naphtalina/iStock via Getty Images

March was like February in that many of the same fears that riled the markets in February were present in March. U.S. equities finished the March quarter with their first quarterly loss since the start of the pandemic two years ago due to high inflation and the Fed’s hawkish tone of raising rates. Russia’s invasion of Ukraine fueled the surge in oil prices as the United States placed many economic sanctions on Russia, including restrictions on importing Russia’s oil and gas. Brent crude oil spiked as much as 79% at its March highs before ending the month up 39%. Investors also feared yield curve inversions, such as when the 10-year Treasury yield fell below its 2-year counterpart. Large caps outperformed small caps while growth slightly outperformed value for the month. There is still a lot of uncertainty in the markets, and it feels like we are at an inflection point where all it could take is one or two events to propel markets in either direction.

The March Purchasing Managers Index (PMI) registered 57.1 percent, a decrease of 1.5 percentage points from the February reading of 58.6 percent. Similarly, the Conference Board Leading Economic Index (LEI) increased by 0.3 percent in February to 119.9 (2016 = 100), following a 0.5 percent decrease in January and a 0.8 percent increase in December. The March PMI reading indicates economic expansion for the 22nd consecutive month. The unemployment rate dropped to 3.6% in March (3.8% in February) as businesses have started the rehiring process.

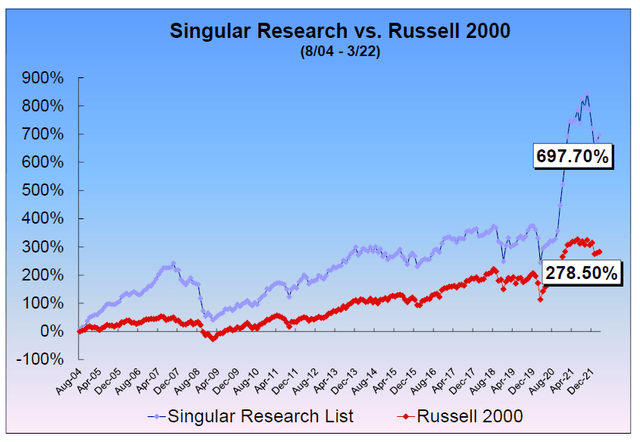

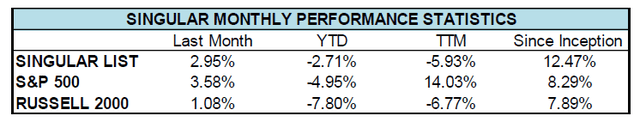

For the month, the Singular coverage list underperformed the S&P 500 and outperformed the Russell 2000 by (62) and 188 basis points, respectively. Year-to-Date, the Singular coverage list has outperformed the S&P 500 and the Russell 2000 by 224 and 510 basis points, respectively. Since our 2004 inception, the Singular coverage list has outperformed the S&P 500 and Russell 2000 by an annualized 419 and 458 basis points, respectively.

For March, GOGO and ZEUS were our top performers as the two Companies posted better-than expected fourth quarter earnings. SAMG and NVEE were not far behind as they, too, had good quarters. GBOX also made our top five performers list as the Company bounced back from a previous short attack.

Singular Research

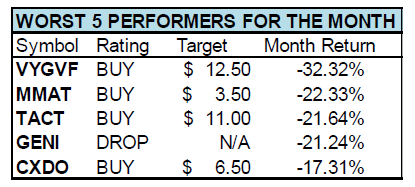

OTCQX:VYGVF was our worst performer of the month as weak crypto trading volume and cease and desist orders from eight states scared investors. MMAT also had a weak quarter as the Company posted a loss of $30 million. TACT was a poor performer for the month as the Company reported potential sales weakness due to chip shortages in their BOHA! product.

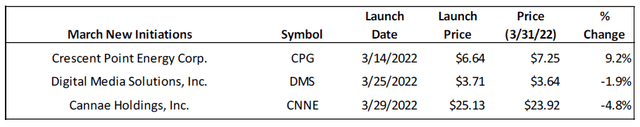

For the month, we initiated coverage on CPG, DMS, and CNNE. CPG is a Canada-based oil and gas producer with assets consisting of light and medium oil and natural gas reserves in Western Canada and the United States. DMS is a leading provider of digital performance advertising solutions in the United States. CNNE is a holding company of diversified investments led by Bill Foley.

Best of the Uncovereds offers new initiation reports on roughly two dozen companies per year, with a focus on under-followed small and mid caps with significant potential. We provide a quarterly earnings update reports on all companies covered, as well as flash reports on significant news announcements by companies. We go further for members, providing recorded interviews with management teams of covered companies when available and a monthly quantitative based “Market Indicators and Strategy Report.”

Be the first to comment