Consumer Confidence and USD/JPY Talking Points:

- Consumer Confidence printed at 121.7 vs. forecast of 113.

- Index printed at highest level since February 2020 as economic conditions improve.

- USDJPY is making an attempt higher after falling to multi-week lows.

April Consumer Confidence Hits Highest Level Since February 2020

The Conference Board’s Consumer Confidence Index printed at a strong 121.7 compared to a forecast of 113, its highest level since February 2020. Last month, the index had surged to its highest level in a year on the back of strong vaccination progress, economic stimulus, and an overall improvement in the economic outlook. Today’s print reaffirms this view among consumers.

Around 30% of the US adult population is now fully vaccinated, and the abundance of vaccine availability now means nearly anyone looking to get vaccinated can do so. Signs point to a hopeful return to some level of economic normalcy this summer.

The Expectations component of the index edged up slightly, rising from 108.3 in March to 109.8 in April. However, the Present Situation component of the index had a massive increase, rising from 110.1 in March to 139.6 for April. This piece of the index is made up of consumers’ assessments of current business and labor market components.

Recommended by Izaac Brook

Get Your Free JPY Forecast

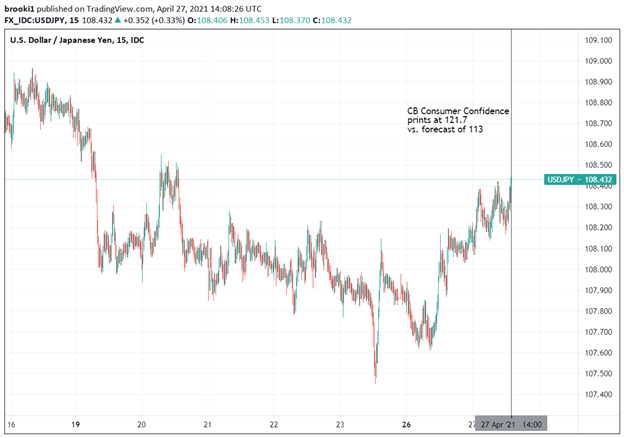

After falling to a low around the 103.75 level at the beginning of 2021, USD/JPY strengthened throughout Q1. The pair rose to a high just shy of the 111.00 level in late March before turning back downward, falling back to the 108.00 level. At the beginning of the week, the pair was trading around a nearly two-month low near the 107.60 level before it began to attempt a rebound higher.

US Dollar / Japanese Yen (USD/JPY) – 15 Minute Time Frame (April 2021)

Chart created by Izaac Brook, Source: TradingView

The pair was trading back above the 108.40 level in the immediate aftermath of the strong consumer confidence print, its highest level in a week.

The overall reaction to the print was muted as markets have their sights set on tomorrow’s FOMC meeting. While the April meeting seems too early for the FOMC to announce a reduction in support, the meeting and accompanying press conference may see a shift in language noting progress towards the Fed’s goals and hinting at upcoming reductions in accommodative policy.

— written by Izaac Brook, DailyFX Research Intern

Be the first to comment