kodda

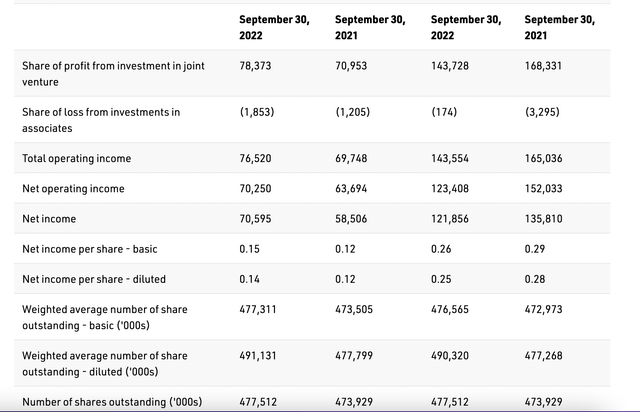

Africa Oil Corporation (OTCMKTS: OTCPK:AOIFF) recently reported strong Q3 2022 earnings, as the oil company continues to grow past a $1.1 billion market capitalization. The company reported strong earnings for the quarter, highlighting its financial strength, and as we’ll see, continues to have a strong pathway to generating shareholder rewards.

Africa Oil Corporation Prime Oil and Gas

The core source of the company’s earnings is Prime Oil and Gas. The company only received $50 million in dividend shareholding from Prime Oil and Gas during the quarter, but the volatility of dividend shareholding is unrelated to the earnings of the asset. The asset continues to chug along and generate reliable cash flow.

The company had economic entitlement production of 25,200 shares / day during the quarter, a bit disappointing of a decline. However, production from the offshore region can be expected to remain volatile. The company did hit its highest average realized price of $101.5 / barrel Brent, highlighting the massive strength of its business and quality of the oil produced.

Financially, Prime Oil and Gas does have a $165.1 million net debt position, a substantial increase from a net debt position attributable to the company of almost $1 billion at the acquisition time. That substantial improvement in financial position means that Prime Oil and Gas will be able to redirect cash towards Africa Oil Corporation instead of balance sheet improvements.

Africa Oil Corporation Share Repurchases

The company has started a massive portfolio of share repurchases.

Africa Oil Corporation Investor Presentation

To start, it’s worth noting that the company’s outstanding share count doesn’t normally increase dramatically year-over-year. Diluted share count increased by 14 million shares, or ~3%, amounting to ~$35 million in annualized dilution. For perspective the company has repurchased more than that many shares since the start of its buyback program on September 27.

We expect the company to continue repurchasing shares with a net cash position overall and a net cash position of roughly $170 million at the parent company level. These share repurchases continue to highlight how the company is a valuable investment.

Africa Oil Corporation Outlook

The company’s outlook continues to have economic entitlement production centered at around 25 thousand barrels / day. There are several important developments that are coming for the company on top of continued strong production in a higher-price oil environment.

Among the most important, Prime Oil and Gas is working with its upstream partners on the conversion (on new PIA terms) of the OML 127 and 130 licenses which are the majority of production. That is expected to happen by the end of the year, which could enable the company to refinance its debt, and support increased distributions to the parent company.

Of course, higher interest rates could make this potentially a worse day. More exciting would be if the developments enable starting on Preowei, part of the company’s OML130 block. The block development could start in 2024 and is expected to have up to 200 million barrels of reserves, which could enable ~70-80 thousand barrels / day in production.

Next quarter we’ll get an indication of Prime Oil and Gas’ expected performance in 2023.

Other catalysts next year include starting the appraisal program on the Venus light oil and gas discovery. As part of this, the nearby Block 3B/4B on the same discovery trend is looking for potential farm outs. Lastly, the company is still looking for a farm out on its Kenyan project over the next year, but it remains to be seen if it can do that.

Our View

Africa Oil Corporation is a unique company with a unique portfolio of assets.

The company’s core Prime Oil and Gas asset has continued to line up with the company’s 25 thousand barrels / day in production target. That has enabled the company to continue generating massive cash flow. The parent company (Prime Oil and Gas) has paid down a substantial amount of debt which will enable larger dividends going forward.

The company is continuing to build up its alternative asset portfolio. There’s several major catalysts expected in 2023 and it’d be great to see the company finally get it’s long running Kenyan project off the ground. Whether that happens remains to be seen, but it’s a high potential development. Overall we expect the company to continue generating high cash flow.

The company continues to have a strong core dividend it can use for shareholder rewards. On top of this the company has started aggressively repurchasing shares which we expect can continue. That strength will enable a growing share price and helps highlight how the company is a valuable long-term investment.

Thesis Risk

The largest risk to the thesis is crude oil prices. As the company discussed in its earnings, the average oil prices in the most recent quarter were a record. There’s no guarantee that that’ll continue and if it doesn’t it’ll substantially hurt the company’s ability to generate continued shareholder returns, making it a worse investment.

Conclusion

Africa Oil Corporation reported strong earnings as the company continues to generate massive cash flow from its producing Prime Oil and Gas asset. Prime Oil and Gas’ debt has dropped dramatically which will enable increased cash flow for the company going forward as the dividends can increase. This is especially true if the RBL can be rebuilt.

The company continues to pay a respectable dividend of several % annualized, a dividend that it can comfortably afford. Additionally, the company has started rapidly ramping up its share repurchases. It’s a level that the company can comfortably afford and we expect to continue. With several catalysts coming in 2023, we expect Africa Oil Corp. to generate substantial returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment