Photographer/iStock via Getty Images

On May 23, 2022, in an article on Seeking Alpha, I wrote, “BG offers an oasis of value in a very volatile stock market that is correcting. The high-flying tech sector is suffering a substantial decline, but the companies that feed and fuel the world are likely to remain the leaders over the rest of 2022 and the coming years. I am a buyer of BG shares on any price weakness, leaving room to add on further price corrections because of the overall stock market decline.” On that day, Bunge Ltd. (NYSE:BG) shares settled at $113.44, and the stock was on its way down from the April 21, 2022, $128.40 peak.

BG shares stopped shy of the 2008 $135 record peak, and the recent correction took the shares below $84 before turning higher. The scale-down buying approach, leaving room to add on further depreciation, allowed for accumulating shares at an attractive average below $100 per share. I remain bullish on the company’s prospects and continue to forecast the shares will rise to a new all-time high in the coming months and years.

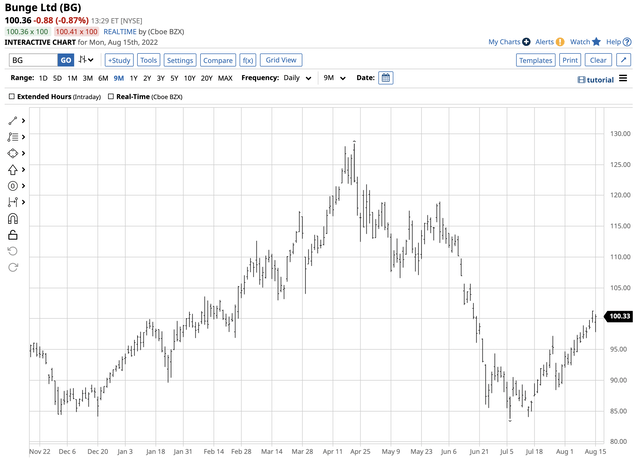

BG reached a low in July

Bunge shares reached a high of $128.40 on April 21, 2022.

Short-term Chart of BG Shares (Barchart)

As the chart highlights, BG suffered a sharp correction that took the stock to a low of $83.78 on July 6, a 34.8% decline in under three months. Turbulence in the stock market and a correction in agricultural commodity prices drove the stock price lower, but BG had come a long way from the March 2020 pandemic-inspired low.

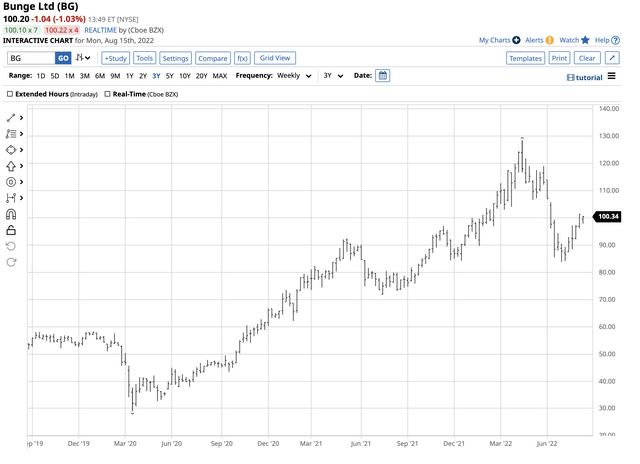

Chart of BG Shares Since the March 2020 Low (Barchart)

The longer-term chart illustrates BG shares reached a low of $29 in March 2020. At the April 2022 high, the stock had more than quadrupled. At the July 6 low, it was still nearly triple the price at the March 2020 low.

Even the most aggressive bull markets rarely move in straight lines. In my late May Seeking Alpha piece, I suggested a scale-down approach with the stock at the $113.44 level. Since the stock fell to $83.78, a scale-down approach would have achieved an average price of $98.655 per share, just below the price on August 15.

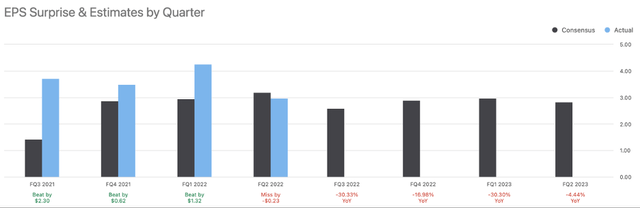

Q2 earnings were disappointing

After successful quarters where BG beat consensus ETP forecasts, Q2 was another story.

EPS Quarterly History (Seeking Alpha)

The chart shows the 23 cents per share miss in Q2 followed by three quarters of better-than-expected results. BG also missed on revenues as the company reported $17.93 billion, $17.93 million less than the market had expected. Meanwhile, BG earned $2.97 per share in Q2, a significant profit for the agricultural company.

Most investment analysts continue to favor BG shares, despite the Q2 miss.

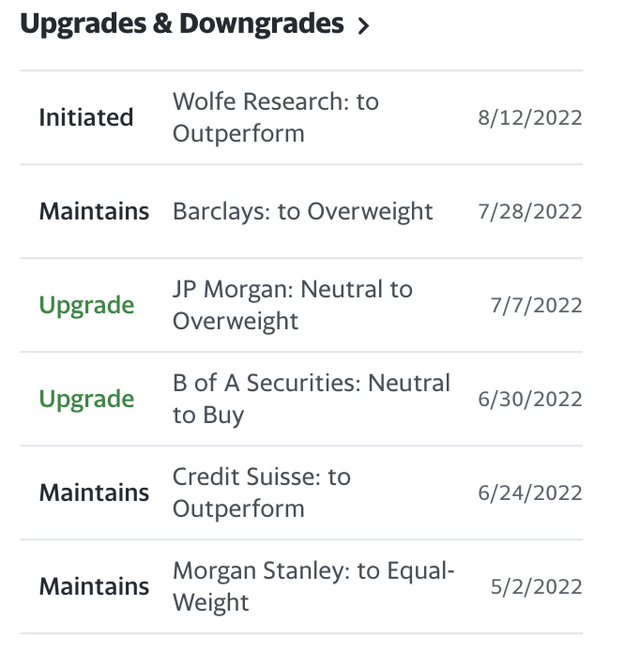

Analyst Ratings- BG Shares (Yahoo Finance)

The chart shows no ratings below neutral.

Selling a Brazilian JV with BP

BP Bunge Bioenergia is a joint venture between BG and BP (BP), embracing Brazilian sugarcane’s role in ethanol production. JPMorgan Chase (JPM) is advising the joint venture with an asset value of $1.96 billion.

The venture is only three years old and manages eleven plants with a capacity to crush 32 million metric tons of sugarcane yearly. The US, the world’s leading corn producer and exporter, processes corn into biofuel. Brazil is the top producer and exporter of free-market sugarcane. The sweet commodity is processed into ethanol in Brazil.

BG stands to profit from the sale of the unit as the rising demand for biofuel makes the JV an attractive and perhaps accretive transaction to a multinational energy or agricultural company. The JV could offer a sovereign wealth portfolio an opportunity to increase or initiate exposure to Brazil. After a record $48.4 billion quarterly profit, Saudi Aramco or the Saudi Sovereign Wealth Fund could be interested in the JV. Meanwhile, there are many other potential acquirers in the current environment.

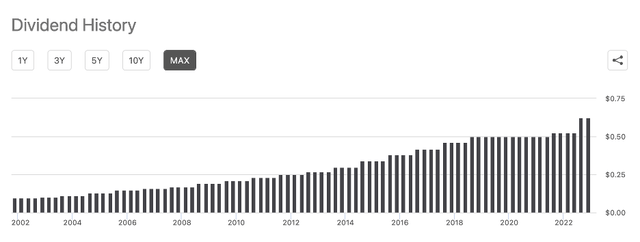

A healthy dividend – Mixed Factor Grades

At around the $100 level on August 15, BG’s current 63 cents quarterly dividend translates to a 2.52% yield.

Dividend History- Bunge Limited (Seeking Alpha)

The long-term dividend trend has been higher over the past two decades. While Seeking Alpha’s Quant Rating is a Hold, Factor grades are mixed.

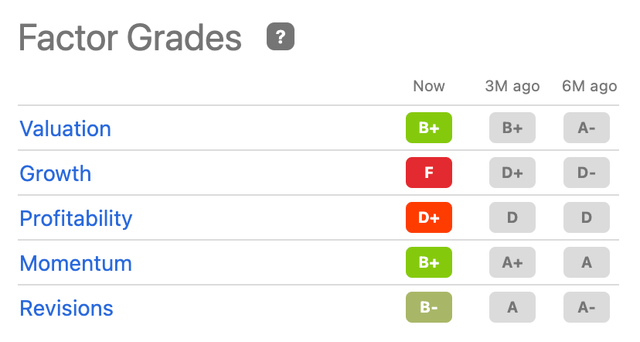

BG Factor Grades (Seeking Alpha)

The low rating for profitability comes from weak gross profit margin, CAPEX/Sales, and cash from operations. BG also gets a failing grade on growth as long-term prospects are weak compared to peers. However, the company receives decent grades on valuation, momentum, and revisions.

BG’s Brazil exposure could be one of the most significant factors weighing on the prospects for the stock. Brazilians will go to the polls in the fall to decide if they will give President Bolsonaro another term or replace him. A socialist leader could substantially impact business in Brazil, creating uncertainty for BG’s interests in the leading South American country.

Three reasons for new all-time highs in BG shares

I continue to favor BG shares at the $100 level for at least three reasons:

- The war in Ukraine presents a unique environment for profits for companies in the agricultural sector. Bunge Ltd. is one of the leading ABCD companies, including Archer-Daniels-Midland (ADM) and privately held Cargill and Louis Dreyfus. Higher agricultural commodity prices translate into rising profits.

- Addressing climate change through biofuels will continue to support agricultural commodity prices and profits for the leading ABCD companies.

- The trend in BG shares remains higher since the March 2020 low, despite the recent correction that took the shares to a low below the $84 level. The trend is always your best friend in markets across all asset classes.

Meanwhile, the high level of soybean crush spreads, where soybean products are outperforming the raw oilseeds, supports BG’s profits. Brazil is a leading soybean producer, and BG is an agricultural powerhouse in the South American nation. December soybean crush spreads at the $2.15 level are at the highest level in years, with nearby soybean crush spreads at nearly $2.60, a record peak.

The over 2.5% dividend at the $100 per share level pays shareholders while waiting for capital appreciation. The sale of the JV could result in a special dividend or add to earnings over the coming quarters.

The all-time high in BG shares was at the early 2008 $135 high. I expect BG to eclipse that level, which is 35% above the current share price.

Be the first to comment