Czgur

Investment Summary

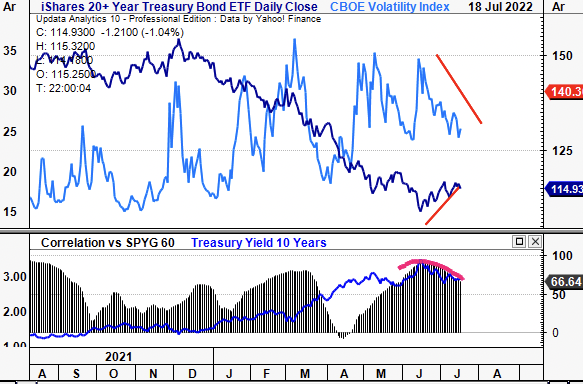

The forward-looking investment landscape is turning on a dime, the narrative constantly flustering between inflation and recession. Indeed, central banks have a delicate situation on their hands, balancing the parity between these two. Alas, the market is increasingly pricing in the risk of recession. The long end of the UST has caught a bid since June whilst the VIX has retraced from its June highs. This suggests investors are pessimistic at the short end (3-5 years) and are adding duration into portfolios to compensate, with long term looking brighter.

Exhibit 1. UST long end has caught a bid since June as investors seek duration to compensate for short-term growth

Data: Updata

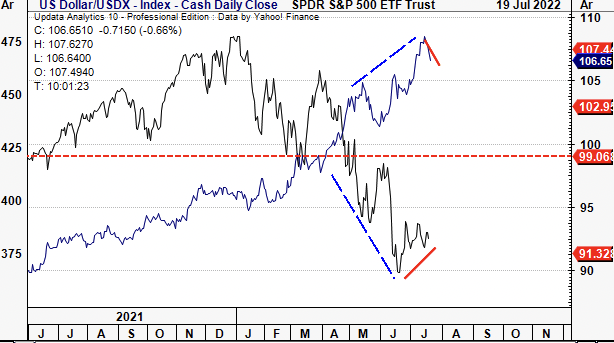

Moreover, there’s been a macro divergence between the DXY and US equities, as seen in Exhibit 2. Since March, this value gap has widened to the downside, following the USD’s breakout from a key resistance level. However, since June, this trend is showing signs of a reversal. With the pair showing such an inverse relationship this YTD, one starts to wonder what a retracement of the DXY towards previous lows means for the inflation/recession debate. Importantly, the recent 21% overshoot of US nonfarm payrolls points to strength in the labour market, alongside the 9.1% CPI print, suggesting the Fed’s hand could be forced to hike 75bps at its next meeting.

Exhibit 2. Macro-divergence between DXY & SPX could be narrowing

Data: Updata

This backdrop is incredibly important to understand our investment thesis on Silk Road Medical, Inc. (NASDAQ:SILK). SILK has set itself a large task in trying to establish its Transcarotid Artery Revascularization (“TCAR”) procedure as the gold standard in stroke prevention. The uphill battle continues, and SILK has copped a beating on the chart in FY22.

Here we demonstrate there’s a lack of affinity to alternative risk premia currently driving equity markets for the benefit to investors and portfolio managers. Without a close affinity to these factors, we rate SILK neutral. PT $40.

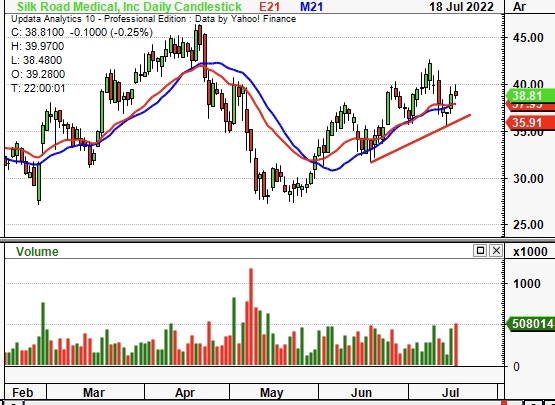

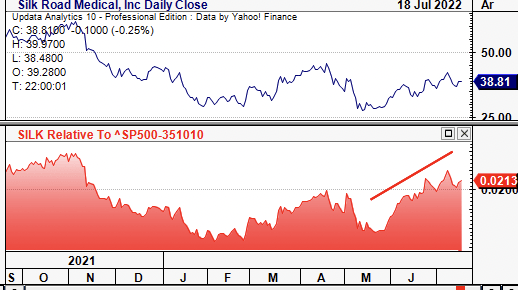

Exhibit 3. SILK 12 month price action

Data: Updata

Market factors

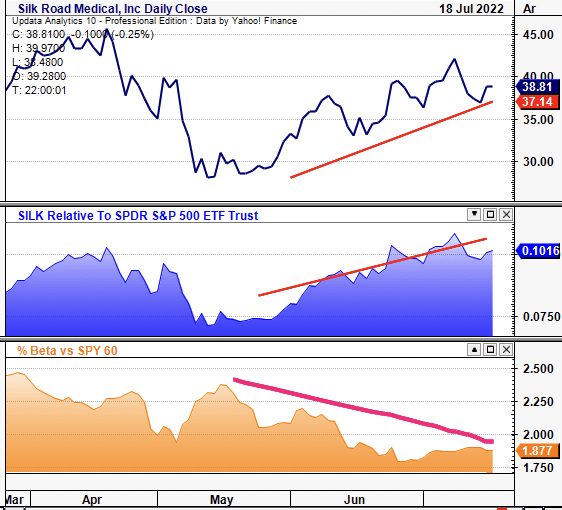

As the ‘liquidity era’ draws to a close, the high-beta/growth trade has now exhausted itself. Unprofitable names within every sector have been punished in FY22, including the medical technology (“medtech”) segment. As such, low-beta, high quality strategies continue to offer investors strategic and tactical alpha into equity and cross-asset portfolios. In that vein, SILK has caught a bid since May and has continued strengthening against the benchmark, as seen below. Simultaneously, its covariance structure is shifting down. Whilst still high at 1.87, the downtrend in equity beta has helped drive its equity returns, by estimate. SILK therefore displays the market properties investors are paying a premium for in FY22.

Exhibit 4. SILK gaining in relative strength vs. benchmark whilst covariance structure shifts downward

Data: Updata

It’s unsurprising therefore to see the SILK share price gain in relative strength to the US medical devices and health care equipment sector. Since May, this trend has been in situ and continues to show signs of continuation, as seen in Exhibit 5. Momentum based strategies will find this information useful in harvesting short-term alpha above healthcare benchmarks.

Exhibit 5. SILK share price performance gaining vs. US medical devices & health care equipment

Data: Updata

Fundamental factors

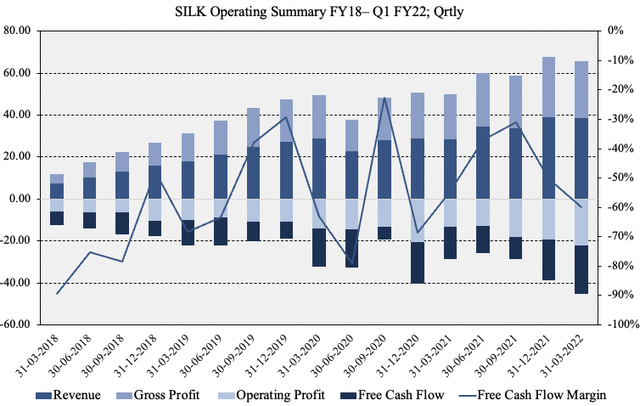

SILK’s most recent earnings shed light onto its fundamental momentum. For Q1 FY22 it printed revenue of $28 million, a 27% YoY growth schedule. Growth was underlined by increasing adoption of the TCAR procedure. It realized 4,025 TCAR procedures in Q1, up 35% YoY and ahead of top-line growth. However, we note this was off a low base. Down the P&L, SILK recognised a 69% gross margin, down 600bps YoY. The step-down was attributed to “production related issues” on the earnings call. However, we also note the company is booking operating costs tied to its first manufacturing output in Minnesota. It should begin to recognize revenue on this in H2 FY22.

SILK’s ENROUTE stent was also approved for use in patients at risk from complications during surgery. The company notes there are ~170,000 annual carotid artery procedures in the US, with ~66% of these allocated to the high-risk segment. Management’s focus is on conversion from carotid endarterectomy (“CEA”) to TCAR as a standard of care. At full utilization, this is estimated to add another $1.2 billion to SILK’s total addressable market in this segment. However, the strategy behind this isn’t entirely clear, and appears to assume it will gain adoption through educating physicians. Per SILK CEO, Erica Rogers on the Q1 earnings call:

Moreover, we expect label expansion to allow physicians to make clinical decisions in the best interest of all patients, truly leveling the playing field between CEA and TCAR, and further reducing the barriers to procedural adoption. That said, adoption will also rely on our efforts to educate and build awareness in the referring and treating physician community.

It did, however, finish FY21 with ~1,000 hospital accounts in the US and has hit “critical mass” of more than 2,000 trained physicians. Right now it’s at 58 sales territories but is aiming towards 70–75 sales territories. This could convert another 200–300 physicians in FY22. We forecast revenue of ~$130 million for SILK this year and see this stretching up to $162 million in FY23. This represents 28% and 24% YoY growth, respectively.

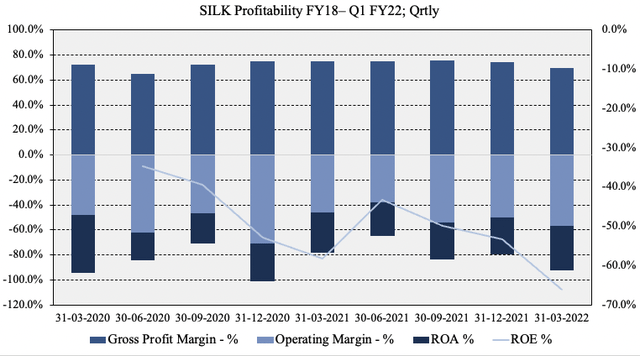

However, the market is shying away from rewarding top-line growth and is focused on bottom-line fundamentals instead. In that vein, SILK’s operating and earnings momentum dislocates from the alternative risk premia investors are paying for in FY22. It has printed a series of operating losses since FY18 on an average ~40% negative FCF margin in that time. As seen in Exhibit 6, the gross-net spread between SILK’s gross profit to FCF has widened over the pandemic. Investors won’t continue to pay for this kind of setup moving forward, putting SILK’s chance of re-rating at risk.

Exhibit 6. The spread between revenue to FCF down the P&L continues to widen

Investors aren’t paying a premium for this kind of setup in FY22 as they have been in the past 2 years

Profitability and other quality-like characteristics are therefore paramount. Here, SILK misses the boat again, both in backward-looking and forward-looking scenarios. ROA has remained bottom-heavy since FY20 whereas operating margins have worsened over that time. As cost pressures continue to weigh in, we aren’t so confident SILK has the headroom to absorb this down the P&L, despite pricing effects in Q1 FY22. We estimate this combination will ultimately recognise further earnings and FCF losses.

Exhibit 7. Profitability has lagged and questions SILK’s ability to absorb cost-inflation down the P&L if needed

Data: HB Insights, Refinitiv Eikon

Valuation

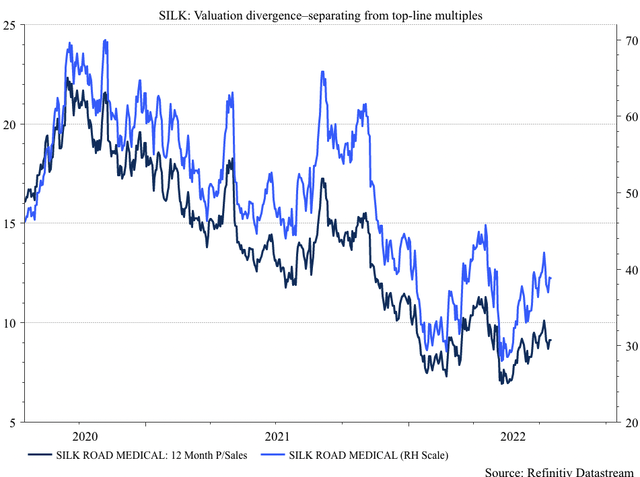

Shares are trading at ~13x sales and sit well above the sector median at 17x book value. It’s difficult to put a tangible value on the stock given its lack of profitability. We are on the hunt for long-term cash compounders and SILK’s lack thereof starts to shine through here. Fact is the SILK share price peaked in November 2020, when it traded at ~25x sales. Since then, it has continued to de-rate whilst sales have only moved up marginally on a sequential basis to $28 million last quarter. The stock has tracked its top-line multiples in tight dispersion these past two years, as seen in Exhibit 8. It has recently gapped to the upside and is diverging from its ~8x forward sales estimates. This corroborates our findings that investors have shied away from rewarding top-line growth.

Exhibit 8. SILK diverging from top-line multiples, loosens capacity to re-rate

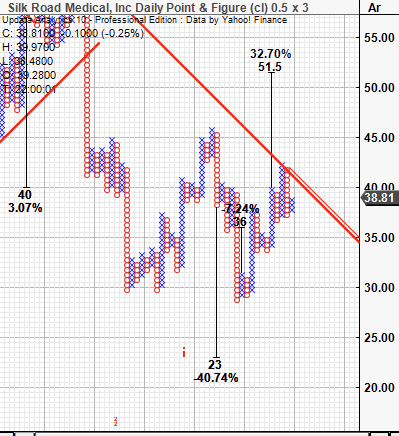

Point and figure charting removes the noise of time and illustrates price action alone. Here, we see SILK poking its neck above longer-term resistance lines, sending off upside targets to $51.50. Recent momentum could help explain this price objective, nevertheless, the stock is now testing key resistance levels. A move above the resistance line here could signal a reversal on towards the $51 objective outlined. We are fine to await for further confirmation of the same.

Data: Updata

At 8x our FY22 sales estimates, this sets a price objective of $29, well below current market pricing. Combined with upside targets set above sees us price SILK at $40 neat. Hence, we feel the market has correctly discounted the stock on the back of its profitability and equity beta characteristics, as shown. Alas, it looks as if SILK is trading at fair value, and won’t stand up against further systematic risks by estimate. Most significant of these is a 20% drop in US earnings. With just a 4.6% margin of safety from our analysis, there’s inadequate downside cover from this.

In short and risks

The risk to our thesis is that the market does in fact reward SILK’s top-line growth and re-rates the stock higher on revenues alone. We feel this unlikely to happen, however. Given the impeding cost-headwinds and potential for economic slowdown, profitability is paramount as a defender of alpha in portfolios.

In that vein, we’ve priced SILK at $40 based on a number of inputs, leading us to believe there’s better names within the medical devices space right now. We see additional challenges to profitability now with higher cost of capital, potential lower earnings and thinner margins. Without the return on capital or free cash conversion to overcome this, we remain neutral on SILK.

Be the first to comment