Marvin Samuel Tolentino Pineda/iStock via Getty Images

In late 2021, my employer announced they would soon expand the investment options in our 401(k) beyond target-date funds to include ETFs, stocks, bonds and everything in between. As someone who enjoys dividend growth investing, I was ecstatic.

Up until this time, I hadn’t paid much attention to my 401(k) as I never could get too excited about target-date funds. While I appreciated the company match, I wasn’t wild about a portion of my contributions going to fees and I felt uneasy buying shares of a highly overvalued market. Soon after this announcement I moved a significant portion of my 401(k) to cash.

Admittedly, once the market began to drop I struggled with analysis paralysis for several weeks. Despite having a 30-year investing horizon, I couldn’t seem to overcome the non-stop headlines about bear markets, recessions and building up cash.

I finally decided to set a goal for my 401(k) and establish some guardrails (reminders) for investing in a down market.

Goal: The goal for my 401(k) is to build a portfolio that produces a consistent stream of income that rises each year regardless of fluctuations in market values.

Guidelines: Here are some simple guidelines I put in place for putting cash to work in this market:

- Buy high quality, credit worthy companies that have a history of raising their dividend each year.

- Purchase companies with good earnings, low payout ratios and strong dividend track records. A businesses ability to continue paying their dividend is just as important as their quality.

- Once you’ve done your homework and determined a quality company is at a good valuation, buy it. You can’t time the market, so stop waiting around for hero prices. Cash will only get eaten away by inflation.

- If you’re worried about price drops, plan to make multiple buys until a full position is reached.

- Focus on share count and rising income instead of market value. If you’re constructing a portfolio that compounds, there’s no better time to buy than when prices are falling. As Chowder said, “The market doesn’t take shares or income away, only perceived values. Perceived values don’t pay the bills, real cash (dividends) do.”

- Rarely, if ever, sell. By far, my biggest mistakes in investing have been selling. Set the dividends to reinvest and leave your portfolio alone so it can compound.

Valuation: There are many aspects that make up the valuation puzzle and each investor must ultimately decide if a company is a good buy based on their objectives. Like any investor, I want to buy shares at attractive valuations and here are a few things I look for:

- steady growth in earnings and cashflow

- EPS yield over 6%

- PE ratio below the multiple the market normally assigns

- current dividend yield greater than the 5-year average dividend yield

- high dividend safety scores

Purchases

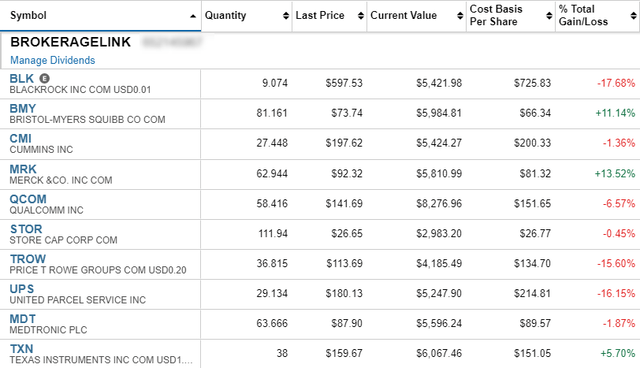

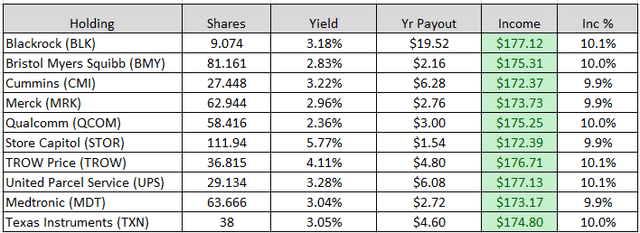

Below are the 10 stocks I’ve purchased so far in my 401(k) (as of 7/18/22 market close) with commentary on why I selected them:

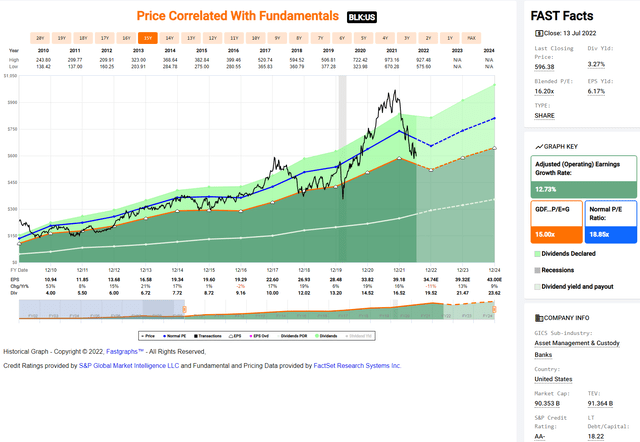

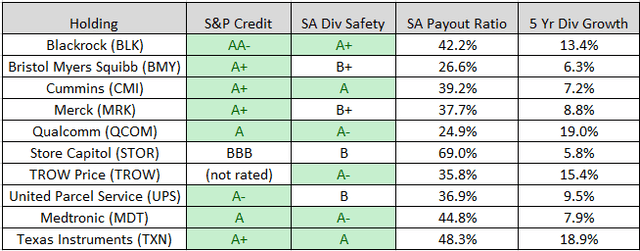

BlackRock – BlackRock (BLK) is the world’s largest asset manager and is one of the highest quality companies you can buy as evidenced by its AA- credit score from S&P and Wide moat rating from Morningstar. BLK has low debt, a payout ratio in the low 40s, and has grown its dividend by 13.4% for the past 18 years. Seeking Alpha Quant metrics assign BLK an A+ for dividend safety.

Despite purchasing BLK four different times at a cost basis of $725, I was too early to the party. I’d like to buy more shares but won’t as I also own this company in my IRA. With a dividend yield over 3% and an earnings yield at 6%, BLK is worth considering for a DGI portfolio.

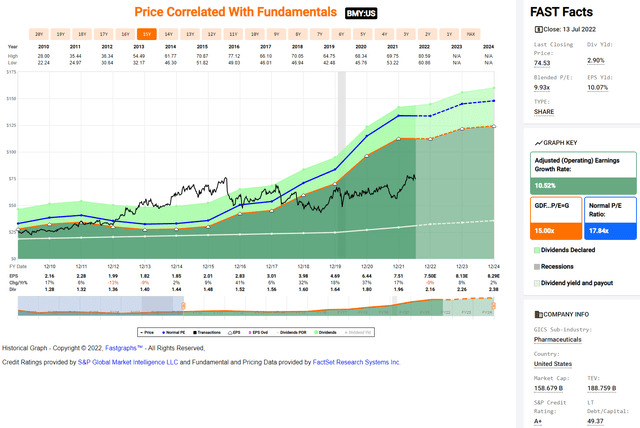

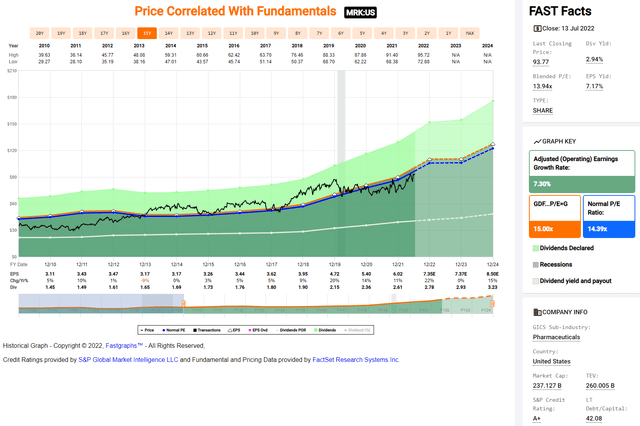

Bristol-Myers Squibb – Bristol-Myers Squibb (BMY) is a pharmaceutical company with an A+ S&P credit rating and a Wide moat by Morningstar. The stock has been out of favor for quite some time as the Market seems less than thrilled with BMY’s M&A debt and patent loss from Revlimid. However, BMY has strong cashflows and a robust pipeline from its recent acquisitions and should do well for long term investors.

I bought BMY multiple times at a cost basis of $66. A low payout ratio (26%), 15 years of dividend growth, and a Seeking Alpha Quant grade of B+ for dividend safety indicate this stock should be able to pay a rising dividend for years to come.

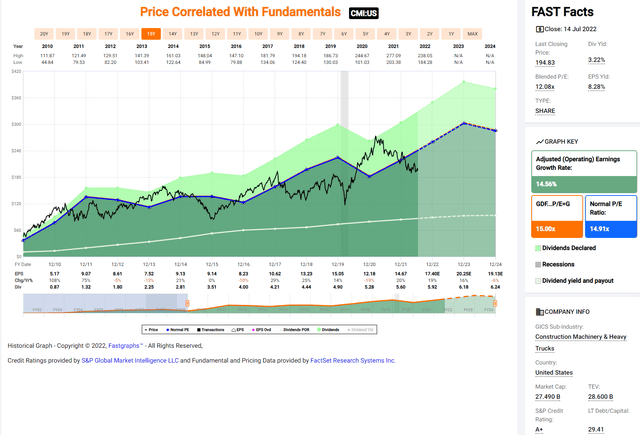

Cummins – Cummins (CMI) is a 102-year-old industrial name well known for its diesel and natural gas engines that has low debt, an A+ credit score from S&P, and a Narrow moat from Morningstar. Even with supply chain issues and a possible recession on the horizon, CMI just raised its dividend 8.3%. This is exactly the kind of company I’m looking to buy.

CMI maintains a payout ratio just under 40, and received Seeking Alpha Quant scores of A for both dividend safety and dividend growth. With a dividend yield over 3% and an earnings yield at 8%, I was content to buy shares at a cost basis of $200.

Merck – Merck (MRK) is a top-quality healthcare company that’s been producing medicines, vaccines and animal health products for over 100 years. MRK has an A+ credit score from S&P and Morningstar awards MRK a Wide moat. MRK is heavily reliant on sales from Keytruda which is why they’ve taken a recent interest in purchasing Seagen (SGEN).

Seeking Alpha Quant metrics assign MRK a B+ for dividend safety and an A for dividend growth. MRK has grown its dividend by 8.8% for the past 12 years and has a low payout ratio (38%). I bought MRK twice with a cost basis of $81.

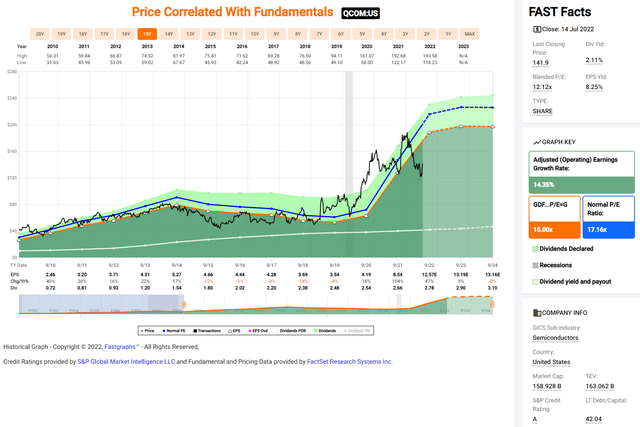

Qualcomm – For years many considered Qualcomm (QCOM) just a chip supplier for wireless phones, but today they’re at the forefront of most major tech trends. QCOM’s licensing business gives it strong cashflow which it has used to establish strong positions in IoT, RFFE and Autos.

QCOM is A rated by S&P, has raised their dividend for 19 years and maintains a low payout ratio (25%). Seeking Alpha Quant metrics assigns them an A- for dividend safety and A+ for dividend growth. This company is growing fast, has high margins, and its shares are cheap at the moment. I bought QCOM multiple times at a cost basis of $151.

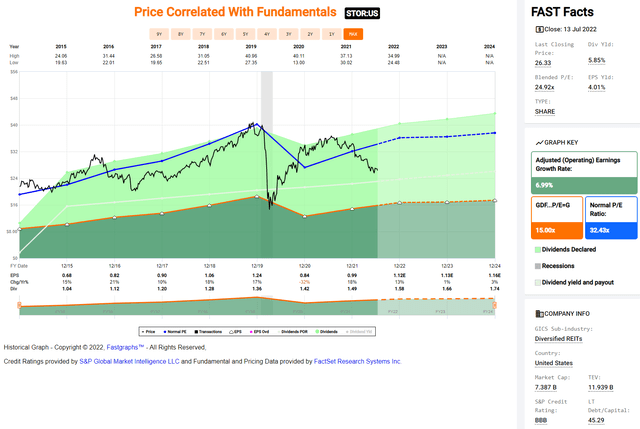

STORE Capital– According to the Q1 2002 Investor Fact Sheet, STORE Capital (STOR) is a diversified, triple net lease REIT with 2,965 properties in 49 states. STOR has seen a 24% decline YTD in its share price and even though it beat estimates and raised guidance the stock price remains low.

Seeking Alpha Quant metrics give STOR a dividend safety score of B. With a low payout ratio (69% is low for REITs), a dividend yield of 5.8% and a 5-year dividend growth rate just under 6%, I was glad to add shares at a cost basis of $26.

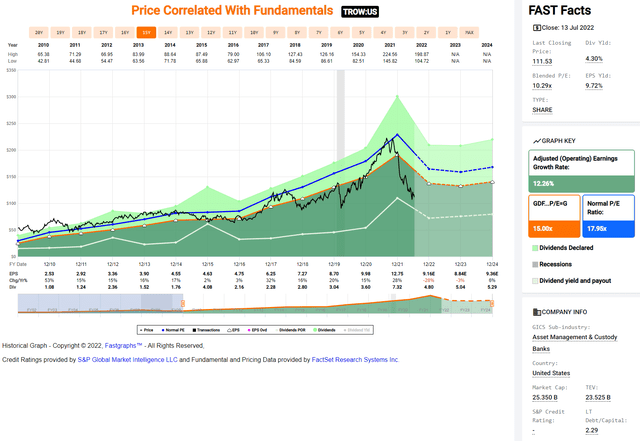

T. Rowe Price – T. Rowe Price (TROW) is another high-quality asset manager scoring a Wide moat rating by Morningstar. The company carries so little debt that it is not rated by S&P. TROW has raised its dividend for 36 years in a row and has a 5-year dividend growth rate of 15%. Seeking Alpha Quant metrics assign TROW an A- for dividend safety and A+ for both dividend growth and consistency. TROW’s payout ratio is a low 36%.

Similar to BLK, TROW is taking a beating because its Assets Under Management have dropped along with the market. I bought TROW multiple times at cost basis of $134 and I am confident this compounder will come back when the market does.

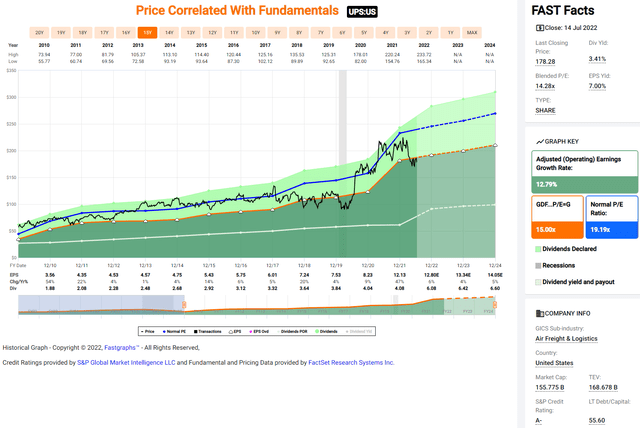

United Parcel Service – United Parcel Service (UPS) is the world’s largest package delivery company and with ecommerce and global consumption on the rise, we’ll most likely be seeing more of their large, brown trucks zooming through our neighborhoods.

UPS has grown their dividend for 22 years and in February, they raised it by 49%. Despite that large raise the payout ratio is only 37%. UPS is A- rated by S&P and has a Wide moat rating by Morningstar. Seeking Alpha Quant metrics assign them a B for dividend safety and an A+ for dividend growth. I bought UPS four times at a cost basis of $214. Today’s buyers can get shares at an EPS yield of 7% and a dividend yield over 3%.

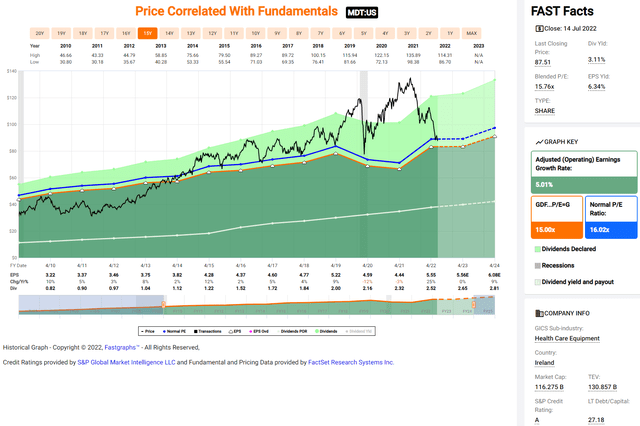

Medtronic – Medtronic (MDT) is a global manufacturer of medical devices and it’s business has been solid for years. It’s A rated by S&P and has a Wide moat rating by Morningstar. MDT has increased their dividend for 45 years and their 5 year dividend growth rate is 8%. Seeking Alpha Quant metrics give them an A- for dividend safety and an A+ for dividend consistency.

This stock has natural tailwinds due to an aging global population and is such high quality that I also own it in my IRA. For me, MDT was a buy when its dividend yield hit 3%. I bought shares at a cost basis of $89.

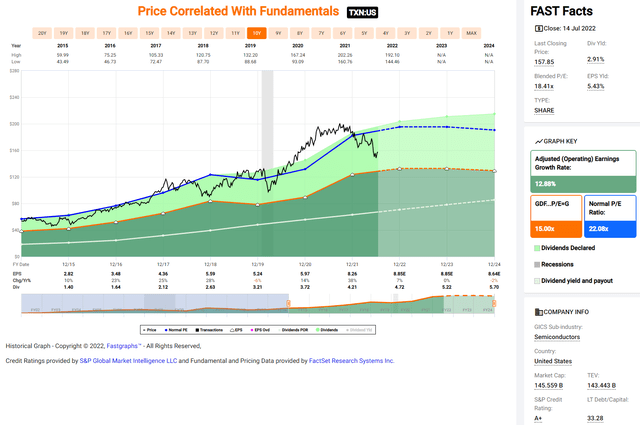

Texas Instruments – Like BLK, Texas Instruments (TXN) is one of the highest quality compounders you can buy as evidenced by its A+ credit score from S&P and Wide moat rating from Morningstar. TXN has a payout ratio of 48% and has grown its dividend by 19% for the past 16 years. Seeking Alpha Quant metrics assign TXN an A for dividend safety and A+ for dividend growth.

I purchased TXN multiple times at a cost basis of $151. While not a screaming buy, TXN’s dividend yield of 3% is above its historical average and dividend investors may want to consider adding this quality name to their portfolios.

Portfolio Commentary

Overlap: I already own shares of BLK, TXN, MDT and QCOM in other portfolios but these are financially strong, excellent businesses that can grow their dividend and I don’t mind purchasing them again. BMY, CMI, MRK, STOR, TROW and UPS are not in any of my other portfolios.

GICS Sector Allocation: As you can see below, sector allocation needs improvement and I will attempt to make future purchases in sectors that are absent (Energy, Utilities, Materials, Consumer Staples, Consumer Discretionary and Communication Services). Here’s the current breakdown:

- Healthcare: BMY, MRK, MDT

- Financials: BLK, TROW

- Technology: QCOM, TXN

- Industrial: CMI, UPS

- REIT: STOR

Quality: BLK, BMY, CMI, MRK, QCOM, UPS, MDT and TXN are excellent quality companies with A or better S&P Credit Ratings and economic moats. TROW is also excellent quality but is not rated by S&P as they carry so little debt. STOR is the lowest quality company in the list with no moat and an investment grade rating of BBB.

Sustainability: QCOM, BMY, CMI, TROW, UPS and MRK have payout ratios under 40% and BLK, MDT and TXN under 50%. STOR’s payout ratio of 69% is low for a REIT. Seeking Alpha Quant metrics assigned 8 out of 10 companies a B+ or higher by for dividend safety.

Cost: Total cost to purchase the shares of 10 companies above was $57,103.

Income: Previously, my 401(k) produced $0 income and charged fees for me to invest in the funds. Today, my portfolio produces $1,748 in income and there are no fees for stock transactions.

Income Distribution: The number of shares purchased for each stock varies based on yield as I try to get the income fairly even across the board. Per the Income column (green), each asset generates close to $175 annually. This helps mitigate the risk of dividend income being too heavily concentrated in only a few names.

Dividends per Yr: $1,748

Yield: 3.1%

Looking Ahead

This article highlighted the first 10 dividend-paying stocks I purchased as I begin to transition my 401(k) into a portfolio that compounds. While many of the stocks I bought may drop further with the market, I have a 30-year investment horizon and I am confident in their ability to grow dividends over time.

Additionally, I am pleased my 401(k) now produces $1,748 in annual income. Prior to this transition, my 401(k) produced $0 in passive income and I paid fees to invest in the funds.

In future articles, I hope to highlight additional stocks I’ve added to this portfolio. The allocation across sectors needs improvement, and I will look to make future purchases in sectors that are currently absent: Energy, Utilities, Materials, Consumer Staples, Consumer Discretionary and Communication Services.

Thanks for reading. Please let me know in the comments what you’ve purchased lately or what’s on your watchlist.

Be the first to comment