gorodenkoff/iStock via Getty Images

Co-produced with Treading Softly

Investors love a good “battleground” stock. Often it means there are extremely strong opinions on either side and the bulls and bears “wage battle” over the future trajectory of the share price.

When it comes to income investors, we rarely dive into the deep end of a battleground. If we’re bullish, we welcome any dip that does not correspond with a fundamental issue and buy up shares at a discounted price versus what was offered before.

Sometimes, however, battlegrounds are laid by misinformation, misunderstanding, or simply lazy analysis. In those moments, we do find ourselves frequently reiterating our viewpoint while collecting large sums of income from our holdings.

So today, we want to take some time to reiterate two excellent income holdings, why we hold them, and remove some of the unnecessary confusion created by those with divergent investing or trading styles. They love to create confusion to profit from your fear, that’s not our style. We’ll tell you why we’re buying, and let you make the choice for yourself! No short agenda here, we’ll likely be holding long after you’ve forgotten about these picks.

Let’s dive in.

Pick #1: OXLC – Yield 14.6%

The cash flow coming from CLO equity positions has reached insane levels. Last quarter, Oxford Lane Capital (OXLC) produced a core NII (net investment income) of $0.55 on a NAV (Net Asset Value) of $5.07/share. That is an annualized cash return on NAV of 43.3%!

Let’s put this in perspective, pre-Covid March 2020, OXLC’s NAV was $3.58, and its core NII was $0.45. An annualized 50% cash return on NAV. The reason for such a nosebleed cash yield was obvious: NAV was reported as of March 31st, and the cash flow that had come in from January through March was not expected to continue. The market was right. In the next quarter, OXLC’s core NII plummeted to $0.23/share. If cash flow is expected to plummet 50%, then the market having such a low valuation makes sense.

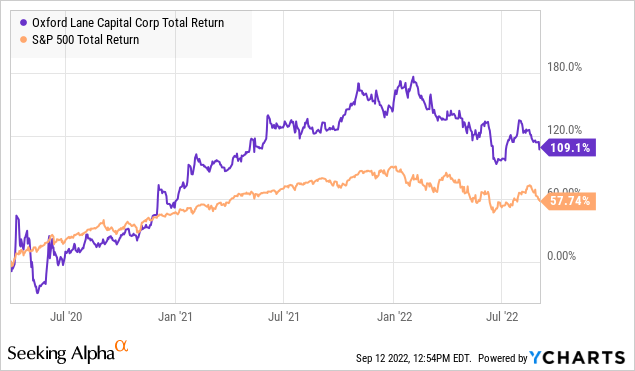

Even though the market was right, in hindsight, it was time to back up the truck on OXLC:

Yet we understand that during that period, there was a lot of uncertainty. A pandemic was spreading around the world, governments shut down businesses with blanket mandates, and many businesses went to near zero in revenues almost overnight. What would happen to all the debt these businesses owed? Nobody knew! There was an unprecedented amount of risk and an unprecedented amount of uncertainty. What was quite certain was that the “redirection” features of CLOs would kick in and that cash flow would be redirected to senior tranches, substantially reducing cash flow to OXLC, which holds equity tranches.

Against that backdrop, a 50% yield on NAV is hard to call “crazy”. We can understand why NAV fell so much, we can understand that the risks were, in fact, very high and required very high returns to compensate for them. In hindsight, those who accepted the risk and bought were highly well-rewarded.

Here we are today, and OXLC’s NII yield is again super high.

Is the macro situation today at all comparable to March 2020? No.

- Fitch’s projection for 2023 default rates is 1.5-2%. In December 2019, before COVID, default projections for 2020 were already at 3%. By March 2020, many were projecting default rates north of 10%.

- In December 2019, OXLC’s Interest Diversion Cushion was 2.98%. This measures how much room OXLC’s CLO positions had before interest payments would be diverted to the senior tranches. Last quarter, that cushion was 4.01%. In other words, if a similar COVID-style crash happened today, OXLC has a larger cushion going into it and would likely see less redirected cash flow than in 2020.

- OXLC has $174.4 million in newly acquired CLOs that have not yet made their first cash payments. Approximately 11% of their total assets. These positions will pay out by the end of the year, growing OXLC’s cash flow even higher.

- In short, in March 2020, loan prices collapsed because investors were fearful that defaults would skyrocket. Today, prices have fallen a similar amount, but it appears to be tied much more to technical factors than fundamental ones. Investors are selling loans to reposition their portfolios out of fear of rising rates, not because they expect widespread defaults imminently.

So we have very comparable price action for OXLC’s NAV, for very different reasons. In March 2020, there were very good reasons to fear the fundamentals. Nobody knew what the impact of COVID would be. Today, CLO prices have fallen just as dramatically, but the outlook on the fundamentals is bright.

Buying into a NAV collapse is scary when you have a very murky or weak fundamental outlook. There might be very good reasons to pass up on the opportunity. When NAV collapses, and the fundamental outlook is very strong, you have a mismatch between valuation and reality. In our book, it is an easy buying opportunity. We can get a +14% yield on OXLC today, and with earnings likely to continue rising, there is a very good chance we see another dividend hike next year.

Pick #2: AGNC – Yield 12%

Investors love to overcomplicate things! Nowhere is this more clear than AGNC Investment Corp. (AGNC). I see a lot of confusion in commentary about AGNC. A lot of investors struggle to understand exactly how AGNC makes money. Well, let’s see if we can clear things up a little.

AGNC buys “agency” mortgage-backed securities. These MBS are guaranteed by the agencies Fannie Mae and Freddie Mac. If a borrower defaults, the agencies buy back the mortgages at face value. Now agency MBS has a fairly low coupon because they are guaranteed. Currently, the “production coupon” that the new MBS is being created at is 4.5%. Astute observers will notice that AGNC is paying a dividend yield of 12%. So how does AGNC transform a 4.5% yielding asset into a 12% yield? Leverage.

AGNC borrows money. Say AGNC is buying a 4.5% coupon for par ($100), AGNC is leveraged at roughly 7.4x equity. This implies that AGNC is using $11.90 in cash and is borrowing $88.10. Lenders allow AGNC to borrow this much (and frequently more, agency MBS can frequently be leveraged 10x+). So on AGNC’s $11.90 investment, they are receiving an annual interest of $4.50. Of course, they have to pay interest on the $88.10 that they borrowed, so the question becomes, how much does AGNC have to pay? Say AGNC pays 2.5% interest on its borrowings, then its return on this transaction would be $2.50. $2.50/$11.90 = 16.8% yield. Take out management fees and other expenses, and now you can see how you can get to yields in the low to mid-teens.

This is the gist of how AGNC makes money. Of course, the real world gets a bit messier. Interest rates change, MBS prices change daily, and AGNC’s job is to balance the yield it receives with its cost of funds (interest paid on debt).

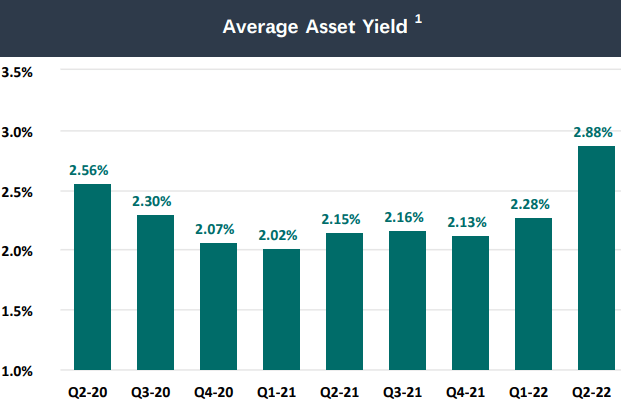

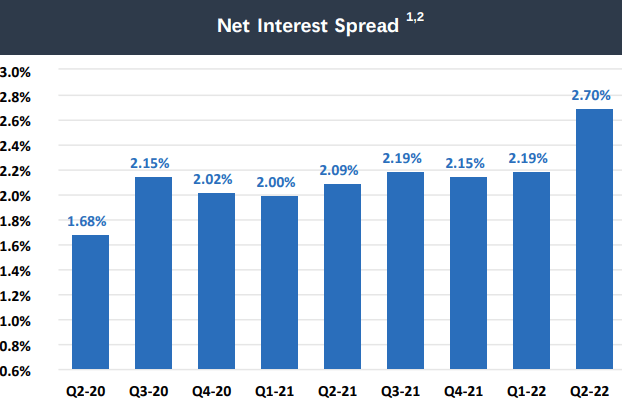

Fortunately, AGNC provides this information to us. (Source: Q2 2022 Stockholder Presentation)

Q2 2022 Stockholder Presentation

Note that AGNC’s average asset yield is well below the current coupons on MBS. This is because it is the average over the quarter and yields moved up significantly in Q2.

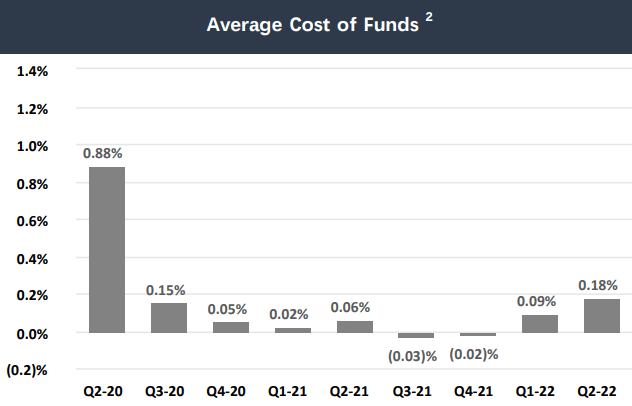

Take that yield and subtract the interest expense:

Q2 2022 Stockholder Presentation

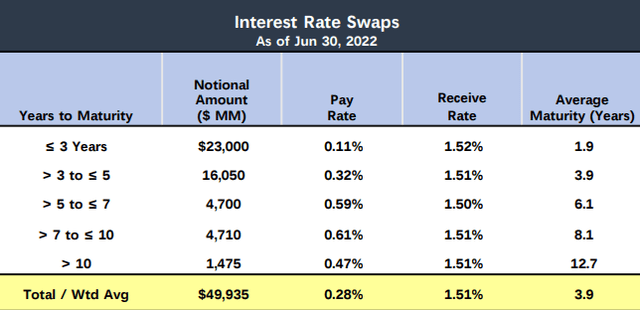

Note that AGNC’s cost of funds has remained extremely low. AGNC can thank its hedge portfolio for this. The cost of funds will drift upward as hedges expire or AGNC expands by buying more MBS, but we are talking several years. AGNC has an average maturity of 3.9 years on its hedges:

Q2 2022 Stockholder Presentation

When you subtract your cost of funds from your average yield, you end up at “Net Interest Spread”. Which is how much profit AGNC is making from its assets.

Q2 2022 Stockholder Presentation

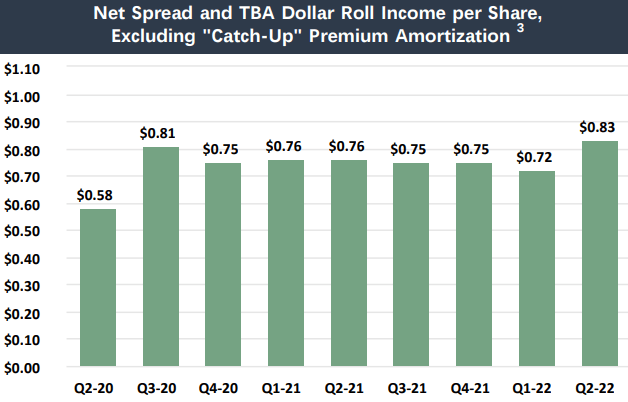

Many are likely surprised to see that AGNC’s earnings were so high in Q2 and that this translated directly to the highest per/share earnings in over two years.

Q2 2022 Stockholder Presentation

After all, AGNC’s book value fell off a cliff in Q2. That must be bad! I often say that low prices are bad… for sellers. AGNC isn’t a seller of MBS. AGNC’s sole purpose for existing is to be a buyer of MBS. The lower MBS prices go, the higher AGNC’s future returns will be.

It is simple math. AGNC buys MBS and holds for the coupon income. Since mortgages are amortizing, AGNC also collects principal payments every month. Most of that principal is either redeployed or reduced leverage. If principal payments are reinvested at higher yields than prior MBS, that increases earnings.

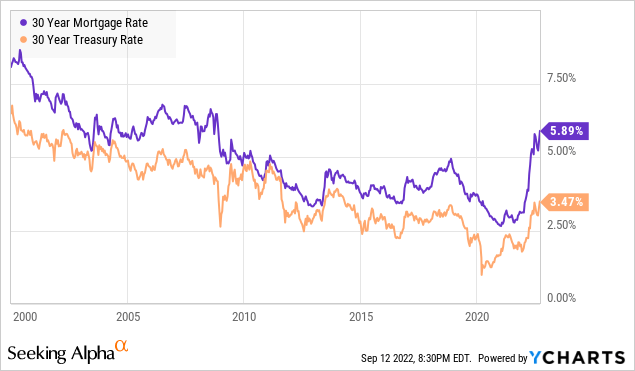

Mortgages are cheap right now. They are relatively high-yielding. The difference between mortgage rates and Treasury Rates is at multi-decade highs of 2.42.

This reduces book value but is a boon for earnings. Historically, such high spreads have not been maintained for long, and while they tighten back up, agency mREITs like AGNC have dramatically outperformed the market.

AGNC is in the business of buying mortgages and collecting the interest. Is AGNC collecting a higher interest rate a bad thing? Of course, it isn’t. Yet investors sell it off and run in fear, just like they run away from bonds. Higher coupons mean higher future returns. I like to buy companies when their expected future returns are likely to be higher!

Istock

Conclusion

Battleground stocks are not for the faint of heart. One common element on every battlefield is the “fog of war”. Lack of information, varied information sources with inconsistent levels of dependability, and a feeling of urgency to make adjustments can cause investors to make poorer decisions than they’d make otherwise.

You need to know your personal investment goals. You need to know why you’re buying what you buy. Knowing these things will allow you to more effectively filter out the noise and focus on the facts.

Retirement should be a time of enjoyment, not stress. Don’t let it creep in, provided by those who profit from your fears and worries. Instead, pick your places and stand strong. It will enable you to gain more valuable income from those who may panic and run.

The farmer does not let a single voice from the city change how they plant or grow their crops. Likewise, an income farmer shouldn’t let a short-term swing trader influence how they grow their income stream. Their true colors show if they mock your resolve to not sell shares for income.

Keep on gathering income. Keep on having the best retirement possible.

Be the first to comment