cmart7327/E+ via Getty Images

MP Materials (NYSE:MP) has been having an incredible year. The company just released revenue figures for its fiscal 2022 second quarter which jumped by nearly 100% as net income nearly tripled. The high realized prices for rare earth oxides continued to provide a boom for the US-based miner which now lies at the centre of plans by the US government to reduce dependency on China for the elements. This need was heightened with Chinese sabre-rattling around Taiwan which at the core exposed the clash of geopolitical objectives of both economies. We saw China exploit its dominance of the sector back in 2010 when it banned exports to Japan following a collision between a Chinese fishing boat and a Japanese coast guard vessel around the disputed Senkaku Islands.

Rare earths are essential for a wide spectrum of technologies including generators for wind turbines, traction motors for electric vehicles, medical devices, fighter jets, and missiles. These industries are being placed at the sacrificial altar if the situation around the Taiwan strait was ever to turn hot.

The strong earnings results also came in against the passing of The Inflation Reduction Act, one of the most significant climate-focused bills in US history. The bill allocates $370 billion over 10 years to decarbonization initiatives that are set to supercharge the rollout of wind energy and EVs in the United States. During the recent earnings call, management stated that the bill, when signed into law, will be fantastic for their supply chain as it provides a material benefit through its 10% production tax credit for critical material processing. Critically, it’s an unprecedented level of government intervention which accelerates the immediate macro drivers for MP Materials. It will bring forward demand and the inherent supply deficit MP Materials states exist for rare earths.

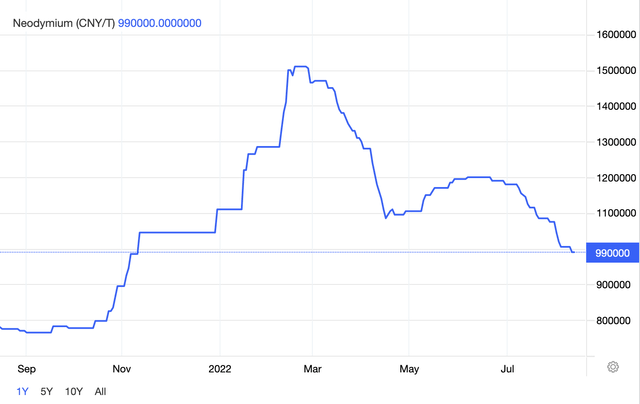

Neodymium Prices Retreat From All-Time Highs

This should not necessarily be news for shareholders, but neodymium prices have been falling. This is part of a wider pullback in commodities, from oil to copper to wheat, as speculative froth initially driven by commodity traders and hedge funds continue to be stripped back. However, MP Materials has stated they expect a constricted global supply chain for rare earths with the still limited number of global suppliers maintaining the supply deficit in the years ahead. This should continue to support profitability and positive cash flows in the coming quarters, but would face a problem in 2023 when year-over-year comps will likely show a decline in a broad range of financial metrics.

MP Materials will see variability in earnings, that’s a natural consequence of being a miner where the economic cycle influences prices. The immediate macro drivers for rare earths are likely to continue to post strong growth even if the economy falls into a recession. This is a scenario made even more likely by the Inflation Reduction Act. Further, as MP Materials is moving to develop a permanent magnet facility in Ft. Worth, Texas, the company stands to improve its profitability by moving beyond just mining REOs. The facility will source refined feedstock from Mountain Pass to transform it into finished magnets, delivering an end-to-end rare earths supply chain within the US.

The company’s recently reported earnings for its fiscal 2022 second quarter saw revenue come in at $143.56 million, a 96.4% increase from the previous year-ago quarter and a beat by $14.81 million on consensus estimates. Whilst MP Materials produced 10.3K metric tons of REOs during the quarter, broadly in line with the year-ago figure, the average realized price was up 90% over the same period with production costs only rising by 14%. This meant a net income of $73.3 million, a year-over-year increase of 170% from $27.2 million. Cash and equivalents at $1.264 billion, increased by 2.5% sequentially. The company also generated nearly $100 million in operating cash flow.

As The Wall Came Down Liberty Flourished

As long as China continues to dominate access to one of the most important elements of modernity and the future, the economies of the world will be at risk of the temperaments of the Chinese Communist Party. With the prospect of the world facing a new cold war, one that puts free capitalist democracies against the alliance of autocracies, controlling access to the critical elements will be key to maintaining economic power and the outsized influence this brings.

This increasing dichotomy between democracies and autocracies could become a defining feature of geopolitics in the coming years, placing MP Materials as a strategically important company. That said, the company is facing a global market with significant supply coming online as other countries rush to boost their respective production of rare earth elements. It remains a company to be on the watchlist of those looking for a pick-and-shovel play on the growth of EVs, wind turbines, and liberty.

Be the first to comment