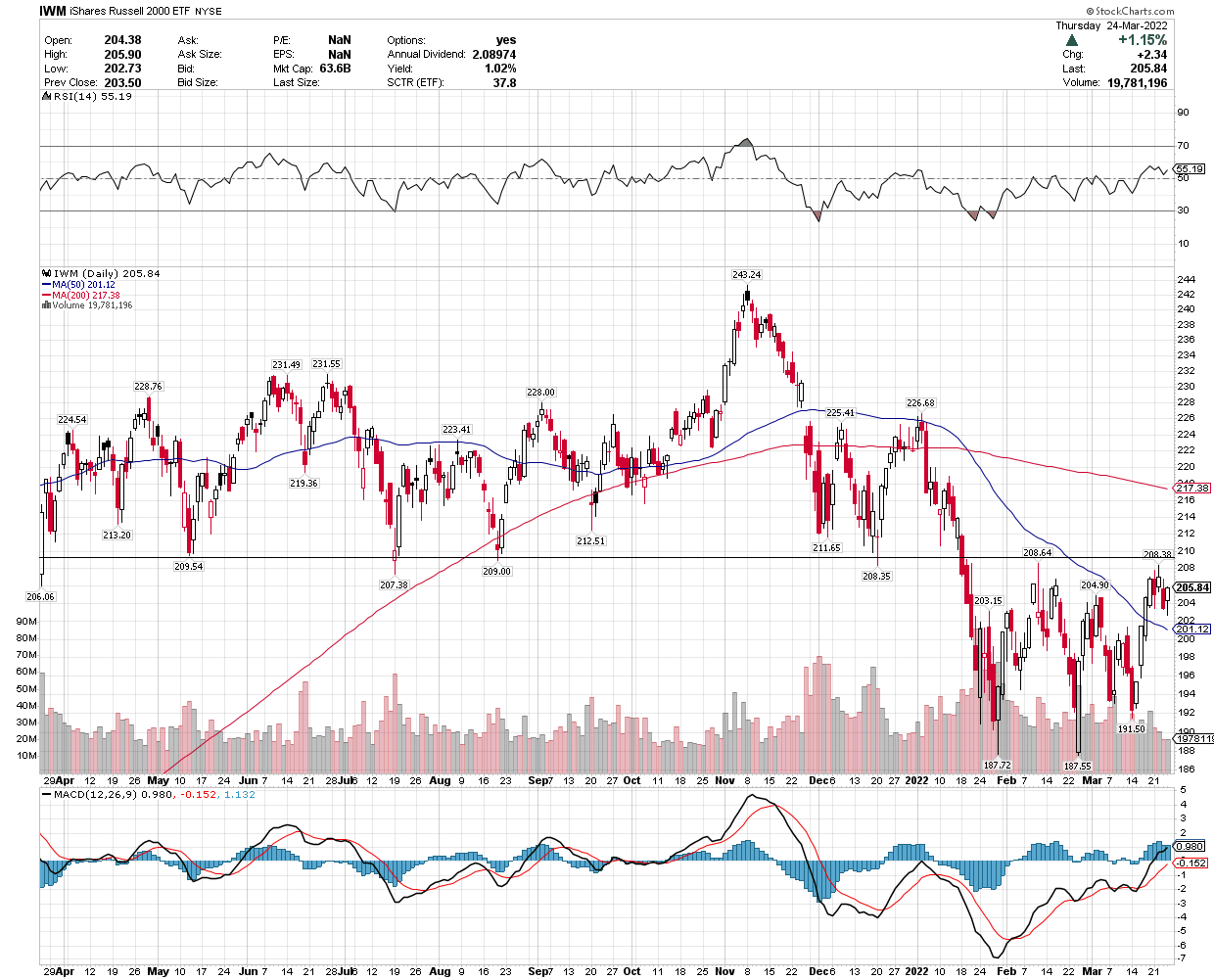

I am watching the Russell 2000 small-cap index, which is a good proxy for the domestic economy, for a break above what had been support for more than a year prior to its bear-market decline. That should foreshadow a recovery in the S&P 500 toward its all-time high.

stockcharts.com

Be the first to comment