Justin Sullivan/Getty Images News

Thesis

Investing in nonlinear stocks like Tesla (NASDAQ:TSLA) is all about anticipating nonlinear effects. Investors not only need to have the ability to see around the corner but also need to do so before most people. However, to say this is hard is simply a truism. And a “trick” I find effective in analyzing nonlinear situations is to draw analogies from another nonlinear situation. I, of course, did not invent this trick. Others have discussed it in length, and books have been written about it. A recent one that I found very readable is David Epstein’s bestseller entitled “Range: Why Generalists Triumph in a Specialized World”. Highly recommended.

Now, the art of drawing analogies lies in the range (hence the title of Epstein’s book). Drawing analogies from similar situations does not help too much. We need to draw analogies from situations with range. Citing an example from his book, if you try to analyze the new competing landscape amid M&As in a dynamic market, analyzing “similar” M&As won’t be too helpful. Most likely, there are no “similar” prior examples. It is more helpful to draw analogies from a completely different domain, for example, the power struggle of countries during a dynamic time (say Europe during the 1500s and 1600s).

Now, back to TSLA. The thesis is to analyze the current situation between its battery production and the QWERTY keyboards. Despite (or thanks to) the wide range of these two examples, you will see the central argument is that due to the lack of standardization, the battery issue potentially creates a winner-take-all situation in EV space, just like the QWERTY keyboard did in the keyboard space. Note that the thesis is not to argue if such potential is good or bad. Whether the dominance of the QWERTY keyboard is good or bad depends on your perspective and historical context. The thesis is just that there is such a potential and TSLA is one of the main contenders, thus creating an investment opportunity with enormous upside.

QWERTY Keyboard and EV Battery

A bit of background on the QWERTY keyboard first – in the off chance that some readers never paid attention to its history. The QWERTY design was designed for typewriters and became popular in 1878. It has remained in ubiquitous use since then. Before it became popular, there was a multitude of contemporary alternatives. But once it did, it dominated and became the only one left.

Now, back again to TSLA and batteries. A few key similarities here. First, the battery issue now, just like the keyboard design in the 1870s, lacks standardization and there is a multitude of alternative designs. TSLA itself has used and is still using multiple cell designs (18650, 2170, and more recently 4680), and it is unlikely that the EV industry will reach a standardization agreement anytime soon.

Second, the battery issue is crucial to the EV industry, just like the keyboard design is to the typewriter industry. We will elaborate more on the importance later.

Third, the winner does not have to be the “best” design, just like in the typewriter case. Many readers try to analyze the technical superiority of battery design A vs B. But the matter of fact is that in a highly nonlinear and dynamic market, many factors besides technical superiority contribute and convolute. Furthermore, once dominance is established, it sticks. The QWERTY keyboard in a sense is the least efficient design for modern computers, but this does not stop it from being the standard keyboard today when jamming the keys is a concern at all.

TSLA’s Battery Plan

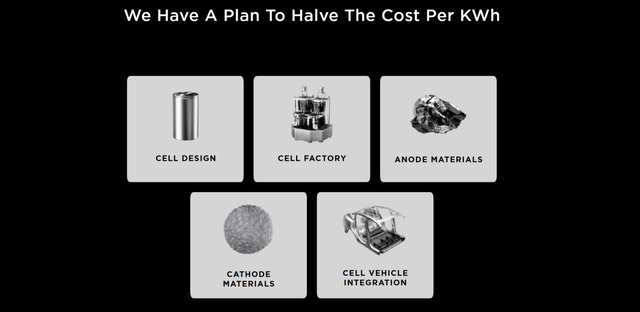

Let’s discuss the crucial role of the battery issue in the EV industry. Simply put, it is the bottleneck issue. In my view, our EV problem equals a battery problem. TSLA (and other EV players too) recognized the issue a long time ago. For example, back in its 2020 Battery Day presentation, TSLA announced a battery plan to improve design, build its own cells, and better integrate the cells into the vehicle.

Fast-forward to 2022, TSLA celebrated its one-millionth 4680 cell production earlier in the year, as you can see from the following Twitter message sent out by Elon Musk. It’s a baby step, admittedly. Each Model Y needs about 1k of these cells. So 1 million 4680 cells are only enough for about 1,000 Model Ys. But it is a good start. Because the next steps can be so nonlinear that a small step can create far-fetching ripple effects, as discussed next.

Nonlinear Effects of Battery

First, some technical background. Compared to the earlier 2170 cells, each 4680 cell is about 5x large in volume and can, therefore, hold about 5x the energy of each 2170 cell. Regarding the 4680 cells, a common comment from readers to my other battery article involves a zero-sum counter-argument. Since each 4680 cell is 5x larger than 2170 cells in volume and only delivers 5x more energy, are they not the same? In terms of material cost, manufacturing cost, weight, et al?

My answer is no because of the second-order effects. Not all the components scale equally. For example, the weight of the steel casings is less in the 4680 which would allow greater amounts of active components (it has to do with the surface area/volume ratio, a detail best left for the comment section). Furthermore, 5x more energy means 5x fewer numbers of cells used per vehicle. When the number of cells decreases, the use of connectors, assemble difficulty, and logistics all decrease. In the end, the 4680 cells can deliver 6x the power (the distinction between energy and power is again best left for the comments) and boost the driving range by 16%.

Then there are even higher-order effects and non-technical effects (well, maybe still technical, just beyond the range of battery technicalities). For example, the in-house production of 4680 cells can lead to more streamlined battery-vehicle integration. Further down the road, battery-software integration would be the next logical step toward driving range optimization and even autonomous driving.

Final Thoughts and Risks

In my view, our EV problem is a battery problem. And the battery problem has the potential to create a win-take-all situation in the EV space, just like the QWERTY keyboard did for typewriters. These two situations share many similarities: notably the lack of standardization and the convolution of many non-technical factors. TSLA’s in-house production of the 4680 cells is admittedly a small step on the battery front. But it creates the potential to trigger other high-order effects. I view it as a bullish catalyst, and it puts TSLA in a more advantageous position as a contender.

TSLA faces many risks, both in terms of its batteries and beyond.

It is currently facing supply chain constraints and rising costs (especially on raw materials and electronics for batteries). As a result, it has just announced significant increases of the prices of EVs with some models going up by as much as $6,000. Whether these price increases can work out successfully or not remains to be seen.

Economies-of-scale is a limiting factor to reduce battery costs, and TSLA’s 4680 cells have not reached this critical scale yet (far away from it). The earlier 18650 cells, for example, have taken billions of units produced to make them economically attractive to a wide range of producers and end-users.

TSLA’s vertical integration plan in the battery space also faces uncertainties and competition. On its 2020 Battery Day, TSLA announced its planned entry into lithium mining. The plan was to start with buying lithium claims on 10,000 acres in Nevada. But nothing has really happened so far (while other players including Berkshire Hathaway (BRK.A) (BRK.B) have been actively developing lithium extraction techniques and facilities). And Musk Twitted recently about “actually” getting on with this (the emphases were added by me):

“Price of lithium has gone to insane levels! Tesla might actually have to get into the mining and refining directly at scale, unless costs improve. There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.”

Be the first to comment