SoFi CEO Anthony Noto Drew Angerer

About half the comments on my last article were talking about SoFi’s (NASDAQ:SOFI) use of held-for-sale (HFS) accounting instead of held-for-investment (HFI) accounting. This has become the newest stick to beat SoFi with, so I thought I’d address it so we can put this issue to bed. The basic idea is that there are two proper ways that a business can choose to account for loans they hold on the balance sheet. Let’s discuss these briefly.

HFI Accounting

HFI is used when a company plans to hold loans through maturity. When a financial institution books a loan that they plan on holding through maturity, they are required to recognize lifetime losses of their loans up front as the loan is originated. This is referred to as Current Expected Credit Losses (CECL) provisioning. In practice, it means that the bank uses empirical data to estimate how many of these loans will default, and they have to subtract that amount from their bottom line.

For example, in 3Q22, LendingClub (LC) originated $1,153M in loans that they added to their HFI portfolio. They set aside $82.7M in CECL provisions, which is about 7.2% of the originations.

HFS Accounting

HFS is used when a company plans to sell the loans before maturity. Instead of taking out a CECL provision, the loans are accounted for on the balance sheet at the fair market value, or the value that they would have if they were sold on the debt markets. No CECL provision is required, but each quarter all loans must be reassessed to determine their fair market value in the current environment. Changes in fair value of loans held from quarter to quarter are accounted as a noninterest adjustment to revenue. Fair value can go up or down depending on market forces and interest rate movements. If a loan goes delinquent for 120 days, it is charged off as a loss, which is accounted for during the quarter it is charged off.

Neither of these accounting strategies is inherently better. Neither is more risky or less risky. They both conform to Generally Accepted Accounting Principles (GAAP) and were developed because different financial institutions have different business models. The decision of which accounting methodology to use is not some decision that the company makes on their own to serve their own needs. The decision of which accounting methodology to use comes down to one simple question. Does the financial institution hold loans to maturity, or do they sell them before maturity?

SoFi Loans Held To Maturity

So, rather than make rhetorical claims based on supposition, I prefer to look at the actual data when I do my analysis. Let’s answer the question of whether SoFi holds loans to maturity together. Fortunately, the answer to this question is easy to find in the Loan Maturity Schedule in SoFi’s 10-Q.

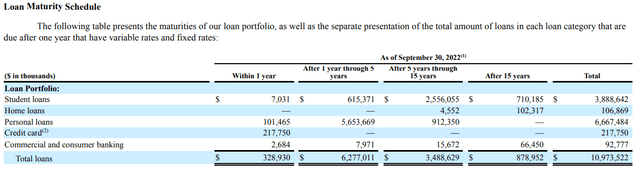

SoFi Loan Maturity Schedule (SoFi)

Credit cards

Let’s start with the credit card balances. SoFi holds all of those to maturity. They therefore use HFI accounting for their credit card loans including setting aside CECL provisions.

Commercial and consumer banking

These are part of the operating business of Golden Pacific Bancorp, the bank that SoFi acquired when they received their change of control bank charter. These are held to maturity and use HFI accounting including setting aside CECL provisions.

Student loans

The total principal amount owed to SoFi for student loans is $3.89B. In order to calculate how many loans they will hold to maturity, we need to know how long it takes to turn over their loan portfolio. Student loan originations have been depressed due to the student loan moratorium. Even with lower than expected rates, they have originated $4.27B in the last 15 months, which makes the current turnover 13 months, or approximately one year. In the next year, only $7M of their $3.89B, or 0.018% of all student loans will hit maturity. I think it’s safe to say that HFS is the correct accounting standard since 99.98% of loans will be sold at the current turnover rate.

Personal Loans

There are $6.67B in personal loan principal that must be paid back. Personal loan originations, as have been covered above, are continually increasing QoQ, but even if you use trailing origination rates from the last three quarters, this is 8.2 months to completely turn over the portfolio. If there is no growth at all and loans hold steady where they were in Q3, it would take 7.1 months to turn it over. This means about 1% of loans will reach maturity before they are be sold. Even if we are extra generous and assume that somehow stretches to a year before they cycle the loan profile, only 1.5% would reach maturity. 98%+ of personal loans will be sold. HFS is obviously the correct accounting standard for personal loans.

Home Loans

There isn’t a single home loan that reaches maturity within the next 5 years. HFS is the correct accounting standard for home loans.

HFS or HFI?

The claim that retail investors are not getting the full picture and are being misled by SoFi because they are using HFS accounting is absurd. The determining factor for which accounting method to use is whether the loans are held to maturity. It’s glaringly obvious SoFi does not hold their loans to maturity even at double their guided holding periods. The only exception is their credit card and commercial and consumer banking portfolios, where SoFi does employ HFI accounting. Why in the world would they use HFI accounting principles when in all cases less than 1% of their loans are held to maturity? In fact, it’d be a huge red flag if they did use HFI because it would prove they are incompetent and classifying their loans wrong. It would be just as absurd to demand that LendingClub report fair value changes in their loans that they are planning to hold to maturity.

Risks

The HFS vs HFI debate completely misses the mark, but that doesn’t mean that SoFi doesn’t have any risks. One of the biggest reasons I dislike the squabbling over accounting is that it distracts from the real risks that ought to be discussed. At the end of the day, it doesn’t matter which accounting standard is used, loans that go to delinquency will affect the business negatively and lead to losses. Decreased liquidity from a decreased appetite for risky loan assets such as unsecured personal loans will affect the business negatively. That is what we ought to be discussing.

People seem to think that because I have a strong buy rating that I think SoFi cannot fail. Let me be clear. SoFi is not immune to a recession. I have included a risks section in each of my last four articles on the company detailing parts of the business model, execution, and macro factors that have fallen short or have the potential to negatively affect their results moving forward. Let me detail exactly how they are at risk. This is nothing I haven’t said before.

Profitability

SoFi is an unprofitable business in a time when the macro is very concerned with profitability. The market could swing further against these companies, including SoFi.

Personal Loans

Mint

Over 50% of revenue comes from interest or noninterest revenue from their unsecured personal loan portfolios. Delinquencies and defaults are increasing on their loan portfolio right now. They remain below pre-pandemic levels at this point but are likely to increase as conditions continue to deteriorate. Additionally, as the Federal Reserve raises rates, SoFi must also raise their rates to maintain revenues and profits. That makes getting a loan more expensive, which can decrease demand from borrowers.

Student Loans

The primary source of student loan originations is refinancing existing loans. Increasing rates decrease the amount of people that will benefit from refinancing and will result in a lower total addressable market (TAM) and in lower student loan originations than if rates had remained low. Additionally, a further extension of the student loan moratorium will keep this once core business depressed for even longer.

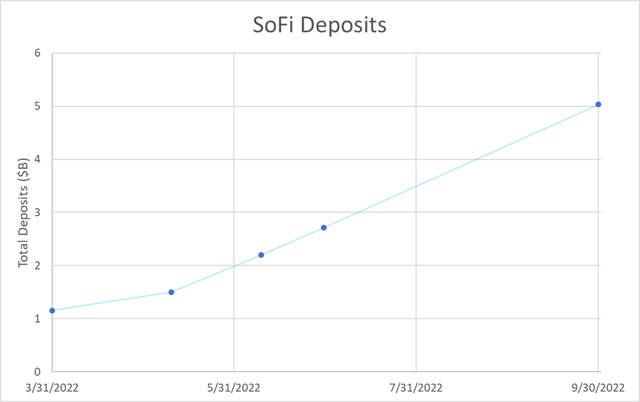

Rising Costs of Deposits

Within weeks of acquiring their bank charter, SoFi released their Checking & Savings account with 1% APY. In the last 8 months they have continued to raise their APY, which now stands at 2.5% on checking and 3% on savings to incentivize membership growth and to increase deposits. As of September 30, they had $5B in deposits and they are now paying almost triple the interest to their members that they were 8 months ago.

Decreasing demand to buy their loans

There are two reasons that SoFi will see decreasing demand from the debt markets in this environment, First, debt investors tend to move toward secured loans such as auto loans or mortgages in a risk off environment because they will at least have an asset with tangible value if the loans go into delinquency. Cars can be repossessed and houses can be seized if the borrower defaults. There is no such financial backstop if an unsecured loan defaults. This decreases demand for SoFi’s largest asset class. Second, rising rates and quantitative tightening also reduce liquidity in the debt markets. Decreased liquidity also leads to lower demand from debt markets across all loan types.

These dual forces that suppress loan demand can hurt SoFi in two ways. First, it can lower their gain on sale margin (GOSM). Right now, SoFi has been able to maintain their GOSM at 4%, meaning that for every $100 in loans they originate, they sell those loans for $104 to debt investors. That GOSM has decreased for personal loans from 4.5% in Q1 and Q2 to 4% in Q3. Deteriorating GOSM leads to deteriorating noninterest revenue from sales of loans.

Second, along with a lower gain on sale margin, they would also need to mark down the loans they hold on their balance sheet. Since they use HFS accounting, every quarter they have to rerate the fair market value of their loans. If the value of their loans decreases, so too will the value of the loans on their balance sheet, further weighing on revenue and profits. One big warning sign in this area is also that SoFi bought back $1.28B in loans from the market in Q3, signaling that at least one of their buyers was looking to offload their loans.

Crypto

Senators have asked regulators to look at SoFi’s offering of digital currencies like cryptocurrencies.

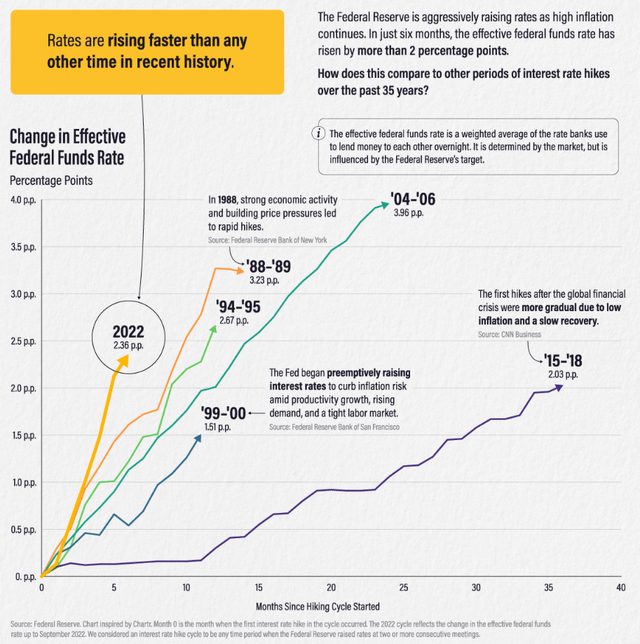

How will SoFi overcome their risks?

One thing that SoFi, and in fact all lenders, have going for them is that the worst of the rate hikes are probably behind us. Prior to this year, the Federal Reserve had not performed a single 75 bps hike since 1994. We just had four in a row. Yes, they are going to continue to raise rates, but the velocity of those rate hikes will slow. It’s possible we see another 75 bps hike in December, but the lower CPI print last week has increased the odds of a 50 bps hike to 80% according to the CME Group at the time of writing. Regardless, we are not going to see the same velocity of rate hikes moving forward as we’ve just seen.

Profitability

Unprofitable does not mean uninvestable. If that were the case, there would be no such thing as angel investors or venture capitalists. Virtually every investment they make is in a nonprofitable company, and lots of them do just fine. A company can have negative GAAP earnings and still be an excellent investment, the two are not mutually exclusive.

A company is worth the entirety of its future cash flows discounted to today’s dollars. I happen to believe that SoFi’s future earnings potential significantly dwarf its current market cap. I acknowledge that I may be wrong, but the fact that SoFi is trading below book value means that the market has already discounted every future profit of the company to $0 for me, so I see very little risk here in further valuation compression. This is especially true in light of the fact that they are expected to reach GAAP profitability by 3Q23.

Personal Loans

Rising rates have been a tailwind because it incentivizes people to consolidate their variable debt like credit card debt into a fixed debt like personal loans. This will continue for the next 3-6 months as variable rate debt finds a new higher equilibrium. At that point away some of the tailwinds may start to fade, but that’s fine because SoFi will continue to take market share through outstanding member growth, access to more and better funding, and high borrower quality. I won’t rehash that discussion here, read my last article if you want more detail.

Student Loans

As I’ve written in the past, this part of their business has already been completely destroyed. When something is dead, it’s hard to kill it more. Student loans will be an awesome catalyst when it comes back, but as CEO Anthony Noto said in this week’s Citi Fintech Conference,

Diversity has allowed us to overcome the challenge of the last three years of student loans being where they’re at. It’s also forced us to scenario plan, when is the student loan moratorium going to end, I think it’s been extended for last count five or six times. But we’ve always had a plan B, C, or D to drive the growth.

The Biden administration extended the moratorium on payments again and SoFi will miss out on those revenues in the near term, but they’ve already planned for it. Whenever the moratorium is lifted, the TAM, although shrinking with rising rates, remains large. At that same conference, Noto also said, “We still think there’s a really big TAM with rates up as high as they are now. It’s a $200 billion of TAM that people would save in student loan financing in our credit box today.” It doesn’t matter if student loans don’t come back because SoFi is winning without them. If they do come back that will be great and help the company. I am planning to hold this for at least 3-5 years and likely closer to a decade, so I’m not worried about it.

Rising Cost of Deposits

SoFi is paying out more in deposits, but the alternative is to use warehouse facilities to fund their loans. Even with the raised APY, they are still making more money by using these funds than by using alternative funding sources. The cost of deposits is going up, but the net interest made from them is going up faster, that’s a good thing.

Decreasing demand to buy their loans

This is the most dangerous risk of all. Luckily, SoFi has two things going for it, decreasing speed of rising rates and excellent management. The decreasing speed of rising rates means that things should normalize moving forward. That means that the worst of demand destruction from debt investors should be behind the company, and if they were able to maintain their GOSM through the last four 75 bps hikes, they should be able to do so in a less stressful environment.

Holding periods

As for whether or not SoFi will maintain its stated guidance of selling loans after holding them for 6-7 months, we won’t really be able to tell for sure until 1Q23 numbers are released. Remember, SoFi raised the guidance on how long they hold loans from about 3-4 months to about 6-7 months after loans were being originated in the bank. While they began operations as a bank in February, they didn’t start originating all loans in the bank until May. SoFi telegraphed the fact that the amount of loans they hold on the books would increase substantially every month until around November or December of 2022 (6-7 months after May).

Many people are observing that loan balances are building and panicking about holding periods without the proper context. In 1Q22, with a holding period of 3 months, they had $6.3B of personal, student, and home loans on the books. Even if originations stayed flat, just doubling the holding period would increase this balance to $12.6B by the end of 2022. In 3Q22, they reported $10.4B of personal, student, and home loans on the balance sheet. They are exactly in line with expectations. In fact, if you take origination growth into account, you would expect the balance sheet to have $10.9B of loans at this point. We will not be able to make any definitive judgements on whether or not they are in line with their 6-7 month holding period until they report 1Q23 numbers. Anything you read by me or anyone else before then is just conjecture.

As for if there is enough demand to sell their loans, I do not have any significant insight into debt markets. What I do know is that SoFi recently securitized $440M of unsecured personal loans. Those loans received a AAA rating from third party credit rating companies (see screenshot above). SoFi put them up for sale on November 11. The entire securitization was sold by November 14. Buyers included JP Morgan Chase. At that same rate of loan sales, they could sell off their entire personal loan portfolio in just under 16 days. This is the only visible look we have into the demand for their loans and on this evidence, demand for their loans seems to still be robust.

SoFi is frontrunning the rate hikes

Additionally, SoFi is frontrunning the Fed in raising rates. This means they are much more likely to sell their loans at a premium than competitors because their loans are already at a rate that is higher than what investors will be demanding including the rate hikes.

People expressed doubts about this assertion in my last article, so I’ll show my work with the 10-Q. If you trust my math, feel free to skip to where it says “Conclusion” below.

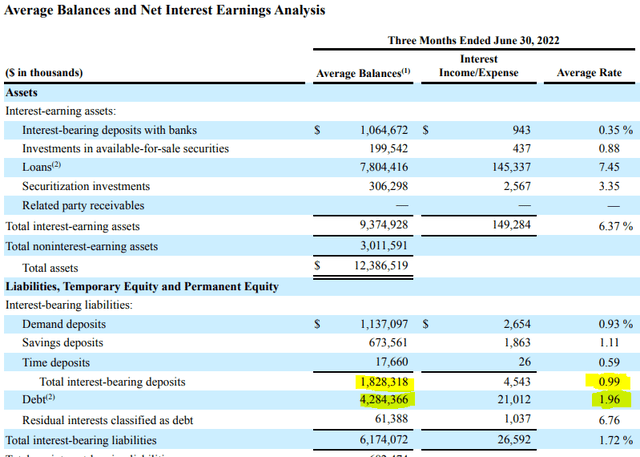

In Q2, average cost for deposits was 0.99%, average cost of debt (warehouse facilities) was 1.96%, and net interest margin (NIM) earned on personal loans was 11.62%. They started the quarter with 16.7% of their loans funded by warehouse facilities and ended it with 10.5% of their loans funded by warehouse facilities, so I am assuming for the quarter they averaged 13.6% of their loans being funded by warehouse facilities (the midpoint between the beginning and the end of the period).

2Q22 Average Balances and Net Interest Earnings Analysis (SoFi)

That means their cost of capital for the quarter was 1.12% (0.99%*0.864 + 1.96%*0.134). The average interest rate they charged for their loans was therefore 12.74% (1.12% + 11.62%).

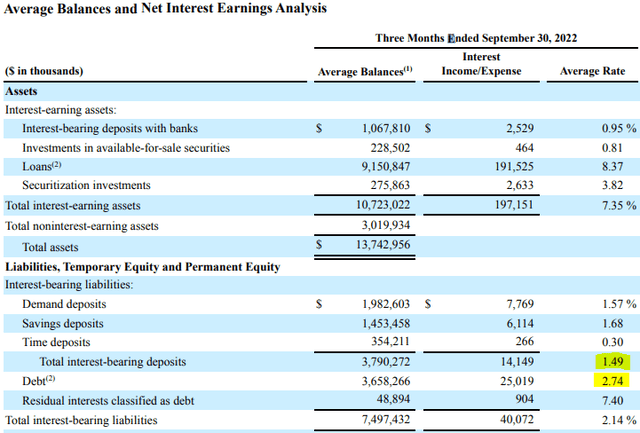

In Q3, average cost for deposits was 1.49%, average cost of debt (warehouse facilities) was 2.74%, and NIM on personal loans was 12.02%. They started the quarter with 10.5% of their loans funded by warehouse facilities and ended it with 9.95% of their loans funded by warehouse facilities, so I am assuming that for the quarter they averaged 10.2% of their loans being funded by warehouse facilities (the midpoint between the beginning and the end of the period).

3Q22 Average Balances and Net Interest Earnings Analysis (SoFi)

That means their cost of capital for the quarter was 1.62% (1.49%*.898 + 2.74% *.102). The average interest rate they charged for their loans was therefore 13.64% (1.62% + 12.02%).

Conclusion: SoFi increased the average rate they charge for a personal loan by 90 bps from 12.74% in Q2 to 13.64% in Q3 while increasing their loan originations by 14%. From Q2 to Q3, their average cost of capital increased by 50 bps from 1.12% to 1.62%. Half of the loans that make up the 12.02% NIM were loans that were originated in Q2 or prior, so the rates on those loans was consistent from quarter to quarter. Taking that into account likely means they increased coupons of new loans originated in Q3 by around an average of 150-180 bps.

SoFi is frontrunning the Federal Reserve and still grew originations by 14% from Q2 to Q3. This shows that the demand from borrowers for their loans is significantly more robust than competitors. They are expanding margins while simultaneously gaining market share. Fintech competitor LendingClub (LC), according to their own Q3 earnings call, has lagged the Federal Reserve by 100 bps since the beginning of the rate hike cycle. They also decreased originations by 8% overall between Q2 and Q3. LendingClub is seeing narrowing margins while simultaneously losing market share. SoFi has pricing power.

Crypto

SoFi’s crypto offerings are essentially just SoFi working as a third party to offer cryptocurrency investing through Coinbase and BitCo. The total crypto holdings of all member is $132M, and revenue from their entire brokerage activities last quarter was $3.85M. Crypto makes up a fraction of that. They have no exposure to FTX, never offered FTT on their platform, and never offered yielding or leverage. Worst case scenario is they close down the crypto portion of their platform and lose less than like 0.5% of their revenue. This is a gigantic red herring and is completely immaterial to SoFi’s business.

SoFi has plans for delinquencies

I have said it before and I will say it again. SoFi is not immune to a recession. They are insulated because their borrowers are high quality, with average FICO scores of new originations of personal loans of 746. However, their delinquencies are increasing and will continue to do so insofar as the macroenvironment deteriorates. As delinquencies increase, charge-offs will increase, hitting the top and bottom line. This is a risk Anthony Noto addressed in the fintech conference:

By the end of 2018, we were delivering 40% to 50% variable profit margin per loan, and we knew that when a deep recession hit and life of loan losses increased, those loans would still provide an adequate return whether we kept them ourselves or we sold them.

And that’s helping us in today’s environment. We try to manage our unsecured personal loans to an 8% life of loan loss or lower. And we’ve been able to do that since 2018. And in some periods where things got rough, we pulled back to make sure we can maintain that standard. And we’ve been able to do that. We’re below that still today. We expect it to normalize and we’ll make the appropriate changes as it happens.

SoFi is well capitalized. If they hold their entire personal loan portfolio to maturity (which they won’t) and you assume their eventual charge-offs reach the same amount as LendingClub sets aside for their CECL provisions, it would be ~$500M over the next 5 years, or $25M per quarter. That entire sum is half of their current cash position, and 1/8 of their available capital resources. Again, this is a worst-case scenario built around them holding all their loans to maturity and assuming that the recession lasts until 2028. They have a strong balance sheet and can handle increasing delinquencies.

Underestimate SoFi’s management team at your own risk

Some people pretend that SoFi is wearing a little red hood and blissfully unaware of the macroenvironment as it skips its merry way down the path to grandmother’s house, not realizing there is a freaking recession wolf wearing granny’s clothes waiting for it in 2023. Please allow me to disabuse those people of this notion.

CEO Anthony Noto was the Head of Communication Media and Internet Equity Research Business Unit at Goldman Sachs during the dotcom crash and was the Co-Head of Global TMT Investment Banking at Goldman Sachs during the Great Financial Crisis. He was the lead professional analyst covering internet companies during the early 2000s. He watched which ones survived and which failed and was talking to their CEOs the whole time. He was in charge of investment banking at a bank during a time when banks were going belly up in 2010. He had a front-row seat during the dotcom bust and was in the trenches during the GFC. This isn’t his first rodeo. It isn’t even his second rodeo.

Anyone who doesn’t think SoFi is adequately prepared for a downturn does not understand who Anthony Noto is, what drives him, and how incredible of an operator he is. SoFi lost the business that was generating over 50% of its revenues in 2020 when the student payment moratorium was announced. That business still hasn’t come back, and SoFi will triple their 2019 revenue by the end of 2022 anyway. That is the same as Apple (AAPL) not selling one single iPhone for the next 3 years and tripling their revenues by the end of 2025.

Do you really think the same management team that navigated losing 50% of their revenue by an executive order without warning as a result of a global pandemic doesn’t have a plan for the most telegraphed recession ever? If there is a recession wolf lying in wait in 2023 he better watch out, because Anthony Noto, a West Point graduate who ranked first in his class, Army Ranger, and captain in the US Army has a detailed plan of attack he’s ready to fight tooth and nail. My money is literally on Noto and his team tanning that wolf’s hide.

Be the first to comment