mikkelwilliam

Introduction

Shares of Electronic Arts Inc. (NASDAQ:EA) have fallen over 10% YoY as growth has been gradually slowing in the post-pandemic world and investors flock to other sectors for safety. Despite headwinds facing EA, its ability to diversify its portfolio and loyal fanbase put the company in a good position to endure future challenges. However, it might be better for investors to wait for better buy-in opportunities as the stock is currently richly valued.

Electronic Arts Overview

Electronic Arts revenue is segmented into products and services. “Products” refers to initial sales from EA titles, while services include any purchases made after (for players to get access to additional in-game content). Currently, EA generates around 60% of its revenue from services and 33% from products. As a result of licensing agreements, EA holds virtually a complete monopoly in certain sports games. These include Madden (Football), FIFA (Soccer), and NHL (Hockey). The gaming market was valued at $229B in 2021, with EA taking 3% of the market. Through 2028, the market is still expected to grow at a 13.2% CAGR.

Electronic Arts Q1 2023 Results

In Q1 of 2023, EA reported net bookings of $1.3B, a decrease of 3% YoY. However, it did beat estimates by $50M. Its EPS was $1.11, beating expectations by $0.16. Despite slowing growth in the gaming industry, management has reaffirmed expectations. For FY 2023, revenue is expected to be between $7.90B to $8.10B, representing between 14.5% to 17.4% in growth. Finally, EPS is expected to be between $2.79 to $2.87.

Sound Fundamentals

In the short term, the biggest concern that investors have is the slowing gaming market. Coming out of the pandemic, behavioral trends have shifted against the once prized pandemic stocks.

However, EA has remained resilient and ready to face any upcoming challenges with its dedication to diversifying its portfolio. Over the past years, they’ve expanded to FPS (First person shooter) games with Battlefront which has seen great results-with over $5B in sales. Recently, EA has announced that it’s bringing back NCAAF, a successful college football franchise last updated in 2013. Production stopped due to legal disputes regarding player likeness. However, the issue has been resolved and NCAAF 2023 is currently in the final stages of development. The franchise used to net $1.3 bn in revenue for EA and for a long time represented 5% of their yearly revenue. Therefore, combined with the pent-up demand for this franchise, NCAAF will no doubt be a large revenue driver for EA.

EA is staying ahead of its peers and has had great success with its mobile expansion. APEX mobile, released in May of 2022, has been wildly successful. It’s seen over 20 million downloads in just two months and has netted $26M in revenue. These results showcase the power of EA’s brand even against headwinds faced by the rest of the market. EA’s ability to successfully diversify and its loyal fanbase makes it an excellent choice even in uncertain times.

Stock Buyback

EA recently announced its $2.6B stock buyback plan, one of its first. With a market cap of $36 Bn, this buyback is significant and indicates that EA is confident in its loyal fanbase and ability to grow.

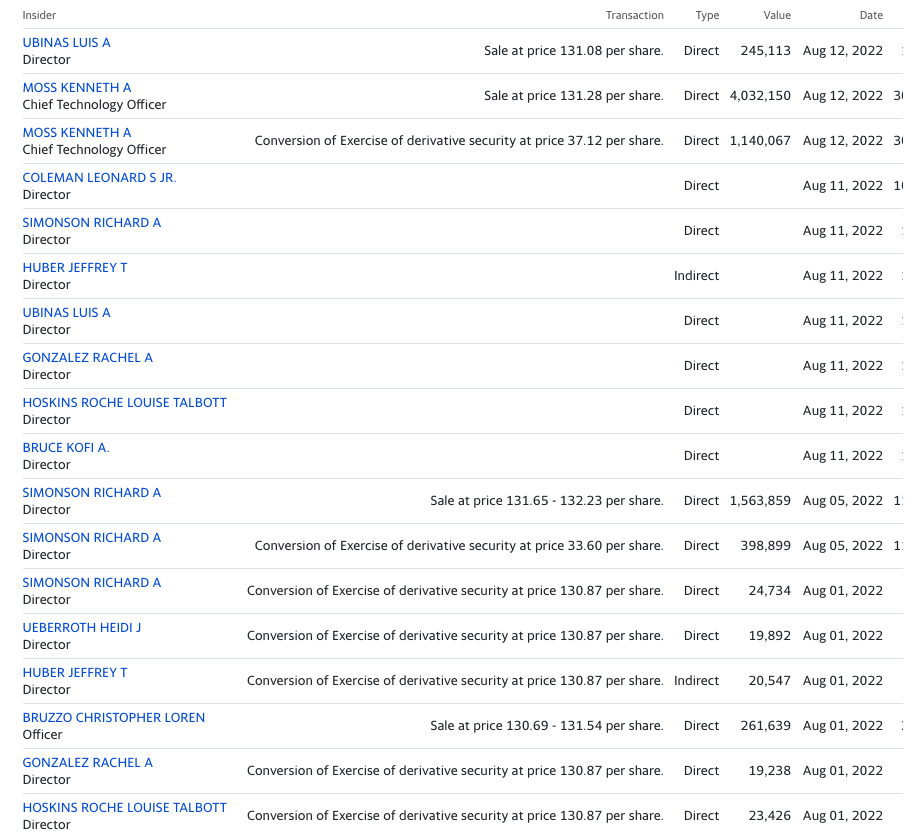

Insider Activity

In the last several months, EA’s directors and CTO have sold off large amounts of its stock. Although this could be for a plethora of reasons, it still sheds confidence for investors and could indicate that the stock is overvalued.

Yahoo Finance

EA Stock Valuation

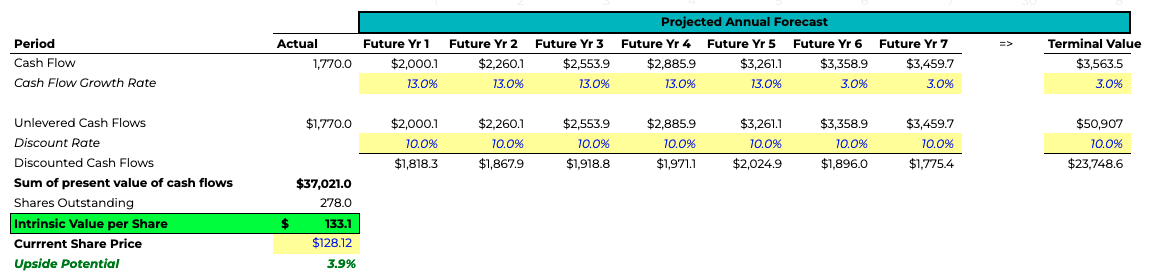

Although I believe the company is in great shape, it is also trading at a steep premium. My discounted cash flow (“DCF”) model uses a 10% discount rate and 3% terminal growth rate, along with a 13% growth CAGR. EA’s revenue growth CAGR has always hovered around the low teens; along with the expected market size growth, a 13% CAGR is reasonable to assume or even optimistic. Even in more bullish scenarios, EA’s valuation might lack a sufficient margin of safety for more cautious investors.

Google Sheets

Conclusion

There is no doubt that EA is facing some tough challenges. However, its ability to diversify its portfolio combined with its loyal player base puts them in good shape to face any upcoming challenges. Still, because I expect the market to remain volatile in the short term, investors will likely be able to pick up EA at a more attractive valuation down the line.

Be the first to comment