Sundry Photography

When Is Palo Alto Conducting A Stock Split?

Let’s begin with some news you can use and then get down to the serious business: Palo Alto Networks (NASDAQ:NASDAQ:PANW) will execute a 3:1 stock split Tuesday, September 13th, 2022. Investors will receive two additional shares for each one owned, and the stock will begin trading “split-adjusted” on September 14th.

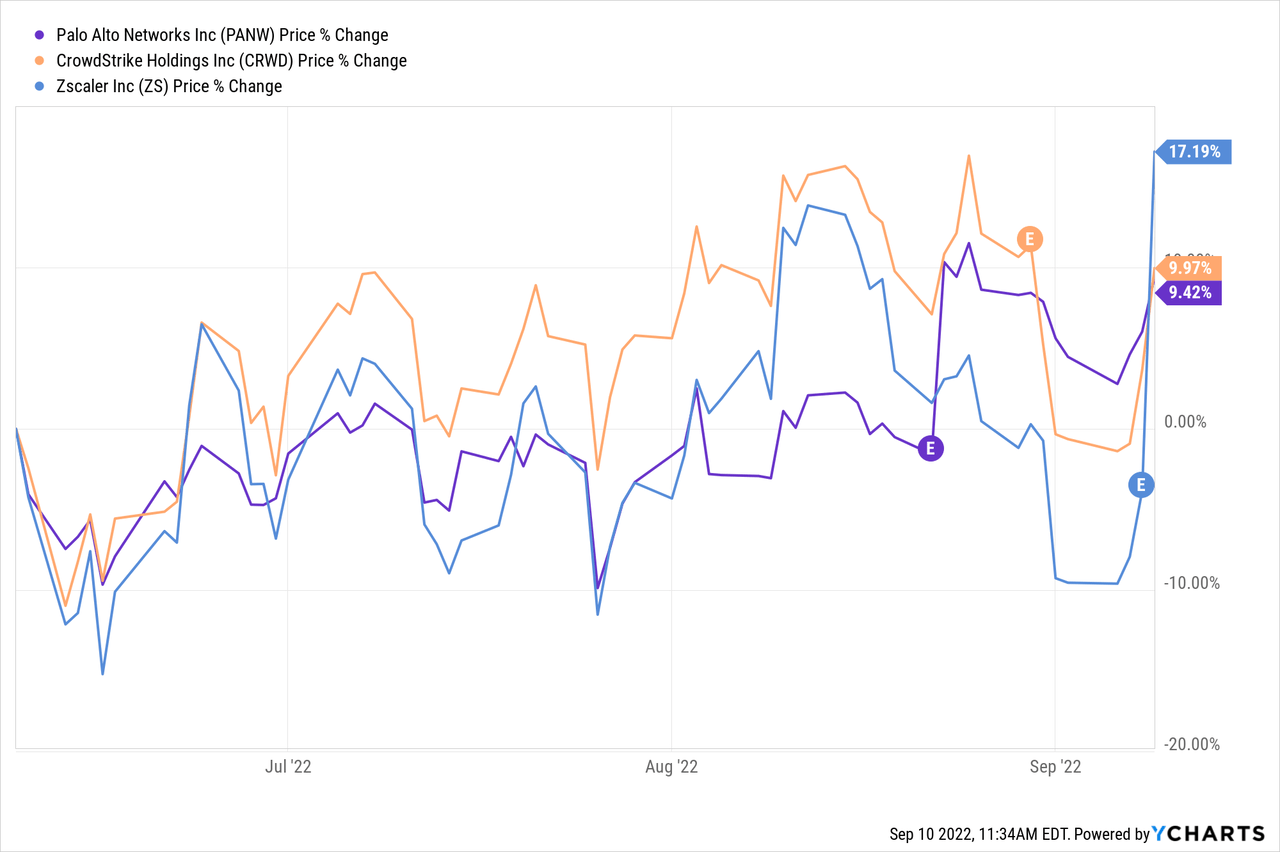

Based on Friday’s close price, the stock will trade for about $188 per share. The stock has been buoyed lately by its quality earnings reports, followed by CrowdStrike’s (CRWD) impressive report, which I covered here, and Zscaler’s (ZS) equally fantastic earnings, as shown below.

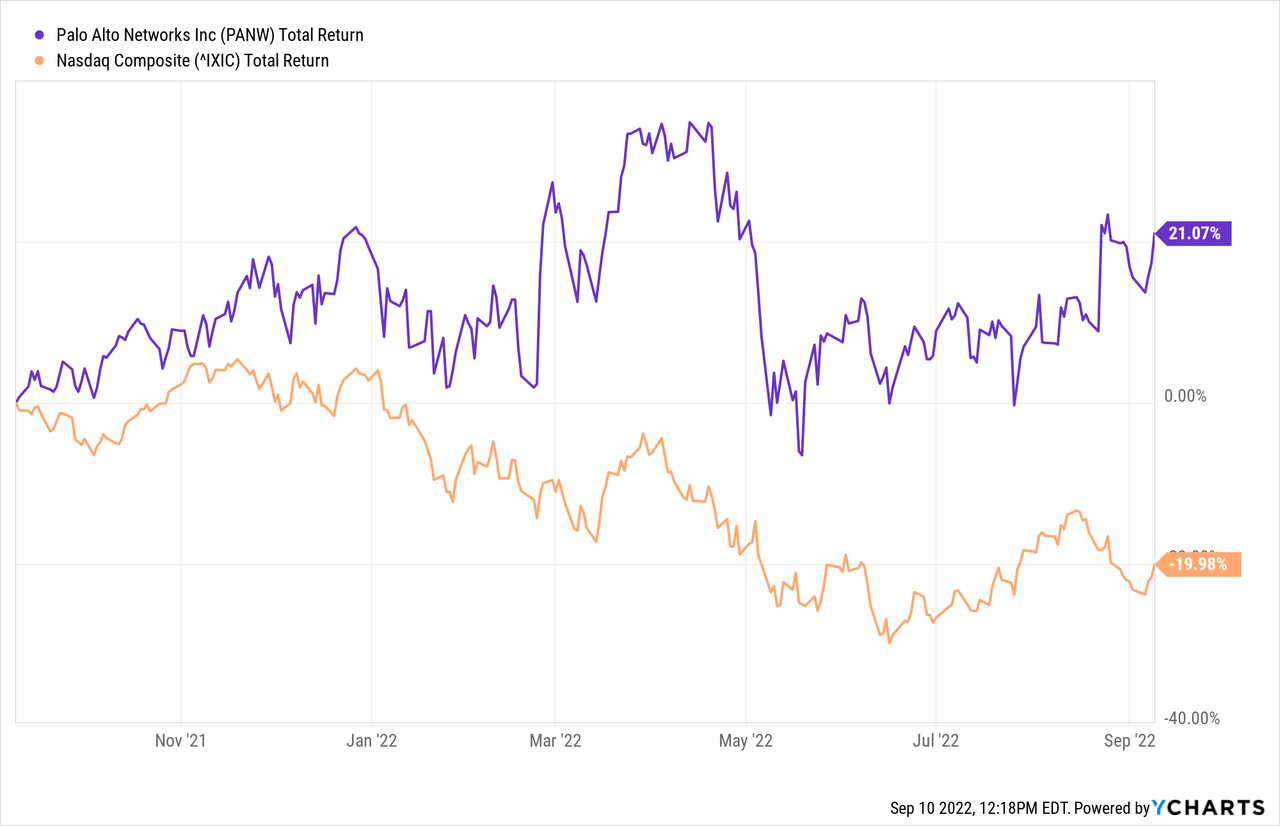

Palo Alto and CrowdStrike have trounced the Nasdaq this year, although only Palo Alto is up year-to-date (YTD).

Palo Alto reported earnings for Q4 and full-year fiscal 2022 on August 22, and the results were sneakily fantastic.

The repeated outperformance explains how the stock has bested the Nasdaq by over 20% YTD and 40% over the last year, as shown below.

The string of impressive earnings reports illustrates the strength of the entire cybersecurity market. The market is thriving, and needs are increasing. Attacks are so commonplace that they barely register as headlines these days, but they are top of mind for IT departments and C-suite executives.

Last week, the Los Angeles Unified School District and the parent company of Holiday Inn and Regent hotels, InterContinental Hotels Group (IHG), were hit. Both caused disruption, but were not catastrophic.

The cybersecurity industry is expected to grow at a compounded annual rate of over 13% through at least 2027 (and likely well beyond) because of the constant vigilance that companies and governments need.

Are Stock Splits Good For Shareholders?

Stock splits matter very little to a stock’s performance in the long run. However, here are a couple of positive effects:

- Splits keep shares more affordable and accessible to smaller investors and the company’s employees.

- The bid-ask spread is lowered due to increased liquidity.

- It’s a great time to take a deeper look at the company, how it grew the share price, and where it is headed.

What Is The Future Of PANW Stock?

Now that the housekeeping is out of the way, let’s get down to the meat and potatoes.

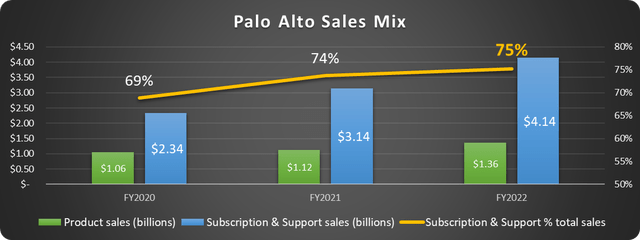

About four years ago, Palo Alto began transforming from a hardware company to a software company. At that time, its next-generation security (NGS) was less than 10% of its total billings. NGS now makes up 38% of billings, and the Prisma Cloud platform is an industry leader. Subscription and support now make up 80% of Palo Alto’s billings.

Subscription revenues are critical as they are (1) recurring and (2) predictable. The best companies on the planet, like Microsoft (MSFT), have successfully transitioned to a subscription model in recent years.

The future for Palo Alto is in cloud-based comprehensive security solutions that support customer security needs end-to-end.

Palo Alto is highly respected and trusted in the industry and reported some significant wins in Q4 FY22:

While we’ve had many large customer wins recently, I want to highlight a team in three transactions. The first is a technology company that purchased products in all three of our platforms and a transaction over $75 million in value. The second is a financial services company that standardized its network security in our platform, including adding VMs and deploying Prisma Cloud, spending north of $40 million. And third is a professional services company that spent over $75 million across Strata, Prisma and Cortex.

PANW Stock Key Metrics

There are several performance indicators that investors should watch with Palo Alto:

- Growth in next-gen security annual recurring revenue (NGS ARR).

- Subscription products mix

- Free cash flow (FCF) and FCF margin.

- Balance sheet strength

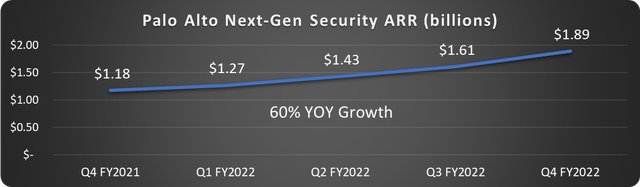

Growth in Next-Gen Security ARR

The revenue recurring annually from next-gen security is an excellent way to measure Palo Alto’s performance, as this is the key to its future success. The company posted 60% year-over-year growth in this category in fiscal 2022. As the CEO mentioned on the earnings call, this segment rivals the subscription growth rates of the up-and-comers like CrowdStrike and Zscaler.

Data source: Palo Alto. Chart by author.

Total revenue grew 29% in FY22 to reach $5.5 billion. Billings took a 44% jump in Q4 which means the strong growth should continue.

Subscription product mix

Investors should watch closely to ensure that management successfully grows recurring revenues as a percentage of total sales. The company’s future is away from products, although product sales are rising and provide a nice bonus.

The company continues to move in the right direction, as shown below.

Data source: Palo Alto. Chart by author.

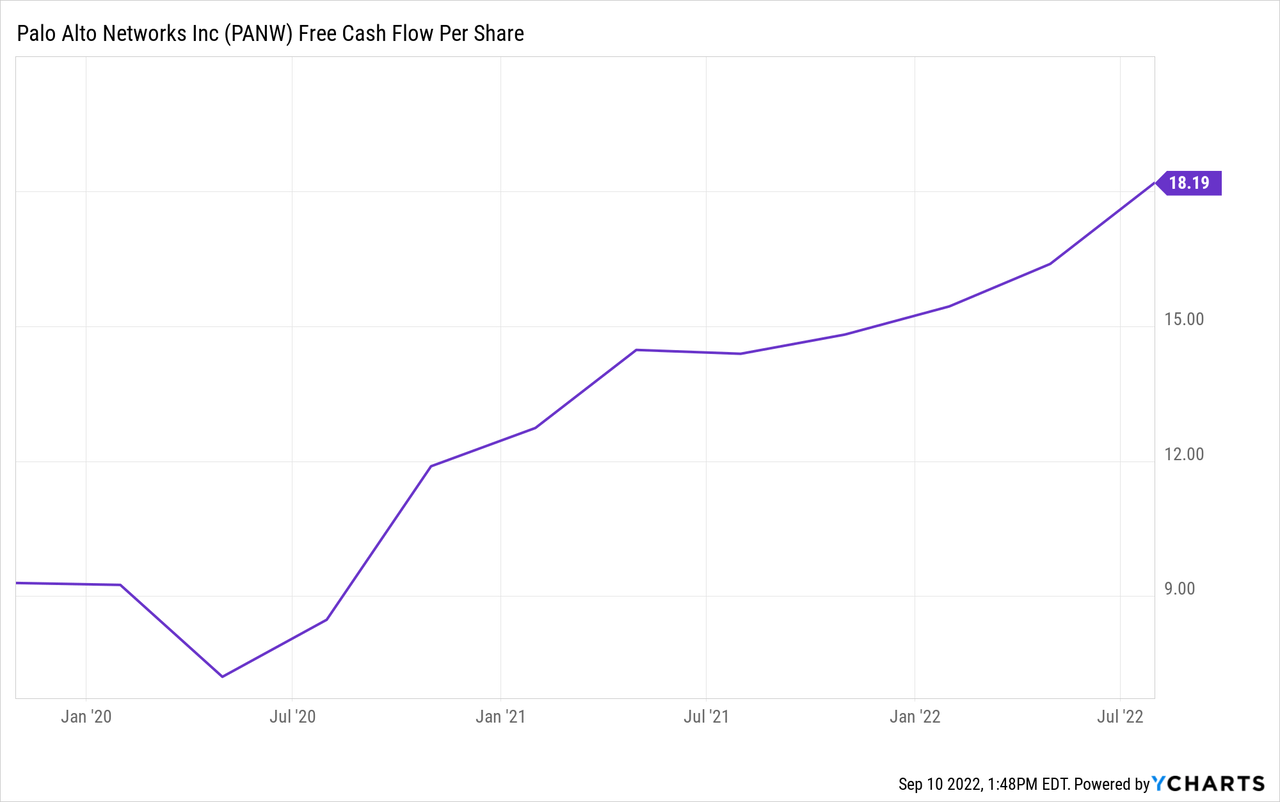

Free cash flow and margin

Free cash flow is one of the best ways to judge a growing software company. Suppose you look for GAAP earnings and traditional price-to-earnings (P/E) ratios seen in legacy industrial companies. In that case, Palo Alto and most of the cybersecurity industry are probably unsuitable for your portfolio. And that’s ok.

For me, cash flow is one of the most important metrics I look for in any investment. Palo Alto has nearly doubled its GAAP cash from operations from $1 billion in fiscal 2020 to $1.98 billion in fiscal 2022. As shown below, free cash flow per share has also risen 95% over the past three years.

Palo Alto expects its free cash flow margin to come in around 34% next year.

Balance sheet strength

Having cash on the balance sheet is essential so the company can make acquisitions without taking on too much debt and have the ability to support shareholders by repurchasing shares.

Palo Alto had $4.7 billion in cash and short and long-term investments at the end of the last quarter, an increase over the $3.8 billion at the end of fiscal 2021.

Current liabilities have also increased from $5.1 billion to $8.3 billion over that time; however, that doesn’t tell the whole story. Of the $8.3 billion in current liabilities, $3.6 billion is deferred revenue. Another $3.7 billion is for convertible notes with an interest rate under 1%, which could be redeemed and reissued. After this, accounts payable and other accrued expenses are just $988 million.

This gives the company plenty of room for tuck-in acquisitions and to use the $1 billion remaining in the current share buyback program.

Is PANW Stock A Buy, Sell, Or Hold?

Much of this will depend on the investor’s risk tolerance and timetable. Because of the uncertainty surrounding inflation, rate hikes, potential economic slowdowns, and other unknown factors, investors need to accumulate stock positions incrementally over time. This lets us take advantage of price drops and reduces the risk.

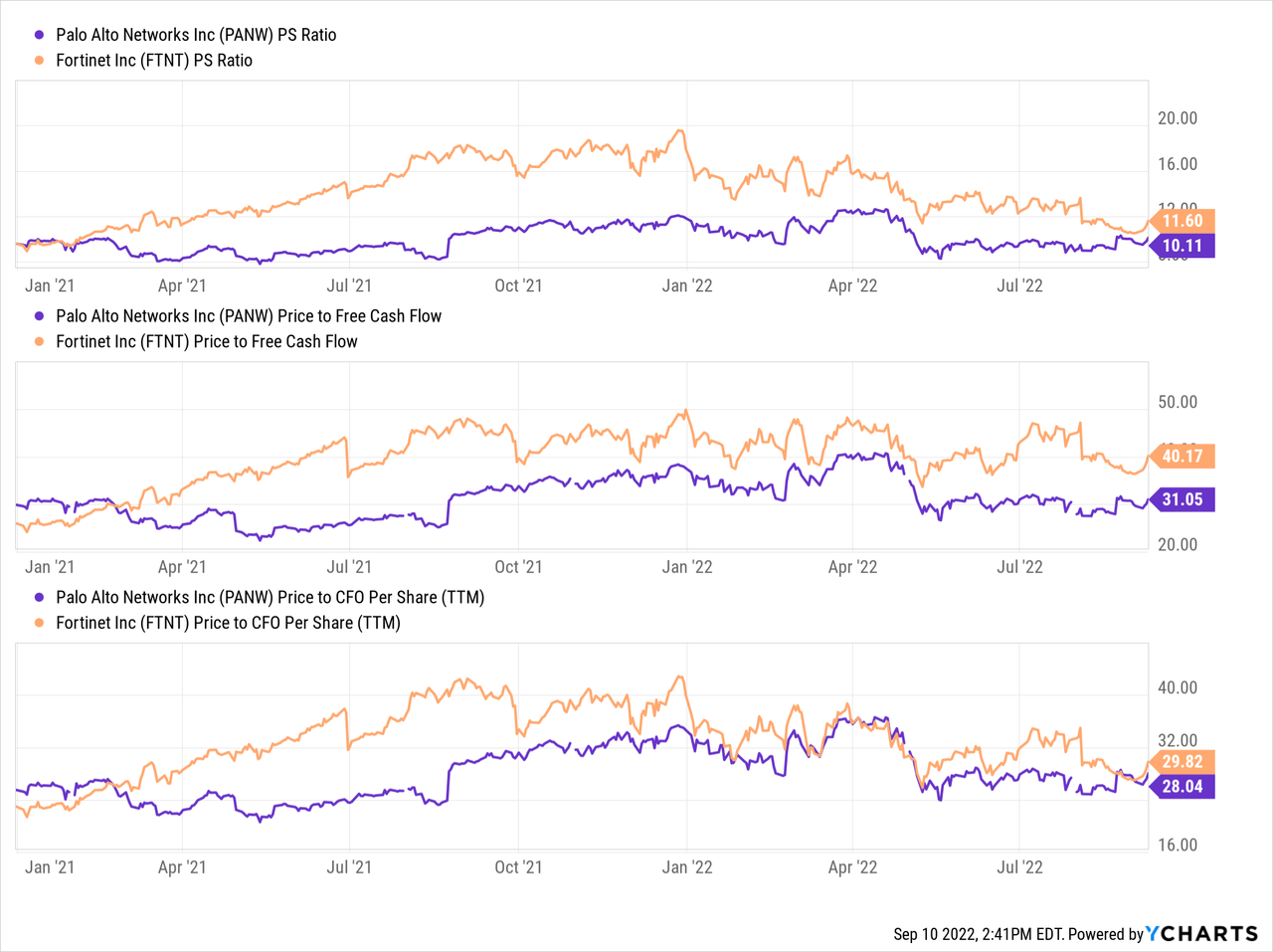

Fortinet (FTNT) is probably the best comparison to Palo Alto as it is also a mature cybersecurity company with product and service income. Palo Alto is less expensive on several ratios, as shown below.

It will probably pay off to let cybersecurity stocks take a breather after the rush of tremendous earnings reports in the short term. There could be a pullback of several percentage points after the momentum fades.

Palo Alto has all the makings of continued outperformance of the broader market in the long term.

Be the first to comment