da-kuk

The Grayscale Bitcoin Trust (OTC:GBTC) is the flagship fund in Grayscale’s digital product portfolio. It accounts for a little over $13 billion of the $17 billion in AUM that Grayscale has in its single asset funds. Over the last couple years, I’ve covered GBTC two times. The first time was in late 2019 when I was highly critical of the fund’s management fee, marketing approach, and premium to NAV. The second time was 13 months later. The reason for writing the follow up was because I had changed my mind. That article is now a year and a half old. The setup is very different for GBTC at this point so I feel an update is warranted.

The Discount Rate

What was still a 6% premium to NAV in January 2021 when I last covered the Grayscale Bitcoin Trust is now a 30% discount. Bitcoin (BTC-USD) was $31k when I wrote that article. Down 32% since then, the price action in Bitcoin has been pretty bad. For GBTC though, it’s been even worse; down from just under $33 per share to $14. This price action also turned what had been a premium to net asset value for most of the fund’s existence into a sizable discount.

Grayscale

The discount to net asset value is now roughly 30% in GBTC shares. That GBTC discount rate is actually so steep at this point, that many of Grayscale’s altcoin funds actually have less severe discount rates than GBTC and even price premiums in some cases:

Source: Grayscale, as of 7/15 close

Two of the biggest factors driving GBTC’s price action are likely the 3AC liquidation and the SEC’s repeated denials of Grayscale’s ETF conversion application.

Three Arrows Capital Sells Out

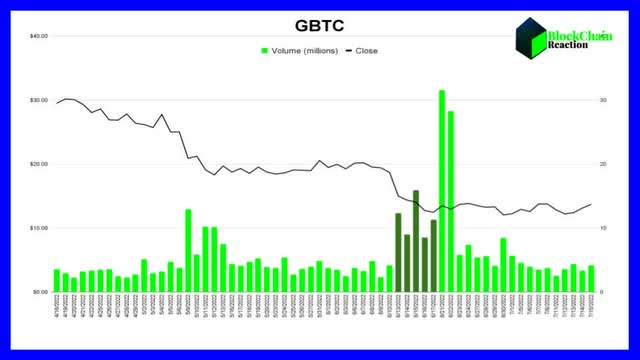

Three Arrows Capital, or 3AC, was once a very large holder of GBTC. That crypto-focused investment fund was forced to liquidate its GBTC position when the crypto market unraveled. The unwinding of what was 5% of GBTC’s outstanding shares by one entity resulted in a large increase in GBTC’s traded volume during the week of June 13th. You can see that week’s volume indicated in the chart below with a darker shade of green:

Yahoo Finance

After market close on Friday June 10th, the average daily session volume for that week was 3.7 million shares. But the following week when 3AC is believed to have liquidated its GBTC position, the average daily volume spiked up to 11.4 million shares and the price of the shares tumbled from $18.68 down to $12.47. In my weekly Digital Market Overview for BlockChain Reaction subscribers, I said this on Monday June 20th:

There was a lot of attention given to the fact that GBTC had made a new discount low late last week. Don’t be surprised to see big green candles today in the Grayscale tickers now that 3AC seems to be liquidated of its GBTC position.

While the price of the shares didn’t deviate too far from $13, after news of 3AC’s Grayscale share liquidation spread, the volume spikes in GBTC during the following week’s early sessions were enormous. June 21st and 22nd saw nearly 60 million combined shares traded. This was about 3x more than the average daily volume from the week prior and about 8x the average daily volume from the first full week in June. The 3AC liquidation was a major catalyst in that volume activity and may have been a capitulation signal to the market.

The SEC and the WSJ

The second issue that is likely exacerbating the discount rate is the repeated denials of GBTC’s ETF conversion applications by the Securities and Exchange Commission. The most recent application denial came in late June and was followed by Grayscale suing the SEC on the same day of the rejection. Grayscale believes the SEC is acting in bad faith and is exercising arbitrary application of securities law when it comes to spot Bitcoin ETFs.

Conventional wisdom suggests a spot Bitcoin ETF will help drive more safe investment demand in Bitcoin from institutions. The SEC, currently led by Gary Gensler, has repeatedly denied requests for spot ETFs but has allowed Bitcoin futures ETFs. The Wall Street Journal recently published an editorial board opinion piece about Gensler and how GBTC’s ETF conversion plans continue to be blocked by the SEC. The WSJ didn’t hold any punches in its criticism of Gensler. The editorial board started with aggressive tone right out of the gate:

Securities and Exchange Commission Chairman Gary Gensler has his regulatory eye on cryptocurrency markets, and he’s taking investors hostage in the process. That’s the best way to explain the agency’s blockade of spot bitcoin exchange-traded products, or ETPs.

The editorial also pointed out why it’s silly to have a futures ETF without a spot ETF. If accusing Gensler of holding investors hostage isn’t spicy enough, the real heat may have been in the final paragraph:

Members of Congress in both parties have sent letters to Mr. Gensler inquiring about his hold-up. Maybe they should call him to explain why he’s undermining crypto innovation and investor protections—and remind him who controls the agency’s purse-strings.

I think this is important. We now have a major financial opinion-driving publication that is calling out both a regulatory body and the chair overseeing that body. It’s a big deal and I think it adds credence to Grayscale’s polarizing decision to sort it out through litigation. We’ll see how that plays out. In the meantime, another ETF conversion has been denied and might therefore be priced in from a discount to NAV perspective.

Risks

Grayscale’s Bitcoin trust is probably one of the most risky ways to buy Bitcoin. It’s a derivative that charges a large management fee while offering no redemption and you can’t trade it outside of normal market hours. If you’re a HODLer, GBTC isn’t the way to do that. Additionally, private placement is currently closed, so as Grayscale continues to take its management fee out of the fund via BTC holding decay, Grayscale is seemingly a net seller of Bitcoin at this point in time.

GBTC total holdings declining (Coinglass)

Furthermore, Grayscale is now entering a legal fight with the SEC. That is a fight that has the potential to be both expensive and damaging to Grayscale in the eyes of US regulators.

Summary

What GBTC does offer investors is a tax-advantaged way to get exposure to Bitcoin whether it converts to an ETF or not. I personally hold GBTC shares in a Roth IRA. That means any potential realized gains on Bitcoin holdings through the shares of the fund won’t be taxed. I think that’s a strong reason to look at GBTC despite the management fee. Furthermore, if you like the fund at a small premium (as I did in January 2021), you love it at a 30% discount.

In my last article covering Bitcoin for Seeking Alpha, I made the case for why I believed the market sentiment was getting too one-sided. I still very much hold that view and believe that even if the cycle bottom isn’t in yet, Bitcoin has yet to benefit from a meaningful bear market rally since giving up $48k in March. After the liquidation of a top shareholder, I think GBTC shares at a 30% discount are a solid way to long Bitcoin for a potential rally in the spot price.

Be the first to comment