Olivier Le Moal/iStock via Getty Images

November 10, I published an article on Silvergate Capital (NYSE:SI) saying I had some short-term questions while liking the stock long-term. Here are some of my conclusions:

The balance sheet looks like Silvergate is likely ok.

There are a few unknowns about Silvergate Capital Corporation, which is why I ultimately like short-term put exposure best for now.

Meanwhile, the FTX implosion is ripping through the crypto landscape like the Maalea freight trains. FTX has entered chapter 11, and it looks like there’s been a hack post-event. BlockFi has paused withdrawals, citing uncertainties around FTX. Crypto exchange AAX has also suspended activities, citing a scheduled upgrade. They’re claiming no exposure to FTX and are blaming an unnamed third party. It seems likely to me we’ll see more companies fail.

Silvergate came out with a statement Friday after hours. This indicates I’m wrong to have short-term questions, and Silvergate isn’t potentially as vulnerable as I thought. Silvergate holds the collateral for its loans (and there is none at FTX) which means the SEN leverage is not a problem (emphasis added):

“In light of recent developments, I want to provide an update on Silvergate’s exposure to FTX. As of September 30, 2022, Silvergate’s total deposits from all digital asset customers totaled $11.9 billion, of which FTX represented less than 10%. Silvergate has no outstanding loans to nor investments in FTX, and FTX is not a custodian for Silvergate’s bitcoin-collateralized SEN Leverage loans. To be clear, our relationship with FTX is limited to deposits,” said Alan Lane, Chief Executive Officer of Silvergate.

Lane continued, “To date, all SEN Leverage loans have continued to perform as expected with zero losses and no forced liquidations. As a reminder, all SEN Leverage loans are collateralized by Bitcoin, and we do not make unsecured loans or collateralize SEN Leverage loans with other digital assets.”

The statement provides clarity, as opposed to its prior statement. Silvergate could get in deep trouble if many things went wrong simultaneously. I wasn’t entirely sure FTX wasn’t a holder of Silvergate its collateral. That’s not the case. I wasn’t sure if SI may have borrowed money to FTX, but clearly, that’s not the case either. Not even collateralized.

They held/hold FTX deposits but they have the assets to meet those liabilities easily. They could still take some losses on their mortgage book related to crypto company clients. But in the grand scheme of things, these losses should be limited.

With the SEN leverage out of the way, there are likely not enough concerns left to impact their balance sheet in a way things get perilous.

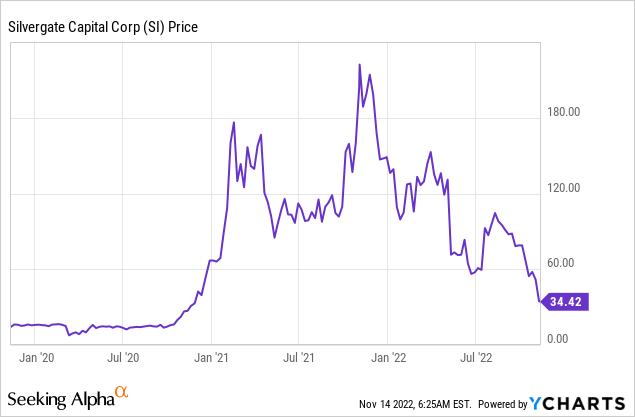

I think this makes Silvergate quite an attractive long position. The share price immediately reversed positively to $41, but I believe that’s still a very attractive entry point (for a longer-term investment).

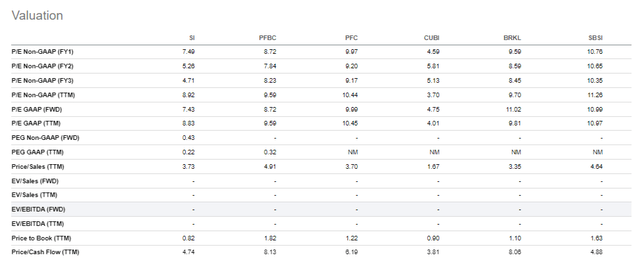

In terms of earnings impact, the increased trading could actually be good, but I suspect the crisis will slow down institutional adoption, which is a negative. But at $40, it is more or less trading at 10x current earnings, which is a “normal” earnings multiple for a small bank while this is a very fast-growing bank with a great position within the ecosystem. To illustrate that the valuation is a bit odd, I pulled Seeking Alpha’s peer group on this name. The peers consist of small banks as well.

Silvergate Capital valuation (Silvergate Capital valuation)

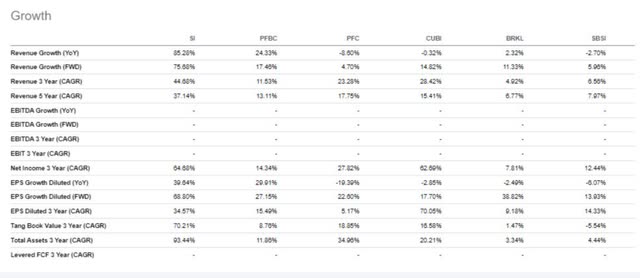

On valuations, things are sort of in-line. You could argue this is very reasonable, given the panic enveloping the crypto world right now. However, if you pull up Seeking Alpha’s data on growth rates in the same peer group, it becomes clear why I think Silvergate is worth a lot more if it weathers this crisis.

Silvergate Capital growth (Silvergate Capital growth)

Silvergate is growing revenue and net income much faster than the peer group. If you are skeptical of crypto even outside of this crisis, you’ll probably discount the growth here, that’s understandable. Even in that case, the assets look good to me, and the valuation isn’t out of line with other small banks. But in better times, the market valued the growth highly:

The current price reflects a dire future, and I’m convinced the worst-case scenarios are unlikely to occur. Admittedly, short term, the price could well decline. The company is trading at a price below a lot of moving averages which means quant, and momentum investors are likely short or at least not picking it up yet. In the short term, Silvergate could also be volatile until the dust settles in the crypto universe. That will keep investors away.

Weighing all the above, the Silvergate selloff seems overdone, with existential concerns mitigated. That’s why I have to reverse course here and go long Silvergate Capital Corporation, even though that looks stupid, given my bearish article three days ago.

Be the first to comment