robwilson39

Bank of America Corporation (NYSE:BAC) recently reported its second quarter earnings before the market opened on July 18. Although revenue increased on a YOY basis, the bank missed estimates for revenue and earnings. Like other banks, investment banking fees experienced massive double-digit declines while provisions for credit losses increased due to the likelihood of an upcoming recession.

On the bright side, strong consumer spending and record high deposits allowed the Consumer Banking segment to see growth and provide protection for the bank. This growth was not enough to significantly improve its efficiency ratios or ROE, but they are in the process of getting better. Overall, Bank of America’s earnings report showed it has some issues but is likely heading in the right direction. Therefore, the stock may be an attractive choice for many investors.

Bank of America’s Q2 Revenue Increased But Still Missed Estimates

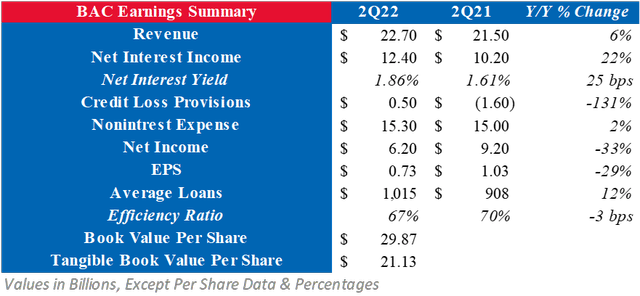

Bank of America recently reported its second quarter financials and missed estimates for revenue and EPS. The bank reported a total revenue of $22.7 billion, growing by 6% YOY but missing estimates by about 4%. This is mainly due to its net interest income growing by 22% to $12.4 billion. However, it reported an EPS of $0.73, declining by 29% YOY and missing estimates by about 3%. This is due to the bank’s provisions for credit losses increasing to $500 million, which was previously a benefit of $1.6 billion. All in all, Bank of America’s reported worse-than-expected financials and has a pessimistic view of the upcoming economy.

BAC 2Q22 Earnings Summary (Created by Author)

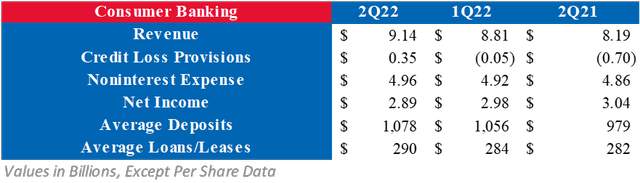

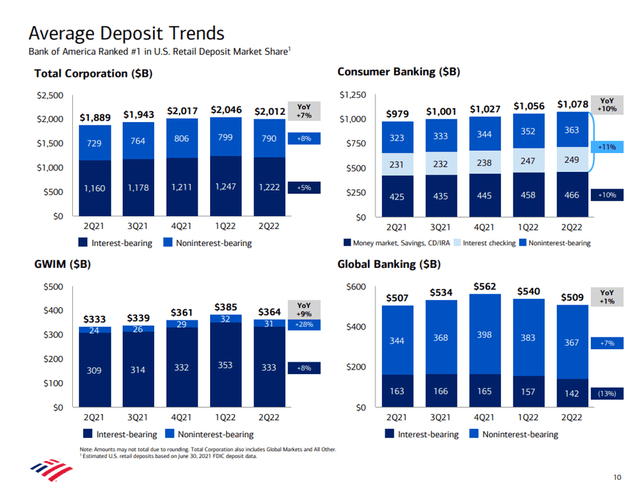

To see how Bank of America performed overall, we can look at each of its segments. Its first and largest segment is Consumer Banking, which reported revenues of $9.14 billion. This is up 3.67% QOQ and 11.61% YOY due to increasing deposits and higher interest rates. However, the segment’s provisions for credit losses were reported at $350 million which was previously a benefit of $697 million last year. This caused net income to fall 2.99% QOQ and 4.9% YOY to $2.89 billion. On the bright side, average deposits hit a record high of $1.08 trillion, up 2.07% QOQ and 10.1% YOY. This will allow the bank to earn more on interest as rates continue to rise.

Consumer Banking Breakdown (Created by Author)

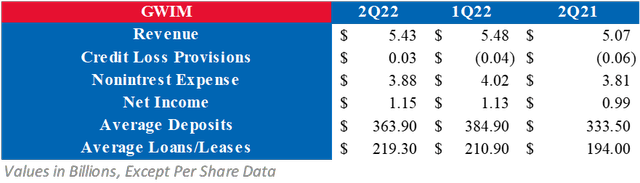

Bank of America’s next segment is Global Wealth and Investment Management and generated $5.43 billion in the second quarter. This figure is about flat QOQ but up 7.27% YOY due to higher balances and interest rates. This also allowed net income to increase 1.5% QOQ and 16.03% YOY to $1.15 billion. The segment’s average deposits were down 5.46% QOQ but up 9.12% YOY. Average loans and leases increased to $219.3 billion due to changes in residential mortgage lending and securities-based lending, marking the 49th consecutive quarter of growth for this figure.

Global Wealth & Investment Management Breakdown (Created by Author)

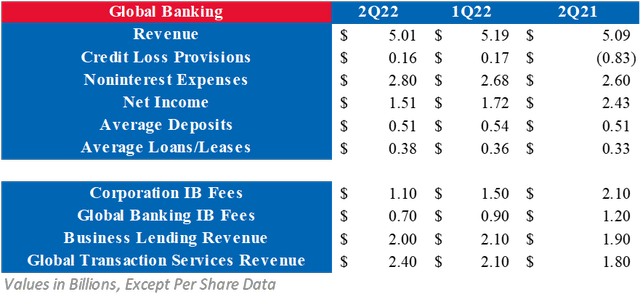

Along with other banks, Bank of America’s Global Banking segment took major hits due to the fall of investment banking. Total revenue was down 3.62% QOQ and 1.65% YOY to $5.01 billion. This is mainly due to corporation and global investment banking fees seeing double-digit declines in revenue. Namely, corporation investment banking fees fell 47.62% YOY because of lower activity caused by the bear market. Along with revenue falling, the segment’s credit loss provisions came in at $160 million, which was a benefit of $830 million in 2Q21. This drop in revenue and higher expenses caused net income to come in at $1.51 billion, lower by 12.59% QOQ and 37.86% YOY. As long as the bear market and economic downturn continue, the Global Banking segment will likely continue to struggle in upcoming periods.

Global Banking Breakdown (Created by Author)

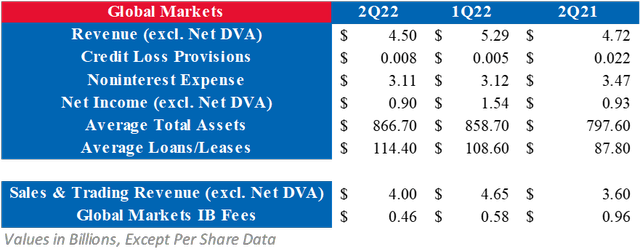

The final segment is Global Markets, which experienced a decline in revenue to $4.5 billion. Revenue from sales and trading was reported at $4 billion, lower by 14.09% QOQ but higher by 11.13% YOY. The annual growth is due to higher fixed income trading, which rose 19.08% YOY to $2.43 billion. Rising interest rates are causing fixed income investments to become more attractive, directly benefitting Bank of America’s sales and trading fees. Global markets investment banking fees experienced major double-digit declines to $460 million. Despite this growth in fixed income trading, the segment’s net income fell by 41.8% QOQ and 3.85% YOY to $900 million.

Global Markets Breakdown (Created by Author)

Along with these earnings, Bank of America set aside $200 million for regulatory fees involving its employees communicating. Last year, the SEC began investigating the big banks to see if they were properly monitoring their employees’ work-related communications. Now, it is setting an industry-wide fine to crack down on employees using personal phones and emails for communications and this is affecting Bank of America’s noninterest expenses.

Consumer Spending Remained Strong and Deposits are Hitting Record Highs

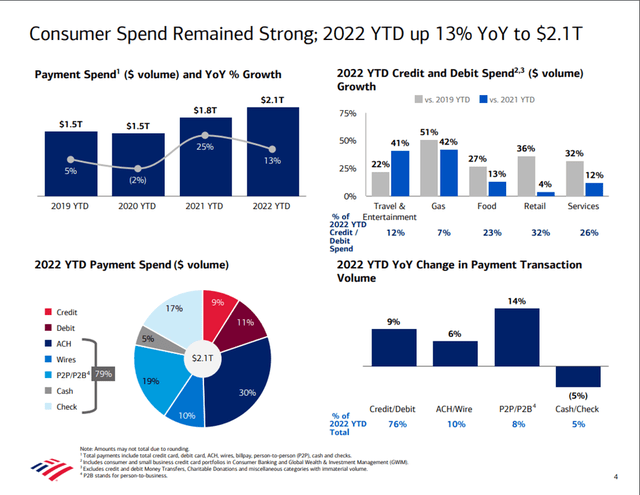

Consumer spending is a key part of Bank of America’s revenue and its health is vital to the bank’s future performance. So far this year, consumer spending has been on the rise when compared to last year. The bank’s YTD payment spend has reached $2.1 trillion, up 13% when compared to the first two quarters of 2021. Furthermore, the combined credit and debit purchase volumes have been on a steady increase. The volume increased 11.08% QOQ and 10.08% YOY to $220.5 billion in the second quarter. Both of these signal strong consumer spending for Bank of America, directly benefitting its Consumer Banking segment.

BAC Consumer Spending Data (2Q22 Earnings Presentation)

Although consumer spending is up, big ticket items are beginning to see a slowdown. The bank’s residential mortgage originations are down 11.59% QOQ and 28.57% YOY. This is due to rising mortgage rates and high home prices leading to consumers not able to afford homes. This is also the reason why the bank’s auto loan originations are flat on a quarterly and annual basis at $7.1 billion. The slowdown of big-ticket items is also a common leading indicator for recessions, which is in line with Bank of America’s buildup for credit losses. On the bright side, Bank of America is experiencing record-high deposits. This combined with higher interest rates will likely allow the bank’s net interest income to further increase, possibly protecting it from an upcoming recession.

BAC Deposits Data (2Q22 Earnings Presentation)

Bank of America Needs to Improve its Efficiency Ratio and ROE

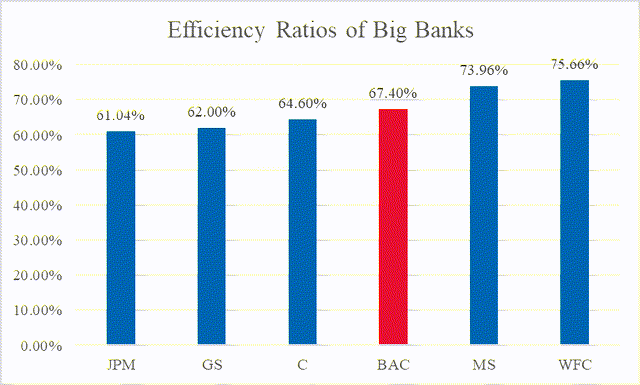

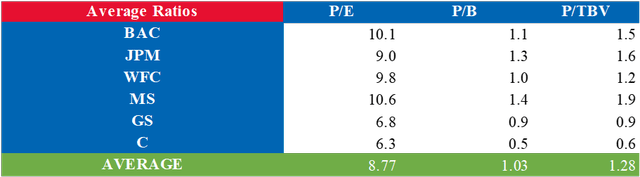

Bank of America needs to work on its efficiency ratio. In the second quarter report, the bank experienced a ratio of 67.4%. This is only better than Morgan Stanley (MS) and Wells Fargo (WFC) and has worsened by 1 basis point when compared to last quarter. However, the ratio improved by about 3 basis points since last year. The quarterly rise is due to its noninterest expense increasing by 2% Y/Y, partially caused by $425 million in regulatory expenses.

Efficiency Ratio of Big Banks (Created by Author)

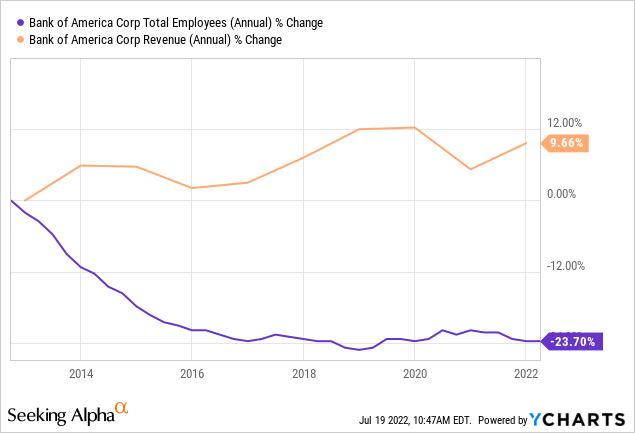

To improve its efficiency ratio, Bank of America may want to consider further reducing its headcount. After the Great Recession, it began cutting its staff to save on expenses and this also has helped improve its efficiency ratios. However, its headcount has now remained flat for about 5 years while revenue has only increased by a few percentage points. Since revenue growth may be difficult during a possible recession, laying off employees may be the bank’s only option to improve its ratio and this is already being done by other banks, including Wells Fargo.

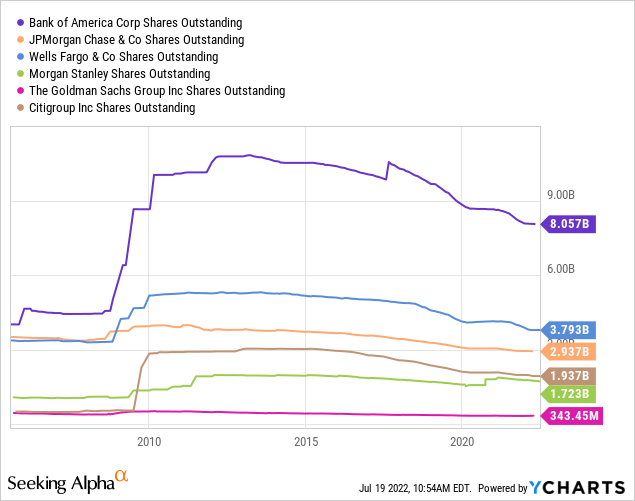

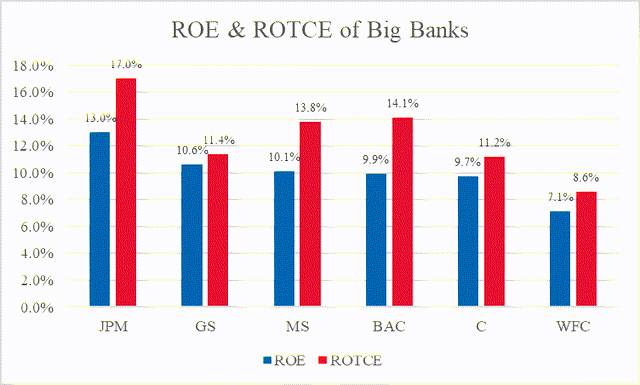

Along with its efficiency ratio, Bank of America needs to work on its return on equity. In its most recent report, the bank experienced a return on equity of only 9.9%. The reason for its low ROE stems all the way back to the Great Recession when it issued billions of new shares to stay afloat. Currently, the bank’s Common Stock line item on its balance sheet is about $60 billion and is far above its competitors, as well as its total number of shares.

This high amount of Common Stock causes its total equity to be much higher than competitors. Therefore, the bank’s net income is not able to make up for its high total equity. This leads to a lower return on equity than its peers. To improve this metric, Bank of America will need to decrease its common stock by repurchasing shares.

ROE of Big Banks (Created by Author)

Bank of America Has a Strong Buyback Program & Increased Its Dividend

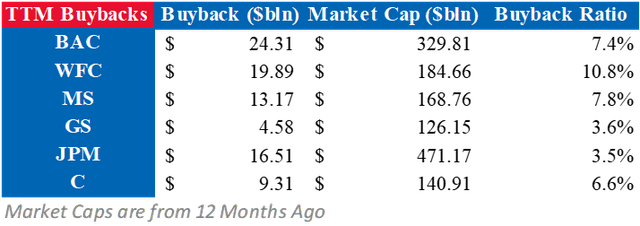

Over the past quarters, Bank of America has consistently bought back billions worth of shares to improve its efficiency ratio and return value to shareholders. Prior to this quarter, the bank repurchased about $24.31 billion worth of stock. When comparing this to its market cap from 12 months ago, a buyback ratio of 7.4% can be calculated. This is among the top of the big banks in the market and comes in second among the Big Four only behind Wells Fargo. The bank continued this trend into its second quarter by repurchasing $1 billion worth of stock.

TTM Buyback Ratios (Created by Author)

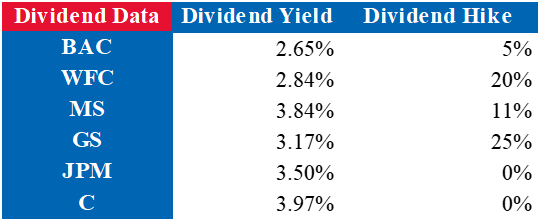

Along with its buyback program, Bank of America pays a decent dividend to investors. After the recent Stress Test, four of the biggest U.S. banks increased their dividends, and this includes Bank of America. Many investors flock towards JPMorgan Chase because of its great dividend yield. Now, Bank of America increased its annual dividend by 5% to pay a quarterly dividend of $0.22 per share. While it has the lowest yield of the big banks, it does help it become more attractive to investors.

Dividend Data of Big Banks (Created by Author)

BAC Stock Valuation

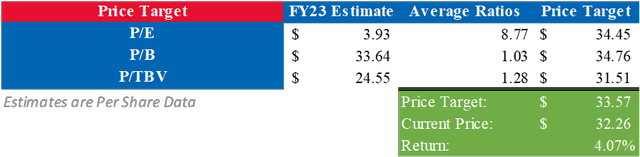

To value Bank of America stock, I created a relative valuation to compare it to its peers. By multiplying consensus analyst estimates for FY23 by the average valuation multiples for P/E, P/B, and P/TBV of Bank of America and its competitors, a fair value of $33.57 can be calculated. This implies an upside of 4.07%. On top of this, the consensus analyst price target is $42.11 and implies an upside of 30.53%.

Average Multiples of Bank Stocks (Created by Author) Relative Valuation of BAC (Created by Author)

What Does This Mean for Investors?

Bank of America recently reported its earnings for the second quarter of 2022. Although revenue increased since last year, the bank missed estimates for both revenue and earnings. This is mainly due to a severe drop in investment banking fees as well as a buildup of credit loss provisions. However, consumer spending and deposits remained strong and allowed the Consumer Banking segment to see a growth in revenue. The bank needs to improve its efficiency ratio and ROE. This can be done by cutting its staff to lower noninterest expenses, and continuing to repurchase shares to lower its total equity line item.

Although Bank of America appears to have some problems currently, it seems it is going in the right direction and is likely undervalued. Therefore, I will apply a Buy rating to the stock.

Be the first to comment