I think it’s safe to admit we are in uncharted territory when it comes to COVID-19, specifically when it comes down to the mandatory shutdown of the United States economy and the world economy. The mandatory closure of businesses across the United States and the shuddering of the European Union’s borders are just two examples of how significant the situation has become.

As with many extreme situations in the past (the dot com bust, 2008 financial crisis), there is usually a disproportionately sized reaction that is based on fear of the unknown. As you can expect, the more uncertainty involved in a situation, the more likely a reaction will exceed what it should be.

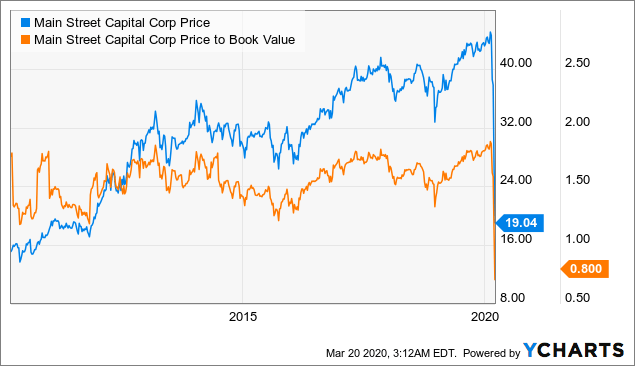

Step in Main Street Capital (MAIN), where we have seen one of the most revered business development companies (BDC) go from being priced at a premium to now being available well below the book value of its loans. As with all companies during these volatile times, the real question is whether or not we are at a place where investors should begin accumulating a position (or adding to an existing one) in MAIN.

Warren Buffett’s mantra of it is wise to be “Fearful when others are greedy and greedy when others are fearful” is one of the most commonly used (and even overused) contrarian quotes about the market, and this article outlines why the opportunity that exists shouldn’t be ignored. I believe that MAIN’s stock price has reached a point where investors should be greedy, and most importantly, they can actually afford to be if they have the cash on hand to do so. This article looks at some of the risks involved and gives insight as to why I believe they are already more than priced in.

Why Invest In MAIN?

MAIN focuses on providing financing for Lower Middle Market (LMM) businesses that have traditionally struggled to find strong sources of financing from traditional lenders. The companies that MAIN focuses on have annual revenues between $10 million and $150 million, and the investment in these companies can range from structured debt, warrants, and direct equity positions. MAIN’s general criterion that it looks for is outlined in the 2019 Annual 10-K report:

- Proven Management Team with Meaningful Equity Stake

- Established Companies with Positive Cash Flow

- Defensible Competitive Advantages/Favorable Industry Position

- Exit Alternatives

The important thing to remember is that Business Development Companies (BDCs) are traditionally riskier investments. However, MAIN has established itself as a best-of-breed company, which is why it has previously commanded such a high premium to book value relative to its competition.

The Interest Rate Drop Is A Negative

Let me start by saying that I think it is absolutely absurd that MAIN stock is currently selling at $19.04/share. With that said, the fall from its record-high $45.10/share has been both swift and brutal.

At $45.10/share MAIN was way too pricey for my taste because at the time that was near twice the book value of what it was actually worth. Prior to COVID-19, I would only have added to the position if shares had dropped below $40 apiece (which was still a pretty rich premium to pay).

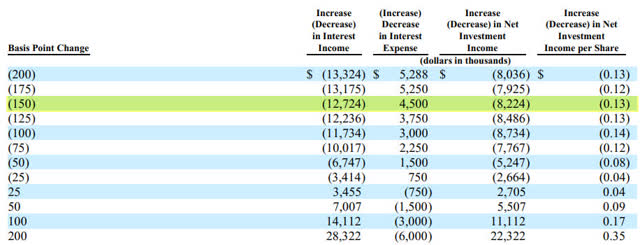

One reason I lowered my price target again was related to the Federal Reserve’s decision to drop the Fed Funds rate by 50 basis points on March 3 and then again by another 100 basis points on March 15. There is no way to describe the drop of 150 basis points in a span of two weeks as anything other than extreme, and I believe it indicates the projected severity of the impact we will feel from shuttering the economy. When the current scenario finally resolves, I expect most countries across the world will see a negative gross domestic product (GDP) quarter over quarter.

The lowering of the Fed Funds rate is intended to entice borrowers to go out and buy stuff, but it will have the opposite effect on MAIN. In Michael A. Gayed’s article, Main Street Capital: Neutral Until Yields Go Higher, he notes the following:

The interest rate on 73% of MAIN’s outstanding debt obligations is fixed. 74% of MAIN’s debt investments are made at floating interest rates.

When rates increase, MAIN’s net earnings rise, and vice versa. The COVID-19 impact will make Fed cut rates – this is a given. Wall Street estimates the rates will fall to zero.

A 100 BPS cut in rates translates to a loss of $8.7 million ($0.14 per share) to MAIN. This is another negative that shareholders have to live with.

Simply put, this means that even though interest rates are dropping, MAIN’s debt expenses will remain largely the same, because nearly 75% of it is at fixed interest rates. At the same time, nearly 75% of its loan portfolio consists of floating interest rates, which means that there will be less interest to collect from the companies that it lends to.

The downside from interest rates are real for MAIN, but it is important to remember that 88% of its debt investments have a contractual minimum interest rate, which means that there are limitations to how much downside it can actually experience. The table below is from the company’s 2019 10-K and provides better insight as to how significant the downside is after the Fed dropped interest rates by 150 basis points.

(Source: MAIN 2019 Annual Report 10-K)

Therefore, it is important for investors to consider that the damage has already been done to MAIN’s Net Investment Income (NII), and that further downside isn’t even possible. On a positive note, the decline in interest rates for MAIN’s portfolio companies means that these companies will be more likely to afford their payments even as we wait and see how the situation with COVID-19 turns out.

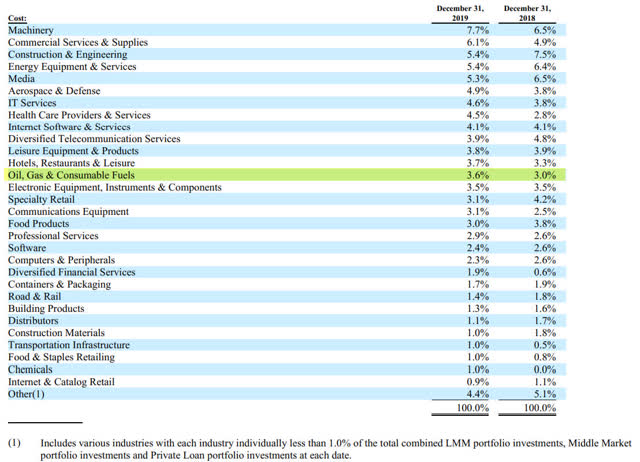

MAIN’s Oil & Gas Portfolio

The second reason I lowered my overall price expectations is that MAIN does have modest exposure to companies that are focused on oil and gas exploration. In the company’s 2019 10-K, it states the following:

A decline in oil and natural gas prices could adversely affect (I) the credit quality of our debt investments and (II) the underlying operating performance of our equity investments in energy-related businesses and in portfolio companies located in geographic areas which are more sensitive to the health of the oil and gas industries. A decrease in credit quality and the operating performance would, in turn, negatively affect the fair value of these investments, which would consequently negatively affect our net asset value. Should a decline in oil and natural gas prices persist for an extended period of time, it is likely that the ability of these investments to satisfy financial or operating covenants imposed by us or other lenders will be adversely affected, thereby negatively impacting their financial condition and their ability to satisfy their debt service and other obligations to us. Likewise, should a decline in oil and natural gas prices persist, it is likely that our energy-related portfolio companies’ and other affected companies’ cash flow and profit generating capacities would also be adversely affected thereby negatively impacting their ability to pay us dividends or distributions on our equity investments.

So just how exposed is MAIN to the oil and gas industry? As of December 31, 2019, there were a handful of companies that would be included in the oil & gas category:

- CMS Minerals Investments – Oil & Gas Exploration and Production – Investment Date: January 30, 2015

- KBK Industries, LLC – Manufacturer of Specialty Oil field and Industrial Products – Investment Date: January 23, 2006

- Universal Wellhead Services Holdings, LLC – Provider of Wellhead Equipment, Designs, and Personnel to the Oil and Gas Industry – Investment Date: October 30, 2014

- Aethon United BR LP – Oil and Gas Exploration and Production – Investment Date: September 8, 2017

- Chisholm Energy Holdings, LLC – Oil and Gas Exploration and Production – Investment Date: May 15, 2019

- Encino Acquisition Partners Holdings, Inc – Oil and Gas Exploration and Production – Investment Date: November 16, 2018

- Felix Investments Holdings II – Oil and Gas Exploration and Production – Investment Date: August 9, 2017

- Larchmont Resources, LLC – Oil and Gas Exploration and Production – Investment Date: August 13, 2013

- Laredo Energy VI, LP – Oil and Gas Exploration and Production – Investment Date: January 15, 2019

- NNE Partners, LLC – Oil and Gas Exploration and Production – Investment Date: March 2, 2017

- TE Holdings, LLC – Oil and Gas Exploration and Production – Investment Date: December 5, 2013

One thing to consider is that a handful of the companies noted in the bullet points above receive their investment from MAIN several years ago and were in existence as private companies before then. That doesn’t mean they can survive the current price war between Russia and Saudi Arabia (see my blog post Market Volatility: Reviewing Events That Are Driving Uncertainty for a summary of the current situation), but it is encouraging to know that many of these companies managed to survive the plunge in oil prices that happened in early 2016.

In total, oil, gas, and consumable fuels represent 3.6% of MAIN’s initial invested capital as of December 31, 2019.

(Source: MAIN 2019 Annual Report 10-K)

Conclusion

As I write this article MAIN just completed funding $31.8 million for Classic H&G Holdings, which focuses on engineered packaging solutions for home & garden and fragrance & cosmetic industries. I find this to be telling of the current economic environment that we are in, because MAIN is simply continuing to do what it does best while the rest of the market chooses to act like the sky is falling.

While I don’t expect to see MAIN issuing equity anytime soon, I do believe that the company is financially sound, as evidenced by its coronavirus update press release which states:

In addition to our conservative capital structure, we also maintain funding from several different debt capital sources, including our revolving credit facility, which includes a diversified group of 17 different banks, our unique relationship with the U.S. Small Business Administration through our three active Small Business Investment Company (SBIC) licenses and our existing long-term bonds. Our capital structure includes minimal amounts of near-term maturities, with only $77 million, or approximately 5%, of our total debt capacity of over $1.5 billion maturing before the end of 2021.

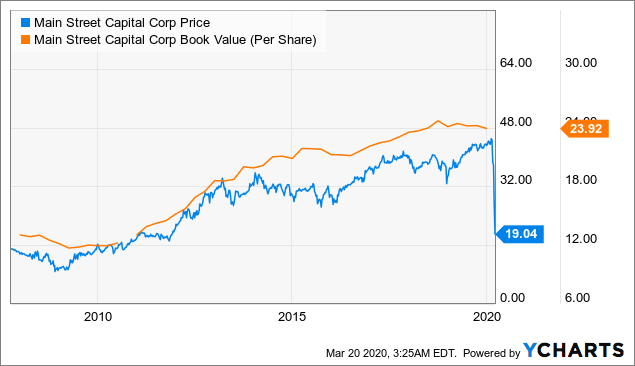

The book value of MAIN compared with its historical share price is one of the most compelling reasons why the company is a screaming Buy and why I have added to my own position, my fiancé’s position, and to the retirees John and Jane (whom I help with their investment portfolio).

Data by YCharts

Data by YCharts

Over the last 10 years, MAIN had always traded at a price/book value of 1.25x or greater, until now. I personally believe that opportunistic investors will look back on this moment as one of the best buying opportunities, since MAIN IPO’d in October 2007 at $15/share. Since then, the company has paid some hefty dividends and nearly doubled the book value per share in the process.

Data by YCharts

Data by YCharts

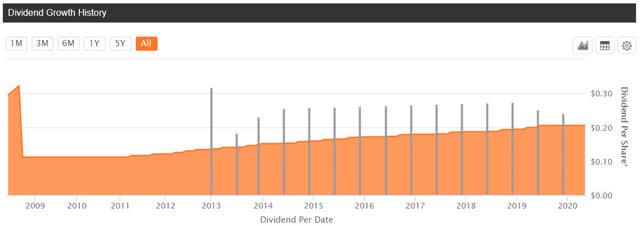

(Source: Seeking Alpha – MAIN Dividends)

Although I fully expect to see a decline in book value/share on the next quarterly update, it does not change my bullishness when it comes to MAIN’s currently undervalued price. I believe that any price less than book value is an absolute must-buy opportunity that serious investors shouldn’t pass on because the risks are already more than priced in.

My clients John and Jane are both long MAIN.

Disclosure: I am/we are long MAIN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes only and does not constitute investment advice. Please do your own research before initiating a position in any company mentioned. Any views expressed in this article are my own and do not represent the views or opinions of my employer.

Be the first to comment