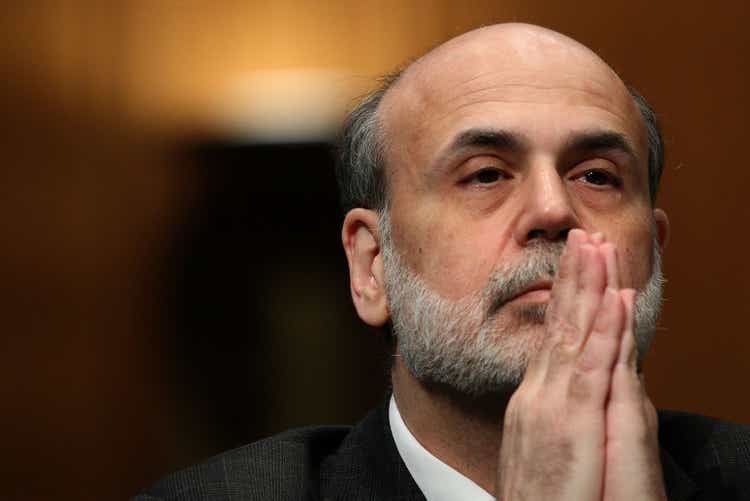

Win McNamee/Getty Images News

Congratulations, Ben, you have received the Nobel Prize for Economics.

The work you are cited for: “the theoretical foundations for why banks exist and why bank panics hurt.”

Mr. Bernanke shares this year’s award with two other economists, Douglas Diamond, and Philip Dybvig.

The specific concept this work was built upon was “information asymmetry.”

The issue in the field of finance and banking: borrowers know more about their creditworthiness than do their lenders.

Just who is a safe borrower and how does a lender know when the borrower’s condition of a safe borrower change

Banks make loans to individuals and businesses based upon the customer’s ability to repay the loan.

In order to provide additional protection of the financial “capital” the bank loans to a borrower, the lender may request that the borrow put up some collateral in order to protect the lender in case the individual’s cash flow cannot cover lending payments.

In residential lending, the bank will require that the lender put up the house that the loan is being used for as “collateral” for the house. That is, if the borrower cannot pay for the loan, the lender can “take over” the house and sell it to recoup the monies that are still owed.

One problem: the value of the house does not remain constant.

In “bad” times the value of the house may decline and the lender may not be able to recoup all of the funds that it has lent to the borrower.

Thus, the lender must use what information it has to increase the probability that relates to the ability to get back the funds lent out to the borrower.

This is the problem of asymmetric information when it comes to the banking world.

The Bernanke Solution

From all his study of banks, and banking, and the history of the Great Depression, Mr. Bernanke drew some conclusions that moved him, and others, into a new understanding of what was needed when the economy started turning sour.

As Greg Ip discusses in the Wall Street Journal, as an economy grows, housing prices rise, that is, household wealth rises, and borrowers look more creditworthy.

Lenders will lend these borrowers more money as collateral positions improve.

When housing prices fall, borrowers look less creditworthy.

Lenders are more likely to close on the borrowers and remove their collateral since the borrower presents a greater risk to the lender.

Bernanke and his co-author Mark Gertler of New York University, referred to this as “the financial accelerator.”

“The financial system wasn’t just a reflection but an accelerator of the business cycle.”

in other words, the “wealth” of the homeowner rose during a rising economy and fell during a declining economy.

Mr. Bernanke came to focus on the “wealth” of consumers.

If the economy began to decline, the Federal Reserve must step in and buttress the “wealth” of the homeowner by helping to keep the price of the home from falling.,

So, this, to Bernanke, became the goal of monetary policy: to sustain consumer wealth and not put the banking system under the pressure to foreclose on the consumer’s collateral.

But, Bernanke expanded this idea.

If it was important for the Federal Reserve to stimulate the economy so as to keep housing prices from falling, it was also important for the Federal Reserve to also stimulate other sources of wealth to help maintain higher and higher levels of consumer wealth so as to keep the economy advancing.

What about stock prices?

Stock prices make up a substantial portion of consumer wealth. If stock prices could be made to rise and continue to rise, consumer wealth would increase, consumer spending would also increase and the economy would have a substantial base to expand upon.

And, this is just the policy that Mr. Bernanke, as the chairman of the Board of Governors of the Federal Reserve System, implemented to bring the U.S. economy out of the Great Recession and generate the longest economic recovery following World War II.

Mr. Bernanke’s Success

So, Mr. Bernanke’s success was based upon rising asset prices.

The “old” monetary policy of cutting interest rates so that corporations would invest in physical capital and this investment would drive employment and income and this spending would be multiplied through the economy to bring about economic prosperity.

The “new” monetary required making asset prices rise, and this would create a “wealth effect” that would generate consumer spending and it would be this consumer spending that would drive the economy forward.

The mechanism: three rounds of quantitative easing.

To generate rising asset prices and then maintain their continued increase, “wealth” had to increase and continue increasing. This process would not work if there were stops and starts. Asset prices must rise and continue to rise.

Quantitative easing fulfilled this requirement. So, Mr. Bernanke instituted three rounds of quantitative easing through the rest of his tenure and was able to maintain rising housing prices and rising stock prices.

Furthermore, it was asset prices that rose, not consumer prices. The economic expansion that followed the Great Recession saw consumer prices rise by only about 2.3 percent. A remarkable performance.

The economy grew by only about 2.2 percent, but it was steady with falling unemployment.

A very nice picture.

The Covid-19 Recession

Mr. Bernanke’s recovery was continued on by his replacement in 2014, Janet Yellen. Nothing much happened during her tenure at the Fed.

Ms. Yellen was replaced by Jerome Powell in 2018.

Mr. Powell got hit with the spread of Covid-19.

Mr. Powell’s response was taken right out of the Bernanke playbook: quantitative easing.

Mr. Powell, fighting the “disruption” of his world, entered into a Bernanke-inspired period of quantitative easing that extended from the late spring of 2020 through the end of 2021. The plan was that the Federal Reserve would acquire $120.0 billion of securities for its portfolio every month.

Asset prices rose. The stock price hit one new historic high after another during this period of time and property values soared. The coffers of financial institutions exploded. Quantitative easing seemed to work.

Inflation And Quantitative Tightening

Inflation now is the problem, not recession.

Now the Federal Reserve is following a program defined as “quantitative tightening.”

In quantitative tightening, the Federal Reserve is attempting to reduce the size of its securities portfolio by about $95.0 billion per month.

The idea is to cause stock prices and housing prices and the prices of other assets to fall so as to bring the inflation rate for the economy back to about 2.0 percent.

How is this going to work? Economists don’t fully know. Investors don’t know.

But, as stated by Mr. Bernanke (and as quoted by Mr. Ip in the Wall Street Journal):

The current situation is “not anything like the dire straits” of 14 years ago.

“Suppressing interest rates to historic lows and flooding the economy with bank reserves via quantitative easing distorted markets for every form of credit in ways economists still don’t understand.”

“The long-term effects on financial stability are only now coming into view.”

The dangers of quantitative tightening have never, ever been observed before.

Consequently, investors have little to base their decisions on.

This is a time to be particularly cautious. The volatility of the market has increased substantially. This is a first-time tried experiment.

Mr. Bernanke, the Nobel Prize winner has had a major impact, not only on academic research but also in terms of real-world policy-making. His efforts have changed the world.

Mr. Bernanke deserves recognition for these contributions.

However, for investors…they are walking on new ground. They have never been here before.

They must be cautious. The Federal Reserve wants stock prices to decline.

But, will the Fed stick with this desire if the decline in stock prices begins to accelerate?

Maybe reality may not match the theory in the current case.

Here we have another case of radical uncertainty the investor must deal with.

Be the first to comment