Torsten Asmus

Passive income investors interested in receiving generous monthly dividend income from a diverse portfolio of U.S. and non-U.S. fixed income instruments should consider the PIMCO Dynamic Income Fund (NYSE:PDI).

The PIMCO Dynamic Income Fund invests heavily in fixed instruments such as corporate bonds, mortgage securities, and other high-yield debt obligations that generate recurring income for the fund and its investors.

The closed-end fund is currently trading at an 8.6% premium to net asset value, and PDI pays a monthly dividend of 13.2%.

Diversified Portfolio Of Fixed Income Securities

The PIMCO Dynamic Income Fund is a closed-end fund that invests in a diverse portfolio of income-producing assets around the world.

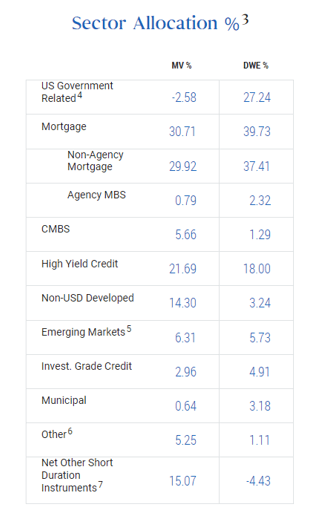

The fund’s common net assets were $4.4 billion as of November 30, 2022, with mortgage securities accounting for the majority of the fund’s assets, followed by high yield credit. As of November 30, 2022, mortgage securities, primarily non-agency securities with higher risk (but higher yield) than agency securities, accounted for roughly 31% of the fund’s investments.

High yield credit was the PIMCO Dynamic Income Fund’s second-largest investment focus, accounting for 22% of investments. Furthermore, by investing some of its assets in non-U.S. assets, the fund achieves international diversification.

The international diversification of the PIMCO Dynamic Income Fund may be particularly appealing to passive income investors seeking exposure to fixed income assets outside of the United States.

Sector Allocation By Percentage (PIMCO Dynamic Income Fund)

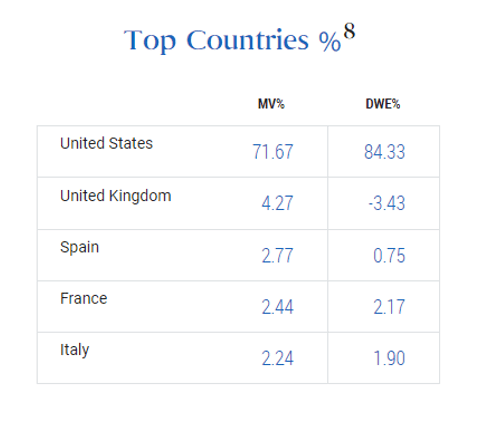

Despite diversifying into foreign corporate bonds and sovereign issues, the PIMCO Dynamic Income Fund’s core investment focus has remained in the United States, and this is unlikely to change in the future.

The United States is weighted at 72%, making it the largest investment target country in the PIMCO Dynamic Income Fund. The United Kingdom is the second-largest investment destination, but it is far behind the United States, accounting for less than 5% of total investment.

Top Countries By Percentage (PIMCO Dynamic Income Fund)

Distribution And Yield

The PIMCO Dynamic Income Fund pays a total annualized dividend of $2.646 per share, but the income is distributed monthly, which may appeal to passive income investors who want to distribute their income evenly.

The monthly dividend is $0.2205 per share, for a dividend yield of 13.2% based on Friday’s closing price of $20.06.

Premium To Net Asset Value

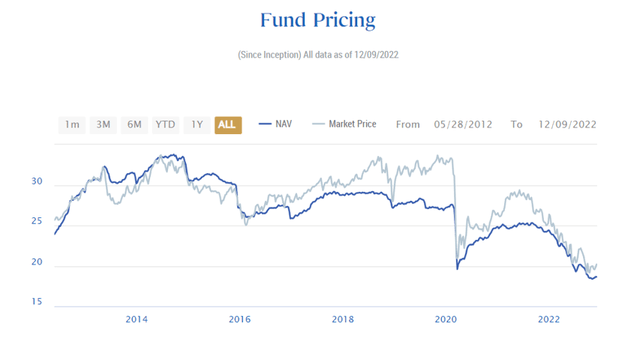

Investors have previously been willing to value the PIMCO Dynamic Income Fund at a premium to its net asset value due to the fund’s respectable performance over its lifetime.

The fund’s net asset value has increased at an average annual rate of 10.39% since its inception. Based on an underlying fund net asset value of $18.47, the fund’s current net asset value premium is 8.6%.

PIMCO Dynamic Income Fund’s historical market performance is plotted against the fund’s net asset value in the chart below. PDI has historically traded at a premium to net asset value, both before and during the Covid-19 pandemic, and the current premium, in my opinion, is moderate.

Fund Pricing (PIMCO Dynamic Income Fund)

Why PDI Could See A Lower Valuation

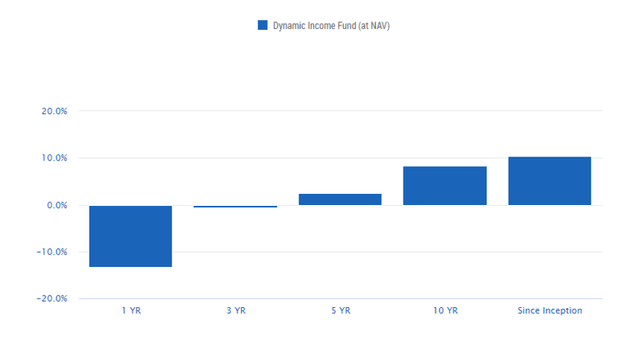

The net asset value of PIMCO Dynamic Income Fund has come under pressure in 2022 as a result of the stock market correction. The fund’s net asset value fell 13.28% over the last year, and lower market valuations for fixed income securities are likely to continue to harm the fund in the short term.

Dynamic Income Fund At NAV (PIMCO Dynamic Income Fund)

Having said that, the fund’s strong diversification across asset classes and geography compensates passive income investors for the risk they are taking with a PIMCO Dynamic Income Fund investment.

A distress event, such as a credit market shutdown or a significant unforeseen shock to the stock market, could result in further valuation haircuts and a decline in the fund’s net asset value.

My Conclusion

The PIMCO Dynamic Income Fund, in my opinion, is an appealing addition to a well-balanced and diverse portfolio that adds fixed income exposure, particularly in the U.S. mortgage market, to the overall mix.

The fund’s holdings of sovereign bonds, corporate bonds, and mortgage securities increase diversification and reduce PDI’s reliance on the U.S. market for yield.

The PIMCO Dynamic Income Fund is currently trading at an 8.6% premium to net asset value and pays a monthly distribution to passive income investors.

The fund’s shares pay a monthly dividend of $0.2205 per share for a current dividend yield of 13%.

Be the first to comment