Igor Kutyaev/iStock via Getty Images

Last fall, I wrote that bond trading marketplace MarketAxess (NASDAQ:MKTX) was “still risky” at then 52-week lows. And indeed, shares are now down another 30% since that point.

It’s a tale often told in financial markets. A stock reaches an utterly breathtaking valuation. It then falls by a moderate amount, attracting dip-buyers who are enticed by the percentage discount off the all-time high. However, that stock often hasn’t fallen far enough to actually make it a value yet.

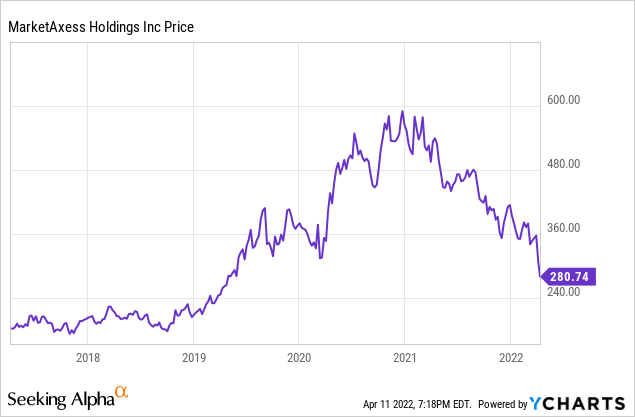

Here’s how that looks in stock price terms in MarketAxess’ case. Shares topped 70x earnings at one point for a company that was unlikely to grow by more than, say, 18% per year for an extended period of time. Not surprisingly, that multiple has had to come down a lot:

Shares peaked around $600 in late 2020. Last fall, they were at $400 and some bargain hunters were starting to step in. Yet, after another set of underwhelming numbers from the business, shares have now slumped through the $300 mark and are approaching support levels from back in 2018 before the pandemic kicked off the bull thesis around faster digital adoption in the first place.

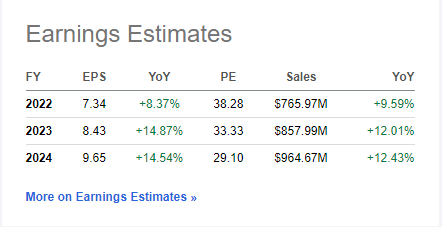

Is this finally enough of a decline? I’d say we’re at least getting close. Even now though, I must warn you, the business is far from a bargain based on traditional valuation metrics. Shares are at 41 times trailing earnings, and still in the high 30s on a forward earnings basis given that earnings growth has trailed off significantly in the near-term:

MarketAxess earnings estimates (Seeking Alpha)

What went wrong? Prior to 2020, MarketAxess was widely viewed as the way to play increased digital bond and credit market trading volumes. Following the pandemic, adoption of digital solutions indeed grew sharply, but rival Tradeweb (TW) earned a large share of the new business. In doing so, the market’s perception of MarketAxess changed from being the best player to one of the various players in the industry.

In addition to the persistent competitive threat that is Tradeweb, there are other competitors gaining strength as well. Electronic trading platform Trumid, for example, just raised $208 million from investors last October and has added high-profile clients such as JPMorgan (JPM) who are operating on the platform.

Momentum is growing in 2022; Trumid just reported 79% year-over-year trading volume growth for March 2022. And the number of users on the platform surged 45% compared to the same month in 2021.

Other players like LiquidNet are not near the competitive level of Tradeweb or MarketAxess today, but excel in some niches and could become larger rivals with the right strategic moves or additional capital investments in their businesses.

Who will be the ultimate winner in this space? I don’t know. If I’m paying close to 40x forward earnings, however, I’d like to have a little more confidence that I’m buying the best horse on the track.

MarketAxess for years had the first mover advantage in many of its markets. It got to its core business many years ahead of Tradeweb and thus developed strong client relationships and patterns of usage. However, we’re now seeing a test of the durability of that first mover advantage in real time.

As Tradeweb in particular innovated, MarketAxess had to try to catch up with it on features. Thus, we saw moves such as MarketAxess’ acquisition of LiquidityEdge in late 2019 as a defensive play. By bringing Treasury hedging to MarketAxess, it was supposed to keep MarketAxess on top and stop the erosion away from the first mover to the seemingly more dynamic Tradeweb. However, in the case of that acquisition, at least, it appears it did not have the desired effect that management had been hoping for.

And now, with more entrants like Trumid making a splash, the competitive threat only intensifies. That said, perhaps it can still do alright from here regardless.

The Outlines of a Bull Case

The argument for owning MKTX stock at this point starts with the idea that a rising tide lifts all boats. By some estimates I’ve seen, only 25% of the volume or so in the major markets where MarketAxess participates are digitally traded right now. The rest is still through alternatives such as voice calls or Bloomberg chat functions.

It’s unlikely the credit market will get to anything close to 100% electronic trading in the near future. That’s because there are far more individual credit products out there, and many of them have special clauses, stipulations, or other features which make them harder to trade. A stock is a stock and they’re easy to list on digitized exchanges. A certain subset of credit products, by contrast, are more complicated and thus likely to rely on human specialists to make markets for a while longer. In some cases, such as the municipal debt of small cities, it may also require human market making to drum up active buyers for such illiquid and unfollowed pieces of credit.

That said, it seems reasonably likely that electronic trading will continue to rise sharply in its share in coming years. The number can reach far higher than 25% before running into natural limits.

With a strong tailwind of digital adoption combined with a rising market volatility period (such as what we appear to be in now) MarketAxess can grow revenues and earnings even without gaining share against other electronic rivals such as Tradeweb and Trumid.

For example, for March 2022, MarketAxess posted its second highest ever month of trading volume on its platform.

Was this a good number in comparison to Trumid or Tradeweb’s results for the same month? No, no it wasn’t. The stock dropped from $340 to $290 around the release of this data point, and Raymond James downgraded the stock based on its downbeat market share figures compared to rivals.

But that might be burying the headline. It was, after all, MarketAxess second best month ever from a total perspective. That’s a good thing, let’s not lose sight of that.

Yes, it could and probably should have been better, but it’s still not that bad. And, arguably, Raymond James throwing in the towel might be a sentiment indicator. After all, MarketAxess has been having market share problems since 2020. This is hardly a new development in April 2022.

If MarketAxess continues to have lackluster market share compared to more innovative competition but can still grow its overall revenue base because the pie is growing so quickly, that’s not the end of the world.

The credit market is seeing one of its most abrupt sell-offs in decades. It’s hard to see the current up move in bond market volatility abating anytime soon, which should be great for trading volumes. And now, MarketAxess is up against weaker comps from 2021 instead of the figures from 2020 going forward.

The Bottom Line

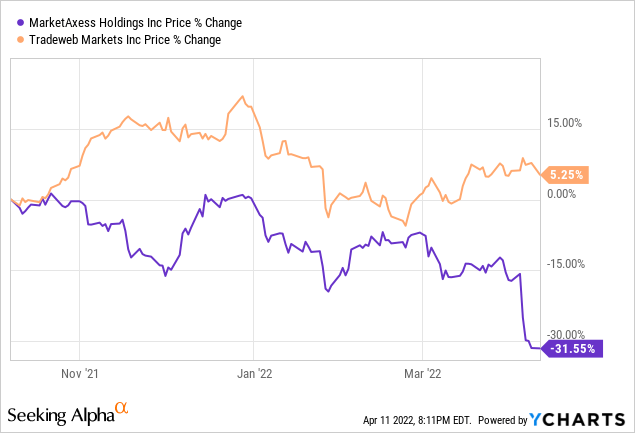

The last time I wrote about MarketAxess, it was still trading at a higher P/E ratio than Tradeweb. This was baffling, given that Tradeweb has been crushing it in the marketplace in recent quarters. Fast forward to today, however, and MKTX stock has underperformed TW stock significantly since last fall:

Now Tradeweb is trading at 48 times this year’s estimated earnings versus 38 times analysts’ estimates for MarketAxess’ earnings. The valuations are now more in line with their competitive positions.

That said, I’m not putting money into either one at current levels. If I’m going to pay 40 let alone 50 times earnings for something, I’d like to either have faster top-line revenue growth or more confidence that my company is going to dominate the industry for a long time.

Ultimately, one of these bond platforms is probably going to be an incredible business that will be a compounding machine for investors going forward. I can understand wanting to take a shot on the industry as valuations come in.

The businesses are of tremendous quality and earn tremendous returns on the capital invested in them. The appeal of owning assets in a capital-light industry like this is obvious.

I still can’t get there on MarketAxess from a valuation standpoint. Buying at 40x starting earnings with 10-12% forward earnings growth can be tenable if you own the market, but is less so if there’s apparent competitive risk of being permanently disrupted.

That said, MarketAxess is starting to get to the point where the baseline valuation isn’t unreasonable anymore if there’s any signs of improvement on the competitive front.

And, even if the competitive status quo persists, perhaps rising market volatility will be enough to keep powering up trading volumes in overall terms. I can see a bull case here. I’m not sold on it yet, but we’re getting closer. If MarketAxess does fall closer to, say, 30x earnings, that’d be in the range the potential upside from good business execution would outweigh risk from rising competition in my book.

Be the first to comment