Getty Images/Getty Images News

In June 2022, we have published an article on NIKE, Inc. (NYSE:NKE) titled Don’t buy Nike yet, highlighting the main pros and cons of investing in Nike’s stock. At that time, we rated Nike’s stock as a “hold.” We found the firm’s execution on its Consumer Direct Acceleration strategy and its commitment to return value to its shareholders favorable, while we rated our concerns regarding the high valuation and the macroeconomic headwinds, including declining consumer confidence, increasing commodity prices, and the geopolitical tension in the Eastern European region.

In this article, we will revisit Nike’s stock and provide an updated view by highlighting the two primary reasons why we still believe that Nike’s stock should be avoided.

1.) Macroeconomic uncertainty remains

On one hand, the macroeconomic environment has not improved drastically.

- While oil prices have come down since our last article in June, they still remain at significantly higher levels than in 2021. The recent oil production cut initiated by OPEC+, may result in rising oil prices again.

- U.S. consumer confidence has somewhat improved but still remains at extremely low levels.

- Inflation in the U.S. and Europe remains high. The soaring energy prices in Europe, fueled by the uncertainty related to Russian gas supplies, cause significant concerns before the winter months.

- China has imposed further lockdowns due to Covid-19 outbreaks across the country. This may lead to reduced demand for Nike’s products as well as to potential supply chain disruptions.

We believe these recent global developments are not creating a favorable environment for consumer discretionary firms, including Nike.

On the other hand, Nike’s decision to leave the Russian marketplace somewhat reduces the uncertainty related to the firm’s operations going forward and potentially helps investors better gauge the firm’s financial performance in the near future.

Economic sanctions imposed on Russia during the fourth quarter of fiscal 2022, impacted our local business and a reduction in the Ruble liquidity affected our ability to manage operational impact and related foreign currency risk. As a result, we deconsolidated our Russian legal entities, the net revenues of which were less than one percent of consolidated net Revenues for fiscal 2021. The deconsolidation of our Russian legal entities resulted in a one-time, pre-tax charge of $96 million recognized within Other (income) expense, net, classified within Corporate. Subsequent to the end of fiscal 2022, we made the decision to leave the Russian marketplace.

As the Russian business only accounted for less than one percent of the consolidated net revenues, in our opinion this decision is not likely to have a substantial direct impact on the company’s performance.

2.) The strong USD creates further currency headwinds for the firm

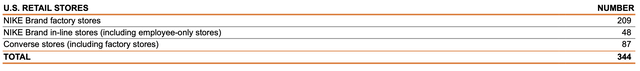

Nike has a large footprint outside of the United States. According to the annual report published in July 2022, the firm had a total of 344 retail stores in the U.S., while it had more than 700 stores outside of the United States.

U.S. Retail stores (Nike) Non-U.S. Retail stores (Nike)

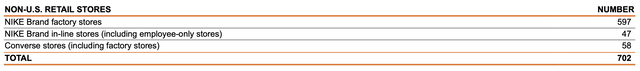

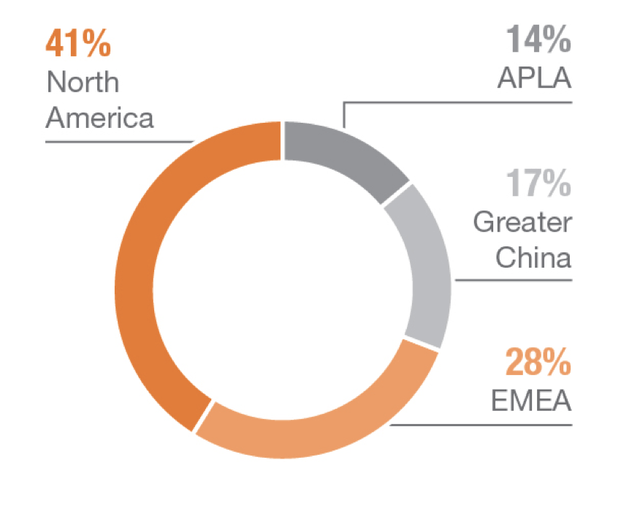

The following chart and table show that the international segment is not only larger in terms of store count but also in terms of revenue.

Revenue by region (Nike) Revenue by region (Nike)

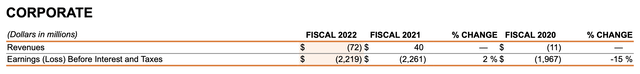

Nike reports their gains and losses on foreign currency under the “Corporate” segment.

Corporate revenues primarily consist of foreign currency hedge gains and losses related to revenues generated by entities within the NIKE Brand geographic operating segments and Converse, but managed through our central foreign exchange risk management program.

The Corporate loss before interest and taxes primarily consists of unallocated general and administrative expenses, including expenses associated with centrally managed departments; depreciation and amortization related to our corporate headquarters; unallocated insurance, benefit and compensation programs, including stock-based compensation; and certain foreign currency gains and losses.

In addition to the foreign currency gains and losses recognized in Corporate revenues, foreign currency results in Corporate include gains and losses resulting from the difference between actual foreign currency exchange rates and standard rates used to record non-functional currency denominated product purchases within the NIKE Brand geographic operating segments and Converse; related foreign currency hedge results; conversion gains and losses arising from remeasurement of monetary assets and liabilities in non-functional currencies; and certain other foreign currency derivative instruments.

Although losses have decreased by $42 million during fiscal 2022, it was primarily driven by the favorable change in net foreign currency gains and losses of $219 million related to the remeasurement of monetary assets and liabilities denominated in non-functional currencies and the impact of certain foreign currency derivative instruments, reported as a component of consolidated Other (income) expense, net. On the other hand, an unfavorable change of $190 million related to the difference between actual foreign currency exchange rates and standard foreign currency exchange rates assigned to the NIKE Brand geographic operating segments and Converse, net of hedge gains and losses was reported.

In the economic and industry risks section of the annual report, Nike also highlights the risk associated with foreign currency transactions:

We conduct transactions in various currencies, which creates exposure to fluctuations in foreign currency exchange rates relative to the U.S. Dollar. Continued volatility in the markets and exchange rates for foreign currencies and contracts in foreign currencies could have a significant impact on our reported operating results and financial condition.

In our opinion, despite Nike’s hedging strategy, the currency headwinds are likely to last as long as the U.S. dollar remains at the current levels against foreign currencies.

Key takeaways

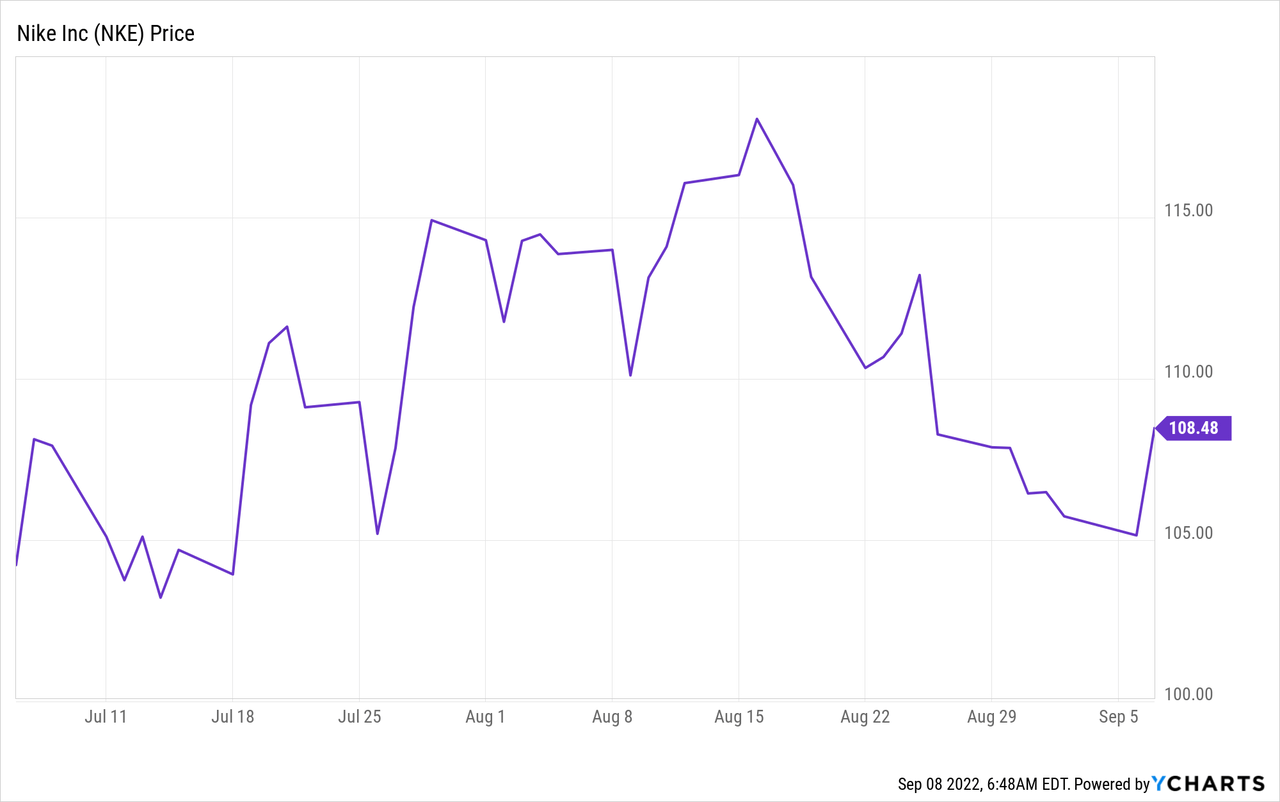

As the price of Nike, since our last article has even increased, while the fundamentals and the macroeconomic environment have not drastically improved, we believe that at the current valuation Nike’s stock still remains overvalued.

What we highlighted in June about the company’s valuation still holds:

Nike’s price-to-earnings ratio (FWD) is approximately 32x, which is more than double the consumer discretionary sector median of ~12.5x. The firm’s EV/EBITDA and P/CF are also showing a similar trend and indicating that Nike is trading at a significant premium compared to its peers.

We understand that Nike is a growing company and its strategic shift to direct-to-consumer sales may result in expanding margins; however, we believe that such a significant premium is not justified.

For these reasons, we maintain our hold rating on Nike’s stock.

Be the first to comment