Vadym Terelyuk/iStock via Getty Images

A Quick Take On Montauk Renewables

Montauk Renewables, Inc. (NASDAQ:MNTK) went public in January 2021, raising approximately $25.9 million in gross proceeds in an IPO that priced at $8.50 per share.

The firm operates U.S. biogas facilities using a variety of feedstock sources.

I view the natural gas pricing environment to be a strong if somewhat volatile one in the months ahead and management has proven its ability to correctly time its RIN commitments.

My outlook on MNTK is a Buy at its current price level of around $9.20 per share.

Montauk Renewables Overview

Pittsburgh, Pennsylvania-based Montauk was founded to develop and operate renewable natural gas (biogas) projects such as waste methane from landfills, livestock feed and other non-fossil fuel sources to provide energy for electricity.

Management is headed by president and CEO Sean McClain, who has been with the firm since 2014 and previously held management positions at BPL Global Limited, Bayer and Dick’s Sporting Goods.

The firm’s customers include landfill and livestock farm operators, local utilities, large refiners and commercial RIN off-take companies.

Electricity customers include electricity utilities that buy electricity according to fixed-price contracts.

Montauk’s Market & Competition

According to a 2019 market research report by Global Market Insights, the global market for biogas was an estimated $72 billion in 2018 and is expected to reach $110 billion by 2025.

This represents a forecast CAGR of 7.1% from 2018 to 2025.

The main drivers for this expected growth are increasing environmental concern over fossil-fuel emissions as well as a desire to achieve energy diversity across the portfolio of sources.

Also, a growing use of renewable energy technologies coupled with increasingly stringent environmental regulations will contribute to the industry’s growth trajectory.

Major competitive or other industry participants include:

Montauk Renewables’ Recent Financial Performance

-

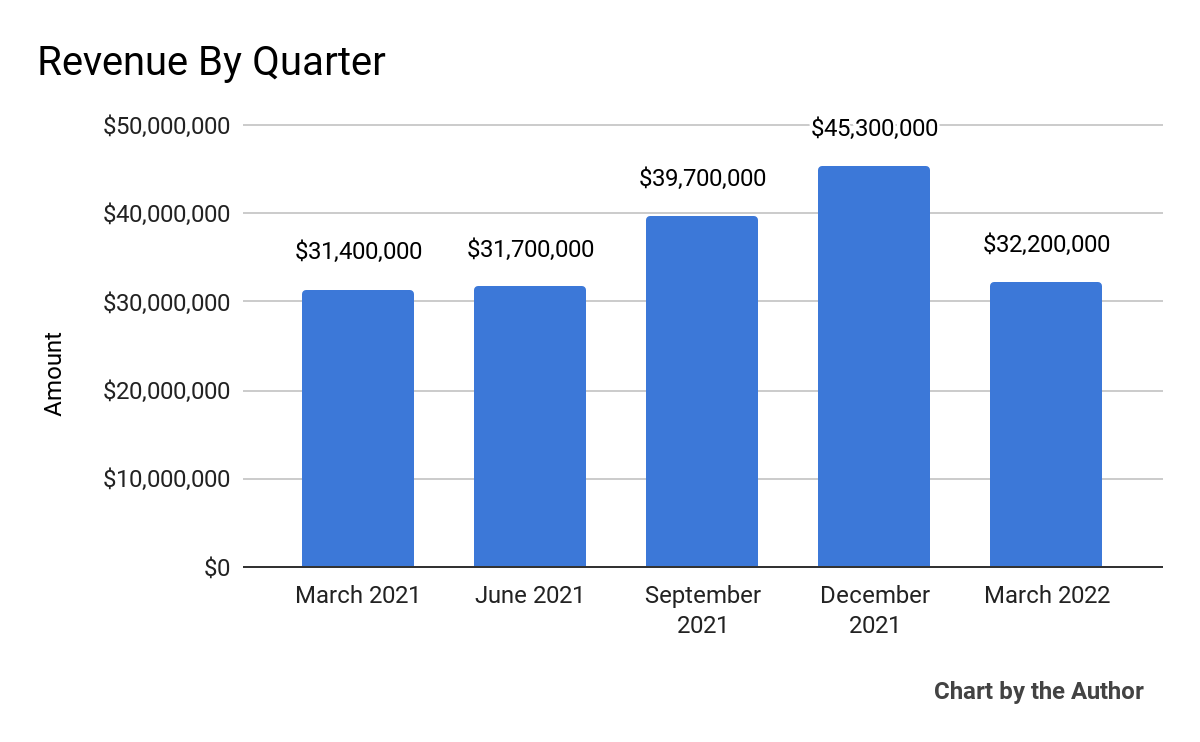

Total revenue by quarter has risen over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

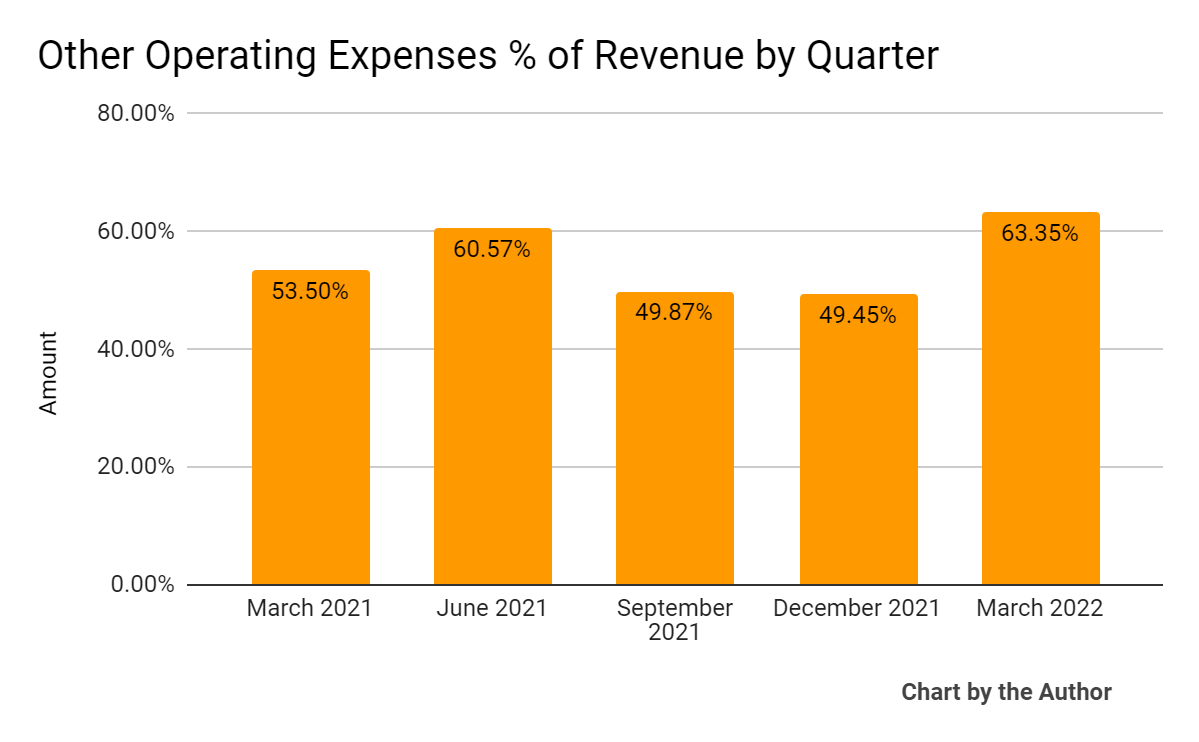

Other operating expenses as a percentage of total revenue by quarter have varied without a particular trend:

5 Quarter Other Operating Expenses % Of Revenue (Seeking Alpha)

-

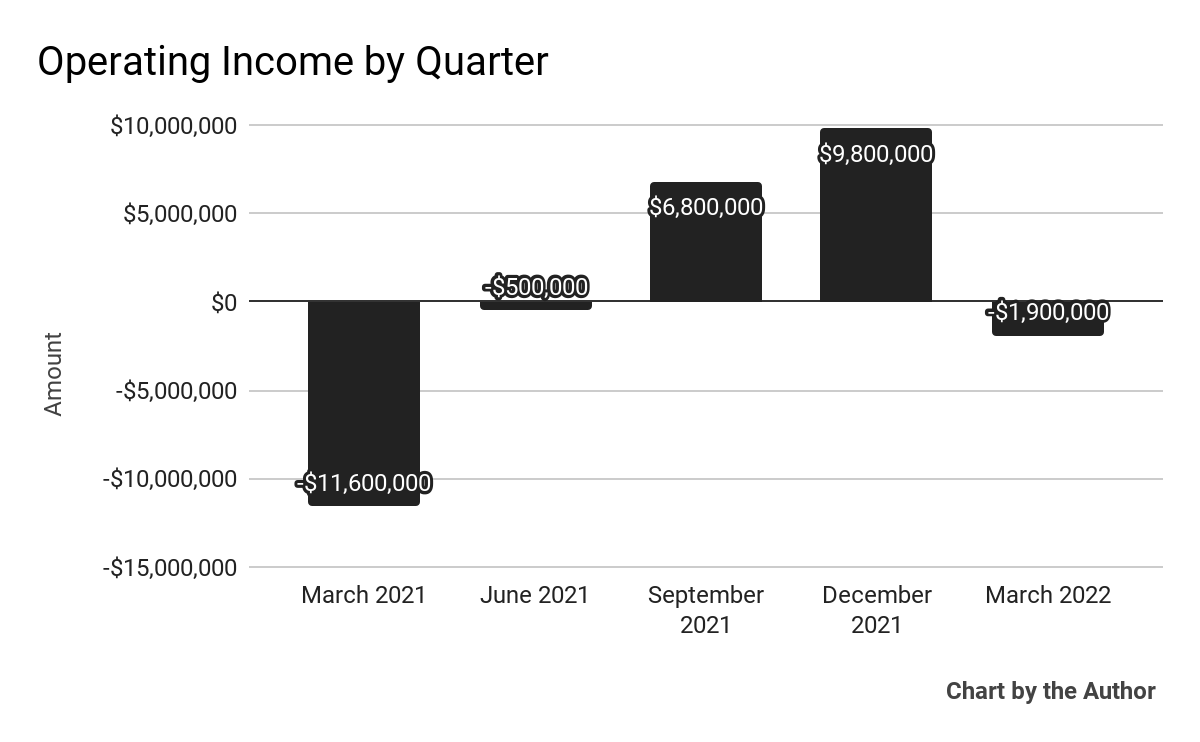

Operating income by quarter has varied significantly, swinging back into negative territory in the most recent reporting period:

5 Quarter Operating Income (Seeking Alpha)

-

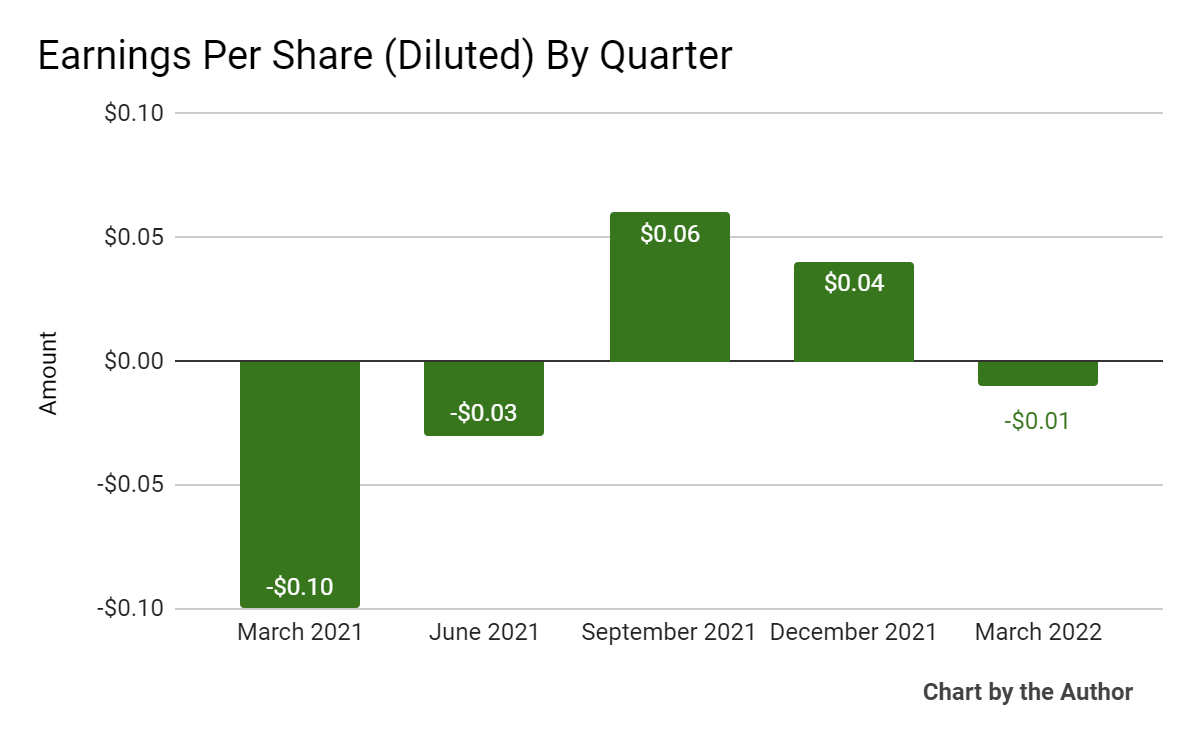

Earnings per share (Diluted) have also turned negative in Q1 2022:

5 Quarter Earnings Per Share (Seeking Alpha)

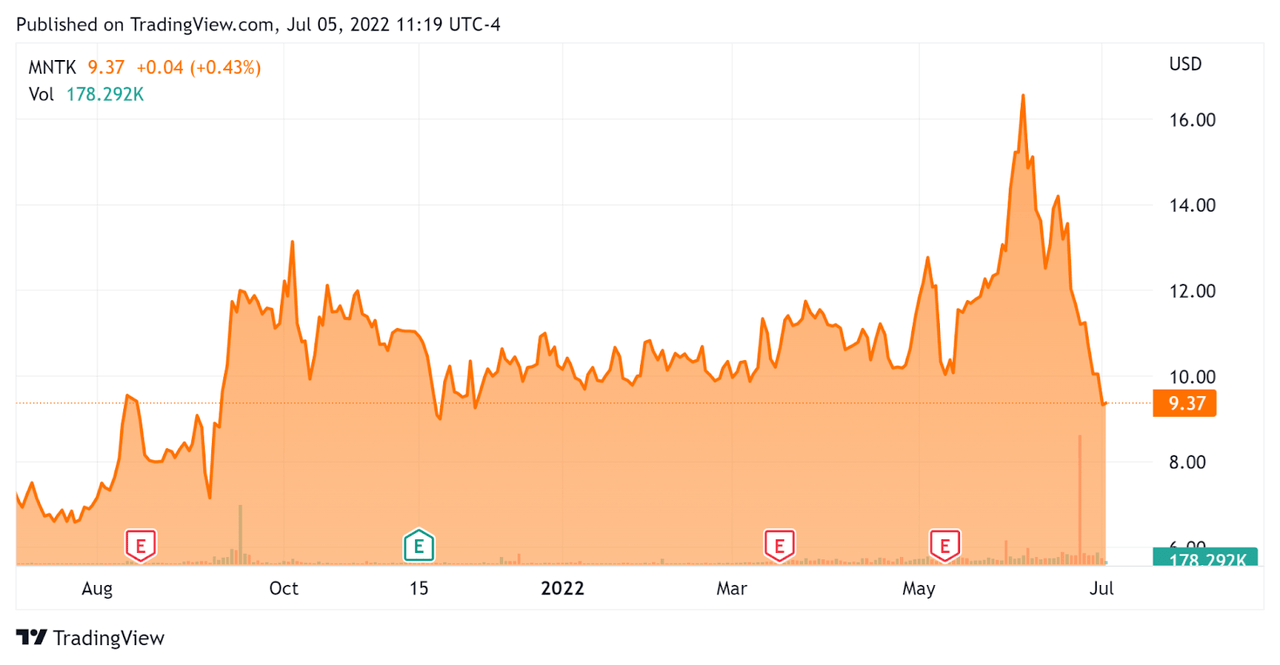

In the past 12 months, MNTK’s stock price has risen 27.5 percent vs. the U.S. S&P 500 index’ fall of around 13.6 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Montauk

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$1,320,000,000 |

|

Enterprise Value |

$1,330,000,000 |

|

Price / Sales [TTM] |

8.84 |

|

Enterprise Value / Sales [TTM] |

8.96 |

|

Operating Cash Flow [TTM] |

$44,710,000 |

|

Revenue Growth Rate [TTM] |

31.23% |

|

Earnings Per Share |

$0.06 |

(Source – Seeking Alpha)

Commentary On Montauk Renewables

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted increased production at the firm’s Pico facility, a dairy cluster RNG (Renewable Natural Gas) project in Idaho.

The firm has been actively managing its RIN tactics and chose not to sell into what it perceived to be a temporarily soft market in Q1, thus lowering its revenue for that period.

So far in Q2 there has been a rebound of D3 RIN index pricing and management has completed commitments to sell all of its generated RINs, so revenue in Q2 should reflect that timing difference at an average price of $3.40 index price per RIN for the firm’s 4.4 million RIN inventory.

As to its financial results, revenue has grown due to a higher natural gas price, up 84% in Q1 2022 year-over-year.

EBITDA for the quarter was $3.8 million versus negative $6.5 million for Q1 2021.

Looking ahead, management reaffirmed its full year 2022 revenue guidance with RNG revenues estimated to reach $203 million at the midpoint and renewable electricity revenue at around $18.5 million.

However, the RNG guidance is subject to market volatility which has been high recently, although in Montauk’s favor as natural gas prices have soared.

Also, regarding acquisition opportunities, management said ‘the opportunity suite that we’re looking at for inorganic growth is unprecedented,’ with the firm in advanced due diligence on some of them.

Should these deals come to fruition, CEO McClain said “they will have a material impact on not only our production, but also the revenue and the corresponding EBITDA…”

Regarding valuation, the market is currently valuing MNTK at around a 9x EV/Revenue multiple.

The primary risk to the company’s outlook is the volatility in natural gas pricing, which is subject to any number of geopolitical and market uncertainties.

However, as natural gas pricing sees potential upside as colder months of fall and winter are ahead combined with a potential acquisition, an upside catalyst could be significant.

I view the natural gas pricing environment to be a strong if somewhat volatile one in the month ahead and management has proven its ability to correctly time its RIN commitments.

My outlook on MNTK is a Buy at its current price level of around $9.20 per share.

Be the first to comment