Drew Angerer/Getty Images News

It has been quite a month for the NIO (NYSE:NIO) stock, as it plunges towards its year-to-date trough in the low-teens again following the short-lived mid-March rally. The stock, alongside its U.S.-listed Chinese peers, has been caught in a slew of volatility-triggering events, ranging from China’s shaky regulatory and macroeconomic environment to the ever-evolving Russia-Ukraine war, since the start of the second quarter.

And just over the past week, NIO has found itself a direct victim of ongoing supply chain constraints composed of parts shortages and Covid-related business disruptions. The Chinese electric vehicle (“EV”) maker did a 180 over the weekend to retract its earlier commitment toward abstaining from price hikes declared across its local peers like Li Auto (Nasdaq: LI), XPeng (NYSE: XPEV) and Tesla (Nasdaq: TSLA) in the first quarter. Citing inevitable price increases on raw materials, and added pressure from the recent Covid outbreak across China, NIO has decided to raise the sticker price of its ES8, ES6 and EC6 SUVs by RMB 10,000 ($1,570; +2% to +3%), effective May 10th.

The company has also been forced to suspend production due to a temporarily severed pipeline of supplies due to Covid-related lockdowns across Jilin, Shanghai, Jiangsu and other major supply hubs. Investors’ concerns over the near-term impact of delivery delays have spurred an immediate meltdown in the stock, opening the week at almost 10% lower than last Friday’s (April 8th) close, and proceeded with intraday declines of as much as 11.5% before paring losses at $19.70 (-2% from Friday close).

But despite the near-term broad-based market and company-specific headwinds, NIO’s fundamental business is expected to remain largely resilient still. Its continued expansion across Europe this year will continue to benefit from accelerating EV adoption, especially as the industry approaches an important milestone of “reaching 20 million plug-in vehicles on the road globally coming June” and “over 26 million plug-in vehicles on the road” by the end of the year. Both China – NIO’s core market – and Europe currently account for a combined 80% share of global EV sales. And with only 2% of the global fleet going electric by the end of the year, the growing EV maker remains well-positioned for greater opportunities ahead, especially with the expansion of its product and technology roadmap across different vehicle and pricing segments, buoying additional market share gains over coming years.

The Macroeconomic Overhang on NIO

Burgeoning macroeconomic and regulatory risks over U.S.-listed Chinese stocks have been a major pain-point for NIO. The market optimism stemming from favorable “policy pledges” by Beijing in mid-March has lost its appeal in recent weeks. Record omicron infection rates and protracted lockdowns in Shanghai, a stronger-than-expected increase in Chinese producer prices, ongoing uncertainties over China’s regulatory crackdown, intensifying geopolitical tensions stemming from the Russia-Ukraine war, and soaring U.S. Treasury yields have all triggered renewed skepticism over Chinese investments since the beginning of April.

More than 373 million of China’s population across 45 cities, including major financial hub Shanghai, remain under “full or partial lockdown”. The figure, which accounts for 40% of China’s GDP, underscores the economic hurdle that the country currently faces in the midst of production and consumer spending disruptions due to widespread pandemic lockdowns. Soaring U.S. Treasury yields following the Fed’s increasingly hawkish comments on tightening monetary policy to quell the highest inflation in four decades are also not boding well for U.S.-listed Chinese equities. Specifically, 10-year Treasury yields surpassed the Chinese equivalent for the first time since 2010. Coupled with the rest of China’s macroeconomic struggles, foreign investors have begun to pull their investments out of the country, adding further pressure to the domestic economic outlook ahead.

These challenges all spell for near-term impacts to consumption within NIO’s core domestic market, which have been largely anticipated as discussed in our previous coverage. While we had initially expected the last of Chinese EV subsidies this year to help maintain NIO’s vehicle sales growth and offset some of the near-term economic challenges to its fundamental business growth, impacts from the latest supply chain constraints and pandemic-related lockdowns on the EV maker’s near-term performance are becoming more pronounced. Although the broader EV demand environment remains strong over the longer-term, the resumption of an uptrend for the NIO stock will likely be delayed into the latter parts of the year or even next year, as investors’ confidence continue to hang on an absolute resolution for both Chinese regulatory and macroeconomic woes.

Temporary Suspension of Productions at Hefei

NIO became the latest Chinese EV maker to suspend productions as a result of extended mobility restrictions imposed to stem the most widespread Covid outbreak across China in two years. While peers like Tesla, Toyota (NYSE: TM) and Volkswagen (OTCPK:VWAGY, OTCPK:VLKAF) have already shuttered their doors for weeks as a direct result of extended Covid-lockdowns in Shanghai, NIO’s latest decision stems indirectly from the lack of supplies to continue productions. Many of NIO’s supply chain partners have temporarily halted manufacturing as a result of the China’s latest efforts in curbing the highly-infections omicron variant.

As a result of the latest suspension of productions, which NIO has not provided a detailed timeline on, customer deliveries will be delayed in the near-term. The impact is expected to be most pronounced in the second quarter, with anticipated easing in the latter half – similar to observations of an operational slowdown in Q1 2020 during the early stages of the pandemic outbreak. The assumption comes as a result of NIO’s strength in navigating through one of the toughest and mostly unprecedented production challenges and supply chain constraints in the history of the broader automotive sector so far. Although its delivery volumes and growth were among the softest compared to domestic peers during the first quarter, it has remained resilient, nonetheless. The EV maker has continued to press toward new vehicle launches and overseas studio openings according to schedule despite mounting operational headwinds, while also delivering record-setting results on the upper range of guidance.

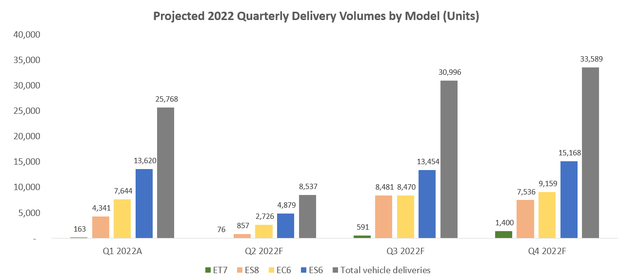

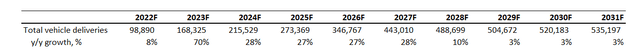

Taking the percentage of production and delivery volume declines observed during the early days of pandemic-related operational disruptions in Q1 2020 as a gauge for potential fundamental impacts in the current period due to the latest Covid-imposed factory shutdown, we are forecasting deliveries of approximately 8,500 vehicles (-61% y/y; -67% q/q) for Q2 2022, down 71% from our previous base case projections. And considering the subsequent rate of recovery and production scaling observed in Q2 2020 onwards as a proxy for our revised forecast on vehicle deliveries over the forecast period, we are anticipating total vehicle deliveries of about 99,000 units (+8% y/y) by the end of the year, with growth towards more than 273,000 units by mid-decade and more than 535,000 units by 2031.

NIO 2022 Delivery Volume Forecast (Author) NIO Delivery Volume Forecast (Author)

The growth assumptions applied are consistent with expectations for new annual production capacity coming online from NeoPark later this year, as well as NIO’s longer-term growth prospects buoyed rapid global EV adoption, continued expansion of its product and technology roadmap, and its international aspirations as previously discussed. Our revised forecast on NIO’s vehicle delivery volumes over the forecast period as a result of the anticipated loss of sales due to recent local Covid restrictions is on average 19% lower on a per-year basis compared to our previous base case forecast.

NIO Delivery Volume Forecast (Author)

Siding with Price Increases After All

In the latest turn of events is also NIO’s last-minute decision to increases prices on the ES8, ES6 and EC6 models beginning May 10th. The announcement is a stark contrast to the company’s affirmation just a few weeks ago that it will not be raising prices in the foreseeable future. Citing “no downward trend can be seen in the near future” on raw material prices due to added pressure from the latest Covid outbreak across key manufacturing hubs in China, NIO has announced a RMB 10,000 ($1,570) premium across the current sticker price on its SUV models, representing an increase of 2% to 3%, beginning next month. Prices on its “Battery-as-a-Service” (“BaaS”) add-on package will also be adjusted upwards to compensate for the record surge in costs of key battery materials, such as lithium and nickel, in recent months.

Despite NIO’s earlier hold-out due to its commitment to “maintaining price stability for the benefit of customers”, its ultimate decision to side with price hikes in an extent similar to those of its peers’ is expected to compensate for the near-term inflationary cost pressures. It will also ensure NIO maintains its current margin expansion trajectory, while partially offsetting impacts from anticipated lower sales due to current quarter Covid disruptions. This, together, bolsters NIO’s longer-term earnings growth outlook towards positive net profits by mid-decade as new and existing model productions and deliveries continue to scale.

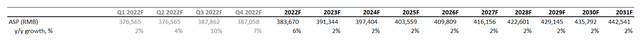

Based on NIO’s new pricing strategy, we have adjusted our forecast average vehicle sales price (“ASP”) for NIO accordingly beginning in Q3 2022. This is the expected timeline for the delivery of vehicles sold on the new pricing model starting May 10th, which is when revenue is recorded based on accounting requirements. Specifically, our previous ASP forecast of RMB 369,000 ($57,928; +2% y/y) for Q3 2022 has been increased to RMB 388,000 ($60,910; +10% y/y) beginning the third quarter. The adjustment considers both the 2% to 3% price increase announced for existing SUV models (i.e. ES8, ES6, EC6), as well as the increasing mix of higher-priced new model (i.e. ET7, ET5, ES7) sales with anticipated production ramp-up later in the year.

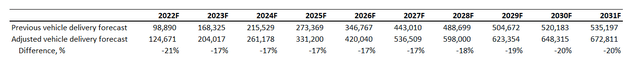

Valuation Sensitivity Analysis

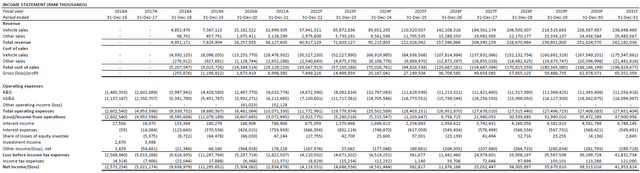

Taking the combined impacts of near-term production plant closures and price increases, we have revised our base case fundamental forecast for NIO. The company is expected to generate total sales of RMB 40.9 billion ($6.4 billion) by the end of the year, with further expansion towards RMB 122.0 billion ($19.2 billion) by mid-decade and RMB 262.2 billion ($41.2 billion) by 2031. Much of the topline growth will be led by vehicle sales, which is expected to expand from RMB 37.9 billion ($5.9 billion) by the end of the year to RMB 110.3 billion ($17.3 billion) by 2025 and RMB 236.7 billion ($37.2 billion) by 2031, reflecting the bullish demand environment for EVs worldwide as well as company-specific growth initiatives buoying continued market penetration over the longer-term.

NIO Revenue Projections (Author) NIO Financial Forecast (Author)

NIO_-_Forecasted_Financial_Information.pdf

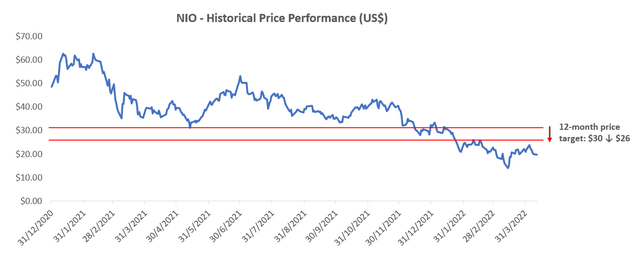

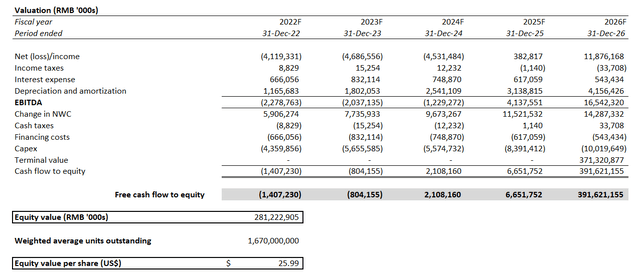

We have also reperformed our valuation analysis to reflect the above fundamental adjustments stemming from lost production volumes as a direct result of Covid disruptions expected in the current quarter. Our revised 12-month price target is set at $26, down from the previous $30. This would still represent upside potential of 32% based on the stock’s last traded share price of $19.70 on April 11th.

NIO Valuation Analysis (Author)

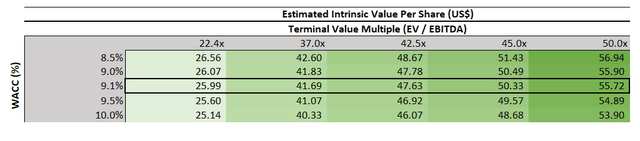

The price target is derived using a discounted cash flow (“DCF”) analysis over a five-year discrete period in conjunction with the revised financial projections as discussed in earlier sections. The analysis considers a WACC of 9.1% to discount NIO’s projected free cash flows in the valuation analysis, which is reflective of NIO’s current risk profile and capital structure. Considering recent market volatility and compressed valuations observed across the board on U.S.-listed Chinese stocks due to mounting macroeconomic and regulatory headwinds, we have applied an exit multiple of 22.4x. The exit multiple is determined based on an implied perpetual growth rate in alignment with the blended economic prospects of NIO’s core markets in the long-run (i.e. China, Europe, U.S.). The exit multiple is also derived on a discount to the more-generous valuation premiums observed across NIO’s comparable American counterparts to reflect the near-term challenges faced by U.S.-listed Chinese stocks.

NIO Valuation Analysis (Author)

Over the longer-term, we expect NIO’s valuation to climb back towards the $50-level on a per-share basis. This long-term price expectation is determined based on the forward-looking valuation multiples currently observed on its American peers, and would be reflective of the scenario when current regulatory and macroeconomic woes looming on U.S.-listed Chinese stocks find an absolute resolution. It is under such a scenario when a rally similar to the one observed in mid-March following Beijing’s “shining policy pledge” will retain its momentum, instead of consistently collapsing on any speculative news.

NIO Valuation Sensitivity Analysis (Author)

Conclusion

Echoing our previous discussion on the stock, NIO’s current share price is still too low despite the recent market and production challenges that it is faced with. But acknowledging that U.S.-listed Chinese stocks have been on a mostly turbulent ride over the past year, we continue to caution investors of potential spillover impacts from Beijing’s protracted regulatory clampdown that have been largely focused on the internet and property sectors, as well as potential delisting risks from American exchanges, which could further dampen NIO’s valuation outlook.

Author’s Note: Thank you for reading my analysis. Please note that I am in the process of planning a subscription service with Seeking Alpha’s Marketplace. The service will allow you to follow my model portfolio, interact with me directly, and participate in chat rooms with other subscribers. I’ll be launching in the near future with a legacy discount for early subscribers and I’ll be sharing more details as we ramp up to launch in the coming months.

Be the first to comment