apomares/E+ via Getty Images

Earth First Investments 8

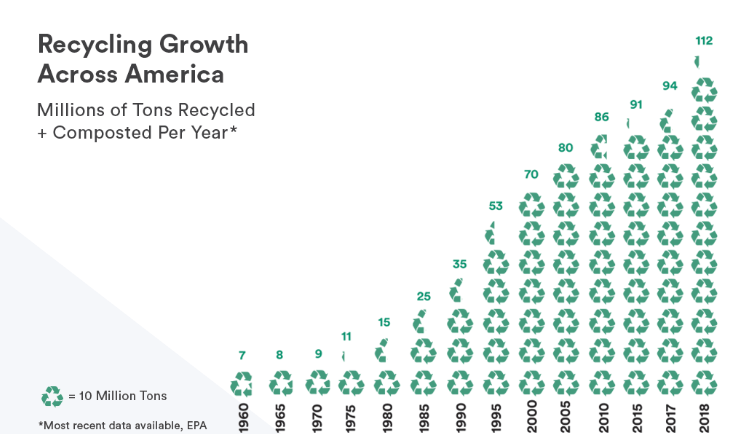

Continuing on with my series on companies at the forefront of sustainable, circular, and environmentally friendly technologies, this article focuses on one of the most contentious industrial fields in the world: plastics. While plastic consumption is leading to significant detrimental effects such as terrestrial and marine pollution or a continuation of fossil fuel industry. To combat this, one company is taking steps to increase the amount of plastic that remains in circulation via recycling.

PureCycle (NASDAQ:PCT) is attempting to solve one the critical problems in plastics circularity: contamination and purification. The issue is that plastic is hard to recycle when there are contaminants from food or chemical remnants and this is why most plastics still end up in landfills or the ocean. Utilizing a purification process developed by Procter & Gamble (PG), PureCycle will be one of the first commercial stage polypropylene (PP) recyclers.

PP is one of the main plastics types in use around the world, and typically averages around 20% of total consumption. While it will be important to either A.) develop recycling processes for other plastics, or B.) rely on industry to move towards increased PP utilization, these issues can be considered further down the road. At the moment, due to the significant need for any form of recycling, the growth path is available for PureCycle to take advantage of.

ReSource

Plastic Usage Information

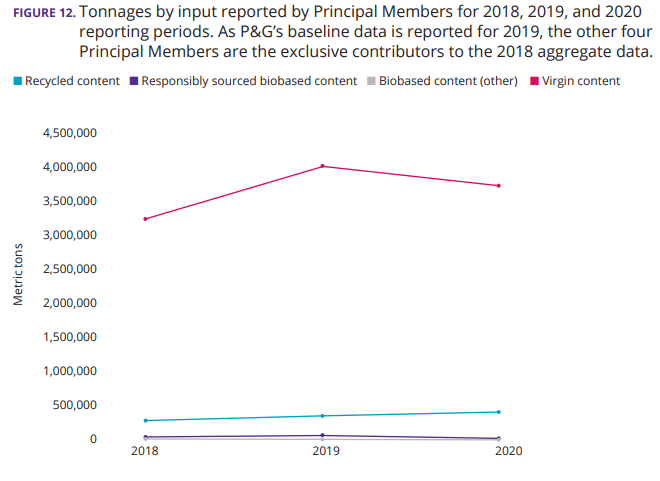

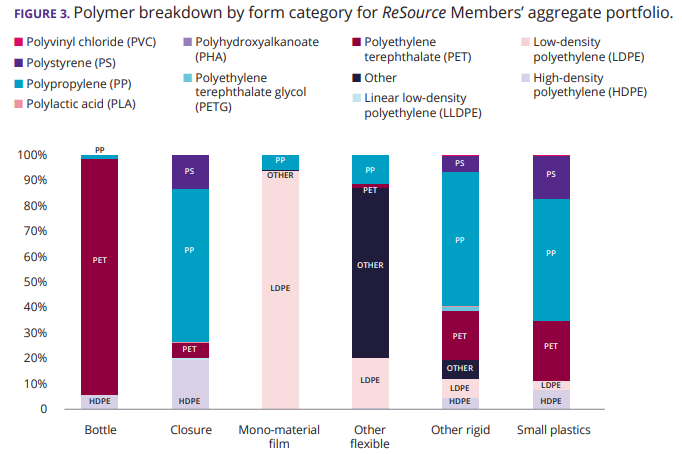

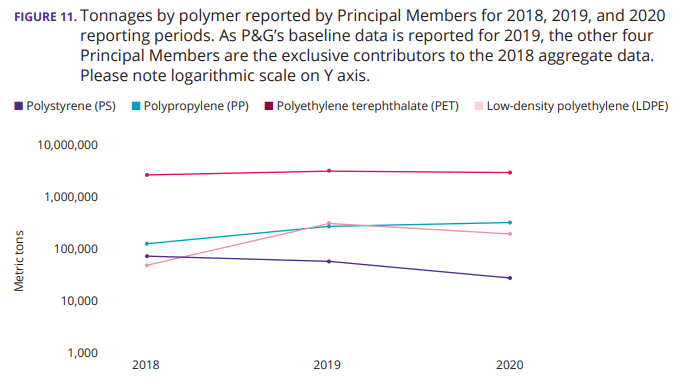

It is actually quite difficult to find accurate information regarding plastic usage, as most national data sources end in 2018. I will be using data provided by ReSource, an alliance between a few multinational companies and the World Wildlife Fund. The members who provide plastic consumption data are Keurig Dr Pepper (KDP), McDonalds (MCD), Procter & Gamble, Starbucks (SB), Coca-Cola (KO), Amcor (AMCR), Colgate-Palmolive (CL), and Kimberly Clark (KMB). While useful to understand the state of US or EU majors and in regards to PureCycle’s available market, much plastic waste is developed from developing nations. However, the data should show that the available market size to take advantage of is significant, and growth will rely instead on PureCycle’s business development capabilities.

RTS

According to ReSource, PP is a significant plastic type for multiple usages, mainly closure, rigid structures, and small plastics (single-use items such as utensils, straws, etc.). Between 2018 and 2020, usage increased with time even as other plastic types fell. With consumption reaching close to 1 million tons per year for just this small group of companies, one can imagine the tonnage available. Lastly, you can see how recycled content is essentially non-existent, so the sooner PureCycle can commercialize their process, the more of a first mover advantage they can obtain.

ReSource ReSource

PureCycle Development Status

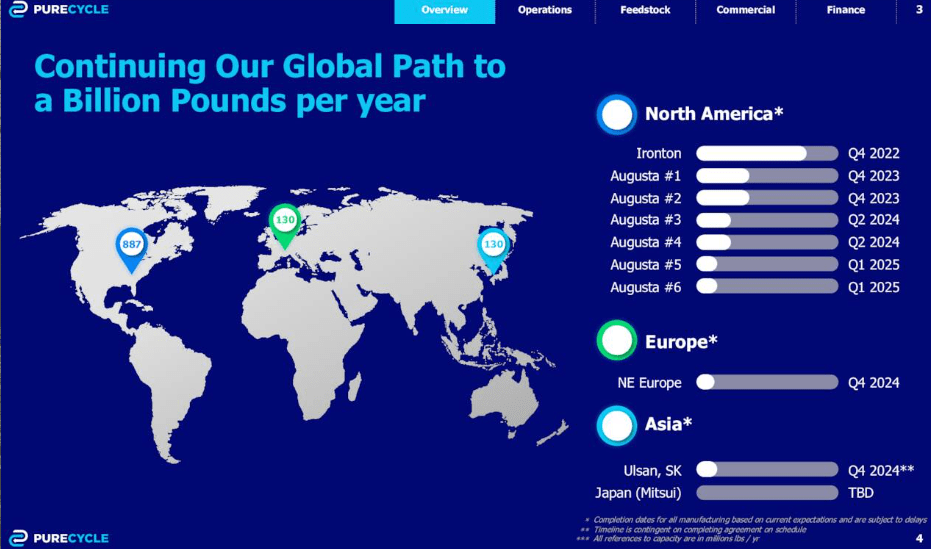

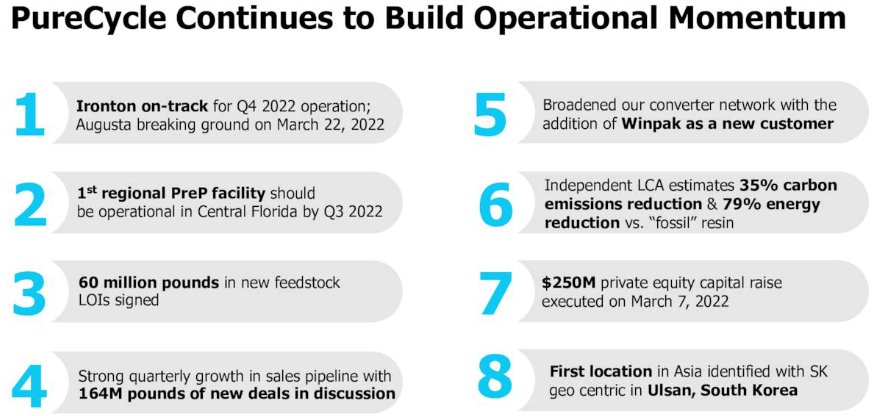

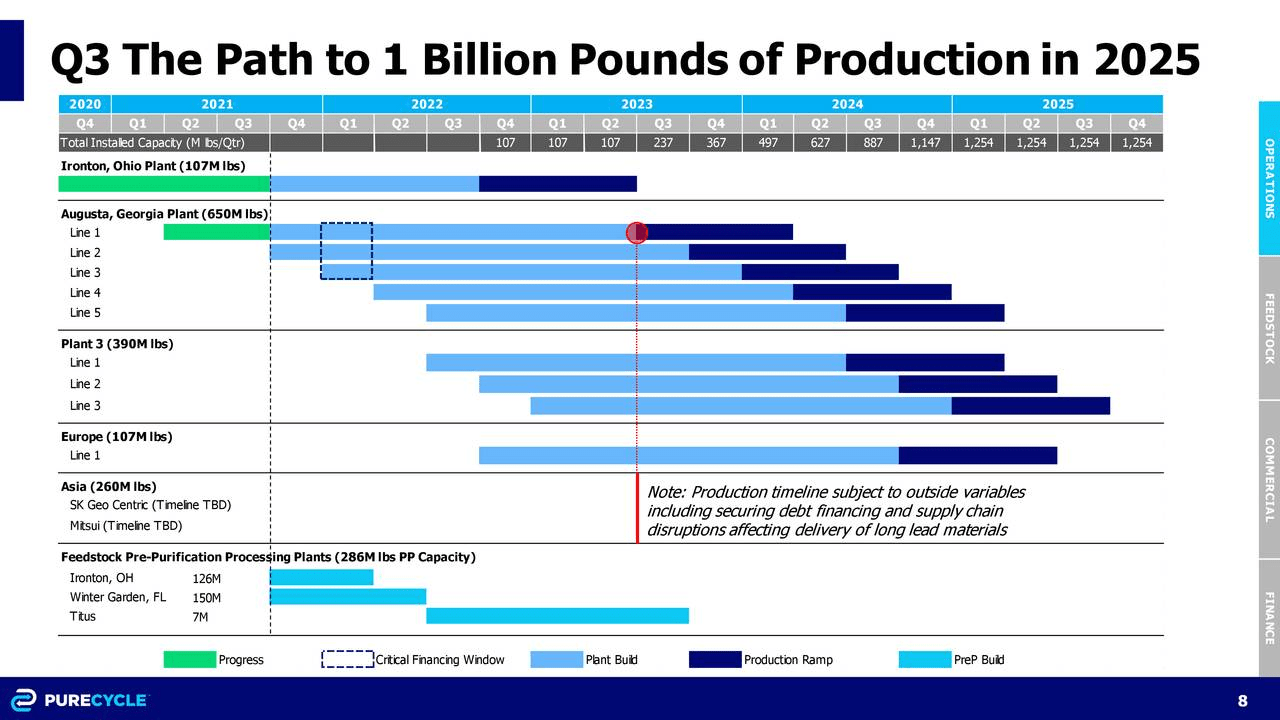

It is important to start off by saying that PureCycle sees no revenues as they remain in the development stage, however the company has multiple facilities in the works, with one set to be online by the end of 2022. First, the Ironton, USA facility is already under construction, with supply issues seemingly being managed well. With no delays announced, the project should be starting up in Q4. A second US facility, Augusta, also just broke ground at the end of March, and management wants the site to be operational by the end of 2024. These two facilities will be the major recycling plants necessary to drive circular plastic production. The combined sites are set to provide at least 1 billion lbs. of PP recycling by the end of the decade. Further, the company has established relations with two other countries, Japan and South Korea, to begin the process of development in the large Asian market.

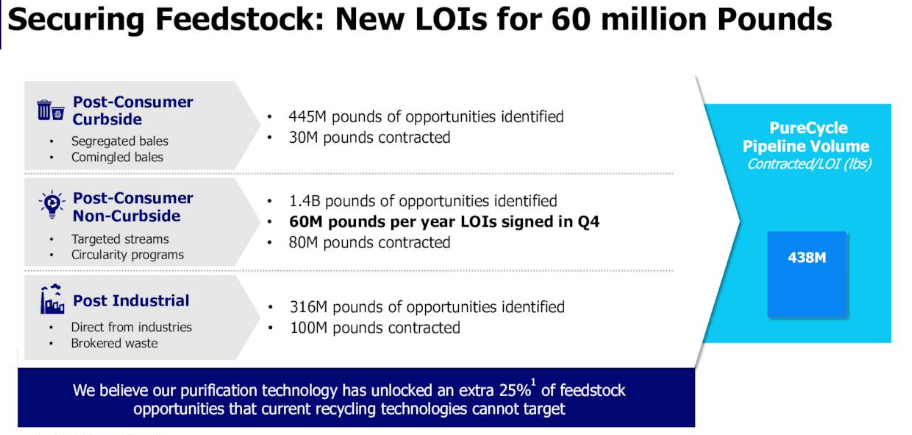

PureCycle

Importantly, the company has already established two preparation facilities in the US, with a third to open in 2023, to collect and prepare PP waste to be the major feedstock for the recycling plants. Currently, the company expects 438 million lbs. in contracted pipeline plastic waste, but should be able to grow supply significantly. As a result, I foresee supply to not be an issue while the ramp of production to be a concern. As with most companies in pre-commercial applications, the majority of data provided is quite speculative, so this increases the risk significantly and must be taken into consideration.

PureCycle

To offset risk, the company has raised significant amounts of cash and investments to support losses. Liquidity currently stands at $432 million in availability, a small change since the prior quarter, thanks to a large $250 capital raise. At 2021 expense levels, the company has 5-6 years of runway to increase their production capability. It will be important to be critical of the future profitability of the company as their production runway is quite slow. However, favorable pricing may allow the company to increase investments as the project NPV increases.

PureCycle

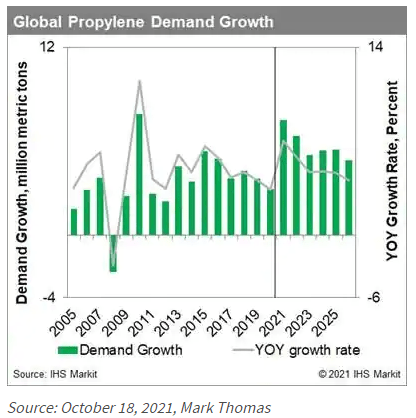

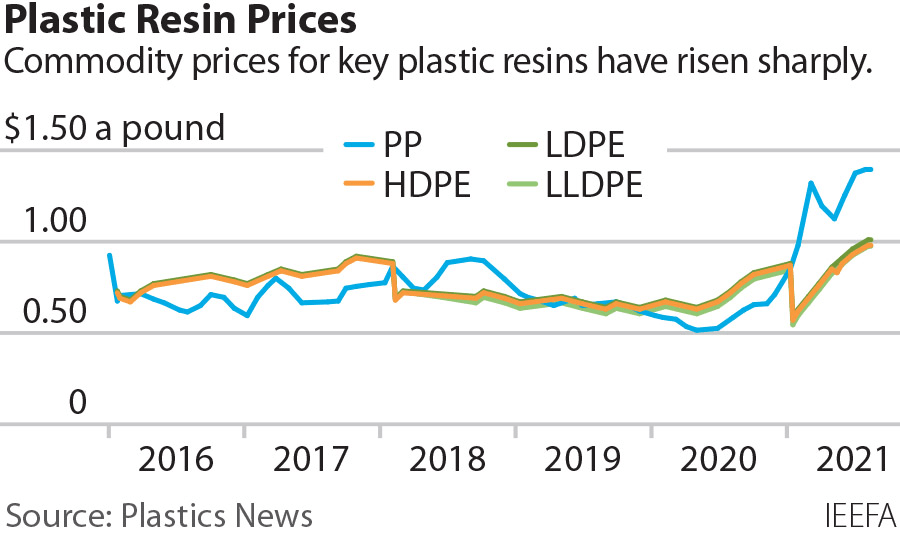

2022 has been a strong year for commodities pricing thanks to supply and demand issues brought about by the end of the pandemic and geopolitics. For PureCycle, this should be favorable as propylene prices are increasing significantly. Prior estimates and prices for the products were between $0.40 and $0.70 per lb., but now prices are reaching above $1.00 per lb. While PCT will be late to the party to take full advantage, I am sure high prices will remain into the future. This should be favorable for the company as they can sell their recycled products at a price that can be both profitable and competitive compared with fossil fuel-based peers.

IHS Markit- Mark Thomas

Considering the company plans on having the Ironton plant operational by 2023, and is set to produce 100 million lbs. of PP, this offers a potential revenue source of between $75 and $140 million depending on prices at the times of sale, competitive pricing, and profitability. The future estimate of 1.2 billion lbs. of total production would equate to $900 million to $1.7 billion in revenues per year at current prices.

IEEFA and Plastic News PureCycle

Conclusion

One of the main reasons I will wait to see commercialization underway before taking a shot at this company is the current market cap. At $1.2 billion, and down more than 70% from highs, mind you, there is not much leeway in terms of meeting expectations. Further, the current 20% short interest will lead to volatility over the next few months as investors take advantage of falling valuations and rising interest rates. Considering the environment, I would say it is best to stay away from speculative names for the moment.

But remember, demand for PP is on the order of millions of metric tons per year and growing, and for those who are long horizon investors, PureCycle may be able to leverage a significant portion of the PP recycling market. I hope no delays or other bad news occur over the next few quarters as this will tank the share price. As such, I think investors should perform their own due diligence and consider taking a position during such an event, if it does occur. If prices remain above $1.00 per lb. for PP, investors can feel confident in the future potential of the company, but it will also to be important to see how the company manages growth. Will they continually become a net loss company, or leverage their technology to the fullest for strong, profitable, and sustainable growth? I will wait and see.

Thanks for reading, let me know if you agree in the comments.

Be the first to comment