icholakov/iStock via Getty Images

The market is not collapsing, contrary to what many believe.

Many traders and investors focus erroneously on the technical picture of the indices. Indices like the S&P 500 (SPY) and Nasdaq 100 (QQQ) are heavily weighted towards large-cap stocks. For example, large-cap stocks Microsoft (MSFT), Apple (AAPL), Amazon (AMZN) and Alphabet (GOOGL) (GOOG) make up close to 37% of the Nasdaq 100.

However, the stock market is a collection of stocks. Under the surface, smaller cap stocks are holding up much better than people realise.

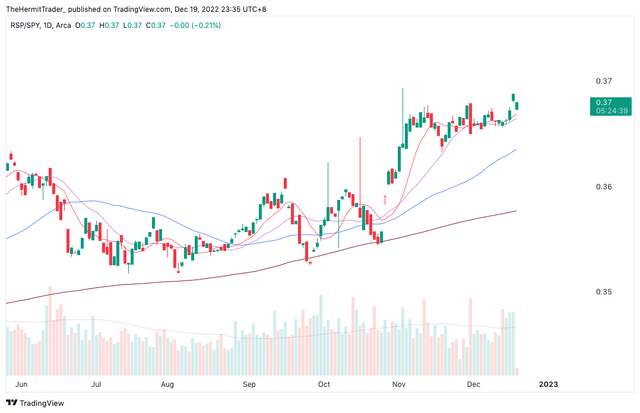

One metric I use to assess market breadth is the ratio of the equal weighted S&P 500 (RSP) against the S&P 500 (SPY).

The RSP/SPY ratio is holding near its 52-week highs. This tells me that there is strength in smaller cap stocks relative to larger cap stocks.

Daily Chart: RSP/SPY

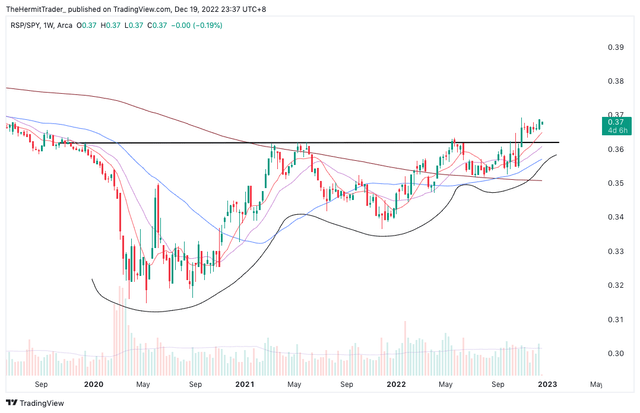

When I look at the longer term weekly chart of the RSP/SPY ratio, the ratio has actually broken out higher from a multi-month base. This is a key development, and it portends further outperformance in smaller cap stocks relative to larger cap stocks going forward.

Weekly Chart: RSP/SPY

The above observations are important because it shows that the leadership baton may be in the process of being passed from the mega-cap FAANG stocks to somewhere else.

In a new bull market, a new batch of leading sectors typically appears that could catch the market by surprise.

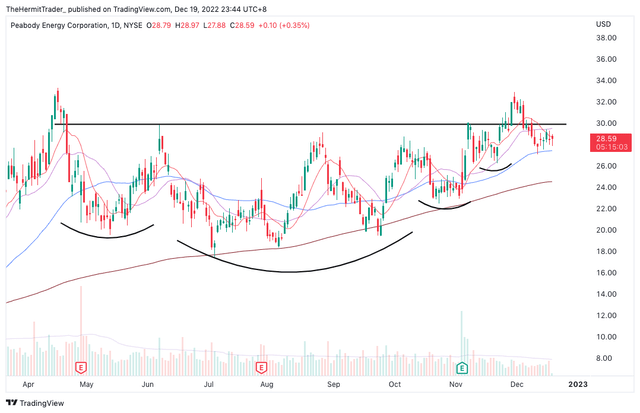

One sector that stands out is the coal sector.

Just check out the chart of Peabody Energy Corporation (BTU), one of the leading coal stocks in the sector. The stock has been building a massive base for months, and has been steadily putting in higher lows. While the broad market has been struggling, BTU is trading near its all time highs.

Daily Chart: BTU

There are many other individual stocks that are stealthily outperforming the broad market and indices. It is important to list down these stocks as they will likely lead the market when the next bull market inevitably comes. First, break the habit of focusing on the indices!

Be the first to comment