Drew Angerer

For experimental brands that relied a lot on the hype for both success in business fundamentals as well as in the stock market, the current recession is proving to be a severe winnowing fork. This is especially true of Beyond Meat (NASDAQ:BYND), the plant-based protein company that had a brief moment in the sun pre-pandemic, but has struggled with a variety of issues since then.

During COVID, Beyond Meat blamed its growth issues on the closure of restaurants, sales to which make up roughly a third of the company’s revenue. Through this year, the company is blaming the recession for pinching consumer wallets and preventing them from trading up to pricier plant-based proteins. The net of the issue is: over the past few years, Beyond Meat seems to have lost vast popularity as a brand and meal alternative.

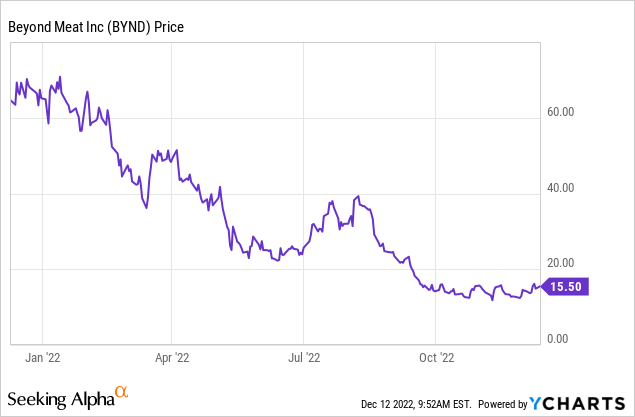

Its stock reflects that reality. Year to date, shares of Beyond Meat are down more than 70%. After a temporary recovery rally in late summer, shares have spiraled downward again, especially after the company’s recent dismal Q3 earnings release.

I remain bearish on Beyond Meat. I wrote in August that the company’s rally was unlikely to be sustained and was probably nothing more than a dead cat bounce. Since then, and after the company’s Q3 earnings release, more bad news has slid in that underlines the reasons why:

- Revenue declines are worsening, owing to a combination of factors: a reduction in pounds sold, strategic price declines that seemingly haven’t produced volume lifts, and FX headwinds overseas

- Gross margins continue to be negative, even after adjusting for one-time write-downs: which makes us wonder if the business is sustainable at the current prices that the company set to drive volume

- Liquidity looks pressured, with little more than a year’s cash left on the balance sheet (plus a load of debt)

And the coast likely isn’t going to clear up anytime soon. Consensus for 2023 is calling for Beyond Meat’s revenue to decline -1% y/y (data from Yahoo Finance), and it also continues to be unclear how the company plans to handle tightening cost pressures and turn its margin story around.

The bottom line here: I don’t see any catalysts, either in the near or long term, that can rescue Beyond Meat from its current situation. Steer clear here and invest elsewhere.

Q3 continues Beyond Meat’s tale of woe: sharpening revenue declines and deep red ink

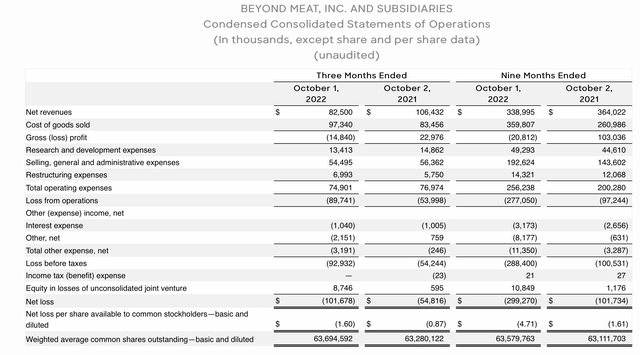

Let’s now go through Beyond Meat’s latest quarterly results in greater detail to isolate the issues the company is facing. The Q3 earnings summary is shown below:

Beyond Meat Q3 results (Beyond Meat Q3 earnings release)

Beyond Meat’s revenue declined -22% y/y in the quarter to $82.5 million, missing Wall Street’s expectations of $84.6 million (-20% y/y) and decelerating severely versus a -2% y/y revenue decline in Q1.

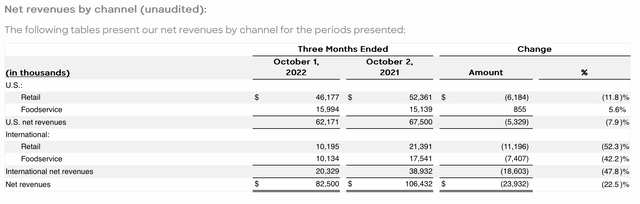

Looking at these trends by channel unveils additional insights. Beyond Meat’s international business, at a -48% y/y decline, is feeling sharper pain than in the U.S. which is seeing revenue decline at -8% y/y: but that’s also owing to FX translation losses due to the strengthening dollar. Within the U.S., foodservice/restaurants are performing slightly better with 6% y/y growth in revenue, while retail/grocery is declining -12% y/y.

Beyond Meat revenue by channel (Beyond Meat Q3 earnings release)

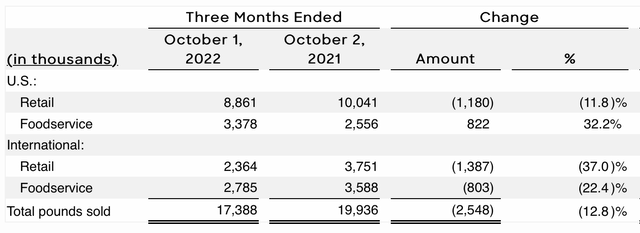

Thanks to the fact that Beyond Meat actually discloses sales by pound, however, we can unearth some more trends. Total pounds sold in the quarter declined -13% y/y, with the one bright spot being U.S. foodservice at 32% y/y growth to 3.4k pounds:

Beyond Meat sales by pound (Beyond Meat Q3 earnings release)

When we take a step back from this and recognize that U.S. foodservice revenue is only up 6% y/y however, we have to do some quick napkin math: revenue per pound in this channel is down to just $4.73, versus $5.92 in the year-ago: a -20% y/y decline.

We’ve known for quite some time that Beyond Meat has slashed its pricing and reduced trade discounts in an attempt to salvage volumes. But it seems that even with this deep discounting in the foodservice channel, the company is only able to produce single-digit growth in revenue while all other channels are still declining sharply y/y.

The impact to gross margins as a result of this price discounting is even more telling. Gross margins in Q3 were -18%. Even after accounting for the fact that nine points of this margin decay were due to a one-time write-down due to a co-manufacturing agreement termination (primarily relating to Beyond Jerky, a product that the company has failed to get off the ground), we find that the company’s underlying ~-9% gross margin to be unsustainable.

Management painted a rather bleak picture of the macro environment for the plant-based meat category, which continued to lose market share in Q3. Per CEO Ethan Brown’s prepared remarks on the Q3 earnings call:

With persistent and 40-year record inflation in grocery stores, shoppers are seeking to dial out inflation by among other measures, switching out higher-cost proteins for lower-cost proteins, whereby, declines, spam rises and so on. And while these items are on either end of the continuum, consumers are trading down throughout, generally from higher-cost beef and pork items to lower-cost chicken.

In this environment, the category in Beyond Meat should be expected to see declines as consumers flock to cheaper proteins. Correspondingly, household penetration for the plant-based meat category according to numerator data, slipped for a second consecutive quarter falling roughly 20 basis points versus second quarter of 2022. Recall that Q2 saw the first sequential decline in household penetration for the category since at least Q1 of 2018, which is as far back as the dataset goes.

Finding trend in household penetration holds true for us and most of our peers as well, and we have seen some brands significantly retrench or exit the category altogether in the US. Despite the category slowdown, there has been a tremendous increase in the number of competitive entrants and activities. As we have maintained, we believe that healthy competition within plant-based meat is a good thing as it brings investment in marketing to the category.

However, in the current environment, we are not seeing this benefit of competition; instead more companies are pursuing the same or fewer consumers. Though, we remain the category leader in refrigerated plant-based meat, the volume of competition has eroded some of our share.”

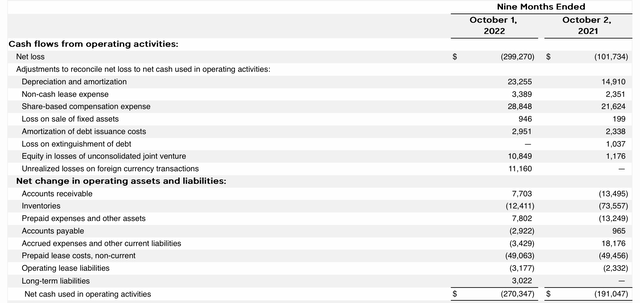

We also need to a keep a close eye on Beyond Meat’s liquidity. Year to date, the company has bled through -$270 million in operating cash flows (-$330 million in free cash flow after accounting for $60 million in capex):

Beyond Meat cash flow (Beyond Meat Q3 earnings release)

Meanwhile, its Q3 balance sheet only has $390.2 million of cash left (against $1.13 billion of convertible debt, which fortunately for Beyond Meat is not due until 2026). Even after accounting for the fact that Beyond Meat announced layoffs in October that account for 19% of operating expenses, it’s difficult to see Beyond Meat turning itself around without an answer for its negative margins and continued revenue decay.

Key takeaways

Beyond Meat is facing a slew of problems that are incredibly difficult to solve: declining interest and consumer enthusiasm for plant-based meats, price discounting that is insufficient to turn trends around and is eroding gross margins, and a tightening balance sheet that will likely require a near-term capital raise. Don’t try to catch the falling knife here.

Be the first to comment