chrupka/iStock via Getty Images

The Barings Participation Investors (NYSE:MPV) is a closed-end fund (“CEF”) that is focused on making loans to small and middle-market U.S. companies. The fund appears well managed and earns its distribution, as its NAV has grown at a 1.2% CAGR over 34 years despite paying out a substantial quarterly distribution.

While I am personally hesitant to commit capital to credit strategies ahead of a recession, I would be interested in accumulating the MPV fund if / when credit spreads blow out in the coming quarters.

Fund Overview

Barings Participation Investors is a closed-end fund that aims to provide a high level of current income by investing in privately placed non-investment-grade corporate debt, primarily to small and middle-market U.S. companies. The fund has $160 million in assets and has been in operation since 1988.

Strategy

The MPV fund primarily invests in private placements of non-investment-grade loans to small and middle market U.S. companies that are typically purchased directly from the issuers. However, the fund may also invest in publicly traded debt securities, convertible preferred stocks, and other marketable securities if an attractive investment comes along.

The fund distributes substantially all of its net income each year via quarterly distributions.

Portfolio Holdings

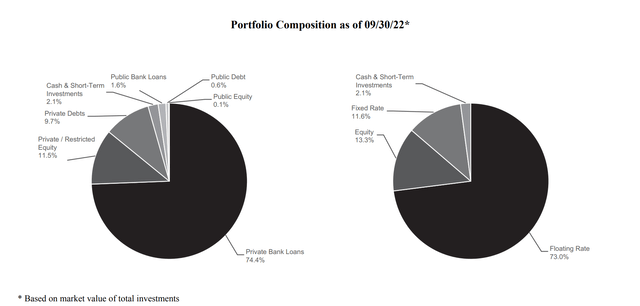

Figure 1 shows the MPV fund’s asset allocation as of September 30, 2022. 74% of the fund is invested in private bank loans. The fund also have investments in restricted equity investments and private debt investments of 11.5% and 9.7% respectively. 73% of the fund investments are floating rate, which has helped the fund navigate 2022 as the Federal Reserve have significantly increased short-term interest rates to combat inflation.

Figure 1 – MPV fund asset allocation (MPV September 2022 Quarterly Report)

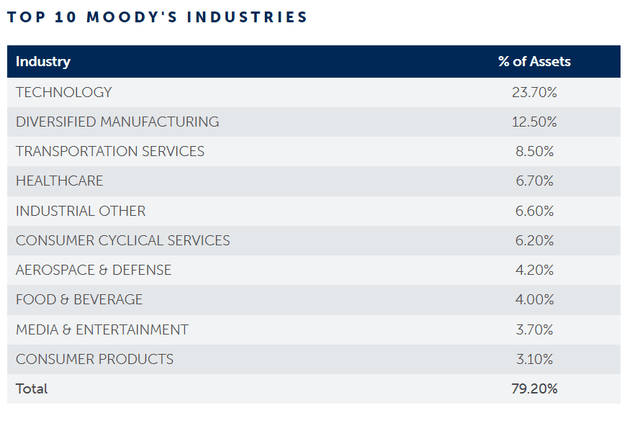

Figure 2 shows the fund’s top 10 invested industries, which account for 79% of the fund’s assets. 24% of the fund is invested in private technology companies, 13% in diversified manufacturing, and 9% in transportation.

Figure 2 – MPV top 10 industries (barings.com)

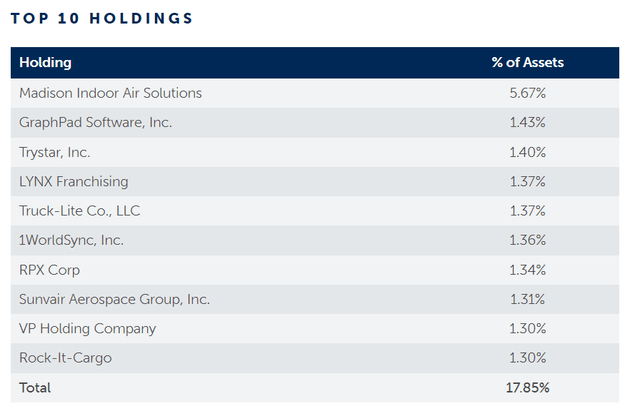

Although the industry allocation is fairly concentrated with 79% of assets invested in only 10 industries, the top 10 positions only account for 18% of the fund’s assets, so the fund is diversified across issuers. However, investors should note that a single issuer, Madison Indoor Air Solutions, account for 5.7% of the fund’s investments (Figure 3).

Figure 3 – MPV fund top 10 positions (barings.com)

Returns

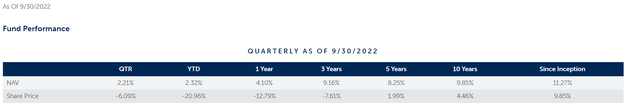

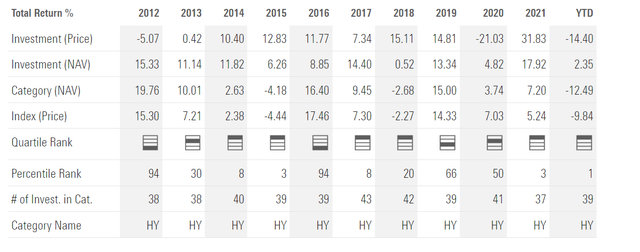

The MPV fund has delivered strong long-term returns, with 3/5/10 Yr average annual returns of 9.2%/8.3%/9.9% respectively, to September 30, 2022 (Figure 4).

Figure 4 – MPV fund returns (barings.com)

Incredibly, the MPV fund has delivered an unblemished 11 year record without a single losing year based on investment returns on NAV (Figure 5). Even during current difficult market conditions, MPV has been able to return 2.3% on a NAV basis to September 30, 2022, primarily as its portfolio investments are 73% floating rate.

Figure 5 – MPV has not had a losing year in the past decade (morningstar.com)

Is 2022 Too Good To Be True?

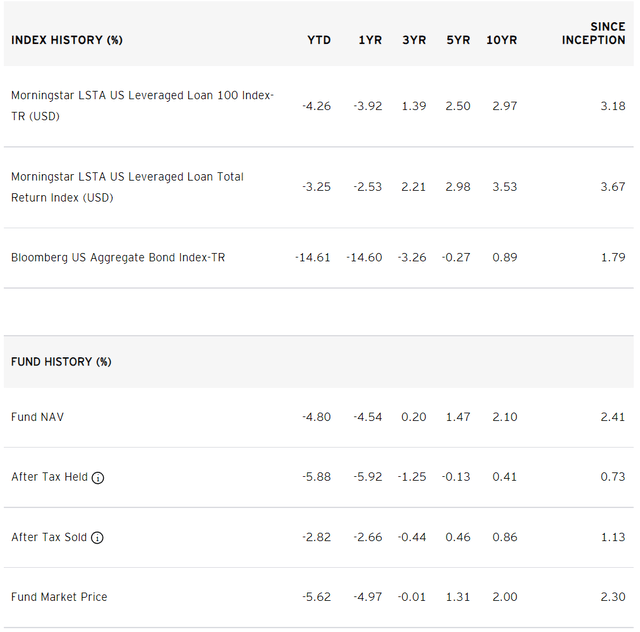

In fact, MPV’s 2.3% return for 2022 appears too good to be true, as the Invesco Senior Loan ETF (BKLN) returned -4.8% YTD to September 30, 2022 (Figure 6).

Figure 6 – BKLN returns to September 30, 2022 (invesco.com)

The BKLN ETF tracks the Morningstar LSTA US Leveraged Loan 100 Index, which is designed to measure the performance of a basket of the largest institutional leveraged loans.

In theory, the small and middle-market leveraged loans in MPV’s portfolio should be riskier than the loans held in the BKLN ETF, since larger companies tend to have better access to capital markets and tighter credit spreads.

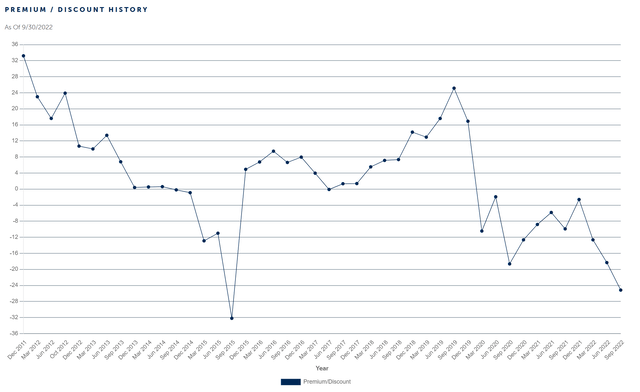

Investors seem to be discounting a far less rosy picture on MPV’s loan portfolio, as they have marked down the market price of MPV’s shares to a 25% discount to NAV (Figure 7).

Figure 7 – MPV currently trade at a steep discount to NAV (barings.com)

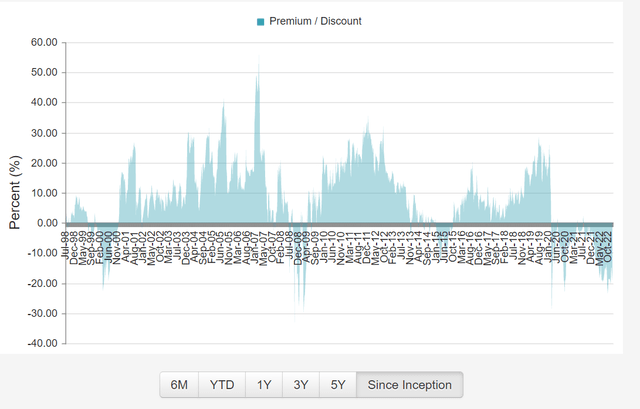

Since the fund’s inception, the only times the MPV fund has traded at a NAV discount like the current 25% has been during periods of significant economic turmoil such as the 2000 recession, the 2008 Great Financial Crisis, the 2015 Global Growth Slowdown and the 2020 COVID pandemic (Figure 8).

Figure 8 – MPV only trades at a discount during economic turmoil (cefconnect.com)

Distribution & Yield

As mentioned above, the MPV fund pays a quarterly distribution that substantially reflects all of the income of the fund. In the most recent quarter, the fund announced a $0.22 / share distribution, which is in line with the $0.27 quarterly net investment income of the fund. The $0.22 / share distribution annualizes to a 7.3% market yield or a 5.8% yield on NAV.

Not A Return Of Principal Fund

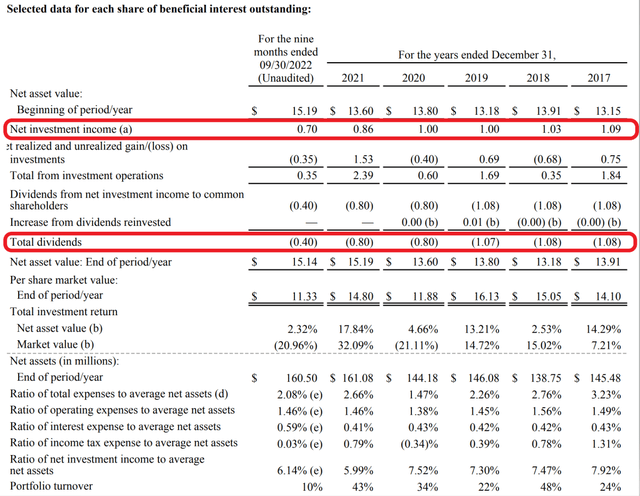

Historically, the MPV fund’s distribution tracks the net investment income, as shown in figure 9. Therefore, MPV is definitely not one of the ‘return of principal’ funds that I have been highlighting recently.

Figure 9 – MPV financial summary (MPV September 2022 Quarterly Report)

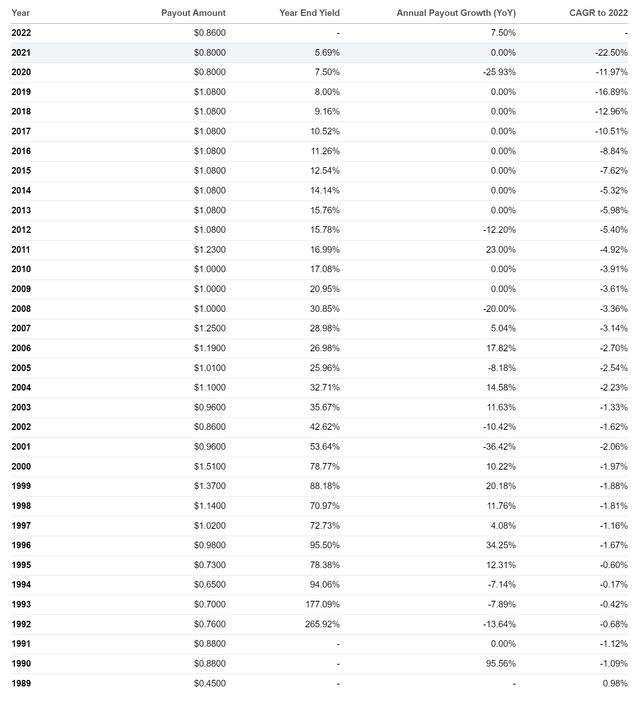

In fact, based on its IPO price of $10.00 / share and its latest quarterly NAV of $15.14 / share, the fund has been able to grow its NAV at a compounded 1.2% p.a. over 34 years while paying out a substantial distribution that was never lower than $0.65 / year, on a full-year basis (Figure 10).

Figure 10 – MPV historical distribution (Seeking Alpha)

Fees

MPV charged a total expense ratio of 2.08% of net assets in the 9 months ended September 30, 2022. This appears reasonable, given the high returns generated by the fund.

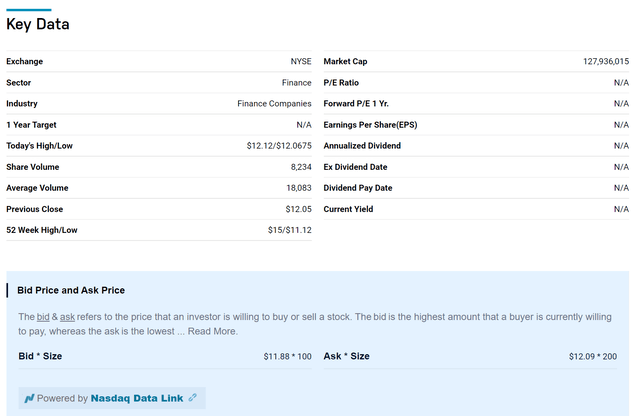

Mind The Liquidity

Investors interested in the MPV fund should be mindful of the low trading liquidity of this closed-end fund. According to data from Nasdaq, the fund only trades an average of 18,000 shares per day or ~$200,000. It has a wide bid / ask spread of $0.21 or 1.8% of price (Figure 11).

Figure 11 – MPV has low liquidity (nasdaq.com)

Conclusion

The MPV is a small to middle-market leveraged loans focused CEF that has historically been able to generate a high rate of return for investors. It pays out substantially all of its net investment income in the form of distributions, which currently yields 7.3%. MPV appears to be a well managed fund that earns its distribution, with a 34 year NAV CAGR of 1.2% in addition to substantial quarterly distributions.

MPV should appeal to investors interested in high current yield from the leveraged loan asset class. However, the fly in the ointment is that the fund current trades at a steep 25% discount to NAV, as its 2.3% YTD return appears too good to be true. Historically, MPV only trades at such a steep discount during periods of economic turmoil. Some investors may be attracted by the discount to NAV, however, I fear the NAV may be marked down in the coming months.

Personally, I would be interested in taking a position in MPV in the coming quarters as a recession hits and credit spreads blow out. However, investors need to be mindful of the fund’s low liquidity.

Be the first to comment