Drew Angerer

Introduction

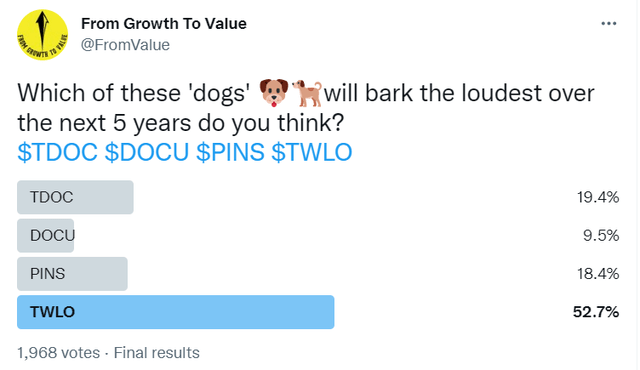

On Twitter, I have more than 81K followers, and sometimes I use this channel to put out a poll. I recently wanted to know what people thought would be the best investment for the next five years of some big losers: Teladoc (TDOC), DocuSign (DOCU), Pinterest (PINS), or Twilio (NYSE:NYSE:TWLO). Almost 2,000 people voted.

As you can see, Twilio won the vote, with a big lead. Does Twilio have a chance of being a good investment over the next five years? Of course, the fundamentals will matter more than a Twitter poll, so let’s look at them.

How I invest

Before we start, I quickly want to explain how I invest. Many people claim to invest for the long term, but they trade in and out of positions relatively fast. I invest for the real long term (in my case 20 years) and I add money to my portfolio every two weeks. I show my subscribers what positions I add to and how much money. If a company doesn’t perform optimally, but the long-term thesis is intact, I tend not to sell but just to hold. I put these stocks ‘in isolation’ as I call it for my subscribers.

As I add money every two weeks, the stocks that don’t convince me for some reason or the other will become smaller and smaller positions in the portfolio. I always order my portfolio according to the original allocation, not the current size. If you take the current size, you are incentivized to punish the winners and reward the losers.

Of course, I sell when I totally don’t believe in a stock anymore. I sold Skillz (SKLZ) last year, for a big loss, but I also sold Baozun (BZUN) for more than a double. For both, I only saw deterioration in the long-term fundamentals. But I also make a distinction between long-term fundamentals and macroeconomic circumstances. All companies suffer if the broad economy isn’t doing well and that often doesn’t really impact the long-term thesis.

Of course, there’s much more to know about my approach to investing, but I just wanted to point out that I’m not momentum-driven or short-term-oriented. That doesn’t mean that if you are, you can’t enjoy this article, I hope.

Twilio, the stock

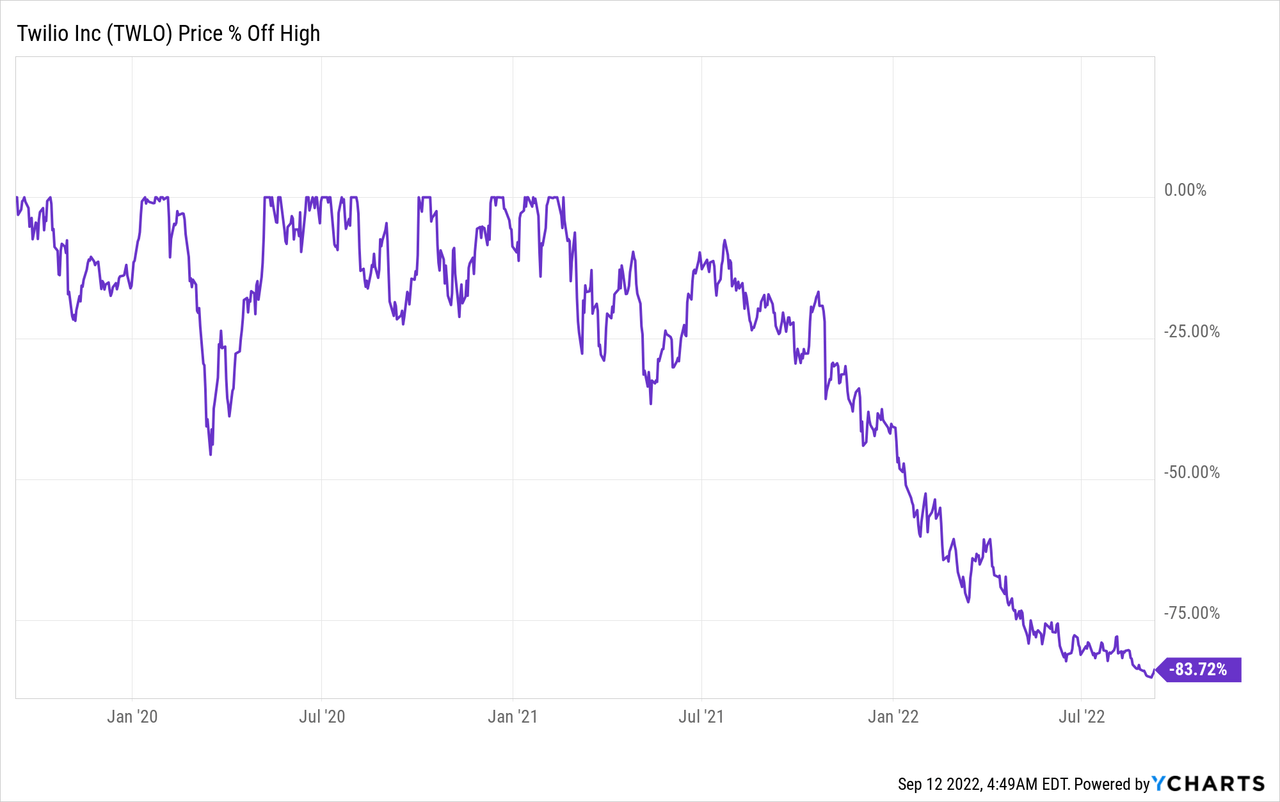

Like many other growth stocks, the company has crashed dramatically from its highs: a whopping 84% in this case.

The stock price of Twilio was overvalued in hindsight, with factors like higher rates and high inflation. That’s easy to say with everything we know now, but it’s unproductive.

The more interesting question is if that means that the stock is attractive at this point. I wanted to go deeper to see if I could shed light on that topic with this article.

The Q2 results and the market’s reaction

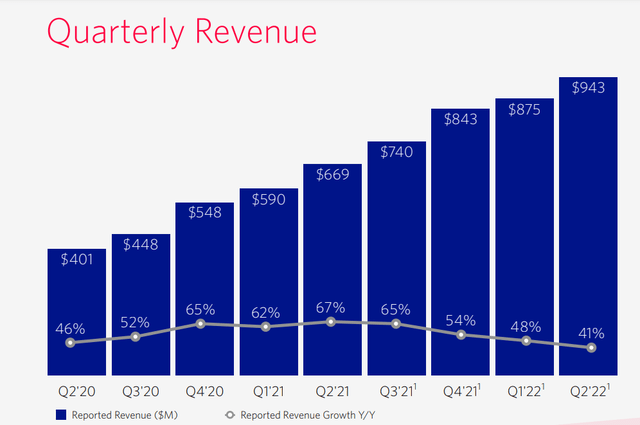

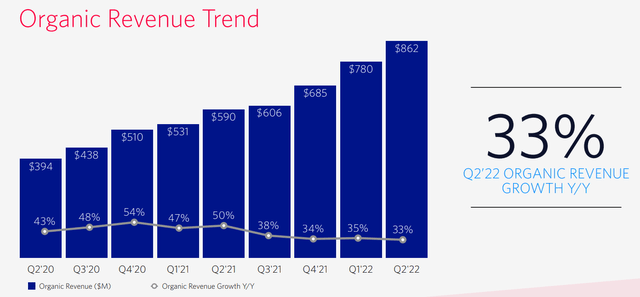

The Q2 results show revenue of $943.35 million, beating the estimates by $22.38 million. That was up 41% YoY. This is a revenue growth slowdown, but that’s nothing to worry about at that scale.

Twilio earnings slides deck

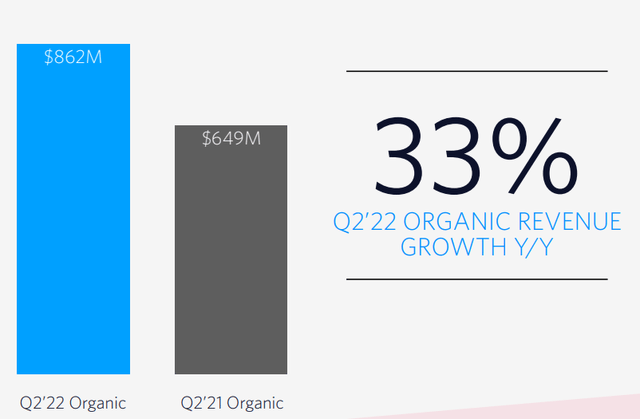

As you can also see in this graph, it would not be the first time that Twilio reaccelerated its revenue growth. It will not be easy this time, as the company is so much bigger. But as it’s adding more and more solutions, never say never, especially not if the company would add some good acquisitions to the mix. Regarding organic revenue, the company is targeting 30% for each of the next three years. This time, it was 33%.

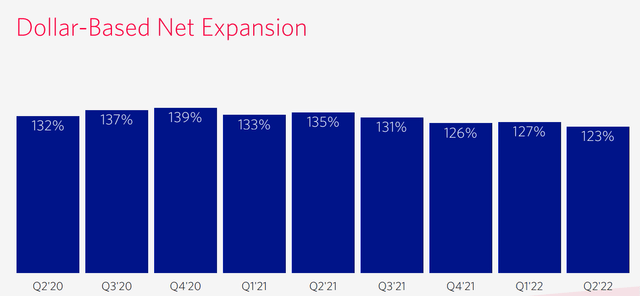

Twilio Q2 earning slides deck

That too has been trending down.

Twillio Q2 earnings slide deck

Non-GAAP EPS came in at -$0.11, beating the estimates by $0.09. Twilio could add 35,000 customers YoY, from 240,000 to 275,000. DBNER or Dollar-Based Net Expansion Rate was 123%, down from 135% in the second quarter of 2021.

Just a reminder: DBNER is the dollar amount customers that didn’t leave spent one year later. For Twilio, DBNER is better than DBNRR, as it has some temporary customers, especially around elections. Politicians use Twilio to reach their potential voters but only around elections. That’s why DBNRR would not make sense. If you want to see some more explanation of the difference between DBNRR and DBNER, I have a short thread on Twitter explaining this.

This was the lowest DBNER since the coronavirus hit.

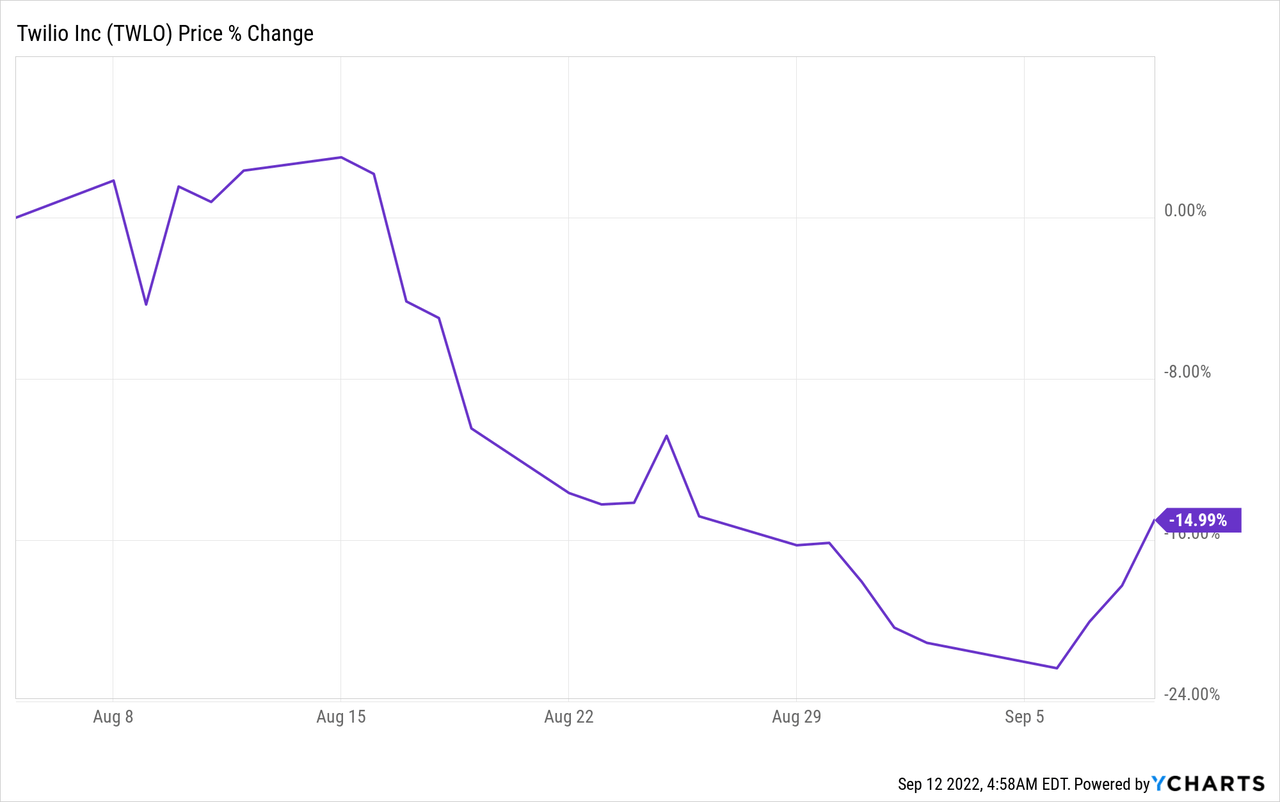

Twilio Q2 earnings slides deck

The stock took a serious beating after the earnings in early August and it was down 25% at a certain point. At this time, it’s still down 15%.

Guidance

The company has said a few times now that it guides for 30% organic growth until 2025. For this quarter, that was not a problem. But Twilio guided for organic growth of 29% to 30% for Q2 and that was probably one of the reasons the stock was dumped, as the company guided for around $970M and the consensus was $976M.

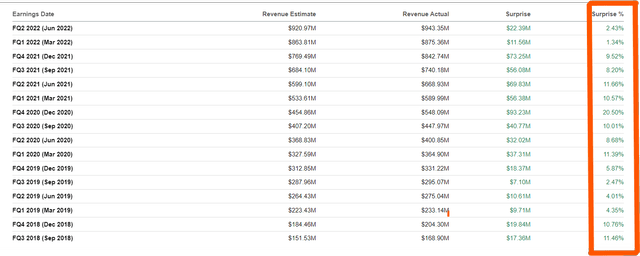

But I’m pretty sure that Twilio will keep growing above that 30% mark, as the company is a very conservative guidance issuer and it has always beaten its revenue guidance numbers and the consensus.

Seeking Alpha Premium, red box added by the author

Even if this table is too small to read for you, you can see that it’s only green in that red box that I drew.

What might have hurt the most was the EPS guidance. -$0.11 was expected, but the company guided for -$0.35. I heard several very negative comments about this and I can understand that, especially in this context. But this bigger EPS loss guidance doesn’t worry me. The reason is that it’s because Twilio takes a one-time charge for an employee program for sabbatical leaves. This charge is not a cash charge, it’s non-recurrent and nothing important in the grander scheme of things. But the market’s reaction ranged from ‘not pleased’ to ‘outraged’.

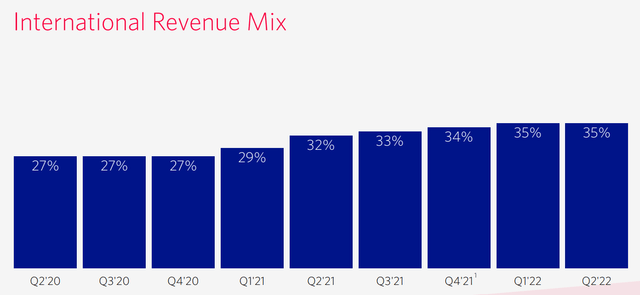

Twilio is also expanding internationally more and more, as you can see from this graph.

Twilio Q2 Earnings slides deck.

But that also means there are more headwinds of the strong dollar.

Unprofitable

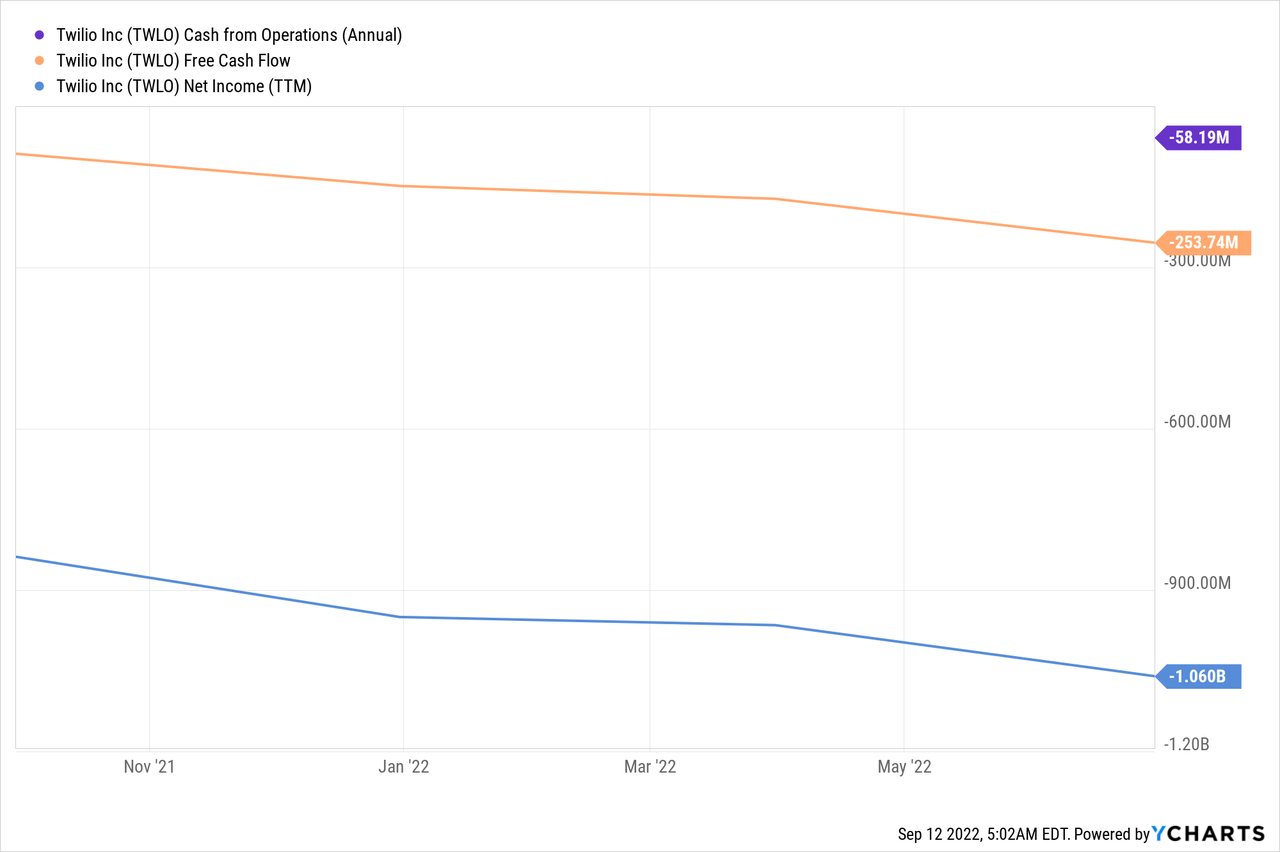

The biggest issue for Twilio might be that it’s unprofitable. In the current macroeconomic context of rising interest rates and tight credit, investors may look with a suspicious eye at this ‘money-bleeding’ company. If you look at net income, cash from operations or free cash flow, they all have one thing in common: they are negative and even worsening.

On top of that, the numbers are getting worse. Nevertheless, Twilio aims to be profitable on a non-GAAP basis in 2023. That could impact growth, of course, and that worries investors.

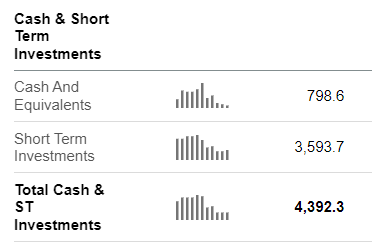

It’s not that the company will go bankrupt at anytime soon, don’t worry at all. This is from the balance sheet.

Seeking Alpha Premium

As you can see, that’s a total of cash and short-term investments of $4.4B. At the current FCF burn rate of $253.7M per year, the company could continue this for another 17 years and still have some money left. You can completely rule out bankruptcy unless the company starts to do crazy things. No worries there. The company will not run out of money and won’t have to raise at unfavorable rates.

The company has also promised to be profitable on a non-GAAP basis starting next year. In his prepared remarks, Jeff Lawson, Twilio’s founder, chairman and CEO reconfirmed this goal:

Twilio

Up to now, Twilio says it has not seen any influence of the macroeconomic circumstances, but it has factored it into its guidance and it’s also taking proactive steps like cutting on real estate.

The Future Of Twilio

Twilio for me is a very early company still. That may be surprising for a company that is expected to rake in almost $4B in revenue this year. But the thesis is only starting to play out. There is a lot of competition in the CPaaS space Twilio operates in. CPaaS stands for Communication Platform as a Service, because that’s what Twilio does.

You can simply incorporate a few lines of code, Twilio’s API, and you have a whole communications platform at your disposal, from a full-fledged call center with Twilio Flex, over Messenger, WhatsApp, or SMS-messaging to e-mail, voice and video messaging and two-factor authentication. And there’s more. For many of those markets, there’s fierce competition, but Twilio is the only one with such a wide range of solutions. The downside to intense competition is that margins are razor-thin.

The bull case for Twilio, though, is that it can offer value-added services on top of its platform, for which customers are willing to pay because it brings them extra sales, extra retention rates or both. That can best be done with Twilio’s products Flex, Segment and especially the new product Engage.

Segment is an acquisition that Twilio did and could be the key differentiator. It’s a so-called customer data platform. In other words, it gathers and unifies all data companies have from a customer. Often there is a lot of information, but it’s scattered all over the company’s channels, especially in bigger companies.

To leverage customer data even more efficiently and combine it with very targeted marketing campaigns, Twilio developed Engage, which becomes generally available later this year. It means that companies can personalize campaigns on every communication channel. This is really a game-changer, for companies but also for Twilio.

With Engage, companies can see which customers are most likely to churn and give them an extra perk or a discount. Think of the integration with Flex, the contact center platform. If someone calls and the employee in the contact center can immediately see all the products the customer has, how long he or she has been a customer, how much they have spent etc. That can make calling a contact center a completely different customer experience. This is what Jeff Lawson said in the prepared remarks about Engage:

As we continue to move up the software stack, we’ve begun to show customers how Twilio’s platform can enable both lower customer acquisition costs, as well as greater lifetime value. These are the two factors that help companies grow efficiently – and Twilio’s Customer Engagement Platform can help address both sides of the equation through better customer data, more effective marketing campaigns, more personalization, and greater automation in their service center.

The margins for Engage will also be higher. For the communication layers, Twilio has to pay other parties each time, Meta Platforms for example, in the case of WhatsApp and Messenger or the mobile carriers for phone messages.

The valuation looks attractive

Twilio has a great chance to work out well over time. Often, companies that can maintain high revenue growth for years are long-term winners. Yes, Twilio has lost money for years, but that’s often necessary for very competitive markets to fend off the competition. It’s the path that Amazon (AMZN) has shown. And with the focus much more on profitability now, Twilio could be a great buy at this moment. Of course, a lot can go wrong and that’s why there is a speculative edge but look at it from a valuation perspective.

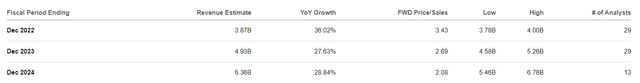

These are the consensus revenue growth projections for Twilio for the next few years:

Seeking Alpha Premium

I think these might be conservative, as the company guides for 30% organic revenue growth, and that means without acquisitions. There is one analyst projecting for 2025 already and I think he might be closer to the real number with $8.85B.

Seeking Alpha Premium

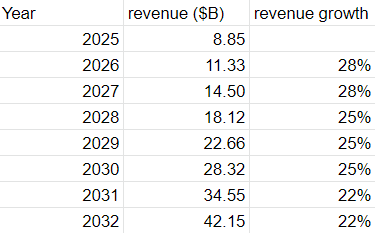

If we project forward, this is what we could see over the next decade:

Made by the author

If Twilio could get a 16% profit margin that would mean $6.75B. Slap on a 25 multiple and you get to a market cap of $168B. With a current market cap of just $13.25B, that would mean more than a 13-bagger from here. Of course, there are many moving parts here and some of my projections may be too optimistic. Valuations are always very, very subjective and that’s how you should treat them.

This valuation versus potential is also the reason why I added to my Twilio position for the first time in quite a while.

3 Cons: SBC, macro and margins

As with every investment, there are pros and cons and I don’t want to sweep the cons under the rug here. To me, the biggest con is the stock-based compensation.

Besides the fact that Twilio still has to prove that it can be profitable next year, it’s also on a non-GAAP basis. Most of that is because of stock-based compensation, SBC from here on. I don’t mind a bit of SBC but in Twilio’s case, it’s higher than I want.

This is for the first six months of 2022 and the first six months of 2021.

| Stock-based compensation | 397,366 | 281,323 | |||||||||||

That’s almost $400M in SBC over the two six-month periods. With revenue of $1.818B over the first six months, that means 21.8% of revenue is in SBC. That’s slightly down from last year, when it was 22.3%, but it’s still very high.

SBC is also the reason why I will not add too much to my Twilio position, just a few shares here and there. I want to see it go down faster than over the last year. Often high SBC is tied to acquisitions and Twilio has had quite a few, but usually, SBC is limited in time with acquisitions. So, let’s hope this is the case for Twilio too.

The macroeconomic context may also be a headwind for Twilio. Up to now, it says that it has not seen any impact. This is what Elana Donio, Twilio’s President of Revenue said:

Twilio

We continue to see strong demand for our portfolio of products that make up our customer engagement platform, and overall our business has remained resilient, though we have seen some limited, recent softness in areas such as crypto, consumer on-demand and social, plus some instances of longer sales cycles. Given our diverse customer base, use cases, and verticals served, this has not had a material impact on our overall business, and we’re seeing increased demand in other areas such as Financial Services and Information Technology.

The company doesn’t think a bad economy would be a big hit:

As our customers work to navigate the current macro environment, we’re providing them the basis to grow, to save, to connect, and to transform. This works well in good economic times, but in challenging times, it becomes even more essential.

The company has taken proactive measures nonetheless.

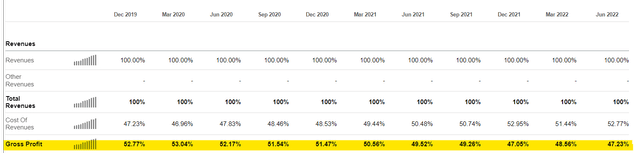

The third con is in the gross margins, which are going down.

Twilio’s 10-Q

The reason is international growth. Twilio’s customers often use Twilio’s text messaging solutions first but those have lower gross margins. So, once more, this is a sign that it’s still very early for Twilio and I see this as the least concerning con.

Conclusion

To me, the fundamental thesis for Twilio has not changed. The stock has dropped like a rock, but this has more to do with the macroeconomic circumstances and the resulting investor sentiment change than with the fundamental thesis for the company.

There are definitely risks associated with Twilio, but for me, there is no reason to sell (unless you want that for tax reasons) and I will add to my position cautiously over time, as long as I see the company do what it should do.

In the meantime, keep growing!

Be the first to comment