Jaiz Anuar

A Quick Take On Tower One Wireless Corp.

Tower One Wireless Corp. (TO) (OTCQB:TOWTF) has filed to raise $86 million in an IPO of its Class A common shares, according to an F-1 registration statement.

The firm leases communication site space to mobile network operators in various countries.

Tower One is growing revenue but also using significant free cash flow.

I’ll provide a final opinion when we learn more about the IPO.

Tower One Overview

Bogota, Colombia-based Tower One was founded to develop, own and operate multitenant communications sites for lease to mobile network operators in large Spanish-speaking countries in Latin America.

Management is headed by President, CEO and interim CFO Alejandro Ochoa, who previously worked at financial services firms such as Morgan Stanley, Prudential Securities and Raymond James.

The company’s countries of operation (or soon to be) include:

-

Ecuador

-

Argentina

-

Colombia

-

Mexico

Tower One has booked fair market value investment of $20 million as of March 31, 2022 from investors.

Tower One’s Customer Acquisition

The company’s sales team seeks to lease its multitenant facilities to mobile network operators wanting to expand or improve their network coverage.

Tower One says it has “strategic relationships” with major Latin America carriers, including Telefonica, AT&T, Millicom and America Mobile.

Advertising and Promotion expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Advertising and Promotion |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2022 |

4.5% |

|

2021 |

2.2% |

|

2020 |

1.5% |

(Source – SEC)

The Advertising and Promotion efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Advertising and Promotion spend, rose sharply to 16.3x in the most recent reporting period, as shown in the table below:

|

Advertising and Promotion |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2022 |

16.3 |

|

2021 |

6.6 |

(Source – SEC)

Tower One’s Market & Competition

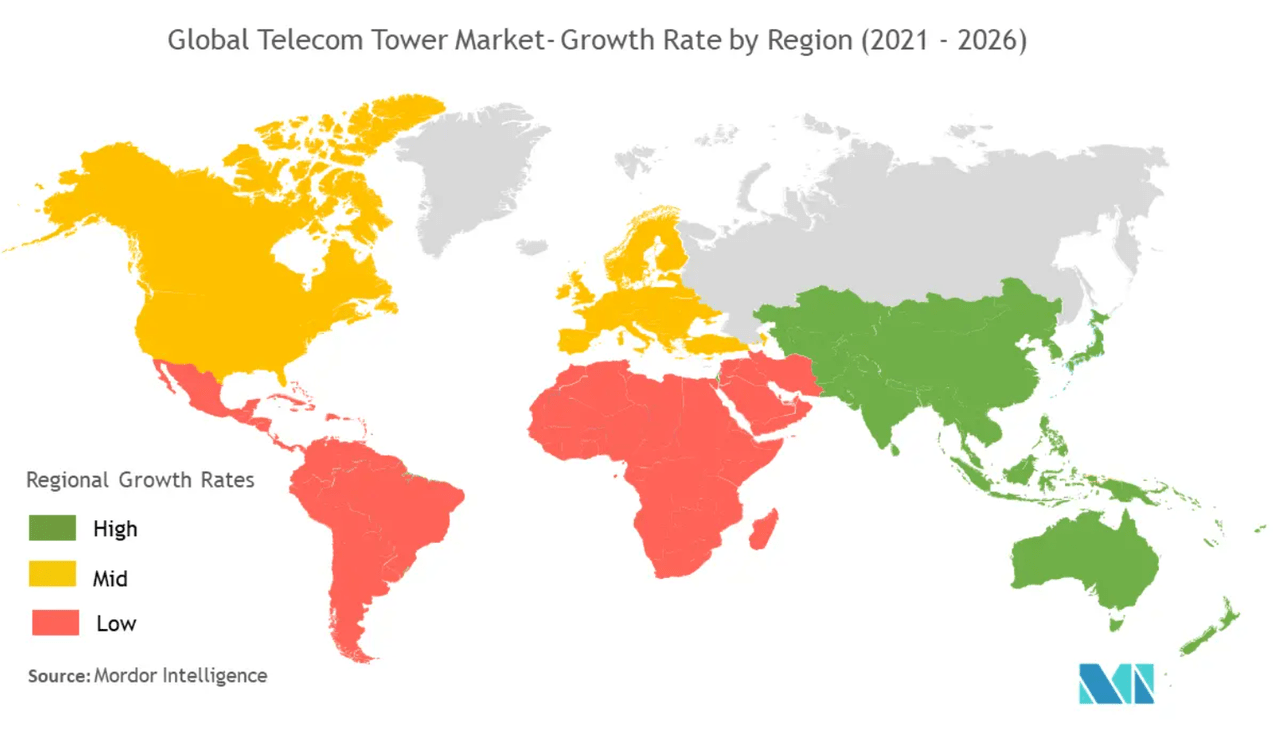

According to a 2021 market research report by Mordor Intelligence, the global market for telecom towers was an estimated 4.34 million units in 2020 and is forecast to reach 5.3 million units by 2026.

This represents a forecast CAGR of 3.34% from 2021 to 2026.

The main drivers for this expected growth are an increase in demand for mobile broadband access as well as rollout of the new 5G wireless standard.

Also, the chart below shows the expected growth rates of various regions globally, with Central and Latin America being projected to grow at the slowest rate of growth through 2026:

Global Telecom Tower Market (Mordor Intelligence)

Major competitive or other industry participants include:

American Tower (Argentina, Colombia, Mexico)

BTS Towers (Colombia, Ecuador)

Continental (Colombia, Mexico)

DigitalBridge (Colombia, Mexico)

IHS Towers (Colombia)

Innovatel/Torresec (Argentina, Colombia, Ecuador)

Phoenix Tower (Argentina, Colombia, Mexico, Ecuador)

SBA Communications (Argentina, Colombia, Ecuador)

Sitios Latinoamerica (Argentina, Ecuador)

Telesites (Mexico)

Torrecom (Colombia, Mexico)

Tower One Wireless’ Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increased gross profit but decreasing gross margin

-

Growing operating profit

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 3,104,154 |

278.7% |

|

2021 |

$ 8,336,348 |

17.1% |

|

2020 |

$ 7,118,344 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 1,253,949 |

64.6% |

|

2021 |

$ 3,449,022 |

5.9% |

|

2020 |

$ 3,256,554 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Three Mos. Ended March 31, 2022 |

40.40% |

|

|

2021 |

41.37% |

|

|

2020 |

45.75% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2022 |

$ 4,066,074 |

131.0% |

|

2021 |

$ 8,211,352 |

98.5% |

|

2020 |

$ 8,226,589 |

115.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2022 |

$ (1,288,158) |

-41.5% |

|

2021 |

$ (3,583,545) |

-115.4% |

|

2020 |

$ (2,865,957) |

-92.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2022 |

$ (1,912,636) |

|

|

2021 |

$ (4,225,153) |

|

|

2020 |

$ 310,611 |

|

As of March 31, 2022, Tower One had $725,086 in cash and $34.4 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was negative ($11.1 million).

Tower One Wireless Corp.’s IPO Details

Tower One intends to raise $86 million in gross proceeds from an IPO of its Class A common shares, although the final figure may differ.

Class A common shareholders will receive one vote per share

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

The company’s stock is currently quoted on the OTCQB market under the symbol “TOWTF”, on the Frankfurt Stock Exchange under the symbol “1P3N” and on the Canadian Securities Exchange under the symbol “TO”.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

for construction and purchase of towers and infrastructure development, including all aspects of site acquisition, permitting and payments of licenses and applicable taxes, with the remainder, if any, for working capital.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm has not accrued any legal claim liability but is currently subject to claims potentially totaling a maximum of CA$318,536 plus legal and court costs.

The sole listed bookrunner of the IPO is Maxim Group.

Commentary About Tower One’s IPO

TO is seeking to go public in the U.S. to provide funding for further tower development, acquisition and for its general growth initiatives.

The company’s financials have produced increasing topline revenue, higher gross profit but reduced gross margin, growing operating profit but increasing cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($11.1 million).

Advertising and Promotion expenses as a percentage of total revenue have risen as revenue has increased; its Advertising and Promotion efficiency multiple rose sharply to 16.3x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future profit to reinvest back into the company’s growth initiatives.

TO’s CapEx Ratio is negative (0.9), which indicates it is spending heavily on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing wireless system infrastructure is large and expected to grow at a moderate rate of growth in the coming years, while the company faces significant competition from much larger market participants.

Maxim Group is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (41.6%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the rising cost of capital and its heavy capital expenditure requirements which may exert a drag on the stock in a stock market that is penalizing such companies.

When we learn more about management’s pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment