Andy Feng

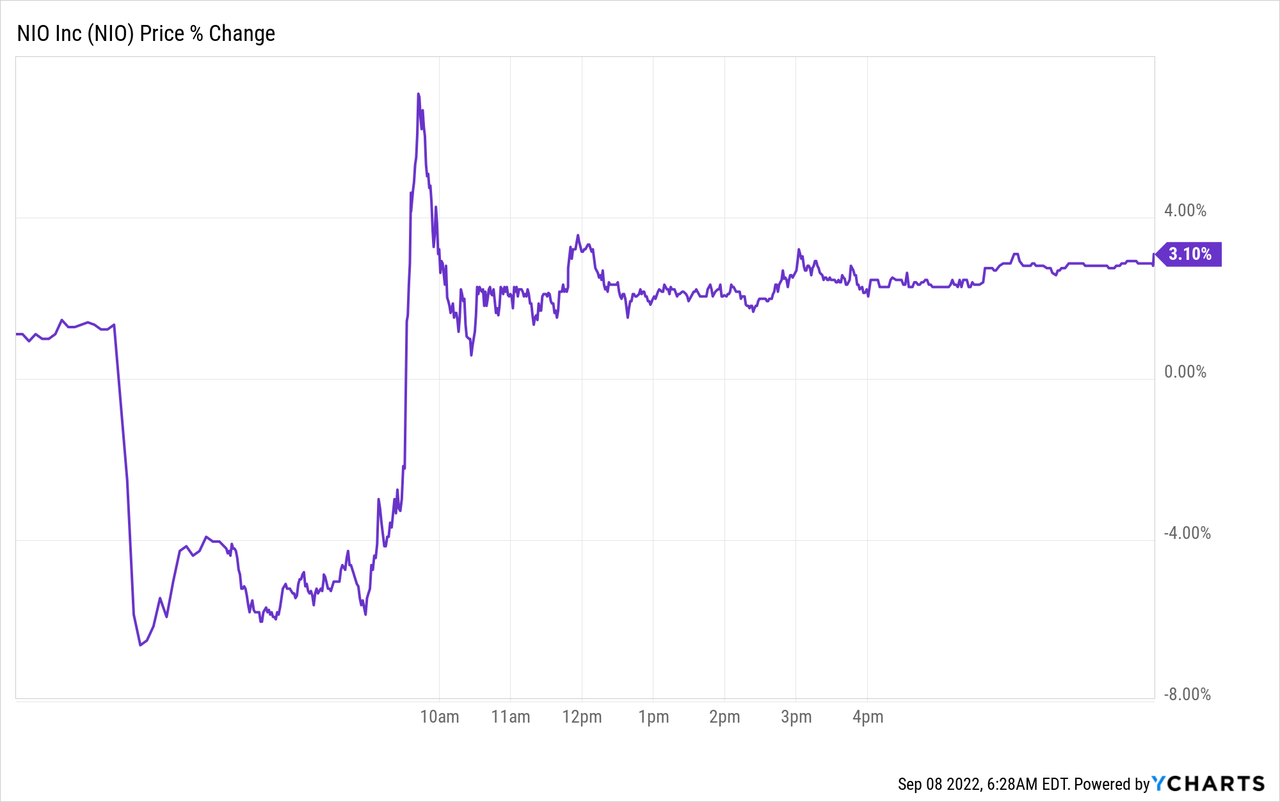

Shares of NIO Inc. (NYSE:NIO) jumped after the electric vehicle (“EV”) manufacturer submitted its Q2’22 earnings sheet, but they couldn’t hold on to all of their gains as investors dug a little more into the company’s results. While NIO beat revenue predictions, the EV company missed on earnings due to widening losses related to production setbacks in the second quarter. The outlook for Q3’22 deliveries is good (and better than my forecast), but headwinds are growing for NIO and the stock. For those reasons, NIO remains a hold!

The good: Earnings beat, robust delivery forecast for Q3

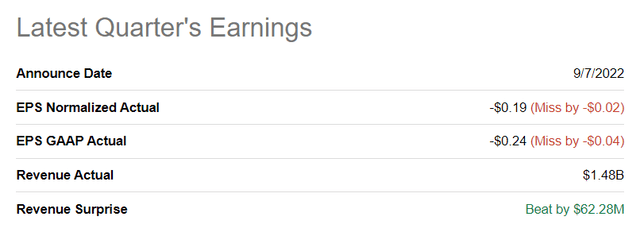

NIO’s second-quarter earnings card was mixed, with revenues beating expectations by a large margin, but widening losses caused the electric vehicle manufacturer to miss on the bottom line. NIO reported Q2’22 revenues of $1.48B, beating the consensus by more than $62M.

Seeking Alpha: NIO Q2’22 Results

NIO’s revenues in the second quarter totaled 10.29B Chinese Yuan which calculates to $1.54B, showing an increase of 21.8% year over year. In the year-earlier period, NIO’s revenues grew 127.2% year over year, so topline growth is clearly moderating for the electric vehicle company. NIO’s revenue growth in Q2’22 was still robust, given that the EV company was hamstrung by supply chain issues and COVID-19 lockdowns in the second quarter.

What was also good was NIO’s delivery outlook for the third quarter. Based off of the latest forecast, NIO sees EV deliveries of 31,000 to 33,000 in the third quarter, which is better than my estimate of 24,500 to 26,500. However, I have become much more conservative in my predictions for NIO’s delivery potential due to the fact that NIO’s monthly delivery volumes have been highly volatile and unpredictable since the start of the year. While I would log the Q3 delivery outlook in the “good category” of NIO’s earnings release, the company is still facing considerable headwinds in the near future.

The bad and the ugly: Widening losses, growing pressure on vehicle margins

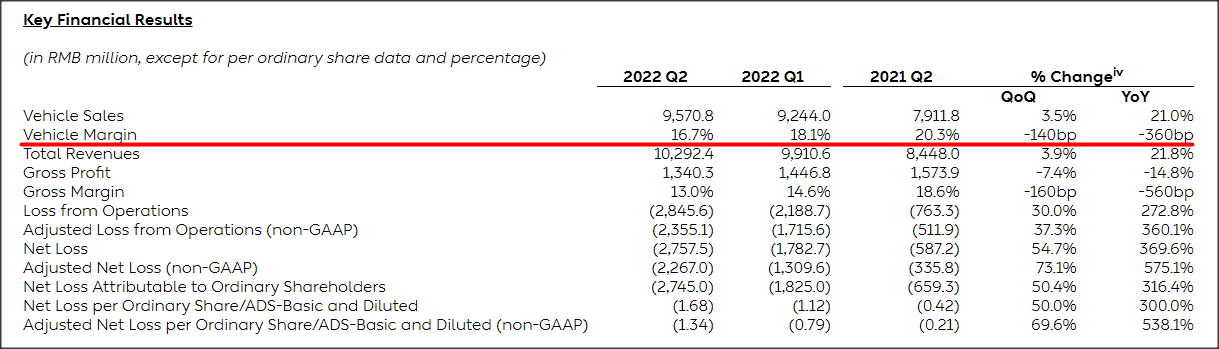

The bad part of NIO’s earnings release was that the firm’s losses are widening. NIO’s net losses in the second quarter amounted to 2.76B Chinese Yuan which calculates to $411.7M, showing a massive 54.7% increase over the previous quarter when NIO reported a loss of 1.78B Chinese Yuan ($281.2 M).

The losses occurred because NIO is investing heavily in the production ramp of its new electric vehicle models that either just came to market (such as the ET7 and the ES7) and are slated to come to market soon (ET5). While the widening of losses was not expected, NIO cannot and should not be blamed for having to deal with a growing number of challenges such as government-mandated factory shutdowns and soaring battery costs.

Unfortunately, NIO’s vehicle margins kept declining in the second quarter. Vehicle margins are a key performance metric for electric vehicle manufacturers and as a premium producer, a decline in vehicle margins is a clear warning sign to investors that profitability pressures are increasing. NIO’s vehicle margins dropped 3.6 PP year over year to just 16.7% in Q2’22. They also dropped 1.4 PP compared to the last quarter as well.

XPeng’s (XPEV) vehicle margins also came under pressure in the second quarter and declined 1.9 PP year over year to 9.1%.

Electric vehicle manufacturers already increased their product prices in the first and second quarter of 2022 in an attempt to pass on higher raw material prices to consumers, but rising costs clearly present a challenge to NIO and the broader industry. If cost pressures persist and NIO is forced to raise EV prices again in FY 2023, margins may improve, but possibly at the expense of slower revenue growth. If NIO’s vehicle margins deteriorate further in Q3 and Q4, NIO’s shares could further revalue to the downside.

NIO: Q2’22 Key Metrics

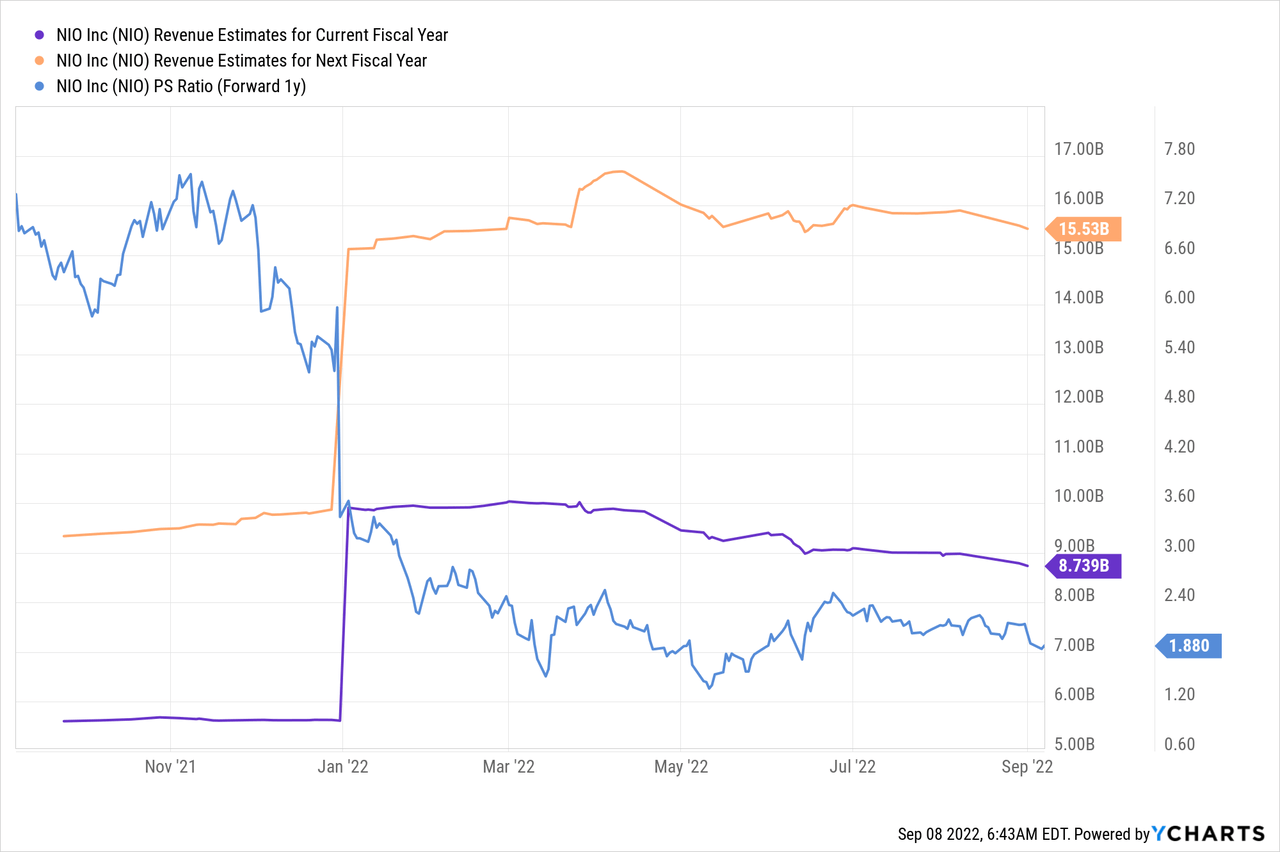

NIO’s valuation

I am neutral on NIO’s valuation, in large part because the recent wave of COVID-19 lockdowns affecting 65 million people in China has the potential to weigh on consumer spending and because NIO’s revenue estimates have dropped off in 2022. NIO’s shares are valued at a P-S ratio of 1.9 X which puts NIO into about the same category Li Auto (LI), which has a P-S ratio of 1.8 X. XPeng is valued at 1.4 X FY 2023 revenue.

Risks with NIO

NIO’s risks relate chiefly to the company’s production and delivery timeline and FY 2022 has shown that the supply chain crisis is still making an impact on NIO’s delivery potential. Because of new COVID-19 lockdowns in a growing number of Chinese cities, I believe these timeline risks have increased in significance lately. What I also see as a commercial risk for NIO is the deterioration of vehicle margins. NIO is a premium producer of EVs, which distinguishes the company from its rivals that chiefly sell lower-priced electric vehicles. A continual decline in margins could be seen as a sign that it may be harder (or take longer) for NIO to generate profits from the sale of EV products.

Final thoughts

NIO delivered a mixed earnings sheet for the second quarter and although the outlook for Q3’22 deliveries was better than I expected, there are headwinds that are affecting NIO’s revenue picture. Most recently, new broad-scale lockdowns in China have been instituted, which may impact NIO’s production and deliveries. Inflation and supply chain problems still represent a challenge as well. The ugliest part of NIO’s Q2 earnings sheet was that NIO’s vehicle margins continued to deteriorate in Q2’22, potentially indicating that it will take longer for the EV company to report profits. NIO, in its current setup, is a hold!

Be the first to comment